Investing in Bitcoin is something on the minds of a lot of people right now. The global economy is in flux, with some markets performing surprisingly well, but experts urging caution. Almost every major economy has had to fire rapid stimulus packages of high value to stem the wounds from COVID-19.

It is at this time many are looking at cryptocurrencies as a valid investment vehicle – while traditional markets falter and people try to secure their savings best. Bitcoin and the cryptocurrency market has also suffered from the pandemic, so it makes sense to ask: Is Bitcoin a good investment?

There are two major camps when it comes to views on Bitcoin and digital assets. The first is the one in favor, championing its qualities of disintermediation and the resultant benefits. The second is the chiding it as a collectible of little to no tangible value that is doomed for failure.

But one of the most significant benefits of cryptocurrencies is their low barrier of entry. You don’t have to purchase one whole Bitcoin. Instead, you can buy as much or as little as you like, based on your risk appetite. We’ll touch on this a little more later, but this makes the asset attractive as a hedge.

Perhaps you know little of Bitcoin and are inclined to think that the critics are right — Bitcoin has no value. On the contrary, there is value, as explained below. There is undoubtedly enough value for a conservative investment to be made and, from that point of view, the question of is it safe to invest in Bitcoin is easy to answer.

What are those properties of Bitcoin that give it any value at all then? Is Bitcoin a good investment solely because of its lack of correlation?

What Makes Bitcoin Special?

Why would anyone bother to create a digital currency? After all, our savings and earnings are digitally recorded and transacted. On the face of it, there might not seem to be any need for a digital currency when our transactions run fine on a day-to-day basis.

But there’s more going on, and it’s understandable why financial institutions would largely oppose something like Bitcoin.

Banks are the intermediaries for your transactions. You open an account to store funds, which it records in its own ledger. You send some money to your friend, but the bank conducts the transaction on your behalf. It updates your account and your friend’s to match the debit and credit.

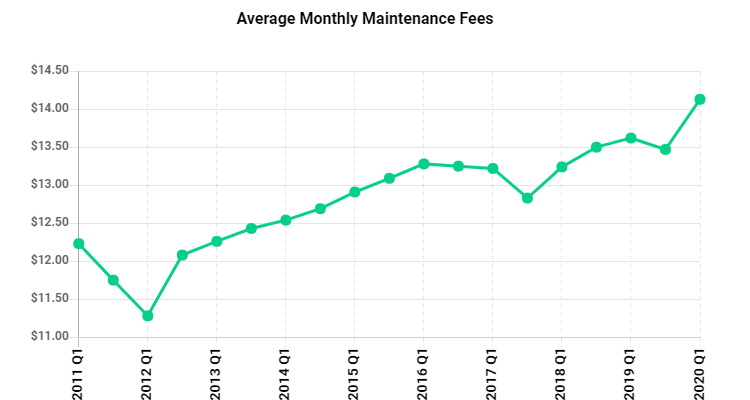

But the bank doesn’t do this for free and must find ways to make its own revenue, of course. One way to do that is by charging a fee on transactions. This is most prominent in an international transaction, which, if you’ve tried it, is expensive and time-consuming. Large transitions can have fees in the range of thousands of dollars and weeks to confirm.

With Bitcoin, however, you don’t need a bank. It’s peer-to-peer, meaning transactions are directly made between the parties. As a result, it’s cheaper, faster, and more secure, as everyone on the network is working together to verify a transaction.

The immutable nature of Bitcoin and the technical design’s solution to the trust problem is the key to Bitcoin’s potential. It gives us a way to exchange value without relying on risky market forces — Bitcoin was created in the wake of the 2008 recession. Not that the cryptocurrency market doesn’t have its own risky market forces, but these don’t strongly correlate with traditional asset classes.

One might ask, ‘Why would one expect markets to collapse?’ Well, there are a few reasons to think so, especially with the precarious situation the COVID-19 pandemic has placed us in.

An Increasing Number of Reasons to Invest in Bitcoin

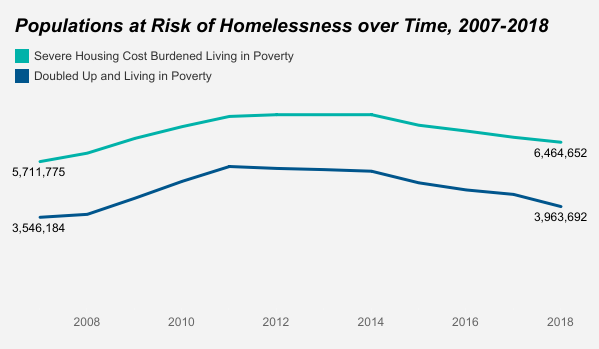

Multiple countries are already facing grave trouble or even a recession, including the United States and Great Britain. Unemployment and homelessness rates in the US are reaching Great Depression figures. The world is delicately transitioning into a pre-pandemic phase, knowing fully well that more outbreaks may occur. Typical travel is an unlikely prospect for the near future.

And there is more. Quantitative easing, which comes in the form of stimulus packages, can help in the short term but do far more damage in the long run. These packages have gone towards helping businesses and citizens in this time of hardship, but it comes at a cost.

One can’t simply print money. If it were that simple, we’d all be rich. The strength of a currency falls when you print more money. More money circulated, the less valuable each unit becomes.

This is a simplified way of describing inflation. In particularly bad cases, such as in Venezuela and Zimbabwe, it becomes hyperinflation.

Experts are divided on whether the US is on the path to extreme inflation. Some are genuinely concerned and, in good faith, ask for sound economic policies. Others are not worried that it will reach worrying levels.

In either case, Bitcoin proves itself a good hedge. It is a deflationary currency with 21 million tokens that can be divided easily. Bitcoin will get more valuable with time, should it prove itself a reliable means of exchange. Should the US Dollar be subject to inflation, Bitcoin would be an alternative that is devoid of the risks of fiat currency.

Combine this with the fact that it can be purchased in small amounts, and the question of whether Bitcoin is a safe investment is answered. Given that Bitcoin has consistently improved to higher yearly lows and you get the answer to whether Bitcoin is a good investment. It can’t hurt to invest just a little for the chance of a good profit, even if that’s only 5% of your portfolio.

There is one more point well worth mentioning about Bitcoin.

For one, the asset comes with a lot of potential benefits for the underprivileged. For the most part, Bitcoin, by its fundamental design, distributes influence equally. Anyone with a phone and an internet connection can tap into the global markets with Bitcoin.

Before, you’d have to have extensive documentation to do so, something the poverty-stricken often do not have. Eliminating financial inequity is a big part of Bitcoin’s ethos.

Similarly, migrant workers will save more when sending money abroad. Bitcoin often finds its best use cases are for those who do not have much money.

How Do You Go About Investing in Bitcoin?

Assuming you’re willing to invest as much as you can lose, the first point of discussion will be the exact size of your investment capital. $100? $1000? There are no severe restrictions here.

This is a task for you to undertake, with a good rule of thumb being 5% for conservative investors and 10% or more for bolder investors. You can alter your positions as you learn more about the market as it develops.

It is also absolutely recommended that you invest for the long-term. Short term investors are equity day traders on steroids — the cryptocurrency market is open 24/7, and it takes some insight to be able to make profits consistently. It’s simply more trouble than is worth for the absolute beginner, so the best option is to focus on long-term gains.

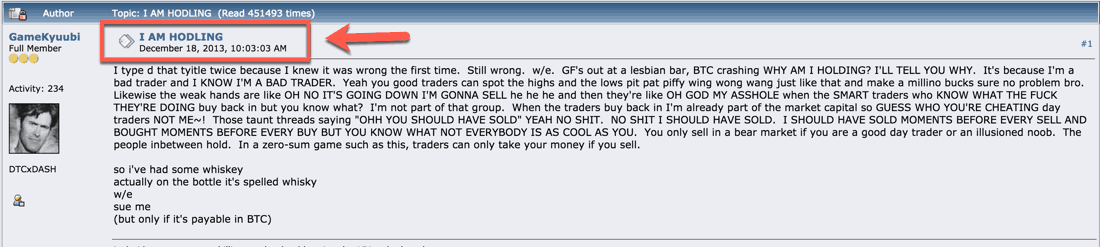

The crypto community calls this hodling, a once drunkenly mistyping of ‘holding’ made by an early proponent who urged people to hold for the long run. Indeed, hodling has proven incredibly beneficial to early Bitcoin investors, who have seen Bitcoin rise from mere cents to $20,000.

While Bitcoin does experience volatility, even this is reducing, making the market resemble the equity market to a degree. The continued survival of Bitcoin through numerous events, and the adoption of the asset among hedge funds and institutions, is proof that Bitcoin is experiencing a leap in maturation, as reported by Bloomberg.

Let’s assume that you’ve invested an appropriate sum and are hodling. What would the potential returns be in, say, five years? In truth, this is a little hard to tell.

If you could do this with stocks, you’d be richer than everybody else. Cryptocurrencies are even more difficult to cast predictions on because they’re nascent and unlike other asset classes.

But we can perhaps make a somewhat vague educated guess. The trend is that it is increasing across all fundamental metrics. This includes price, traded volume, global dissemination, institutional investment, mining power — all going up, or at least the baseline of these metrics are growing higher every year. This tells us that several stakeholders are putting in enormous amounts of resources to support the network.

Governments are also opening up to cryptocurrencies, though some seem keener on Central Bank Digital Currencies (CBDCs). Some even recognize it as an asset and have made laws surrounding the market. Most are on the fence and still examining how it can benefit their economies, but the prognosis looks good for cryptocurrencies and blockchain technology.

As Bitcoin spreads and entrenches itself in different layers of society, it would be reasonable to expect prices to go up. But high as $250,000 by 2023, as Tim Draper said? Or perhaps $288,000, as PlanB has stated?

Others have put more conservative figures of $50,000 or $100,000. You’ll notice one thing, though, that all of these investors and analysts predict the price to go up.

A Primer on Making Your First Investment

If you’re convinced, then you’re ready to make your first purchase. This is quite an easy and straightforward process, though it may appear strange at first. Some platforms have even emphasized a friendly user experience to make it easy for new investors.

We won’t go over the process in detail over here, but you can take a look at our guide on purchasing your first Bitcoin for that. Here, we’ll concentrate on a quick way for you to begin investing.

Take that sum that you think you can risk losing and head to a cryptocurrency exchange. There are several options, but you’ll have to make sure it’s available in your country. If you’re in the US, Coinbase is a popular option. For most other countries, Binance is a reliable choice.

Both of these exchanges have made it easy for new users, especially with their mobile apps. Once you’re on the exchange’s website, sign up. You’ll have to offer KYC details and wait a while for confirmation, but it won’t take more than a few days.

Once you’ve logged in, you can begin purchasing Bitcoin quite easily. Both Coinbase and Binance offer different kinds of payment options, including debit and credit cards, and bank transfers of various fiat currencies.

Enter the amount you would like to spend in your local currency, and the exchange will automatically show you how much Bitcoin you will get in return. Confirm the payment, and you’re done! That’s your first Bitcoin purchased.

It is advisable to store your Bitcoin in a wallet that isn’t on an exchange. Your choices are desktop, mobile or browser wallets. There are also paper and hardware wallets, but these may be too advanced for a beginner. It is imperative to keep your Bitcoin safe, however, as if you lose access to your private key, you lose your asset.

Conclusion

The biggest quest for new investors is if it is safe for them to invest or not — particularly when it comes to the other generation. But Bitcoin has proven itself time and again over the decade or so it has existed. You might argue that’s not a long time to warrant a hefty investment, but a counter-argument would be that you can invest as little as much as you like. There’s no harm, right?

The hedge against other markets is at the core of Bitcoin’s appeal. Many investors do champion it as being a democratic, censorship-free form of money that gives power back to the people. But when it comes to investing, institutions themselves see it being better for its market-independent nature.

Investing in Bitcoin is almost a no-brainer, even if you are only doing so to hedge with a tiny portion of your capital. Leave the day trading and predictions to others who are willing to risk it all and play the long game of hodling.