Aptos is a scalable, layer-1 proof-of-stake blockchain launched in 2022. If you are looking to buy the native APT coin and learn more about how the project is faring in 2025, check out this complete guide. Here’s how to buy Aptos and everything else you need to know.

- How to buy Aptos (APT)

- What is Aptos (APT)?

- How does Aptos (APT) work?

- Where to buy Aptos (APT)

- Kraken

- Coinbase

- Uphold

- KuCoin

- Bybit

- Why is Aptos (APT) popular?

- Aptos (APT) vs. other cryptocurrencies

- Aptos (APT) ecosystem

- Aptos (APT) wallets

- EVO Wallet

- Trust Wallet

- Nightly Wallet

- FoxWallet

- Gem Wallet

- Aptos (APT) staking

- Aptos (APT): Should you buy into the hype?

- Buy Aptos and other cryptos with caution

- Frequently asked questions

How to buy Aptos (APT)

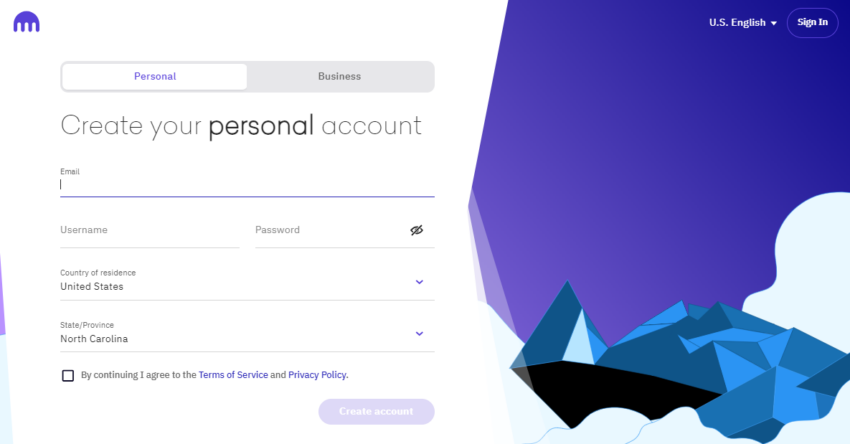

A number of leading cryptocurrency exchanges support Aptos (APT). For this demonstration, we will use Kraken, a U.S.-based exchange available in more than 190 countries.

1. Create a personal account: Before you can buy Aptos, you must select an exchange that supports it. When you do, create a personal account. You will need a phone number, email address, and government photo ID to use Kraken.

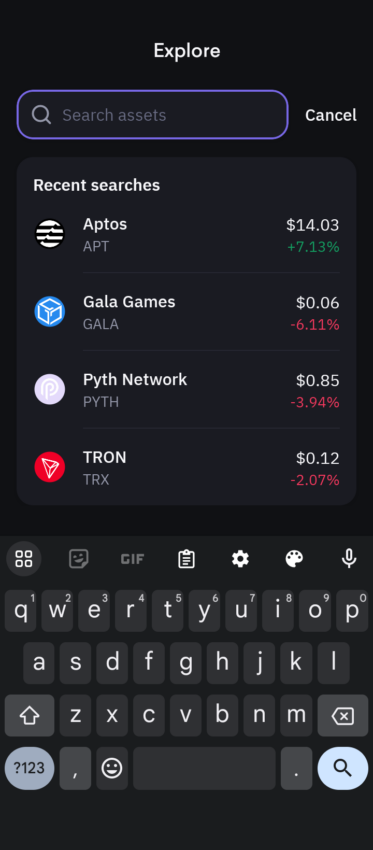

2. Download and open the Kraken app: After you create your account, download and open the Kraken app on your phone. It is available in the Google Play and Apple Store. Open the app and select “Explore.” Select Aptos (APT) to continue.

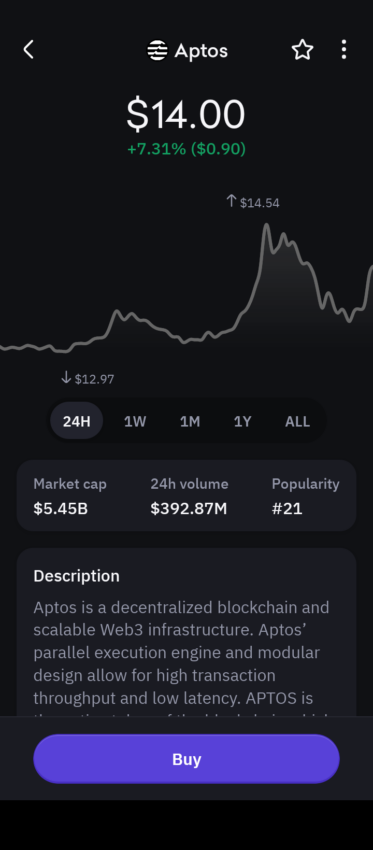

3. Select the “Buy” button: On the following page, you will notice a chart of Aptos’s price performance. You can select between five different time intervals. Navigate to the bottom of the screen and select the “Buy” button to continue to the next step.

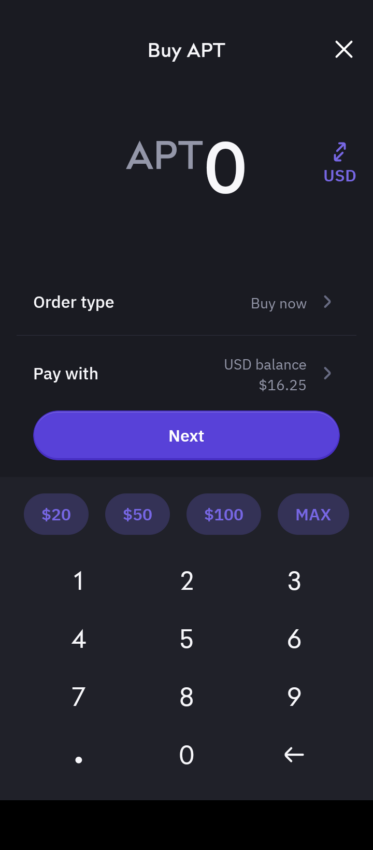

4. Select the amount to buy Aptos (APT): On this screen, select the amount of Aptos you want to buy. Here, you have four buttons to select an amount. You will also notice that you can choose between different order types and payment methods. Press “Next” once you have entered this information.

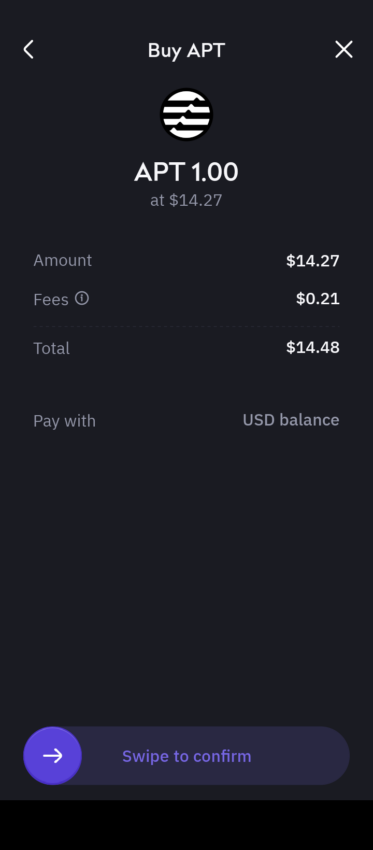

5. Confirm your choices: Check all of the information you have entered. If everything is correct, swipe right at the bottom of the page to confirm your order.

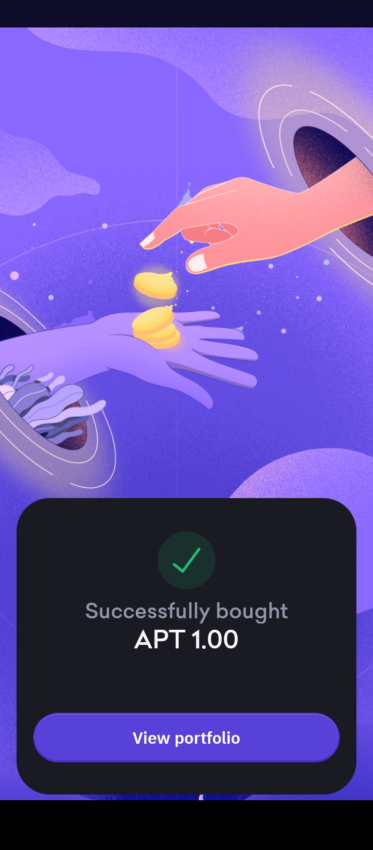

Congratulations, you have successfully bought Aptos (APT)!

How to sell Aptos (APT)

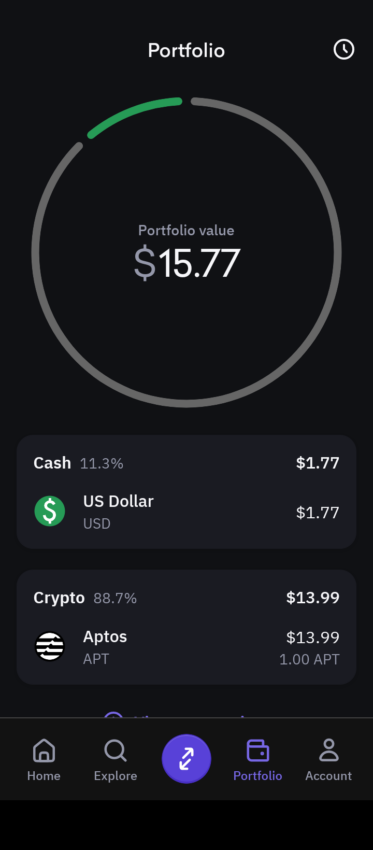

1. Navigate to your portfolio: Open the Kraken app and navigate to your “Portfolio” tab. Here, you can see the balance of your deposits and all of the cryptocurrencies that you currently hold. Select Aptos to continue.

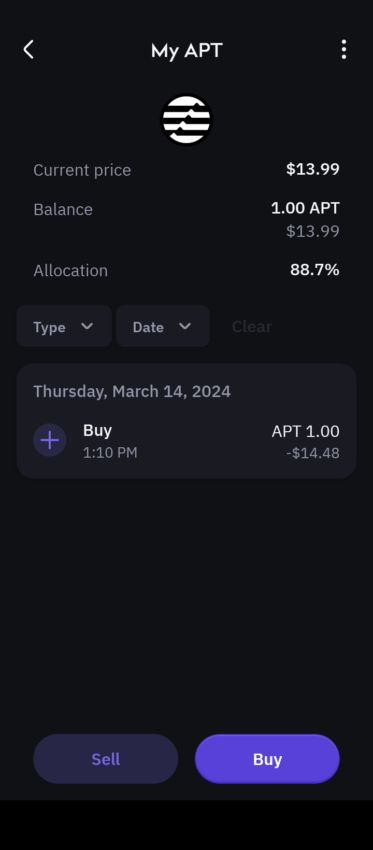

2. Select the “Sell” button: Once you click on Aptos, it will take you to a page that shows the complete history of your Aptos transactions on the Kraken app. Press the “Sell” button at the bottom of the screen to sell your APT.

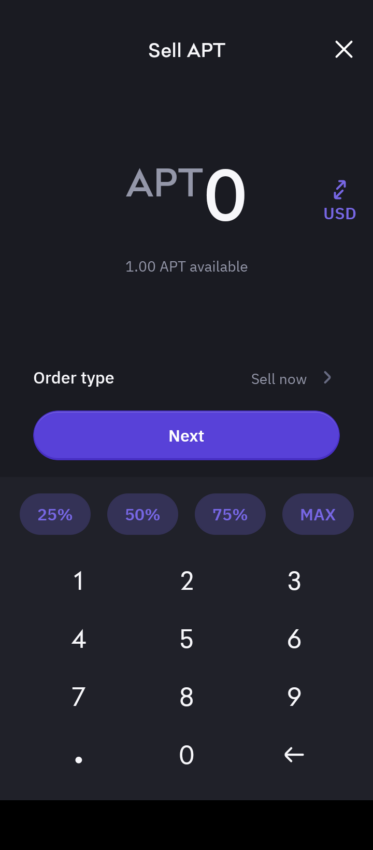

3. Select the amount of APT to sell: Similar to the process of buying APT, you can also select different order types to sell APT. There are also buttons to select a predetermined amount of APT to sell for quick transactions. Once you have selected the amount, press “Next” to continue.

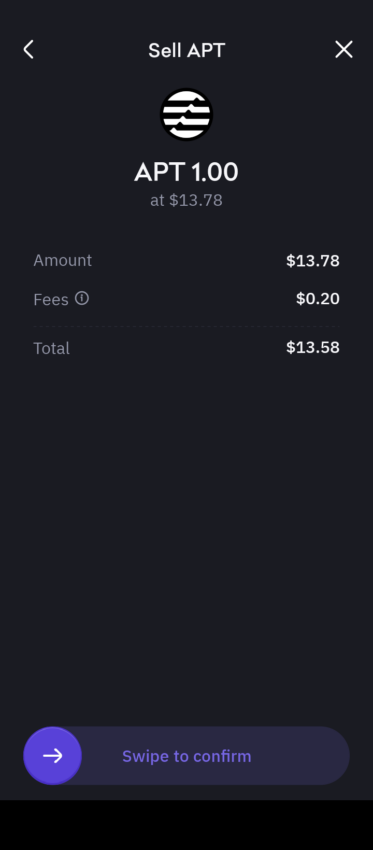

4. Confirm your choices: After you have selected the amount, you land on the following page to confirm your choices. After you have checked to make sure all of the information is correct, swipe right at the bottom of the screen.

Congratulations, you have successfully sold Aptos (APT)!

What is Aptos (APT)?

Aptos is a layer-1 blockchain armed with smart contract capabilities. The name “Aptos,” derived from the Ohlone language, translates to “The People.” Aptos debuted on Oct. 12, 2022, with its main blockchain network, termed Aptos Autumn, debuting shortly afterward on Oct. 17, 2022.

Mo Shaikh, serving as CEO, and Avery Ching, acting as CTO, spearheaded the development of Aptos under the banner of Aptos Labs. Both founders are alumni of Meta, where they contributed to the now-defunct Project Libra, a proposed blockchain and digital currency initiative.

The Aptos Network is a protocol that’s designed to help potentially replace the way the internet exists today… Aptos sets itself apart from its competitors by constantly innovating and changing the way where we exist.

Mo Shaikh, CEO of Aptos Labs: YouTube

Despite Project Libra’s discontinuation, its technical groundwork and vision influenced the creation of Aptos Labs, paving the way for the Aptos and potentially other similar blockchain ventures.

Aptos has received at least $350 million over multiple rounds of funding from at least 25 well-known investors. Some of these include Franklin Templeton, Dragonfly Capital, A16z, FTX, and Binance Labs.

How does Aptos (APT) work?

Aptos stands out from other blockchains in many ways. The most obvious USP is its parallel execution of transactions. For reference, Ethereum is single-threaded. This means it can only execute transactions one at a time, one after another. This is the case for most blockchains, which presents a bottleneck for users. With parallel execution, Aptos can process multiple transactions at the same time without causing a conflict in the ledger. Here, throughput significantly increases beyond that of single-threaded blockchains.

In other words, the consensus process is constructed in a parallel framework, with each task — order, execute, and commit — processed independently. This structure enables transactions to be performed concurrently rather than having to wait for the following transaction to be committed.

Another aspect unique to Aptos is the Move language. Move is a web3 smart contract programming language based on the Rust programming language. Meta (formerly Facebook) created Move for the Diem (Libra) blockchain.

AptosBFT is the Aptos protocol’s BFT consensus algorithm, which is based on the Jolteon consensus mechanism. It is a proof-of-stake (PoS) blockchain, which means that validators must stake or lock up their cryptocurrency in order to update blocks on-chain.

Where to buy Aptos (APT)

Before you buy APT, you must choose a platform that can facilitate the transaction. Crypto enthusiasts looking to buy Aptos have a number of leading cryptocurrency exchanges to choose from. Here’s a quick summary of BeInCrypto’s top recommended platforms for users looking to purchase APT safely and securely.

Kraken

Kraken, founded in 2011 by Jesse Powell, is one of the oldest Bitcoin exchanges that has since pivoted to offer altcoins as well. It is known for its advanced trading features, such as an advanced trading interface, charts, order types, platform security, and cryptocurrency derivatives offerings.

Coinbase

Brian Armstrong and Fred Ehsram created Coinbase in 2012. It is one of the oldest cryptocurrency brokerage on the U.S. It operates both an exchange and a brokerage and has a subscription that allows users to take advantage of lower trading fees and other customer perks. Coinbase is also renowned for its platform security.

Uphold

Uphold is a cryptocurrency exchange that was launched in 2015 by Halsey Minor, who also created CNET. It is based out of the U.S. and is one of the few regulated exchanges that offers a vast selection of altcoins. It is also known for its services for converting crypto into fiat and precious metals.

KuCoin

KuCoin is a global cryptocurrency exchange that provides a variety of financial services to new and seasoned investors. KuCoin, which launched in September 2017, has expanded swiftly and is well-known for its user-friendly design, diverse cryptocurrency trading pairs, and unique features.

Bybit is a cryptocurrency exchange that specializes in derivatives trading, particularly in cryptocurrency futures and perpetual contracts. Founded in 2018, it has quickly become one of the popular platforms in the crypto derivatives market, catering to a range of traders from beginners to advanced professionals.

Why is Aptos (APT) popular?

Much of the interest surrounding Aptos can be attributed to its intriguing background. Aptos is a blockchain guided by its unique ambitions and technological framework. It also draws historical significance from its roots in Meta’s abandoned Diem blockchain venture.

Notably, a significant portion of the Aptos development team previously contributed to the inception, architecture, and progression of the Diem project. Additionally, Aptos has garnered attention due to its close relationship with the Sui blockchain, another platform engineered by ex-Diem professionals.

This shared lineage between Aptos, Diem, and Sui highlights a deep-seated connection in their foundational technology and expertise, contributing to the buzz around Aptos.

Aptos (APT) vs. other cryptocurrencies

There is no shortage of cryptos with which to compare APT. The most anticipated comparison is arguably with its proverbial sibling, SUI. Here is a brief comparison of the platforms and their respective native coins.

Aptos (APT) vs. Sui: An ultimate comparison

Sui and Aptos are very similar in that they are both Diem’s spiritual offspring. The founders of both are from Meta. The networks also share some investors. Both blockchains use the Move programming language, although Sui uses a slightly modified version of Core Move.

| Aptos/Move | Sui/MOVE | |

|---|---|---|

| Data storage | Stored at a global address within the account of the owner | Stored at a global address |

| Parallelization | Can infer parallelization at runtime | Specifying all data access is reuired |

| Transaction safety | Sequence number | Transaction uniqueness |

| Type safety | Module structs and generics | Module structs and generics |

| Function calling | Static dispatch | Static dispatch |

| Authenticated storage | Yes | No |

| Object global accessibility | Yes | No |

But there are differences, too. For example, Sui can handle about 120,000 transactions every second, while Aptos can handle more — around 160,000. Aptos makes a new block every five seconds, but Sui is a bit faster, at every three seconds. Also, Aptos achieves finality in less than a second, while Sui is even quicker, taking only 480 milliseconds.

Sui has a maximum supply of 10 billion SUI. APT, on the other hand, does not have a fixed supply. Aptos has 140 validators operating the blockchain, while Sui has slightly fewer — about 106 validators.

When it comes to staking, the majority of SUI tokens are staked, which is over 8 billion SUI as of July 9, 2024. Users are staking almost 871 million APT, which is slightly less than the circulating supply of APT, which sits at a little over one billion.

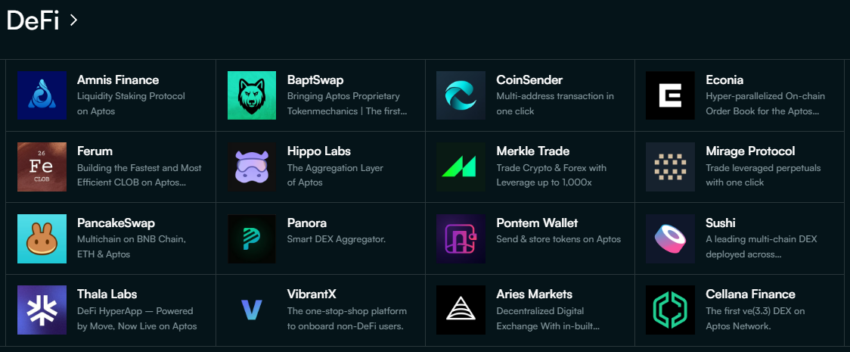

Aptos (APT) ecosystem

Moving to Aptos applications, users are spoiled for choice. Aptos has a huge variety of applications for users to choose from, ranging across many categories, such as:

- Decentralized finance (DeFi)

- Non-fungible tokens (NFTs)

- Bridges

- Crypto wallets

- Social

- Marketplaces

As you can see in the image above, projects like PancakeSwap and SushiSwap have already migrated to the Aptos ecosystem. Both are decentralized exchanges (DEX) native to the BNB blockchain that allow for DeFi activities.

Speaking of DeFi, Aptos also has a stablecoin. Thala is a token that allows you to borrow MOD, an overcollateralized stablecoin.

In the realm of bridging, you will also notice a few familiar faces. LayerZero, Wormhole, and OKX DEX are a few of the big-name bridges that you can use to move assets onto Aptos. LayerZero and Wormhole are key projects in the bridging sector. The former allows bridging for both messaging and assets, while the latter primarily deals with assets.

Aptos also supports decentralized social media. Chingari, TowneSquare, and Cafeteria are a few options that you can choose from. Chingari is a web3 social media platform that caters to India, Indonesia, Turkey, and many other countries.

Cafeteria is a social media app that allows you to create your own social media groups. Furthermore, TowneSquare is a social media app that covers a multitude of activities, including payments, community spaces, and discovering your favorite content and digital items.

Aptos (APT) wallets

Consider the following crypto wallets if you’re looking for the perfect place to store your APT. Each offers safe and secure storage for your Aptos crypto. Ensure that you always practice good crypto wallet security and never download or click on links you aren’t certain are official.

EVO Wallet

The EVO wallet is a user-friendly platform designed for the Aptos blockchain, compatible with both iOS and Android devices. Notably, EVO wallet offers two-factor authentication (2FA) for enhanced security, includes a feature to track NFTs, and supports staking, which allows users to earn rewards on their holdings.

Trust Wallet

Trust Wallet is a mobile cryptocurrency wallet that supports a wide variety of digital assets. It allows users to send, receive, and store a range of cryptocurrencies and digital tokens. Beyond basic wallet functionality, Trust Wallet includes features such as a web3 browser that enables users to interact with decentralized applications (DApps) directly through the app.

Nightly Wallet

The Nightly Wallet is a multi-chain cryptocurrency wallet that supports a variety of blockchains, including Solana, Near, Aptos, Sui, and Aleph Zero. The wallet is available both as a mobile app and a browser extension, catering to a wide range of devices and preferences.

FoxWallet

FoxWallet is marketed as a web3 wallet. The wallet supports various main chains including Ethereum, Aptos, Solana, BNB, and many more. It provides a platform for users to manage different digital assets, access decentralized applications, and store art NFTs and game assets all in one place.

Gem Wallet

Gem Wallet is designed for DeFi and supports a range of activities including sending, receiving, trading, and buying crypto assets. It is available on both iOS and Android platforms. Additionally, Gem Wallet allows users to swap and trade over 1000+ crypto assets privately, stake cryptocurrencies, and store NFTs, among other features.

Aptos (APT) staking

Staking involves participants locking up utility coins to support network consensus. Validators’ vote weights are proportional to their stakes, aligning blockchain performance with validators’ interests.

The staking process accommodates different roles: owners control funds, operators manage nodes, and voters engage in governance. Changes like adding or unlocking funds impact stake states and validator statuses, influencing their activities and rewards within the ecosystem.

In Aptos staking, you can delegate your coins to a validator — essentially like choosing someone to vote on your behalf in the network. To participate in the Aptos network as a validator, you must stake at least 1M APT tokens, with a maximum limit of 50M APT tokens.

Once part of the validator set, your stake is locked for a duration determined by Aptos governance. The network offers an Annual Percentage Rate (APR) of 7% on staked APT, with rewards distributed after each Epoch.

Validating process

As mentioned earlier, staking gives validators certain governance rights. Primarily, validators can update the distributed ledger that forms the blockchain. The process unfolds as follows:

- A validator leader is selected based on performance and stake, not by vote.

- The leader proposes a new block order and includes previous quorum votes.

- All validators vote on this new block proposal.

- Consensus among validators finalizes the block.

- Only the leader gets rewards, not the voting validators.

- The cycle repeats for subsequent blocks, with rewards distributed at the epoch end.

Aptos (APT): Should you buy into the hype?

Proof of concept is one thing, but how does Aptos fare in the wild? Continue reading to find out if Aptos is worth the hype.

Pros and cons of investing in Aptos (APT)

| Pros | Cons |

|---|---|

| Fast block times and finality | Small validator set size |

| High transaction throughput | High staking requirements |

| Low transaction fees | Poor network performance in prod. |

| Energy effecient | |

| Ownable objects (e.g. tokens) |

Aptos is very ambitious, which is commendable. In a world of EVM dominance, it is one of the few projects that has ventured into uncharted territories to build out its own ecosystem, virtual machine, and tooling.

However, ambition is not enough when it comes to users. Aptos has many good qualities and is extremely fast when it comes to transaction throughput and block times. Moreover, the revolutionary Move language allows accounts and addresses to actually own objects like fungible tokens.

In contrast, Ethereum and EVM-compatible chains do the opposite. Your tokens are simply smart contracts on Ethereum. The smart contract keeps track of all of the addresses holding the tokens. Your Ethereum account doesn’t actually hold the tokens.

On the other hand, Aptos has a small validator set, which means that the attack surface is small compared to that of its competitors. In the case of staking, this is where the ugly side of PoS can rear its ugly head. Aptos has a very high minimum staking requirement. In order to gain any share in the validator set, you must purchase tokens, which would inevitably and simultaneously increase the price. Lastly, Aptos boasts a high network performance potential, but it has yet to actually reach these metrics in production.

Is Aptos (APT) a good investment for you?

Despite its performance and concerns around decentralization, there may be opportunities for APT yet. However, users should keep in mind that there is a difference between trading and investing. Traders can make money regardless if the project is successful, while investors mainly depend on the success of the project itself.

That being said, APT has made higher highs in early 2024 in price and market cap. This could be due to positive performance in the crypto markets in general, with Bitcoin having surpassed its all-time high on March 11, 2024 — a bullish sign for the entire decentralized asset ecosystem. APT has since made a significant pullback as of July 9, 2024.

However, major events like the impending Bitcoin halving, U.S. interest rate pauses, and a possible reversal could contribute to the performance of APT in 2024 and beyond. Regardless, investing is risky and traders should conduct their own market analysis before trading.

Buy Aptos and other cryptos with caution

Overall, Aptos has done relatively well since its debut. It is revolutionary in the sense that it has built a unique product that users can enjoy. The network also created a lot of hype alongside its “sister” blockchain, Sui, and the team has since secured multiple deals that have added to the value of the chain. If these accomplishments pique your interest, you now know how to buy Aptos.

Remember to always do so with caution and a plan in place, including an investment strategy that includes exiting. Keep in mind that profits are not guaranteed, even in a bull market, and crypto remains a highly volatile asset class.

Frequently asked questions

How can I buy Aptos coin?

Can I buy Aptos on Binance?

Which exchange is Aptos listed on?

Is Aptos a good investment?

What will be the price of Aptos in 2025?

Is Aptos better than Ethereum?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.