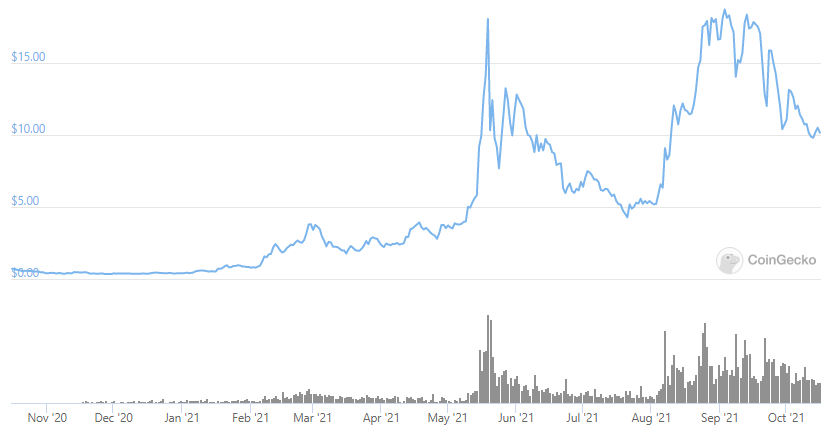

In 2021, there still exists a focus on bridging the gap between Bitcoin and Ethereum. While multiple solutions have been presented, one of the most intriguing is Ergo, a project that has experienced a sudden surge in interest. The project’s objective of addressing the flaws of both Bitcoin and Ethereum was captivating enough that the ERG cryptocurrency price tripled within a month in August 2021.

Ergo aims to fortify smart contracts through its clever use of Proof-of-Work consensus. At a time when DeFi hacks happen on a regular basis, this could be very significant for the market. We offer a general overview of Ergo (ERG) and its solutions, as well some of the more subtle aspects of the project here.

Understanding Ergo and other blockchains

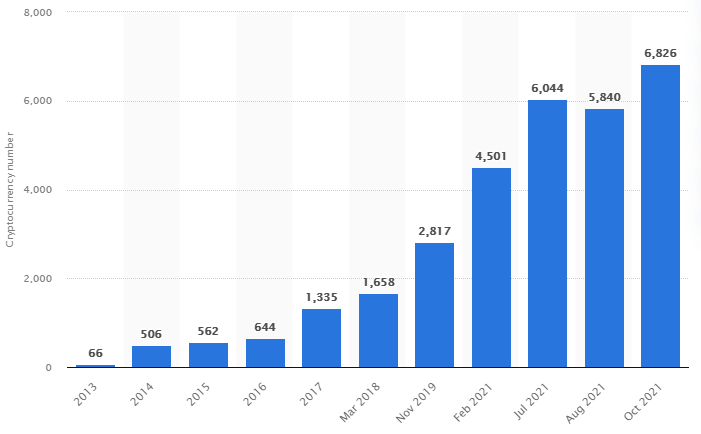

If you have been following the crypto space even for a few months, you may have noticed that there are many blockchains competing for market share. Bitcoin has recently returned to its $1 trillion market cap, making up about half of the entire crypto valuation, consisting of over 6,000 crypto coins. Yet, many are under the impression that this makes bitcoin the best and the most advanced cryptocurrency.

While it is true that Bitcoin is the oldest, most secured, and holding the highest value, it lacks some critical features that came about later. For example, Ethereum, Solana, Avalanche, or Algorand are all smart contract blockchains. Unlike Bitcoin, this gives them the ability to codify a wide range of functions performed by institutions.

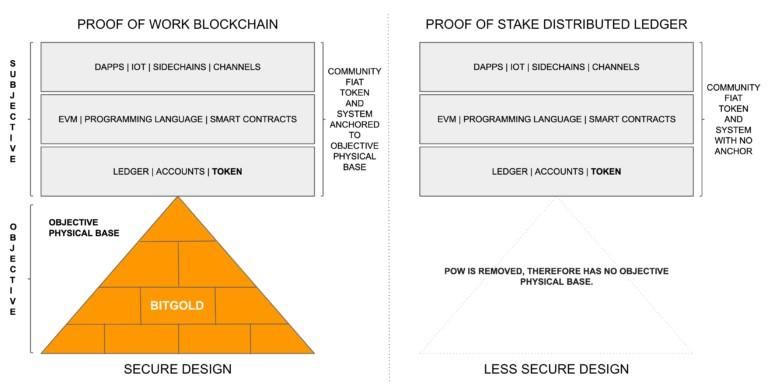

The most popular ones are borrowing, lending, and decentralized exchanges. In two words, smart contract blockchains are the backbone of decentralized finance (DeFi). However, all of those mentioned blockchains use the Proof-of-Stake (PoS) consensus algorithm to secure the network. Meaning, they use economic staking instead of mining, which requires gas fees.

Who made Ergo crypto?

The lead developer behind the Ergo project is Alexander Chepurnoy. He is a blockchain veteran, having participated in Bitcoin’s development since 2011. Chepurnoy has co-authored and published multiple papers on blockchain technology, and is a degree holder from the Saint Petersburg National Research University (ITMO). Chepurnoy’s first big project was the NXT platform.

Together with Dmitry Meshkov, they embarked on the effort to create Ergo, launching the mainnet on July 1, 2019. Meshkov has a Ph.D. in physics and a similarly rich experience in software development. At the time of Ergo’s launch, Chepurnoy issued a statement clarifying what the ergo crypto is all about:

“We have developed an approach to smart contracts in line with Bitcoin’s original concept, but with small additions that potentially cover 99% of current use-cases. Ergo allows people to synchronise with the network by downloading less than a megabyte of data, reducing the process from potentially weeks to minutes and enabling it to take place on mobile devices – all with the same security as current third-party solutions.”

Ergo has a lot in common with Cardano

Interestingly, another heavyweight of blockchain development, Charles Hoskinson, the founder of Cardano (ADA), has been supporting Ergo since 2017, calling it a “technological marvel.” This is not surprising as Chepurnoy worked as a research fellow at Cardano’s IOHK foundation. Some of Ergo’s developers had also worked on Facebook’s Libra cryptocurrency, which has since turned into the Diem stablecoin.

It seems the core developers are going with Cardano’s philosophy moving forward. Both teams emphasize creating a proper research groundwork first before implementing code. Although this approach results in more delays, it does tend to incur fewer code vulnerability issues down the line.

Most recently, on October 12, 2021, open-source Ergo developers held the 2nd Hackathon — ErgoHack 2.0 — with judgment on submissions still pending. Joseph Armeanio, Ergo’s business manager, noted that submissions covered artists, traders, and miners. The third hackathon event will focus on privacy, specifically a mixer to ensure transactions are protected from prying eyes.

“We need to retain the privacy aspect… Otherwise, in my opinion, we are downgrading. It may be a technological upgrade, it may create more efficiency, but in terms of human freedom and wellbeing, I don’t see it as a positive choice.”

During the same week, they also held a competition for an official logo. The Ergo project never had an ICO (Initial Coin Offering), nor did it have venture capitalist funding or pre-mining.

Ergo explained

The Ergo team sees that both Bitcoin and Ethereum have considerable flaws. Ergo was born as a result of a motivation to address these issues. Like Bitcoin, Ergo (ERG) employs Proof-of-Work (PoW) consensus to secure its blockchain network. However, like Ethereum, Ergo is simultaneously a programmable blockchain capable of deploying smart contracts.

In both instances, Ergo appears to solve the downsides of Bitcoin and Ethereum:

- Instead of exerting high electricity requirements like Bitcoin to solve complex cryptographic equations, the ergo crypto uses a different mining algorithm. Dubbed Autolykos, it makes mining more energy-efficient because it creates a limit on both mining pools and specialized ASIC machines. This way, one can mine ergo with a commercial-grade GPU, just like in the old days.

- When it comes to Ergo’s Ethereum-like programmability, it has an advantage as it doesn’t have any gas fees, which is the cost users have to pay every time they make a transaction. Ethereum is notorious for having exorbitant gas fees the more traffic its network onboards. Instead, ergo has very stable and negligible transaction fees — at about 0.0011 ERG or one cent ($0.01).

Although these two features make ergo stand apart, what is it exactly?

Primarily, because it uses Proof-of-Work consensus, it has higher fault tolerance compared to Proof-of-Stake blockchains like Ethereum — 50% vs. 33%. One could say that makes Ergo more objectively grounded, just like Bitcoin, as shown below.

This is why the Ergo development team calls it a “Resilient Platform for Contractual Money,” as it combines the benefits of the Bitcoin and Ethereum networks, without carrying on their downsides — energy waste and lesser security.

How does Ergo work?

Thanks to its user-friendly ErgoScript programming language, each ergo coin hosted within smart contracts has a layer of protection. It specifies when the coin can be used, by whom, and under which conditions. ErgoSript uses Sigma Protocols as the building blocks for zero-knowledge proof, used in cryptography.

In practice, this means that a sigma (Σ) protocol revolved around a 3-fold proofing mechanism to secure contractual money:

- Message sent from the prover to verifier, as the first one

- Random challenge coming from the verifier

- Message sent from the prover to the verifier, as the second one

Based on these sigma protocols, ErgoScript makes it easy to develop smart contracts. Moreover, this is further helped by Ergo’s support for light nodes. These are blockchain software packages that neither need to hold an entire blockchain copy nor do they need to run 24/7. As such, they make Ergo very mobile-friendly because the need for storage space and computing power is significantly reduced.

Furthermore, by divesting itself from general-purpose languages, such as C, Java, or Python, ErgoScript was specifically designed to be the best at what it does — create code for decentralized finance. Specifically, contractual money in a Turing-complete manner but with a reduced potential for spam attacks thanks to its ahead-of-time estimation feature.

Lastly, just like Tezos (XTZ), Ergo (ERG) is a self-amending blockchain, making it easier to upgrade for the long haul, which is another part of its resiliency feature. Unlike Bitcoin, Ergo doesn’t have a hard block size limit. Based on network demand, it can shrink or increase, but its growth rate is limited to a certain rate to prevent spurts in a short time span.

Notable Ergo dapps

Like other smart contract platforms, Ergo can support a wide range of complex DApps. One of the more notable ones are:

ErgoMixer

Hailed as the first non-custodial and non-interactive crypto mixer, it secures user privacy by sending tokens in batches and then mixing them up. Although not impossible, it makes tracking user transactions significantly more difficult as opposed to just directly sending tokens from one wallet into another.

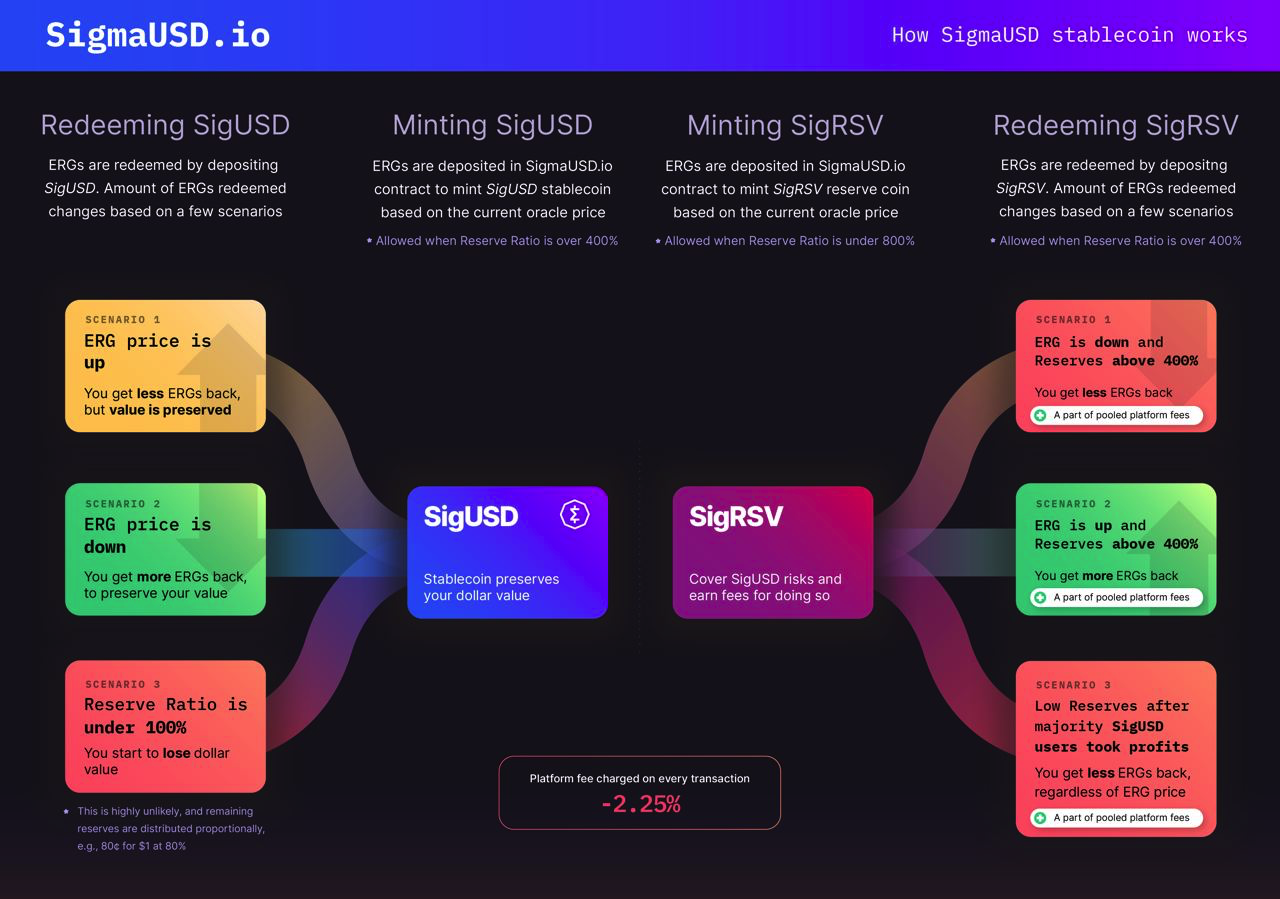

SigmaUSD

Built on the AgeUSD protocol, it is the first UTx0-based stablecoin. Unlike USDC or USDT, sigmaUSD is a decentralized stablecoin that has been developed in partnership with Cardano’s IOHK and Emurgo. Its collateralization and emission setup is as follows:

Ergo Auction House

What would a smart contract blockchain be without an NFT marketplace. As of press time, Ergo Auction House is running 222 active auctions worth 1012 ERG, which translates to $10.3k.

Still in the works, Ergo is yet to release its decentralized exchange and a crowdfunding platform.

Tokenomics

ERG is a deflationary token, hard-capped at under 100 million ERG. It doesn’t have a long tail of emission, and its block rewards steadily decrease following a two-year period.

When ERG launched on the mainnet, block rewards were set at 75 ERG. After eight years, it will go down to zero, at which point the total ERG supply will have a settled number.

Presently, ERG’s maximum supply is 97,739,924 ERG, with circulating supply a third of that, at 32,012,428 ERG. To put ERG’s emission into perspective, Bitcoin’s emission will be completed over 100 years, with nearly 75% mined within BTC’s first eight years.

Improving upon Bitcoin design, ergo crypto has a feature called storage boxes — UTXOs. If they have been inactive for over four years, ergo miners receive storage rent fees in addition to transaction fees. This approach gives miners a source of revenue once block rewards run down to zero. Additionally, storage fees recycle lost coins back into ergo’s economy at a rate of ~0.13 ERG every four years.

Since its launch, ergo (ERG) token price achieved its ATH on 16 Dec. 2017 at $22.37, followed by a three-year gap under $5, to currently settling at $10. Given that the ERG token has a relatively small market cap, at $327.64 million, it is not surprising to see wild price fluctuations. It appears that its price resistance level hovers around $18, still in need of a breakout since 2017.

Ergo mining

As mentioned previously, Ergo’s minting of the entire supply will occur during the first eight years after its mainnet launch. The prerequisites for mining ERG tokens are very friendly to newcomers. One only needs to configure an Ergo node. Then, a GPU with merely 4 GB of VRAM would suffice, although 8 GB is recommended.

Needless to say — because Ergo uses a tried and tested Proof-of-Work consensus — miners can employ multiple GPUs on a single Ergo node. Likewise, you can take advantage of mining pools. The dev team recommends selecting smaller pools, listed here.

Ergo supports four types of wallets, two of which are web-based — Yoroi and Viawallet. However, of the two, only Yoroi supports native assets. Ergo’s official full node desktop wallet is by far the best to use, offering native asset support, multisig, and scripts support. If you want a lighter one, Ergo mobile wallet is available on Google Play Store, having a high rating above 4.5 stars.

Where to buy ERG?

The current list of cryptocurrency exchanges where you can buy ERG tokens is rather short:

- KuCoin

- Gate.io

- CoinEx

KuCoin is a non-US-based exchange headquartered in Seychelles after cutting its ties from mainland China. It is the most popular place to buy ERG tokens. You can either download KuCoin’s app for iOS/Android or create a desktop account. After following KYC (Know-Your-Customer) procedures to confirm your identity and link up your funds, you are ready to go.

KuCoin supports all the major payment options — VISA, MasterCard, Apple Pay, and direct bank transfer via European SEPA, which offers the lowest transaction fee.

Is ergo worth a buy?

If you focus on transaction privacy, befitting the spirit of cryptocurrency as outlined in Ergo’s manifesto, then ergo is potentially worth investing in. You may have noticed that ergo hasn’t been funded by venture capitalists. That’s because they tend to avoid blockchain projects that don’t allow for full transaction transparency.

More importantly, ERG token hasn’t yet been listed on major exchanges like Binance, Gemini, or Coinbase. If that happens, its price level could rise, given its unique blend of Bitcoin and Ethereum features discussed at the beginning.

In the end, it all depends on the hard work of open-source developers and community-driven engagement. However, given Ergo’s unique prospects, and the relatively low ERG price, it likely wouldn’t hurt to diversify your crypto portfolio with it.

Frequently asked questions

What is ergo crypto?

Is ergo a good investment?

Is ergo coming to Coinbase?

What is the value of one ergo coin?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.