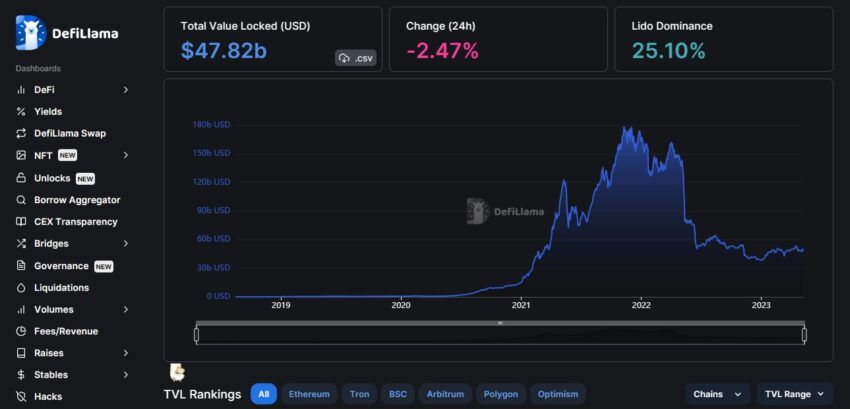

Decentralized finance (DeFi) has experienced an upsurge in both projects and users. Yet with so much data to track, it becomes increasingly difficult to aggregate DeFi apps from various sources due to its inherent decentralized nature. Platforms like DefiLlama track the total value locked of prominent projects in the space and provides up-to-date information for its users free of charge.

Read on to discover why DefiLlama is the top choice for obtaining DeFi market data, why its use is important, and what alternatives exist today.

BeInCrypto Trading Community in Telegram: read reviews on the best DeFi projects, read technical analysis on coins & get answers to all your questions from PRO traders & experts!

What is DefiLlama?

DefiLlama is currently the largest fully open-source and transparent DeFi data aggregator. It is an analytics dashboard for all things in decentralized finance that tracks TVL (total value locked) for projects like ethereum, various DEX (decentralized exchanges), lending protocols, yield farming, and staking pools.

DefiLlama has proven to be one of the most accurate DeFi market data providers and research tools for individuals needing up-to-date real-time data without paying for it. In addition, the DefiLlama platform tracks information across major chains, including Terra, Avalanche, and Cardano. DeFi applications are hard to track due to being decentralized. DefiLlama aims to solve that dilemma.

DefiLlama origin

The platform officially launched in October 2020. The developers recognized the need for a centralized platform that could offer users a comprehensive overview of the DeFi ecosystem. It has since become one of the most popular platforms for DeFi monitoring.

One anonymous contributor to DefiLlama goes by the name of 0xngmi. Notably, the leadership of DeFiLlama came under dispute in 2023 after a nearly identical site emerged (llama.fi, which now redirects to the main DeFiLlama site), and a team member reportedly attempted to launch a LLAMA token without full leadership backing.

Another member, Tendeeno, stated that 0xLlam4 is the original creator, while 0xngmi is the legal majority owner responsible for the project’s development since joining the team. Meanwhile, Charlie Watkins and Ben Hauser are known by name as the co-founders.

The parties have since settled the dispute, issuing the following statement on March 20, 2023.

DefiLlama roadmap

The team plans to expand the platform’s capabilities in the future. This will include integrating with more DeFi protocols and chains and adding additional features such as notifications and alerts. Some updates already added to the site include the addition of new metrics such as DEX volumes and transaction fees. Currently, DefiLlama is a community-driven project that is not funded by investors or any organization.

How does DefiLlama work?

The DefiLlama platform aggregates data from various blockchains to provide users with the most up-to-date and real-time DeFi market insight. On the website, users can track cross-chain data from different DeFi chains, DeFi applications and forks, oracles, and even NFTs. DefiLlama sources its information from more than 80 layer-1 blockchains and hundreds of apps as well as direct sources from CoinGecko and Uniswap.

The DefiLlama dashboard shows TVL and rankings cover different activities in USD as well as TVL from blockchains and protocols. The dashboard provides the percentage changes over a day, a week, and a month. You can scroll the rankings based on the chain you choose. In addition, the sidebar menu features individual sections to monitor and track yield farming protocols, airdrops, NFTs, etc.

Why is it important?

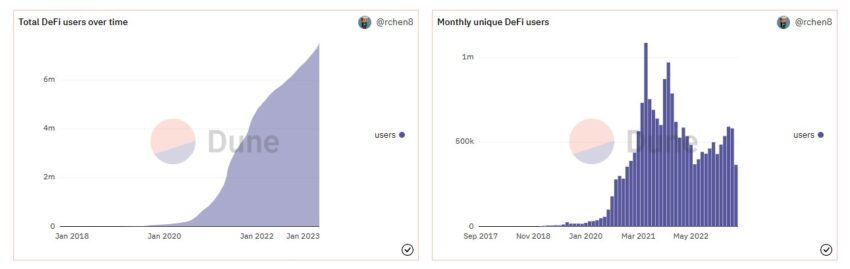

Firstly, DeFi is on the up — in a big way. The graph below shows the number of DeFi users from 2018 to January 2023, as well as monthly unique DeFi users. It is clear that decentralized finance is growing exponentially.

These days, it’s difficult to track and monitor DeFi market data and protocols across a wide range of apps and platforms. Because of its decentralized infrastructure, no centralized “engine” can provide details on the spot. Interested parties are left to check each platform and database individually just to keep updated. This can be very time consuming and potentially costly if fees are required.

This is why DefiLlama has become so popular. It does the work for you, and it does it using the most accurate, up-to-date information, at no cost to the user. Furthermore, DefiLlama promotes competition and innovation in the DeFi space by giving the projects listed more exposure and visibility. And there’s no better time than now to provide such services, as DeFi adoption goes mainstream — even amongst international banks.

“Despite the building distrust in the broader crypto ecosystem, the trustless technology showcased by DeFi platforms comes off as a key bridge to the future of finance, and banks are catching in on the action.

Robert Quartly-Janeiro, the Chief Strategy Officer (CSO) at Bitrue Exchange: BeInCrypto

DefiLlama features

The DefiLlama platform’s main feature is its aggregator. It brings together a wide range of DeFi protocols and the performance and yields of each into one app. Users can view the information via one single intuitive dashboard. The platform also segments TVL based on the deployment of the application. For example, Curve Finance is deployed on various networks, including Ethereum and Arbitrum, so the dashboard breaks it down into one easy chart.

Currently, DefiLlama tracks TVL from:

- Most major blockchains, including Ethereum, Solana, and Avalanche

- All major DEXs, including Curve, Uniswap, and SushiSwap

- Major lending protocols, including AAVE and Abracadabra

Moreover, the platform’s protocol explorer allows users to navigate its search index to check protocol features including tokenomics, risk factors, and governance. Some additional features that are prominent on the platform are outlined below.

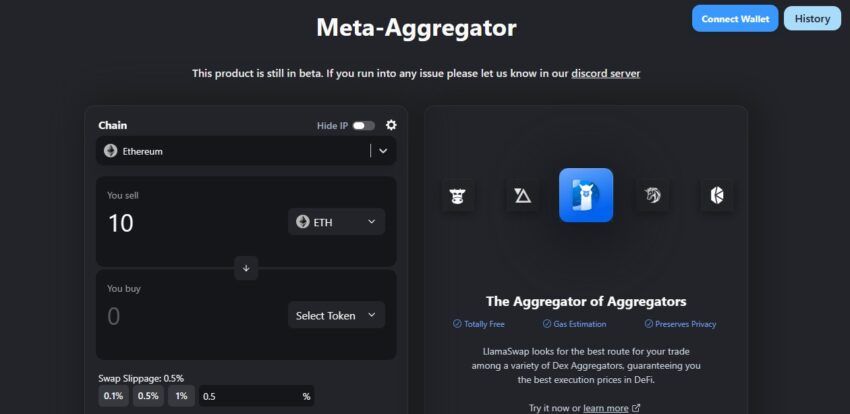

Meta-DEX Aggregator

DefiLlama has recently released a new meta-DEX aggregator feature that is currently still in beta. It queries other popular aggregators such as Cowswap and 1inch to help you find the best price. Since DefiLlama takes no fees on the swaps, users can obtain the best price when executing large on-chain orders.

Airdrops

This is another feature that was recently added to the dashboard. Essentially, users can check out all the DeFi tokens or projects that are rumored to have an upcoming airdrop on 130 different networks. This feature comes especially in handy for those wanting to get in on airdrops sooner and still have the capacity to research the entire project all in one platform. You can even filter the query by chain or TVL range.

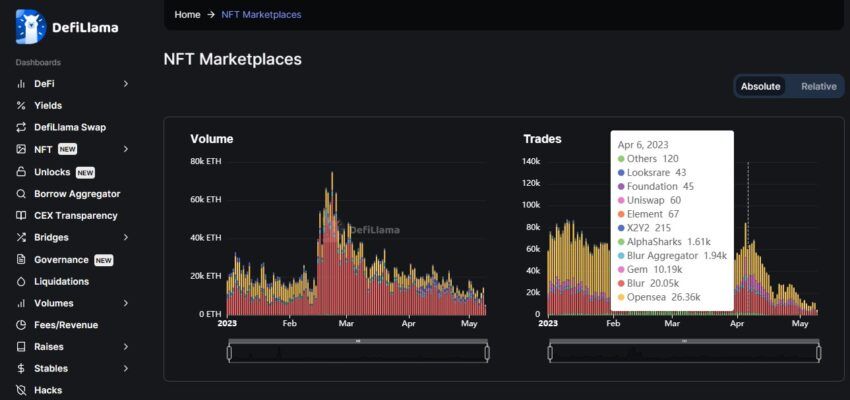

NFTs

An NFT aggregator was a feature that DefiLlama was missing initially. However, users can now explore the top NFT collections as well as NFT marketplaces on DefiLlama’s dashboard. The aggregator provides details such as the floor price, the total supply of the collection, and the daily or weekly price changes. In the NFT marketplace section, you can view the total volume and trades according to each platform.

What are some DefiLlama alternatives?

While DefiLlama may be the largest TVL DeFi data aggregator, there are some big-name competitors out there. These alternatives are ranked according to traffic, community votes, reviews, and volume.

- Etherscan.io: Etherscan is an analytics platform and block explorer that provides details on ethereum blockchain transactions. The data offered include wallet addresses, smart contracts, and transaction data, all related to ethereum. It is the most trusted blockchain explorer for this particular network.

- DappRadar: This is the largest web3 DApp distribution platform where users can track and analyze DApp performance over time. It’s a DApp store where users can trade anything DeFi, including gaming and NFTs.

- DeFiPulse: This platform is an index for DeFi monitoring and is known for being the original innovator for TVL. The platform data’s focus is on Ethereum’s ecosystem. You can explore curated DeFi lists, a collection of the best DeFi resources, and the DeFi Pulse Farmer newsletter.

- CoinMarketCap: The world’s largest crypto price-tracking website, CoinMarketCap is a trusted source for all crypto projects, complete with live data and charts.

DefiLlama contributes to the future of DeFi

The future of DeFi looks promising. As the market experiences more demand, there is an increasing need for faster, more reliable data. DefiLlama delivers this, sourcing its data directly from open and permissionless protocols on multiple blockchains. In addition, its API is open and free to use. In all, it’s likely we will continue to see an upsurge in DeFi data aggregator usage, with DeFiLlama right at the front of the pack.

Frequently asked questions

What is DefiLlama used for?

Is DefiLlama good?

Who is a competitor of DefiLlama?

Who created DefiLlama?

How does DefiLlama make money?

Are there any alternatives to DefiLlama?

How accurate is the data on DefiLlama?

How often is the data on DefiLlama updated?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.