Valkyrie’s Steven McClurg said filings for exchange-traded funds (ETFs) that track the prices of Ethereum (ETH) and Ripple (XRP) could follow a Bitcoin (BTC) ETF approval.

McClurg said the progress of the XRP asset and its inclusion in Grayscale’s Digital Large Cap fund (GDLC) are good omens for a possible ETF.

McClurg said that Valkyrie would tailor fees for its own Bitcoin ETF according to the market. However, he added that rather than looking to be the cheapest ETF provider, Valkyrie would focus on bringing value to investors.

Why Did Grayscale Add Ripple to Crypto Fund?

McClurg said that Valkyrie was not afraid of crypto ETF competition from established players at BlackRock. Customers gravitate toward companies that are the best in their market segment.

Read more: 11 Best Crypto Portfolio Trackers in 2024

“If you’re the best at what you do and you’re the niche player that focuses on the thing that you invest in, then people are going to still choose you,” McClurg stated.

He believes that Grayscale’s inclusion of XRP in its Digital Large Cap Asset Fund and the progress of XRP could encourage some ETF providers to offer XRP-related institutional products. He argues that XRP’s value to institutional investors is arguable since the asset can be accessed through other channels.

But why did Grayscale include the asset in GDLC? Could it know something others don’t?

Grayscale Could Launch Ripple Fund

Grayscale was the first to offer institutional access to Bitcoin through shares in its Grayscale Bitcoin Trust (GBTC) in 2013. At their peak, shares in the trust were trading at more than double the price of their underlying BTC.

This premium meant that buying GBTC shares was more expensive than purchasing the amount of BTC they represented on spot markets. The 2% fee reaped Grayscale handsome rewards for operating the only Bitcoin fund for several years.

But since March 2021, GBTC has been trading at a discount. The discount widened during the recent crypto winter that started with the collapse of the Terra Luna ecosystem in May 2022. Grayscale hopes the discount between GBTC and the underlying Bitcoin will be fixed if the SEC approves its plan to convert the Grayscale Bitcoin Trust into an ETF.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

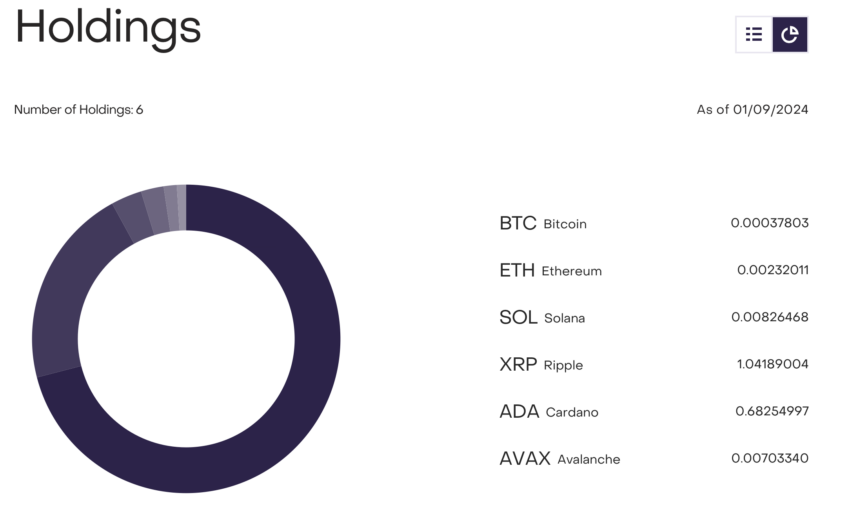

Therefore, the XRP community is excited about Grayscale’s XRP move. They feel adding XRP to the Digital Large Cap fund means a trust, and potentially, an ETF, could be on the way.

The company closed a previous XRP trust after the SEC sued XRP’s issuer, Ripple Labs, for using the asset in an unregistered securities offering. Before that, Grayscale started removing XRP from the Digital Large Cap Asset fund. Therefore, the re-addition of the asset could signal a shift in sentiment toward the asset’s institutional suitability.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.