BlackRock’s iShares Bitcoin Trust (IBIT) experienced its first-ever outflow day, with $36.9 million leaving the fund on May 1.

This notable outflow broke a 77-day streak of stable or positive net flows, raising eyebrows among investors and analysts alike.

Spot Bitcoin ETFs Experience Record Outflows

This shift comes at a time when the broader US spot Bitcoin exchange-traded funds (ETFs) have also witnessed record net outflows. The outflows sum up to $563.7 million across various funds on May 1.

Among these, the Fidelity Wise Origin Bitcoin Fund (FBTC) reported the largest single-day loss with $191.1 million, followed closely by the Grayscale Bitcoin Trust (GBTC), which saw $167.4 million exit its coffers.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

| Date | IBIT | FBTC | BITB | ARKB | BTCO | EZBC | BRRR | HODL | BTCW | GBTC | DEFI | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| April 24, 2024 | 0.0 | 5.6 | 0.0 | 4.2 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | -130.4 | 0.0 | -120.6 |

| April 25, 2024 | 0.0 | -22.6 | -6.0 | -31.3 | 0.0 | 1.9 | -20.2 | 0.0 | 0.0 | -139.4 | 0.0 | -217.6 |

| April 26, 2024 | 0.0 | -2.8 | -3.8 | 5.4 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | -82.4 | 0.0 | -83.6 |

| April 29, 2024 | 0.0 | -6.9 | 6.8 | -31.3 | 0.0 | 1.8 | 2.7 | 0.0 | 0.0 | -24.7 | 0.0 | -51.6 |

| April 30, 2024 | 0.0 | -35.3 | -34.3 | 3.6 | -2.4 | 0.0 | 0.0 | 0.0 | 0.0 | -93.2 | 0.0 | -161.6 |

| 01 May 2024 | -36.9 | -191.1 | -29.0 | -98.1 | -5.4 | -13.4 | -9.7 | -6.5 | -6.2 | -167.4 | 0.0 | -563.7 |

Despite these significant movements, experts like James Seyffart, a Bloomberg ETF analyst, reassure investors.

“These ETFs are operating smoothly across the board. Inflows and outflows are part of the norm in the life of an ETF,” Seyffart said.

Additionally, cryptocurrency enthusiasts continue to debate the impact of ETF flows on Bitcoin’s price. Coosh Alemzadeh, a noted Bitcoin investor, argues that the influence of Bitcoin ETFs on market trends is overstated.

“Bitcoin ETFs are more of a narrative IMO and have less impact on trend than people think.Solana has had “zero” ETF flows and yet has outperformed Bitcoin,” Alemzadeh wrote.

The outflows from ETFs coincided with a dip in Bitcoin’s price, which fell below $57,000 for the first time since February. BeInCrypto reported that this downturn is due to a decrease in demand among crypto whales and spot Bitcoin ETFs.

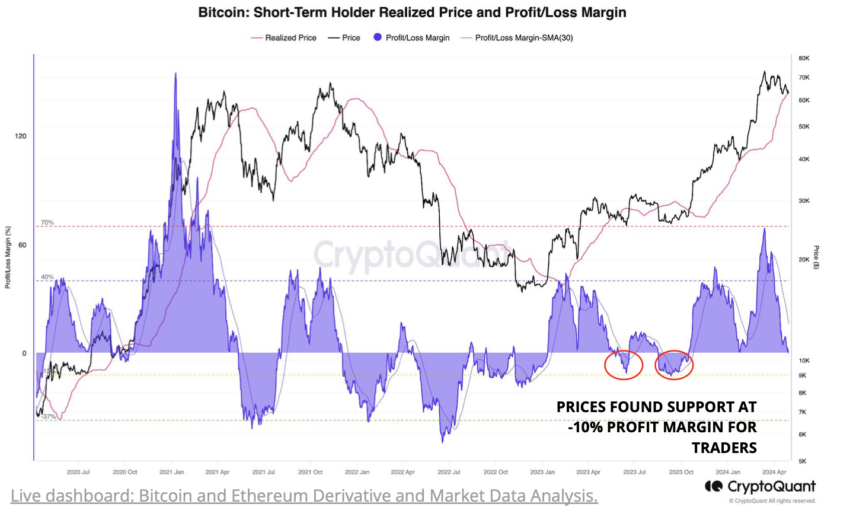

The current price of Bitcoin is situated below the short-term holders’ realized price, which lies around $63,000. Traders use this metric to gauge the cost basis of short-term holders’ purchases.

On-chain analysis platform CryptoQuant suggests that Bitcoin’s price might soon find a floor.

“The $55,000 to $57,000 level is 10% below the current realized price of short-term holders, which has historically acted as the ultimate support during bull markets,” the firm explained.

Read more: Bitcoin Price Prediction 2024/2025/2030

This insight indicates that the price might rebound in the short term unless the market shifts into an extensive downtrend.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.