Ethereum co-founder Vitalik Buterin has responded to community concerns about the network’s transitioning from Proof-of-Work (PoW) to Proof-of-Stake (PoS).

Over the past week, Ethereum’s PoS transition faced scrutiny from community members, particularly amidst concerns it prompted increased scrutiny by US regulators.

Was Ethereum’s Transition to PoS a Mistake?

Since its launch in July 2015, Ethereum operated on a PoW consensus mechanism similar to Bitcoin. In PoW, participants compete to solve cryptographic algorithms, requiring significant computational power and energy to validate each block in the blockchain.

Concerns over the environmental impact of PoW cryptocurrencies prompted authorities in various countries to advocate for their ban in favor of more sustainable alternatives.

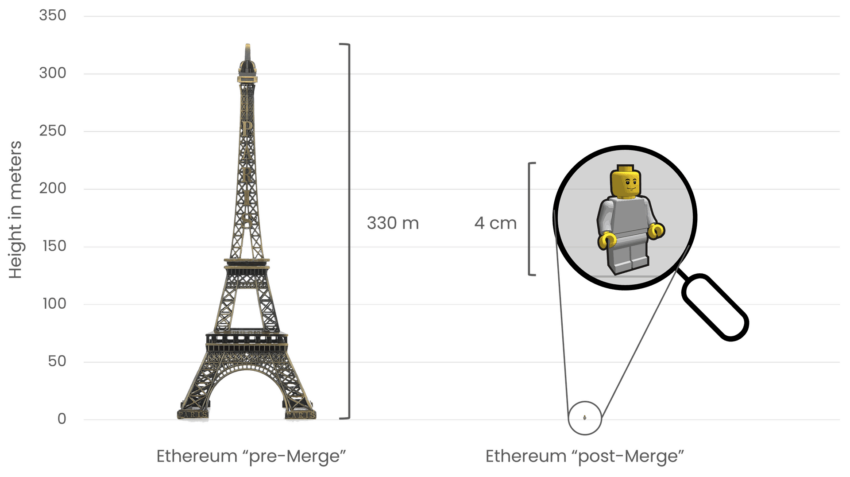

In September 2022, Ethereum developers initiated a major transition known as “The Merge,” moving towards a PoS infrastructure. This monumental shift replaced miners with stakers, addressing the environmental concerns and aligning with Ethereum’s long-term objectives.

Read more: Proof of Work and Proof of Stake Explained

Vitalik Buterin stressed the importance of this transition, highlighting PoW’s centralization and its temporary nature before PoS implementation.

“PoW was also quite centralized. It was just not talked about as much, because everyone knew it was only a temporary stage until PoS. And that doesn’t even get into how we probably mostly avoided ASICs only because the upcoming PoS switch meant no incentive to build them,” Buterin said.

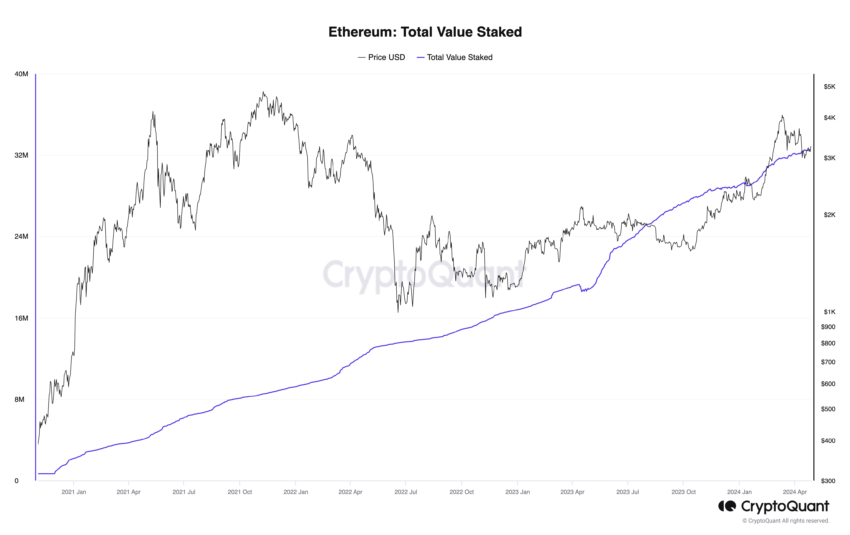

Since completing the transition to a PoS chain, Ethereum has witnessed a surge in validator numbers and staking demand. More than 25% of ETH’s circulating supply has been staked, enhancing network security and providing yields for participants.

However, Ethereum staking has drawn scrutiny from the Securities and Exchange Commission (SEC). SEC Chair Gary Gensler suggested that PoW cryptocurrencies allowing staking might meet the criteria for securities under the Howey test.

Still, a Consensys spokesperson told BeInCrypto that Ethereum’s transition to PoS has nothing to do with the SEC’s decision to investigate the Ethereum Foundation.

“Nothing about Proof-of-Stake itself versus Proof-of-Work would make Ethereum a security. I think really that’s just grabbing at some explanation for the SEC as to why they have flip-flopped on the question of Ethereum because, of course, there’s the famous speech in 2018, where director Hinman said that Ethereum wasn’t a security,” the Consensys spokesperson said.

The uncertainty surrounding Ethereum’s regulatory status remains pertinent, impacting compliance efforts for entities dealing with ETH.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.