June was an interesting month for the cryptocurrency market, characterized by considerable increases and new yearly highs across the board. BeInCrypto looks at the crypto predictions for the upcoming month of July.

The month of June was decisively bullish for the cryptocurrency market. In average terms, Bitcoin (BTC) outperformed the altcoin market, though there were some exceptions.

Below are the biggest crypto predictions for July relating to Bitcoin, altcoins, and the possibility of a minor altseason.

A Minor Altseason Will Commence

The Bitcoin Dominance Rate (BTCD) has increased significantly since its 39% low in September 2022. The rate of increase accelerated in February 2022, and the price broke out from the 48% resistance area shortly afterward.

The breakout was crucial since the area had previously been in place for 763 days. Therefore, a breakout from such a long-term resistance level often leads to significant upward movements. As expected, BTCD reached a high of 52.20% in June.

While there is a distinct lack of overhead horizontal resistance, there are signs that suggest a local top may be in place.

Firstly, the weekly RSI is deep into overbought territory and has nearly reached a new all-time high. By using the Relative Strength Index (RSI) as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset. The previous time it reached these levels (red circle) led to a sharp downward movement.

Read More: 9 Best Crypto Demo Accounts For Trading

Secondly, the BTCD was rejected by the 0.382 Fib retracement resistance level at 52%. The principle behind Fibonacci retracement levels suggests that after a considerable price movement in one direction, the price will retrace or return partially to a previous price level before continuing in its original direction.

So, BTCD may drop to the 48% level again, this time validating it as support. In turn, this would mean that altcoins will outperform Bitcoin. Since the crypto market is bullish, the most likely scenario would be that altcoins increase at a faster rate than BTC.

This prediction will be rendered invalid if BTCD reaches a weekly close above 52%. In that case, a sharp increase to the next important Fib resistance at 60.33% will be likely.

Litecoin (LTC) Will Follow in the Footsteps of Bitcoin Cash (BCH)

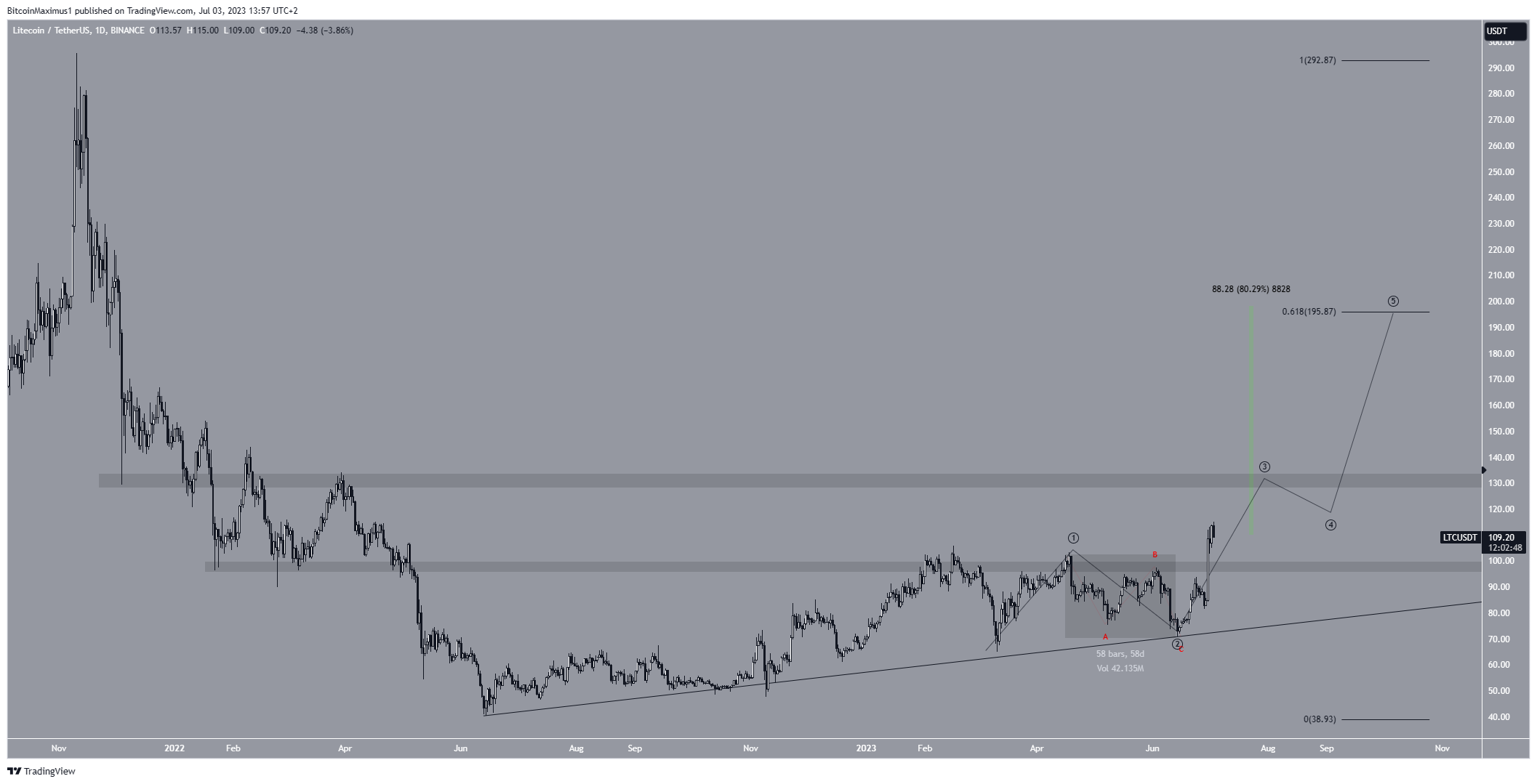

Bitcoin Cash (BCH) has been one of the biggest winners in June, increasing by 170%. The price action of Litecoin (LTC) suggests that the altcoin could pull a similar increase in July.

Between April and June (highlighted), the LTC price completed a corrective A-B-C structure (red). This was likely the second wave in a five-wave upward movement (black).

Utilizing the Elliott Wave theory, technical analysts examine long-term price patterns and investor psychology that recur to determine the direction of a trend.

If the count is correct, the LTC price has begun the third wave, as evidenced by the decisive breakout above the $95 resistance area.

While there is strong resistance at $135, the most likely level for the completion of the entire upward movement is at $195, created by the 0.618 Fib retracement resistance level.

Despite this bullish LTC price prediction, a close below $95 will mean that the count is incorrect and the trend is still bearish. In that case, the LTC price could drop to the long-term ascending support line situated at $80.

Chainlink (LINK) Will Clear the 420-Day Range

The final crypto prediction has to do with Chainlink. Over the past 420 days, the LINK price has traded in a horizontal range between $5.75 and $9.20. While both the support and resistance areas of this range have been touched multiple times, the price has not broken out or down from them.

This seemingly all changed in June when the LTC price reached a weekly close below $5.75. However, this turned out to be a deviation (green circle) since the LINK price reclaimed the area shortly afterward. It has increased since then.

Sharp upward movements often follow such deviations. Therefore, the LINK price may break out from the $9.20 resistance area and increase to the next resistance at $13.

This bullish outlook will be invalidated if the LINK price closes below $5.75. In that case, a drop to $4 will be expected. This would amount to a new yearly low.

More From BeInCrypto: 9 Best AI Crypto Trading Bots to Maximize Your Profits

For BeInCrypto’s latest crypto market analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.