Bitcoin’s (BTC) price jumped 2% after the US Bureau of Labor Statistics published the September non-farm payrolls report on Friday. A vital on-chain indicator suggests that BTC is in a prime position of bullish price action in the coming weeks.

Bitcoin price edged toward reclaiming $28,000 on October 6, as markets reacted positively to the latest US Labor market report. Can the bullish whale investors capitalize on the positive news event to reclaim the $30,000 territory?

Non-Farm Payroll Report Has Impacted Bitcoin Prices Positively

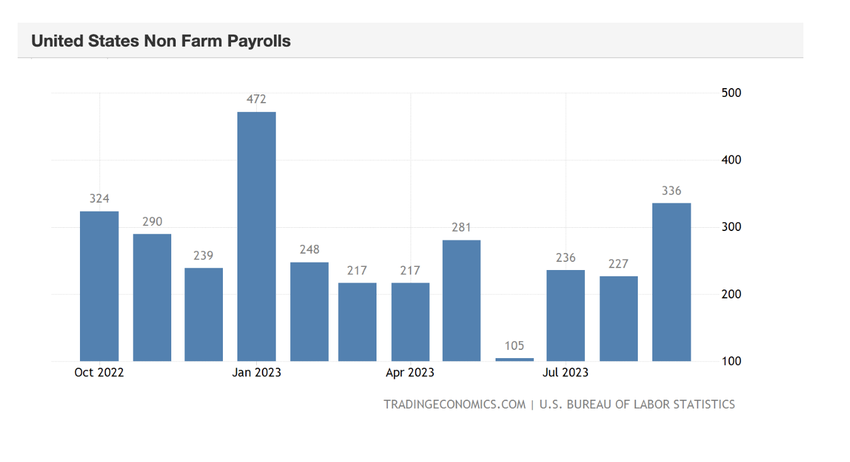

On October 6, the US Bureau of Labor Statistics published the latest non-farm payroll figures for September 2023. As seen in the chart below, the records show that non-farm payrolls increased by 336,000. Notably, the markets had priced a consensus expectation of 170,000, according to TradingEconomics.

Non-farm Payrolls (NFP) data is a closely watched economic indicator in the United States, and it can impact various financial markets, including Bitcoin. Typically, a better-than-expected NFP report indicates a strong job market and improved economic health.

With the latest NFP report exceeding last month’s figures by 48%, it could boost the confidence of major Bitcoin investors in the USA and beyond.

Read More: 9 Best Crypto Demo Accounts For Trading

US Whales on Coinbase Have Started Stacking up on BTC

The NFP report appears to have boosted institutional investors’ confidence in Bitcoin. In an indication of this, a vital on-chain indicator shows that crypto whales based in the US have started piling on buying pressure this week.

CryptoQuant’s Coinbase Premium Index shows the percentage difference between the prices of Bitcoin on Binance and Coinbase Pro spot trading platforms.

As depicted below, the BTC Coinbase Premium Index has been trending positive values for the better of this week, sitting at 0.92 as of October 6,

Notably, Binance is the dominant player in the BTC retail trades globally. Meanwhile, trading activity Coinbase Pro is largely dominated by US-based entities and high-networth investors looking to trade in a regulated environment.

Hence, when the Bitcoin Coinbase Premium Index enters positive values, spot prices on Coinbase have exceeded Binance’ marginally. When this happens, it means that US investors are increasing buying pressure.

Historically, the chart above illustrates that BTC price has often rallied within days after BTC Coinbase Premium breaks into positive values. Recently, this phenomenon has been observed on August 29 and September 20, respectively.

In both cases, Bitcoin price made noticeable gains within days after the crypto whales trading on Coinbase Pro began to move the needle.

However, it remains to be seen if BTC retail market participants will latch on the whales’ positive disposition in the coming days.

BTC Price Predicition: $30,000 is Within Reach

The abovementioned on-chain indicator establishes a close correlation between Bitcoin price and US-based whale investors’ trading activity. Hence, BTC bulls could capitalize on that to drive the ongoing price rally toward $30,000.

The Global In/Out of Money Around Price (GIOM) data, which depicts the entry price distribution of current Bitcoin investors, also supports this prediction.

If Bitcoin bulls can surmount the initial sell-wall at $29,300, the BTC price rally could hit $30,000.

As illustrated below, the 3.1 million addresses bought 1.6 million Bitcoin at an average price of $29,300. If they book early profits, they could inadvertently trigger a premature pullback.

But if the drop in whales’ confidence influences retail traders as predicted, Bitcoin price could rally toward the $30,000 range.

Still, the bears could invalidate this bullish prediction if the BTC price reverses below $25,000. However, the chart depicts that 635,000 addresses purchased 2.42 million Bitcoin at the maximum price of $26,613. If they HODL, that could mount a significant support support wall.

But that vital support buy-wall caves could catalyze a prolonged Bitcoin price reversal toward $25,000.