Bitcoin’s (BTC) price has held firm at the $34,000 territory. However, positive on-chain signals have emerged ahead of the Federal Open Market Committee (FOMC).

The US Federal Reserve is expected to announce another short-term interest rate pause during the FOMC meeting on November 1. While markets appear to have the news already priced in, historical data reveals that it could have a far-reaching long-term impact on Bitcoin prices.

US Economy Set to Enter Longest Rates Restriction Phase Since 2022

Following an unfortunate sequence of a global pandemic, geopolitical tensions, and a supply-chain crisis, the US economy plunged into a “technical recession” as consumers groaned under double-digit inflation.

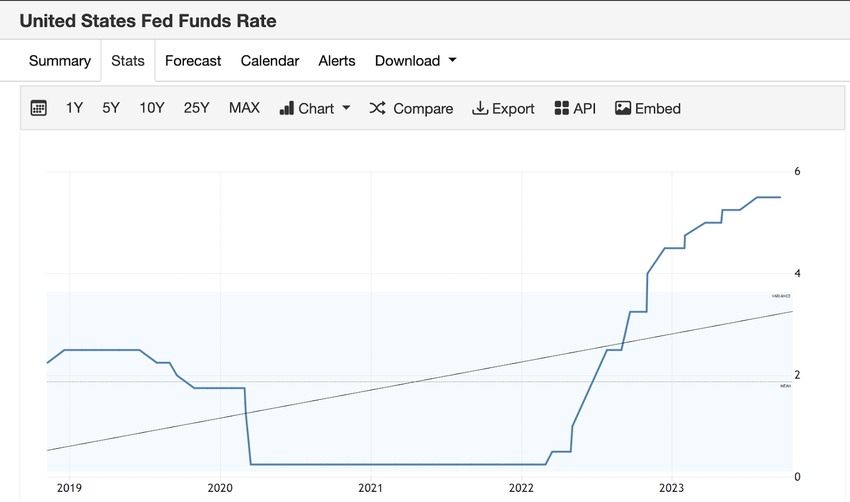

In an unprecedented response to the ravaging inflation, the Fed gradually raised the funds rate by 525 basis points over a 16-month period dating back to March 2022.

However, since rates reached a 22-year high of 5.25%-5.5% in July, the Fed announced a pause at the September 20 meeting.

The Federal Open Market Committee (FOMC) is the body responsible for directing monetary policy through open market operations. The 12-member group meets eight times yearly to make key economic decisions, including setting interest rates.

How Does Fed Rate Impact Bitcoin Price?

Like other risk-on assets, Fed rate announcements impact Bitcoin prices depending on the change in direction. Typically, during periods of high inflation, governments raise interest rates to mop up excess money supply between March 2022 and September 2023.

The resulting increase in yield on government bonds also inadvertently reduces investors’ demand for risk-on assets such as stocks and cryptocurrencies.

This phenomenon was observed as the BTC price dipped 66% from $47,000 in March 2022 to December 2022. When the Fed carried out 80% of the 525 basis point rate hike.

.

Meanwhile, as inflation drops, the Fed is expected to either maintain a neutral stance or cut the Fund rate. This is to avoid dampening economic activity in the long term.

The resulting increase in money supply also inadvertently incentivizes investors to channel capital into risk assets Bitcoin.

However, while announcing the rate pause in September, Fed chief Jerome Powell noted that inflation is still too high. Hence, strategic investors anticipate that the US economy is still a few months away from outright rate cuts.

The recent Consumer Price Index data and Non-Farm Payroll reports have both exceeded market consensus expectations. With this evidence of above-trend economic growth, labor market bounce suggests that the Fed will announce another rate pause on November 1.

The historical Fed rates trend table above shows that a second consecutive rate pause will send the US economy into its longest rate restriction phase since February 2022. This could have a prolonged positive impact on Bitcoin price and other cryptocurrency assets.

Corporate Entities Racing to Buy BTC to Front-Run Upcoming Fed Rates Cuts

Considering that the last rate pause had driven BTC price up 30%, recent on-chain data shows that corporate entities and high-networth investors are anticipating more gains.

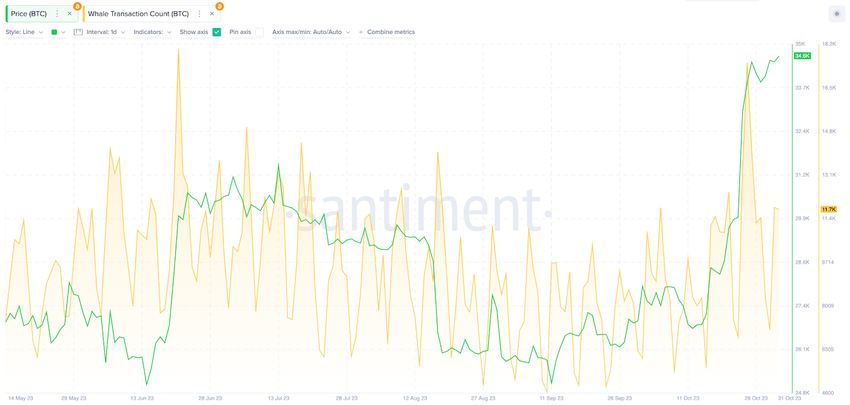

According to data from Santiment, Bitcoin has attracted a consistent flow of demand from large institutional investors since the Fed rate pause was announced on September 20. The whale demand has further intensified over the last two weeks.

The chart below illustrates that Bitcoin has attracted at least 7,000 confirmed whale transactions in each of the last 10 days. This dates back to October 22.

In fact, the 17,520 large transactions recorded on October 24 were the highest since Blackrock announced its Spot BTC ETF application in June 2023.

The Whale Transaction Count metric is a daily aggregate of the number of unique transactions exceeding $100,000. Intuitively, an increase in whale transactions is a bullish indicator, signaling increased demand from corporate entities and high net-worth investors.

In summary, drawing inferences from these historical data trends, Bitcoin price will likely make another leg-up toward $40,000 if the expected rate pause is officially announced.

Read More: 9 Best Crypto Demo Accounts For Trading

BTC Price Prediction: Road to $40,000

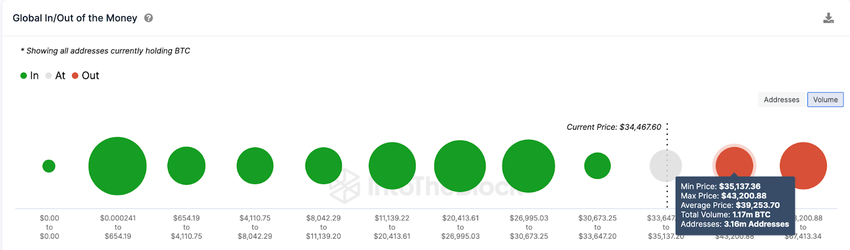

With 79% of Bitcoin holders in profitable positions, the overall sentiment within the ecosystem is dominantly positive. If the Fed Rate pause announcement intensifies the bullish momentum as expected, the BTC price will likely retest $40,000.

The Global In/Out of the Money data, an on-chain representation of current BTC holders’ historical buying trends, also confirms this prediction. It shows that the $35,100 resistance is the most significant obstacle blocking the $40,000 territory.

As depicted below, 3.16 million addresses had bought 1.17 million BTC at the minimum price of $35,137. If they close out their positions early, this could set off an instant Bitcoin price retracement.

But if the Fed rate pause incentivizes corporate entities to keep buying, the Bitcoin price rally could reach $40,000 as predicted.

Alternatively, the bears could invalidate that prediction if the BTC price dips below the $30,000 mark. But as observed over the last week, the initial support wall around $33,500 appears daunting.

The chart above shows that 1.06 million addresses currently hold 513,580 BTC bought at the average price of $33,650. If they keep HODLing, they will likely prevent a major Bitcoin price reversal.