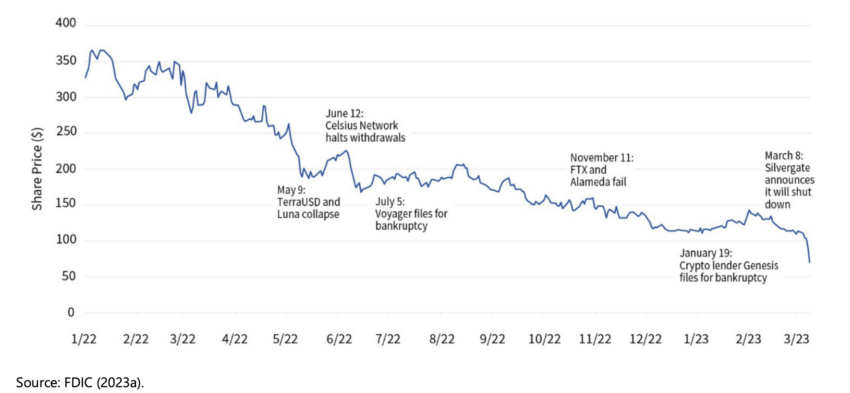

The Bank for International Settlements (BIS) cited the concentration of crypto assets in banks as one of the reasons for the 2023 banking crisis. At the end of June 2022, banks had $4.2 billion in direct exposure to crypto assets.

Signature Bank, the BIS argues, failed to perceive the risks of relying on crypto industry deposits, which disadvantaged it during the crypto collapses of 2022. It also did not have enough liquidity to satisfy outflows from non-crypto depositors spooked by the liquidation of Silvergate.

BIS ‘Proactive Intervention’ Could Overreach

According to the BIS, the failure of Silicon Valley Bank (SVB), which held cash reserves backing Circle’s USDC stablecoin, can be attributed to two factors. Its risk policies failed to match the growth of its asset base, and its management did not notice any problems with how the business ran or its balance sheet strategies.

Its management also allegedly treated supervisory interventions as compliance exercises rather than opportunities to self-evaluate. Before failing in March, the bank had 31 open supervisory inquiries looking into different aspects of its business model and risk approach.

Going forward, the BIS recommends regulators embrace a holistic approach that combines rules with proactive intervention when necessary. This approach, however, has legal risks since banks may resist any intervention lacking a legal basis.

Read more: 2023 US Banking Crisis Explained: Causes, Impact, and Solutions

Signs of legally murky intervention first occurred when the Federal Deposit Insurance Corporation asked the acquirers of Signature Bank to offload its crypto customers and assets worth $4 billion. The House Financial Services Committee during the Obama administration called similar efforts to strangle certain industries an abuse of power.

Money Laundering Fears Still Palpable

One of the obvious victims of the banking collapse was Circle, whose stablecoin lost $10 billion in market cap two weeks after SVB’s collapse. Many crypto users have since migrated to Tether, a larger but more controversial stablecoin.

But a more interesting story is shaping up as the crypto collapse pushes regulators toward clearer crypto regulations. Hong Kong, Japan, South Korea, and some European countries offer licensing regimes for crypto firms that legitimize their operation.

A side effect of this legitimacy is the need for registered firms to secure local banking partners. Banks are critical in transferring funds to exchanges and for cashing out holdings.

However, many banks still fear poor Know-Your-Customer processes that make exchanges vulnerable to money laundering. Binance, for example, lost banking and payment partners after the US Commodity and Futures Trading Commission hinted it engaged in money laundering.

Read more: 14 Best No KYC Crypto Exchanges in 2023

Initially, Asian branches of the HSBC and Standard Chartered banks hesitated to onboard crypto businesses because of money laundering associations. UK consumer banks, NatWest, Chase UK, and TSB Bank, have all placed restrictions on crypto-related transactions.

Banks in Progressive Regions Are Being Proactive

But the ice age is thawing. Customers of HSBC Hong Kong can invest in Bitcoin and Ethereum exchange-traded funds, provided they confirm their understanding of educational material on virtual asset investments.

Before opening its fiat-to-crypto payment rails to licensed Hong Kong exchanges, ZA Bank operated a sandbox that involved 100 firms. It linked its systems to the city’s company register and conducts anti-money laundering procedures to minimize risk.

South Korea’s oldest bank, Shinhan, is also testing remittances in a closed sandbox. Stablecoins insulate transfers from currency fluctuations and will benefit from the AML framework within which the bank already operates.

Do you have something to say about the BIS report after the collapse of crypto banks or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.