South Korea’s Shinhan Bank recently completed a stablecoin remittance proof-of-concept pilot on the Hedera Network that could make bank payment rails obsolete.

The pilot achieved real-time settlement and foreign exchange using the Thai baht, the New Taiwan dollar, and the South Korean won.

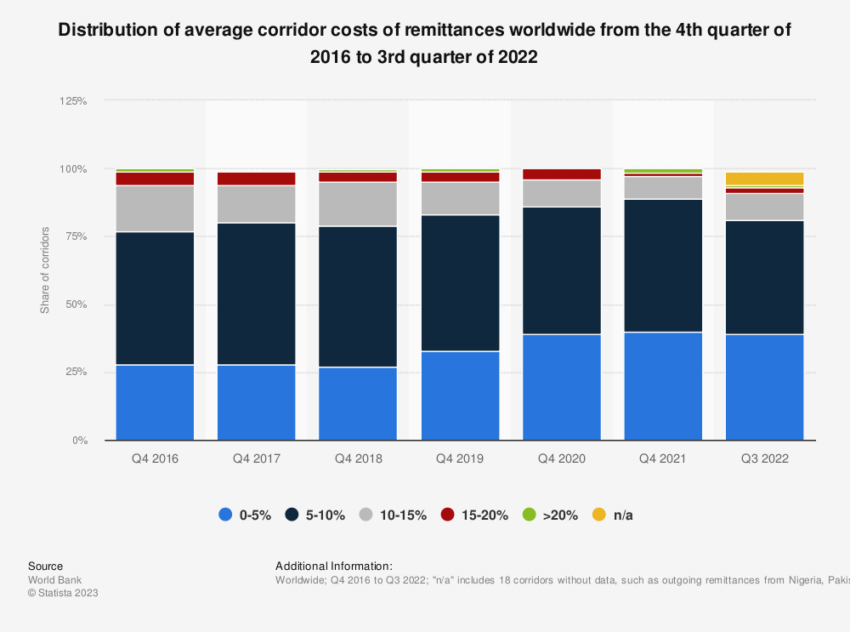

Stablecoin Transfers Can Cost 50% Less Than Traditional Remittances

The bank partnered with SCB TechX, a Siam Commercial Bank technology unit, to test the stablecoin transfers.

Stablecoins can be useful to lock in an exchange rate for the sender and recipient. The service provider sending the funds would buy stablecoins based on the exchange rate between the original currency and the currency the stablecoin is pegged to.

Learn more about stablecoins here.

This immediate lock-in would protect the sender’s funds from exchange rate changes during a wire transfer that could take up to five days. The service provider on the other end will convert the assets to local currency before giving it to the recipient.

FinClusive and Anclap, two members of the Stellar Foundation, successfully concluded a test of USDC stablecoin remittances between the US and Colombia in April. The transfers cost half of what traditional providers would charge for this corridor.

Additionally, it revealed the potential for interoperability between blockchains and banking rails.

Bank Payment Rails Still Take Too Long

In addition to their use in remittances, stablecoins play a vital role in buying crypto. Exchange customers can buy stablecoins which allow them to buy other digital assets faster than fiat.

On the other hand, fiat purchases of crypto across traditional bank networks can take days to clear. In addition, instant transfers to exchange accounts can be expensive.

A recent Hong Kong University paper urged the government to issue a stablecoin to combat the dominance of US dollar reserves. After a recently-passed bill to oversee crypto exchanges, the region said it would focus on stablecoins.

In the meantime, exchanges must rely on bank relationships for trading activity.

Several banks, including HSBC and Standard Chartered, recently revealed an unwillingness to service crypto exchanges in Hong Kong. Other banks, including ones with links to China, have supported crypto companies.

Got something to say about stablecoin transfers or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.