The U.S. central bank is pumping more money in to bail out the embattled banking system as the crisis continues. This could be one of the factors driving the war on crypto.

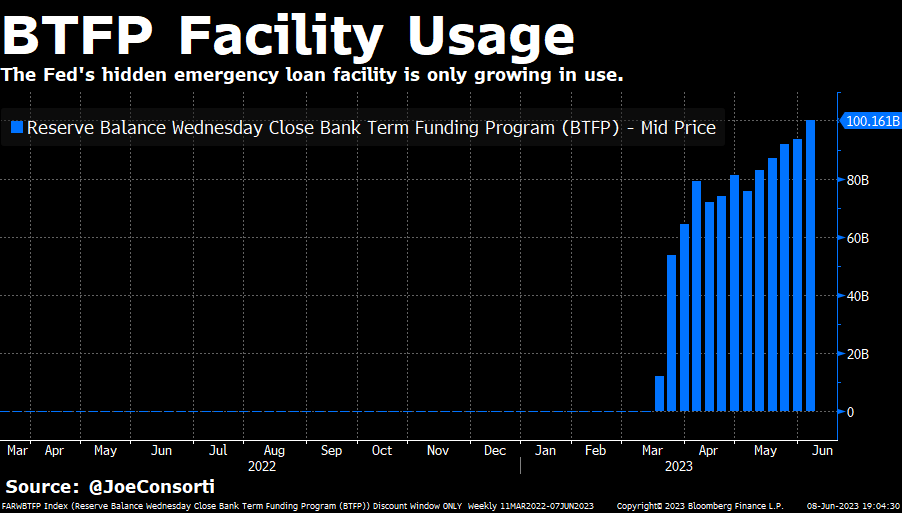

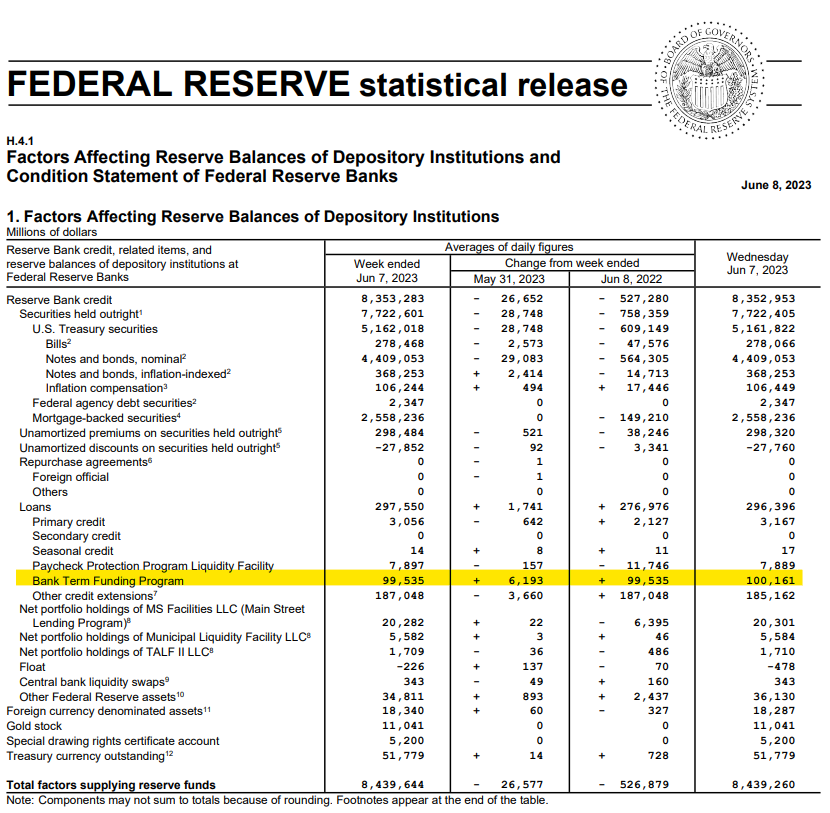

The Federal Reserve’s new emergency bank loan facility just hit $100 billion in usage. The surge in funding for banks is a clear sign that the U.S. banking crisis is far from over.

Banking Crisis Not Over

The new funding program allows banks to “receive par for their devalued assets in secret,” noted market analyst Joe Consorti.

The Bank Term Funding Program (BTFP) was created in March 2023. The aim was to make additional funding available to eligible depository institutions. This would be to help assure banks have the ability to meet the needs of all their depositors, in other words, a banking bailout.

Consorti observed that banks in crisis were using the fund to boost the value of their assets.

“Banks are turning 50¢ into $1 without other banks knowing they’re distressed and backing away.”

He added that it was a “band-aid for now,” but “hidden risk is spreading.”

Wall Street Journal chief economics correspondent Nick Timiraos observed that Fed lending to banks through the BTFP has edged up to a new high. The funding has increased for the fifth consecutive week, he added.

Get the lowdown on the 2023 U.S. banking crisis:

2023 US Banking Crisis Explained: Causes, Impact, and Solutions

The emergency lending for small banks was also noted by financial analyst ‘Frog Capital’ who commented:

“The Emergency Bank Term Funding Program, (BTFP) your Fed made up on their own and told Congress it wouldn’t exceed $25 Billion, is now over $100 Billion.”

Reasons Behind War on Crypto

Uncle Sam is doing all it can to keep its embattled banking system afloat. Several large banks have already failed this year as fears over another 2008-style banking crisis escalate.

Big banks and Wall Street holds a lot of sway over federal regulators, which could explain why they’re coming down so hard on crypto.

Bitcoin was spawned from the 2008 financial crisis when fractional reserves and toxic loans bought the system tumbling down.

Crypto is a clear threat to the banking system which is why it is so vehemently against it. Just today, Binance.US lost its banking partners and was forced to suspend USD deposits.

Banks and their partners in the government will continue striving to quash crypto, the biggest major threat to their profit margins ever to emerge.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.