The Axie Infinity (AXS) price reached a high of $7.51 today before falling slightly. It was the highest price since June 5.

During the ascent, the price cleared a critical horizontal resistance area. Can the price sustain its momentum and move towards $10?

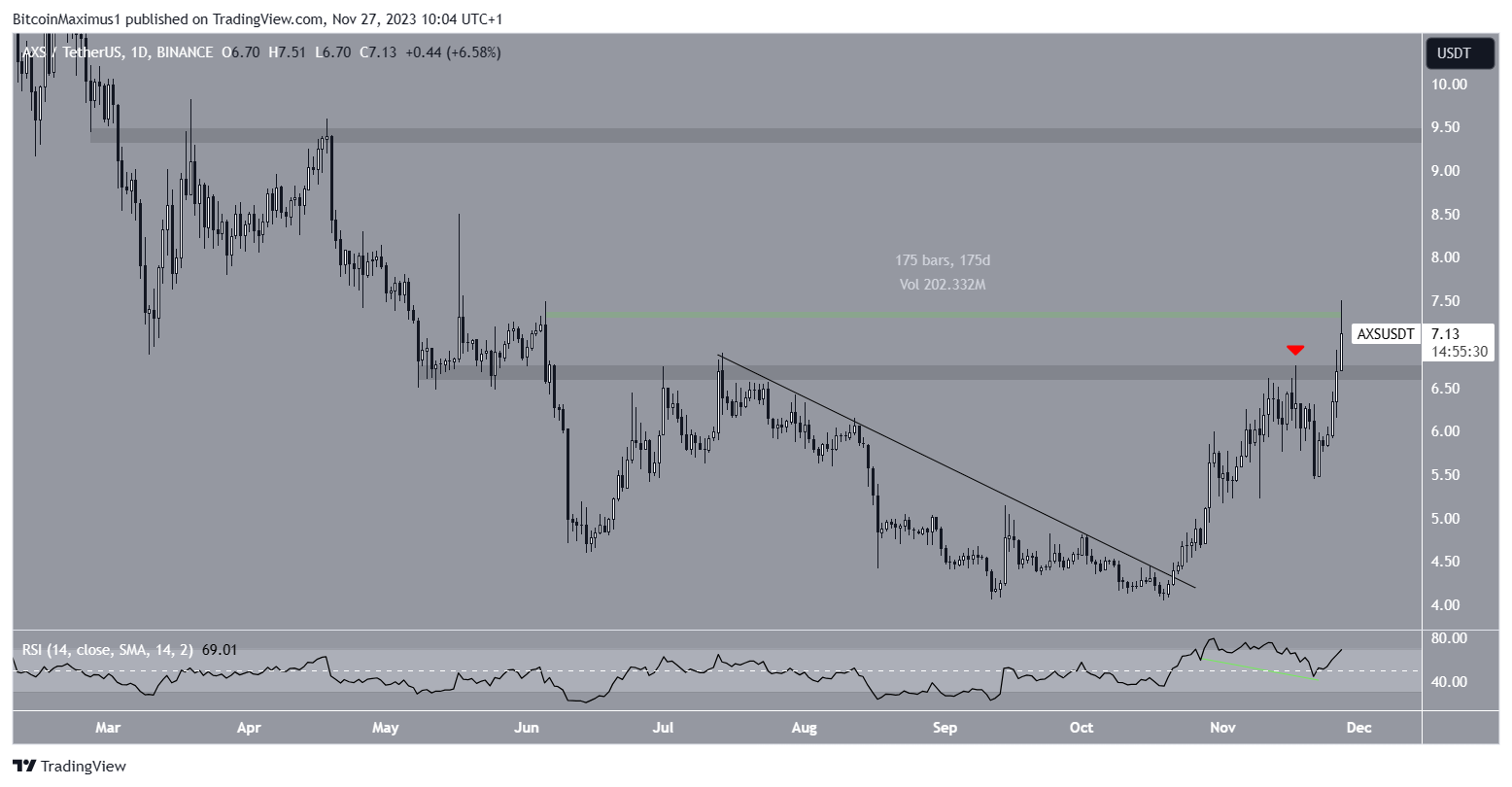

AXS Reaches 175-Day High

The technical analysis of the daily timeframe shows that the AXS price has increased rapidly since breaking out from a descending resistance trend line on October 21.

Initially, the price was rejected by a pivotal horizontal resistance area that has stood since June (red icon). However, the AXS price regained its footing shortly afterward and broke out today. The price reached a high of $7.51 before a small drop.

Market traders use the Relative Strength Index (RSI) as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset.

Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite. The RSI is above 50 and increasing. Additionally, it has generated a hidden bullish divergence (green), a sign of trend continuation.

Read More: Best Crypto Sign-Up Bonuses in 2023

Why Did AXS Price Rally?

Last week, the Sky Mavis team came out with many positive announcements.

Firstly, they stated that the original Axie Classic game has returned. Players have been flocking back to the game that started the ecosystem, with the number of weekly users reaching 100,000 in only four days.

Additionally, the team announced the launch of the Axie Infinity Merch Store.

Cryptocurrency trader and analyst Quang Avenue is bullish on the future price.

He outlined a bullish inverse head and shoulders (H&S) pattern, suggesting that the breakout from it will lead to an AXS price of $12.

AXS Price Prediction: Is $10 Attainable?

Technical analysts employ the Elliott Wave theory as a means to identify recurring long-term price patterns and investor psychology, which helps them determine the direction of a trend.

The most likely wave count suggests that the AXS price is in the third wave of a five-wave upward movement (black). The third wave is often the sharpest and longest of the bullish waves.

If wave five extends to 1.61 times the length of wave one, the AXS price will reach a high of $9.60 before correcting. This will align with the $9.50 horizontal resistance area and is an increase of 35% from the current price.

Afterward, the price could finish the fifth and final wave well above $10.

Despite this bullish AXS price prediction, a close below the $6.70 horizontal area will invalidate the breakout. In that case, the AXS price can fall by 25% to the closest support at $5.50.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.