In August 2019, BeInCrypto published an article about the ‘arms race’ that was emerging among state-backed stablecoins. Since then, the competition has only grown more intense. BeInCrypto investigates in this special report.

Today, many governments across the world are openly mulling the possibility of issuing their own central bank digital currencies. Commonly known as CDBCs, some have already issued pilot runs in the hopes of being the first.

For countries like China, tokenizing fiat is seen as a way to gain an international advantage. It seems likely that the next decade will be defined by a digital push that will forever reshape global commerce. As the IMF wrote in a September 2019 blog post:

“The world of fiat money is in flux, and innovation will transform the landscape of banking and money.”

The State and Corporate Power Struggle

However, it’s not only state-backed stablecoins that have captured the spotlight in the past year. Corporations, too, have been toying with the idea, and it’s easy to see why. Corporate-run digital currencies would allow firms to create their own internal economies with a native, fiat-backed currency underpinning them. Facebook’s Libra was among the first to publicly propose the idea despite the legal problems that have bogged it down. For better or worse, CBDCs and corporate stablecoins will someday become a fixture of the digital world. Providing for near-instant cross-border transfers, it is arguably the next logical leap in the global economy. So, who’ll be the leading actors pushing for change in this new domain? And how will they restructure the world as we know it today? BeInCrypto believes that the 2020s will undoubtedly be a decade defined by digital currencies. In part one of this in-depth investigation, we will explore the frontrunning CBDCs in this competitive sector.The Many Central Bank Digital Currencies (CBDCs)

CBDCs possesses many advantages over the current fiat model. Aside from their increased efficiency, they allow the financial world to be more inclusive under a singular system of account. This makes payments safer and encourages competition. On the other hand, the rise of CBDCs would also be an unprecedented expansion of monetary control, providing central banks with new tools beyond quantitative easing and interest rates policy. Critics contend that transitioning to a purely digital currency would allow states to monitor all cash flows, as the Chinese nation was reportedly doing in Hong Kong. As you might expect, the landscape of CBDCs is vast. According to a survey published in the journal Central Banking this year, 46 countries are actively researching digital currencies. However, unsurprisingly, most are still wary of blockchain technology because decentralization takes control away from the state. These are some of the leading nations which are currently investigating CBDCs:China

China has not held back when it comes to their commitment to a working CBDC. As BeInCrypto covered in late May, the Chinese state has accelerated efforts since it contained COVID-19. With fears that the United States may block Chinese investments, the ‘digital yuan’ is trying to position itself as an alternative, parallel financial ecosystem to the U.S. dollar. The digital yuan (called the ‘DCEP’) is part of China’s national blockchain program, set in motion last year. By all estimates, the DCEP appears close to the finish line. Leaked images show wallet app testing in 4 major Chinese cities: Shenzhen, Chengdu, Suzhou, and Xiongan. The wallet can also be used offline reportedly, allowing for digital fiat transfers through phone-to-phone contact. Officials claim that the DCEP can support 220,000 transactions-per-second, an impressive feat, but that has yet to be proven. The Chinese government also stressed that it does not intend to convert all of its circulating yuan to DCEP. Instead, the digital currency will initially be used for international settlements and bank-to-bank transfers. China has a notorious reputation for cracking down on cryptocurrencies and has maintained the ‘blockchain, not crypto’ stance despite criticism. Authorities are not backing down from the DCEP party line, which will allow the state to fully control its monetary policy.

Cryptocurrencies, in general, allow for capital flight and a lack of oversight. Given that China is chiefly concerned with social stability, the DCEP will likely work hard to contain these risks. A member of the Chinese Central Bank told Wired in February, the purpose of the DCEP is to:

China has a notorious reputation for cracking down on cryptocurrencies and has maintained the ‘blockchain, not crypto’ stance despite criticism. Authorities are not backing down from the DCEP party line, which will allow the state to fully control its monetary policy.

Cryptocurrencies, in general, allow for capital flight and a lack of oversight. Given that China is chiefly concerned with social stability, the DCEP will likely work hard to contain these risks. A member of the Chinese Central Bank told Wired in February, the purpose of the DCEP is to:

“to protect our monetary sovereignty and legal currency status.”Think of the DCEP as a ‘cryptocurrency with Chinese characteristics.’ Chinese elites view it as the best means of undermining the dollar’s dominance.

France

The Banque of France made headlines earlier this year when it announced it was exploring central bank digital currencies. In a published call for applicants, the central bank was looking to:“Identify concrete cases integrating [CBDCs] in innovative procedures for the clearing and settlement of tokenized financial assets.”The project is part of a greater one, which, if successful, will impact the entire Eurozone. The Banque of France has been openly discussing the idea since late 2019. The central bank along with Société Générale have already successfully settled securities using a prototype CBDC in May. France is currently only experimenting with CBDCs, and an official ‘digital euro’ is still a long way off. Blockchain is also not the exclusive system that the bank plans to use, either. Nonetheless, the Banque of France’s effort is the most concrete step the Eurozone has taken thus far towards tokenizing their currency. The central bank will be electing ten applicants to lead this CBDC-focused team on July 10th.

Sweden

Sweden lies outside of the Eurozone, but its experiment with CBDCs may nonetheless prove to be a blueprint for the rest of Europe, if successful. The country began testing its ‘e-krona’ in February, and the pilot will last for a year. The e-krona, with the help of a digital wallet, is also compatible with smartwatches and cards. Currently, Sweden’s parliament and its central bank are working on developing an expanded definition of ‘legal tender.’ What consequences the e-krona will have on the greater Swedish economy still needs to be documented. Regardless, Sweden’s e-krona is one of the few CBDCs that is actually blockchain-powered. The experiment is fitting, given that Sweden also happens to be among the most cashless societies in the entire world, a perfect testing ground for CBDCs.Thailand

Thailand has surprisingly proven to be a leader in CBDCs in Asia. Eight local commercial banks are participating in a CBDC trial according to a press release from May 2019. The project, called ‘Inthanon,’ was first announced in August 2018 as a blueprint and has since been expanded. In January 2020, the Hong Kong Monetary Authority, together with the Bank of Thailand released a report on cross-border payments through Inthanon. While promising, it should be noted that Thailand’s CBDC will likely only be used for financial institutions and markets – it is not intended for the general public. Implementing CBDCs in Thailand will take time. As the Governor of the Bank of Thailand (BoT) told reporters in November 2018, it will take “three to five years” for digital currencies to be adopted. Since we are in 2020 now, perhaps we could see widespread adoption among Thai financial institutions by 2022/23.Turkey

Turkey is looking to build a fintech ecosystem with its own ‘digital lira.’ As you may recall, the lira has been struggling for years with high inflation. In the past five years, a single lira has more than halved in price, from $0.37 to $0.15. Turkey hopes that converting to a CBDC-like model might make the lira more attractive as the country tries to reorient itself globally under President Erdogan. It’s a tall order with limited details at the moment. And currently, it’s unclear how much progress has been made since the initial commitment in 2019. We do know that it was included in the 2019-2023 roadmap in July of last year. There have also been some on-the-ground developments on the local level, as BeInCrypto reported in January 2020, with cities tokenizing assets. Alongside blockchain, the government has plans to improve its public services and administration with other emerging technologies like AI and big data.United Kingdom

The Bank of England was one of the first major entities to propose a transition towards CBDCs in 2017. Given London’s reputation as a global financial hub, the idea makes sense. However, the bank has struggled to implement a simple prototype. Instead, authorities have mostly paid lip service through endless discussions and research papers. In March 2020, the central bank unveiled a 57-page report on how CBDCs could potentially be introduced. The bank envisions CBDCs as both a “store of value” and for “everyday transactions.” Last year, it made headlines for its comments on Facebook’s aspirations with Libra:“We’re keeping an open mind, but not an open door”, its governors told reporters. For now, the United Kingdom seems to be falling behind despite its initial interest in the promise of CBDCs.

United States

The United States has the most to gain by bucking the CBDC trend and has, therefore been slow to experiment. Currently, the Federal Reserve is mainly focusing on another, instant-payment service called FedNow, which is intended solely for private banks. According to US Federal Reserve head Jerome Powell:“many of the challenges [CBDCs] hope to address do not apply in the US context.”He claims that the U.S. financial system is far more sophisticated than those currently experimenting with CBDCs. That hasn’t stopped others from proposing the idea, however. Last month, the Digital Dollar Project published a white paper on how a tokenized U.S. dollar would look.

For the Federal Reserve, the idea is currently still being explored, but no concrete steps have been taken. Critics say that America’s relative ambivalence towards a ‘tokenized dollar’ may come back to haunt it. Perhaps policymakers are taking the dollar’s current dominance for granted.

As JP Morgan’s chief economist told Bloomberg in a May report:

For the Federal Reserve, the idea is currently still being explored, but no concrete steps have been taken. Critics say that America’s relative ambivalence towards a ‘tokenized dollar’ may come back to haunt it. Perhaps policymakers are taking the dollar’s current dominance for granted.

As JP Morgan’s chief economist told Bloomberg in a May report:

“There is no country with more to lose from the disruptive potential of digital currency than the United States.”The United States’ exceptionally slow implementation could undermine its position as holder of the world’s reserve currency.

India

Much like the United States, India has been slow to investigate CBDCs. Shaktikanta Das, the governor of India’s central bank, has repeatedly said it is “too early” to talk about CBDCs. According to Das, the technology has far too many implementation issues as of now. The central bank stands firmly against private cryptocurrencies. Given that most of the leading central banks are now investigating CBDCs and/or testing them, India’s position is especially curious given its position on the world stage. It, too, may fall behind if it continues to ignore them.Saudi Arabia

Saudi Arabia has been desperate to reorient its economy away from an almost entirely petroleum-based one. This, however, has come with difficulties as the country tries to reinvent itself as a ‘tech hub.’ The ongoing oil glut has not made its bottom line any easier, of course. The country has nonetheless seen some progress on CBDCs, however. In late January 2019, Saudi Arabia and the United Arab Emirates jointly tested a cross-border digital currency pilot. As part of the initiative put forward by the Saudi-Emirati Coordination Council, it is currently unclear whether this effort will be expanded. For now, the experiment was solely targeting banks for easy, cross-border payments.Marshall Islands

Despite its small stature, the Republic of the Marshall Islands is leading the world in CBDC adoption. In February 2018, the country revealed plans to issue its own digital currency called the Marshallese Sovereign (SOV). In March, the small republic came a step closer to making this a reality by announcing the SOV would be built on the Algorand (ALGO) protocol. The SOV will co-exist with the U.S. dollar as legal tender and will grow at a fixed rate of 4% per year. Once launched, it will be among the first state-backed cryptocurrencies in the world. Ultimately, the republic wants to position itself as a hub for fintech and blockchain-related developments.The Geopolitical Stakes At Play

With CBDCs now entering the mainstream, cryptocurrencies will soon have serious geopolitical implications. Emerging technologies continue to drive competitive advantage on the world stage, and CBDCs will play a part in shaping this increasingly multipolar world.The Dollar’s Dominance

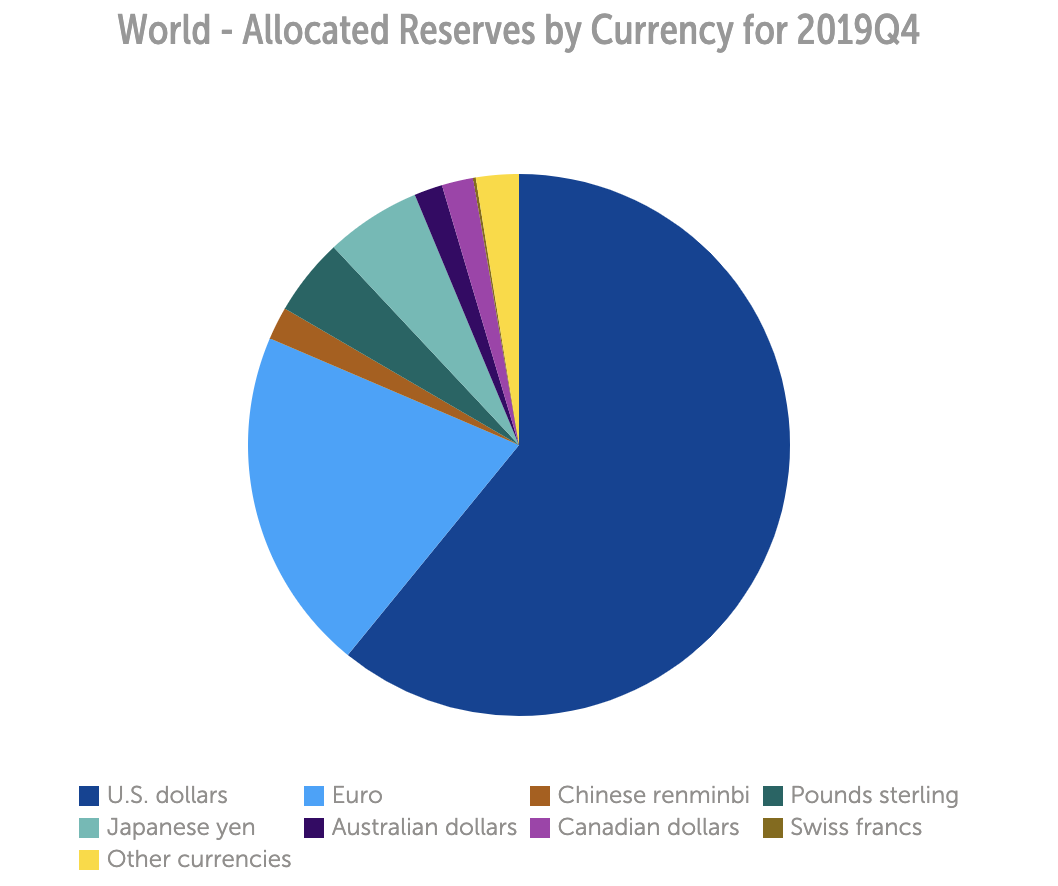

In the past few years, the world has grown more diffused as the United States steps back from its international entanglements. Yet, the dollar remains dominant. Even during the ongoing coronavirus crisis, demand for the dollar has continued to rise. In March, the benchmark DXY index, measuring USD against a basket of other leading currencies, rose 7% for the year. This has only continued in the following months. According to the IMF, the dollar’s dominance in allocated reserves for Q4 2019 was roughly 61%. This is relatively unchanged from what it was in 2010, according to data. Even the Great Recession was not enough to chip away at the dollar’s dominance. The only real competitor to the dollar, as of now, is the euro. However, ever since the Eurozone crisis hit in 2010, its usage as a reserve currency has dropped from 26% to 20% in the past decade.

The Chinese renminbi often said to be the dollar’s future competitor, currently stands at just 2% of all allocated reserves. It should be noted, however, that the renminbi was only internationalized in 2014, so it is relatively new on the scene.

It seems unlikely that the U.S. dollar will be deposed while the existing financial system is still in place. However, CBDCs propose an altogether new model that would effectively abandon the current SWIFT system.

According to Huang Qifan, the VP of the China Center for International Economic Exchanges, this is the strategy for China’s CBDC, which it hopes will rival (and replace) SWIFT. The SWIFT system has been around since 1973. This alone won’t be enough to dethrone the dollar, but some of its more fragile aspects are now in the crosshairs.

A weakened dollar would also diminish the United States’ ability to enforce sanctions against ‘terrorist financing,’ which it often does by leveraging the strong dollar through SWIFT. America’s soft power is dependent on a strong dollar, so this will have grave implications for international stability.

The only real competitor to the dollar, as of now, is the euro. However, ever since the Eurozone crisis hit in 2010, its usage as a reserve currency has dropped from 26% to 20% in the past decade.

The Chinese renminbi often said to be the dollar’s future competitor, currently stands at just 2% of all allocated reserves. It should be noted, however, that the renminbi was only internationalized in 2014, so it is relatively new on the scene.

It seems unlikely that the U.S. dollar will be deposed while the existing financial system is still in place. However, CBDCs propose an altogether new model that would effectively abandon the current SWIFT system.

According to Huang Qifan, the VP of the China Center for International Economic Exchanges, this is the strategy for China’s CBDC, which it hopes will rival (and replace) SWIFT. The SWIFT system has been around since 1973. This alone won’t be enough to dethrone the dollar, but some of its more fragile aspects are now in the crosshairs.

A weakened dollar would also diminish the United States’ ability to enforce sanctions against ‘terrorist financing,’ which it often does by leveraging the strong dollar through SWIFT. America’s soft power is dependent on a strong dollar, so this will have grave implications for international stability.

The Chinese Gamble

In a world dominated by technological competition, China is betting that a greater focus on blockchain, AI, big data, and other emerging technologies will give it a competitive advantage. As BeInCrypto reported in October 2019, President Xi announced that blockchain would form a cornerstone of the new national strategy. The DCEP is a core part of this grander vision. However, it ultimately all fits together into China’s long-term goal: the competition of its Belt and Road Initiative which is expected to be done by 2049, the 100th anniversary of the country. The Belt and Road Initiative is the long-game for China, setting up a parallel trading and financial ecosystem that will rival U.S. dominance. The DCEP, as one might expect, will inevitably play a crucial role. Banks and financial institutions will be able to make cross-border settlements with the DCEP and the renminbi would be pegged to most commerce along the vast trading region. The Belt and Road Initiative is currently made up of around 60 nations. The Chinese strategy bears some resemblance to how the U.S. dominated international commerce after the Second World War. It was then that the U.S. took the paternal role of protecting international trade and providing stability. Pax Americana created the current financial and international order we live in today and China looks to shape this with a parallel system of their own. Yet, for this to happen as China plans, the country needs a less dominant dollar. Given that China holds much of the U.S.’s debt today, outright attacking the dollar would be self-destructive. Hence, they are now forced to play the long-game using the DCEP as a core piece of their greater strategy.Looking Ahead to the 2020s

In a post celebrating the new year, Coinbase outlined a few key areas that will lead the cryptocurrency industry in 2020. Some of the leading concerns include scalability, privacy, a focus on emerging markets, and above all else – utility. For much of cryptocurrency’s young history as an industry, these issues were largely internal. Regulatory concerns would often flare up as uncertainties ebbed and flowed over whether governments would crackdown on the burgeoning sector. It never had stark international significance. In the 2020s, though, the cryptocurrency landscape will change drastically and will take on, for the first time, serious geopolitical importance. With governments now actively involved in curating their own digital currency ecosystem, the blockchain space will inevitably become ‘bigger than Bitcoin.’ The last comparable shakeup in the financial world happened during the 1970s with the end of the Bretton-Woods agreement. Free-floating exchange rates between currencies became the norm with the U.S. dollar at the helm. This begs the question though: what would a world of CBDCs look like and will the change be as drastic? Given current implementation plans, the world will see its first, fully-fleshed out CBDC within a decade. As the next few years roll on, the Chinese DCEP will become fully operational. With the second-largest economy in the world converting to a CBDC model, the impact of this development cannot be understated. Other nations will inevitably follow and make similar commitments. The United States will have to accelerate its plans for a tokenized dollar lest it fall behind. But there is also the possibility that private conglomerates take up the cause for themselves. As BeInCrypto will explore in the following piece, corporate-backed, and dollar-denominated stablecoins are growing in prominence—and perhaps they could salvage America’s dominance despite the government lethargic CBDC response. The future of CBDCs and how they will shake up the geopolitical order is not set in stone. China’s rise with the DCEP is by no means inevitable. In May, Warren Buffett repeated his belief that one should always “bet on America.” This resolve will be put to the test in the decade ahead.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Advertorial

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

READ FULL BIO

#Cryptocurrency Market News

#Regulation News

#Blockchain news

#Stablecoin News

#China News

#Central Bank Digital Currencies (CBDC) News

Sponsored

Sponsored