Berachain is everywhere! On X, in your DMs, and probably in your dreams at this point. Despite sounding similar, it’s not about the bear market (your portfolio is safe — for now). Berachain is a layer-1 blockchain that runs on a unique proof-of-liquidity (PoL) model. This model ensures that capital remains active in the ecosystem rather than sitting idle like in proof-of-stake (PoS) chains. This quick guide covers what you need to know in 2025.

KEY TAKEAWAYS

➤Berachain isn’t just another layer-1 — it’s a blockchain built on proof-of-liquidity (PoL), where validators stake liquidity instead of locking tokens.

➤Its three-token model — BERA (gas), BGT (governance), and HONEY (stablecoin) — creates a self-sustaining economy where liquidity providers, validators, and protocols are all connected.

➤With a growing ecosystem of DeFi, GameFi, and NFT projects, Berachain is redefining how liquidity, governance, and network incentives interact on a layer-1 blockchain.

What is Berachain?

Berachain is a layer-1 blockchain built using the Cosmos SDK. It features an EVM-identical environment and a proof-of-liquidity (PoL) consensus mechanism.

Note: This setup ensures Ethereum-based DApps can migrate without trouble while liquidity providers play a central role in securing the network.

While this L1 may seem like just another Ethereum alternative, its staking model makes it fundamentally different from traditional PoS chains.

Berachain is built on the Cosmos SDK. This means the platform benefits from a modular structure for easy upgrades and optimizations.

Why Cosmos SDK matters?

Most blockchains are rigid; once they’re built, they’re hard to change. Berachain, on the other hand, is able to swap out components as needed, thanks to Cosmos SDK. Think of it as a modular home; if you want to upgrade the kitchen, you don’t need to tear down the whole house.

Did you know? Berachain started as an NFT project called Bong Bears, created by pseudonymous founders Papa Bear, Smokey the Bera, and Dev Bear.

How does Berachain work?

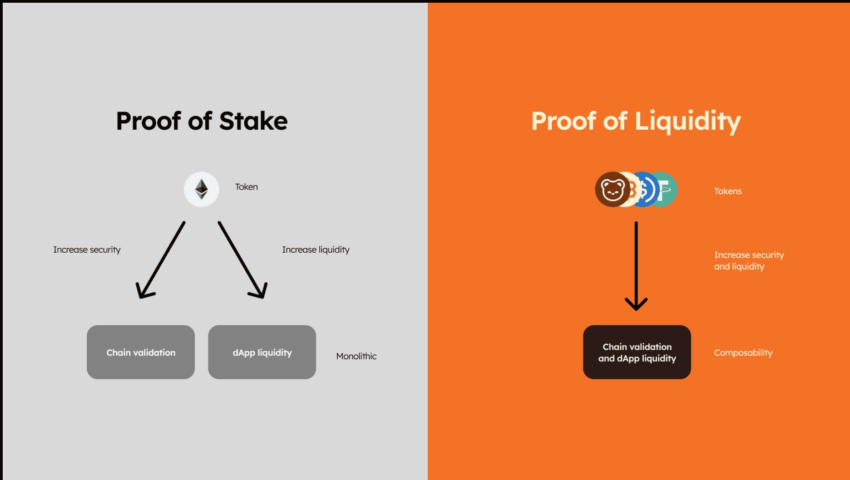

Berachain runs on proof-of-liquidity (PoL), a mechanism where validators stake liquidity instead of just locking tokens to secure the network.

What is proof-of-liquidity (PoL)?

Proof-of-liquidity (PoL) is Berachain’s unique consensus mechanism, where validators secure the network by staking liquidity provider (LP) tokens instead of locking native tokens.

This ensures that liquidity stays active in DeFi rather than being removed from circulation.

Here is a quick overview of how that works:

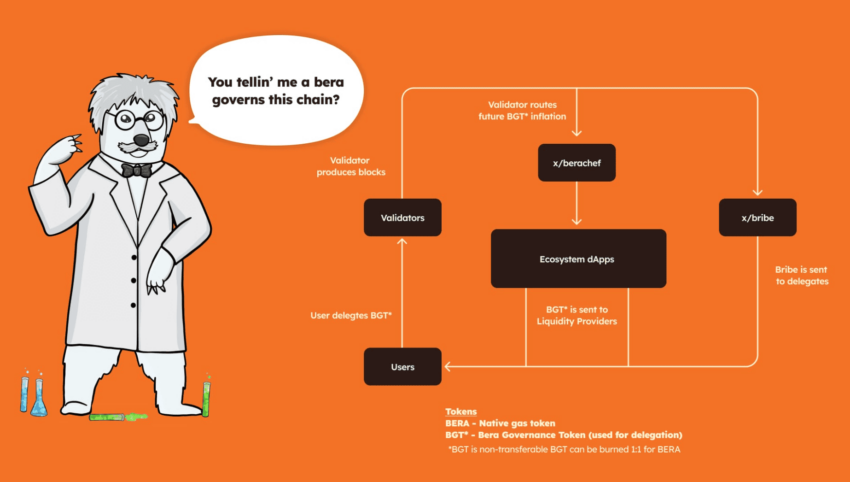

- Users deposit assets (e.g., BERA, USDC, HONEY) into liquidity pools and receive LP tokens representing their share.

- Users stake LP tokens in Reward Vaults to earn BGT (Berachain Governance Token) as an incentive.

- Validators need BGT to direct emissions, meaning they must attract BGT delegations from users to gain influence.

- Protocols want more liquidity, so they offer incentives to validators to direct BGT emissions toward their liquidity pools.

- Users follow the highest BGT emissions, ensuring that liquidity moves efficiently across the ecosystem.

- BGT can be burned to mint BERA, ensuring a self-sustaining token flow.

A more simplified take: Unlike PoS, where staking just locks tokens, PoL ensures that every asset in the system remains usable while still securing the network. BGT emissions act as the economic driver, controlling where liquidity flows, while BERA remains the gas token powering transactions.

What’s being built on Berachain?

The Berachain mainnet went live on Feb. 6, 2025. The ecosystem already encompasses 80+ projects across domains. Here are a few notable elements:

DeFi platforms

- BEX (Berachain Exchange): BEX is Berachain’s native decentralized exchange (DEX), which facilitates secure token swaps. BEX features the widest possible array of DeFi options: liquidity pools, yield farming, and low transaction fees.

- Apiarist Finance: A DeFi platform offering yield farming, staking, and lending services, leveraging Berachain’s high transaction speeds and low fees to provide efficient financial operations.

- Honeypot Finance: A community-run DeFi hub with a unique flywheel model that churns out dual incentives.

Gaming

- Boink: A Berachain-native blockchain game offering $BERA prizes and fun-filled gameplay.

- Honey Jar: An unofficial community-driven project that combines NFTs with gaming, centered around the Bong Bears theme.

SocialFi

- Berally: A platform exploring the intersection of social media and decentralized finance within the Berachain ecosystem.

NFTs

- Bera Monks: A cultural NFT project blending art, lore, and community with unique hand-drawn characters.

- BAO BAO: An NFT collection offering exclusive NFTs, events, play-to-earn options, and DAO benefits.

Berachain tokenomics

Berachain runs on a three-token system, where each token has a distinct but interconnected role.

$BERA (gas & utility token)

- Powers all network transactions (gas fees).

- Used as a base trading asset in Berachain DeFi protocols.

- Earned by validators as part of block production rewards.

$BGT (governance token)

- Earned only by providing liquidity in Berachain DApps.

- It cannot be transferred but can be burned to mint BERA (giving liquidity providers an exit).

- Used to vote on governance decisions, directing protocol emissions and incentives.

$HONEY (liquidity token & stablecoin)

- It can be minted by depositing collateral.

- Used as the main stable medium of exchange within the Berachain ecosystem.

- Backed by reserve assets to maintain price stability.

Together, these three tokens create a balanced economic flywheel, ensuring that network security, liquidity provision, and governance are all taken care of.

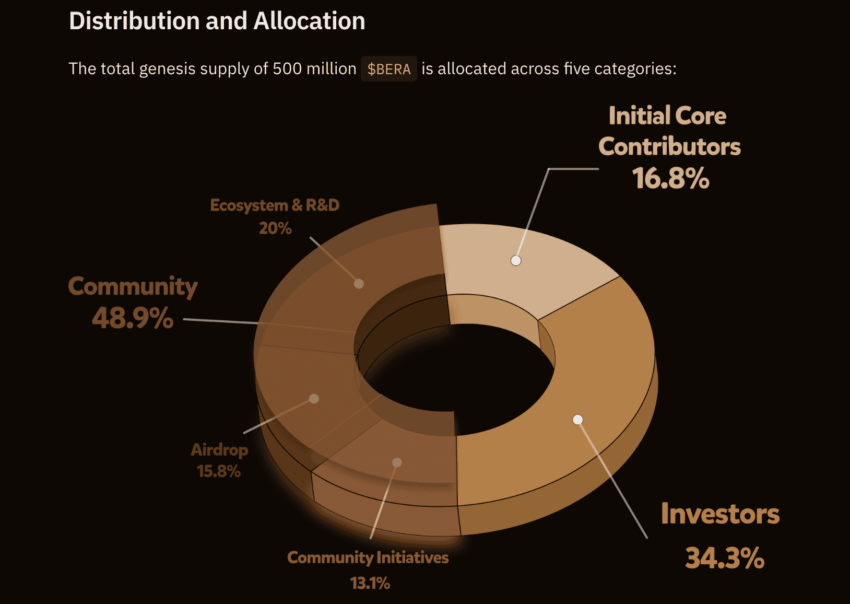

While Berachain operates with three tokens, the primary focus of tokenomics discussions revolves around $BERA because it is the fixed-supply asset (500 million BERA at Genesis). Additionally, BERA is the main token used for transactions, staking, and protocol rewards. And finally, it is directly affected by the burning of BGT, which influences its circulating supply.

At Genesis, 500 million BERA tokens were allocated as follows:

| Category | Allocation | BERA supply |

| Core contributors | 16.8% | 84M |

| Investors | 34.3% | 171.5M |

| Community and Airdrop | 15.8% | 79M |

| Future Community Incentives | 13.1% | 65.5M |

| Ecosystem & R&D | 20% | 100M |

After a one-year cliff, 1/6th of allocated tokens become liquid. The remaining 5/6ths vest linearly over the next 24 months.

What about a Berachain airdrop? Alongside the mainnet launch, the Berachain Foundation announced a much-anticipated Token Generation Event (TGE) and airdrop allocation. BERA is already in eligible users’ wallets, except in cases where the use of a bridge or an exchange claim was required.

Berachain vs. other layer-1 blockchains

Berachain offers a capital-efficient alternative by keeping liquidity active, unlike traditional PoS models. Here is a quick table to help you locate the differences:

| Feature | Ethereum | Solana | Avalanche | Berachain |

| Consensus | PoS | PoS | PoS | PoL |

| Staking model | Locked tokens | Locked tokens | Locked tokens | LP token staking |

| EVM compatible | Yes | Partial | Yes (C-Chain) | Yes |

Can Berachain change the L1 game?

Berachain is redefining how layer-1s handle liquidity, governance, and security. Instead of locking tokens, it keeps capital moving. Instead of passive staking, it rewards active participation. Realistically, it won’t replace Ethereum. However, it may force other L1s to rethink their liquidity models. While it’s early days, if proof-of-liquidity scales, the bear-themed blockchain could set a new standard for layer-1s.

Disclaimer: This article is written for informational purposes only and should not be considered investment advice. Always prioritize your security, especially when interacting on newer networks. Do your own research (DYOR) and never invest more than you can afford to lose.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.