Another month, another airdrop. This time, the Ethereum-based restaking platform EigenLayer is acknowledging its users, early adopters, and contributors with a much-anticipated airdrop. In addition to being a promotional event, the EigenLayer airdrop event is also a tested method to decentralized token ownership and encourage participation. But who can claim the tokens, and how does it work? This guide covers everything you need to know about EigenLayer airdrop eligibility and how to claim EigenLayer tokens.

Unpacking EigenLayer and its stakedrop

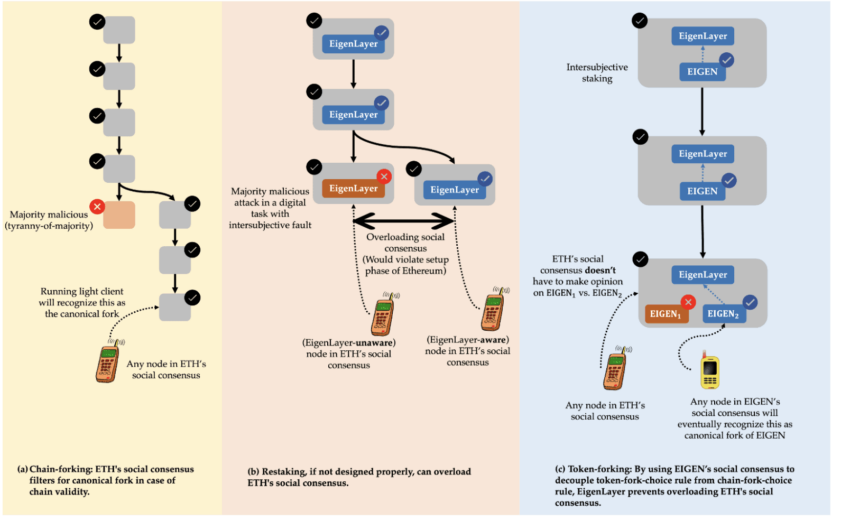

EigenLayer allows Ethereum stakers to further the utility of their staked ETH by using it across diverse, decentralized applications and protocols. Like many other platforms relying on blockchain technology, EigenLayer has also resorted to crypto airdrops to drive its strategic objectives.

Here is the latest update released by the community:

Did you know? EigenLayer prefers to call its airdrops “stake drops,” focusing on increasing liquidity and enhancing the decentralized finance (DeFi) engagement.

As mentioned, an airdrop from EigenLayer isn’t just a marketing gimmick. Instead, it comes with the following perks:

- Incentivizes staking, aligning with Ethereum’s scaling effort

- Fosters network growth, which is crucial for the Ethereum 2.0 vision to come into effect

- Attracts the Ethereum scaling-specific layer-2 solutions and their users to participate in restaking, eventually assisting with ETH 2.0 upgrades.

- Rewards users for participation with the EigenLayer tokens have other utilities across the decentralized finance (DeFi) space.

- Once the EigenLayer token (EIGEN) is officially out, it can be used to secure EigenDA as a governance token.

How to qualify for EigenLayer airdrop?

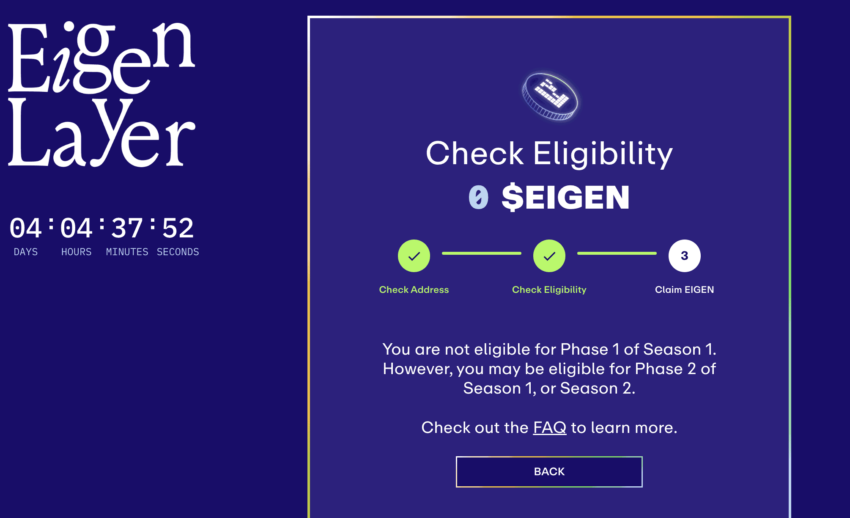

Qualification for the EigenLayer airdrop depends on a user’s level of interaction with the EigenLayer ecosystem. Also, EigenLayer’s airdrop phases are segregated as Season 1 and Season 2, with Season 1 proceedings underway. Here’s a look at the eligibility (qualification) for Season 1.

Season 1 EigenLayer airdrop

Firstly, the EigenLayer airdrop eligibility for season 1 is already taken care of via a snapshot that was captured on March 15, 2024. This means any move after this data capture will not result in additional tokens as part of the Season 1 rollout.

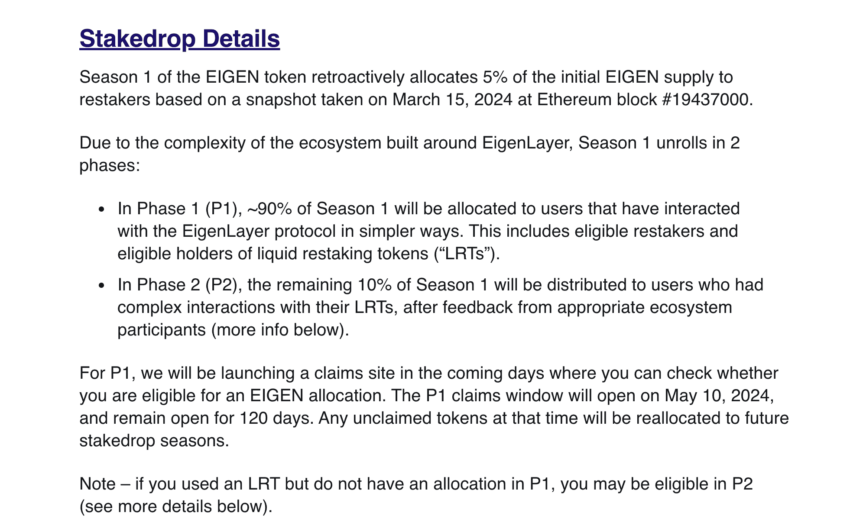

Eligibility here depended on the extent of a user’s Ethereum restaking — either via staking in EigenLayer or utilizing other DeFi markets like Pendle. Staking via EigenLayer is eligible for 90% of the Season 1 stake drops, also referred to as Phase 1. Phase 2 stands for 10% of the airdrop rollout via Ethereum restaking using platforms other than the EigenLayer platform.

Here are other aspects of the Season 1 rollout:

- 5% of the total supply is meant for Season 1

- The claim window opens on May 10, 2024, and stays like that for the next 120 days.

- The 10% allotment or Phase 2 (allocated for Ethereum restaking via platforms other than EigenLayer) will start a month later after the community decides the process.

Here are some additional details regarding the Phase 1 and Phase 2 of Season 1:

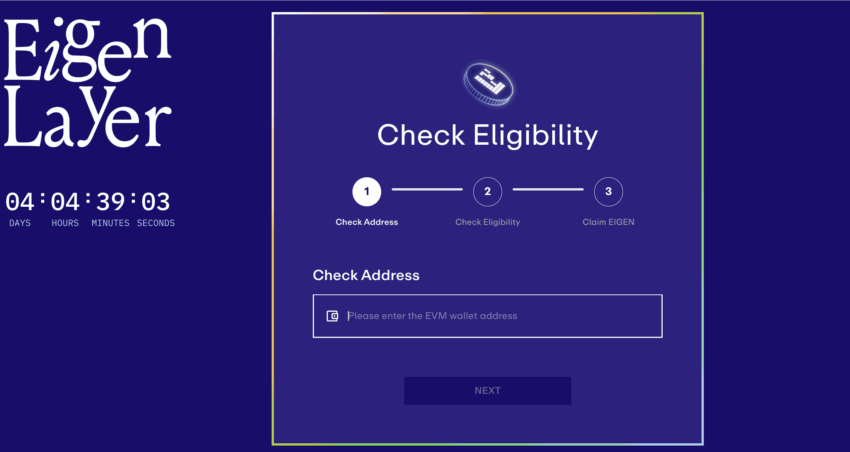

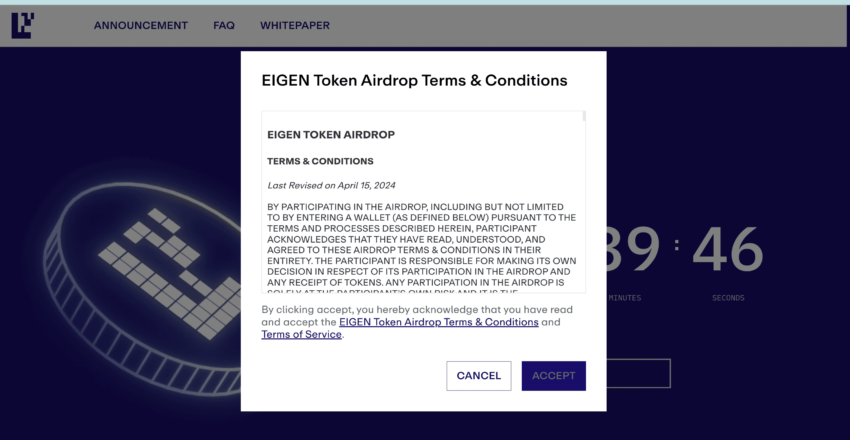

Also, you can check the claim status of the Season 1 stake drop while reviewing the terms and conditions:

Phase 2 details:

Season 2

Even though the details of Season 2 are not yet completely clear, we could see another 5% of the allocated 15% as Season 2 stakedrops. Also, the focus of Season 2 will be on long-term engagement and protocol-specific contributions.

Also, any kind of protocol interaction that happened after March 15, 2024, will qualify for Season 2.

Here are some of the qualification metrics for Season 2:

- Snapshot of the Ethereum network, translating into activities like staking in EigenLayer, interacting with the EigenDA using EIGEN and/or ETH, and more.

- Direct staking and complex staking via other protocols will also be eligible in Season 2 as more instances of restaking automatically qualify for the staking rewards.

- In Season 2, we can expect direct interactions with the AVS via smart contracts to be eligible for rewards.

- Season 2 airdrops could be about interacting with Ethereum’s proof-of-stake (PoS) model more extensively, helping achieve the Ethereum 2.0 vision.

Other qualification details will be revealed by EigenLayer in days to come.

How to participate in the EigenLayer Airdrop?

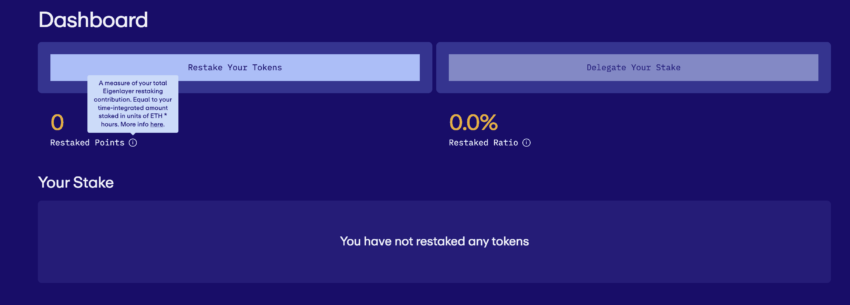

Season 1 is done. However, here are the steps to participate in Season 2 of crypto airdrops from EigenLayer.

Option 1: Direct staking

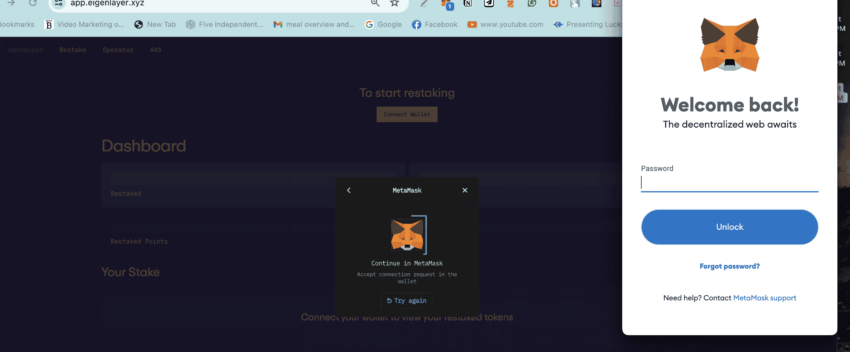

- Keep a compatible wallet handy — such as MetaMask, Trust Wallet, or any other supported question.

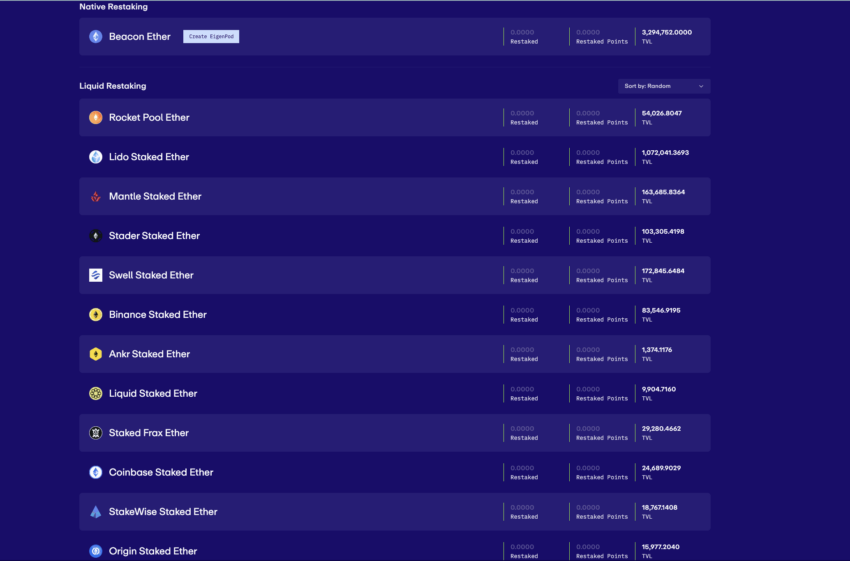

- Once you log into the EigenLayer ecosystem using your wallet, you will be asked to choose the ecosystem from which you can source your staked assets.

- Once you restake the staked ETH specific to any ecosystem, you will earn points that will later reflect as EigenLayer airdrop eligibility.

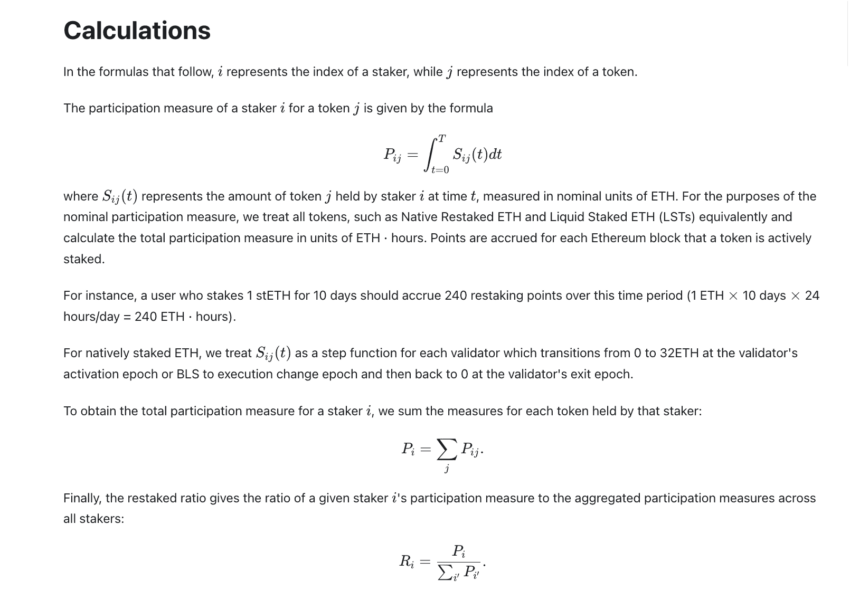

Here is how the points are calculated:

Option 2: Active participation

- For this kind of participation to work, you first must wait for the EIGEN tokens to surface. Once these tokens are available to trade and buy, you can start to deploy them across community-based governance decisions and the EigenDA.

- Once there are EIGEN tokens in play, one way of interacting with the ecosystem would be via the Ethereum scaling solutions and rollups.

- With the EigenLayer tokens, you can also choose to be a DA operator, increasing your chances of earning staking rewards.

- Active participation also means working as a Disperser or Retriever. This way, you can interact with smart contracts to handle transactions, using EIGEN tokens to pay for the fees. As a retriever, you can rely on data tokenization, which is meant to fetch and verify chunks from the DA operators. Retrievers can earn EIGEN tokens in the process and also be eligible for future airdrops.

Option 3: Via External restaking hubs

- Start by choosing a compatible wallet, such as MetaMask.

- You can then head over to platforms like EtherFi to directly stake your Ethereum (ETH), converting it into eETH.

- The eETH can then be staked onto the EigenLayer via Ether.Fi itself, automatically. This process lowers the learning curve while still offering eligibility for EigenLayer points.

- For platforms like Swell, the liquid staking token is swETH. Restaking into the EigenLayer staking pools is initiated during specific Windows.

- Users can still earn points via Pearls, which makes them eligible for future EigenLayer airdrops.

Option 4: Via complex DeFi markets

Once the EigenLayer tokens are released, the entire aspect of DeFi integration will change. Based on what might happen, the airdrop eligibility for Season 2 can be determined via the following strategies:

DeFi integrations and liquidity provisioning

- Identify platforms that have EigenLayer’s tech integrated within.

- You can use these platforms for EigenLayer token-based staking and to passively secure AVS or other activities.

- Also, popular DEXs will be quick to list the EIGEN token once the airdrop claiming date surfaces. And once the token is listed, there will be staking pools.

- You can contribute your EIGEN and other tokens to the pools to earn staking rewards and be eligible for airdrops.

Simply put, EigenLayer might end up giving users free tokens to provide liquidity. Staking providers will also be able to manage and tweak their liquidity stake depending on the performance and health of the pool.

Season 1 hasn’t been kind to the DeFi markets:

Note: Only the Season 1 airdrop structure was eligible for testnet-based allotment via Goerli testnet. Now that Goerli is deprecated, newer testnet interactions via Holesky are not eligible to receive EigenLayer tokens as airdrops.

In addition to the mentioned options, EigenLayer’s airdrop eligibility for Season 2 and other upcoming seasons might also depend on how well users stack up against Sybil attacks. The platform has already implemented strategies to prevent users from creating more than one account to claim multiple tokens. Over time, the robust identity verification process might be implemented throughout the ecosystem, with each instance attracting free tokens as airdrops.

Honesty could go a long way in users receiving the EigenLayer airdrops.

Criticism and community feedback

Before delving deeper into the criticisms, let us take a look at the Season 1 token allotment highlights:

- Total fixed supply: 1.67 billion EIGEN tokens.

- Initial allocation for Season 1: Initially, 5% of the total supply, or approximately 83.5 million tokens, were allocated for the Season 1 airdrop.

- Adjustment after community feedback: Following community backlash regarding the fairness of the token distribution, EigenLayer announced an additional airdrop worth approximately 28 million EIGEN tokens to address these concerns.

- Point conversion and value: Per the latest data, 50 Eigen points are equal to approximately one Eigen token (as of May 7, 2024). Also, upon listing, experts believe that the price of one EIGEN token could be around the $9.5 mark.

Here is why EigenLayer’s entire airdrop structure was criticized:

- Linear distribution: The Season 1 airdrop was initially based strictly on the amount of Ethereum restaked, which did not account for the duration or loyalty of participants’ staking activities.

- Initial non-transferability: The tokens distributed would be initially non-transferable, limiting their utility and causing frustration among recipients.

- Exclusion of certain users: Users involved with liquid staking integrations like Pendle were excluded from the first phase of the airdrop, which caused dissatisfaction among these stakeholders. Phase 2 is expected to be announced soon.

- The community expressed significant dissatisfaction with the initial allocation and the restrictions placed on the airdrop. The season 1 airdrop saw EigenLayer favoring early developers and investors instead of the regular community stakers.

- Geographical exclusions: The airdrop excluded users from several countries, such as the US, China, Russia, and Canada, leading to further discontent.

- Cost to claim: High gas fees associated with claiming the airdrops.

Other concerns highlighted:

Here is a detailed explanation highlighting the rationale behind additional tokens, country-specific restrictions, and more:

Here is the entire list of excluded countries:

- People’s Republic of China

- Republic of Cuba

- Democratic People’s Republic of Korea (North Korea)

- Kingdom of Cambodia

- Republic of the Union of Myanmar (Burma)

- Lao People’s Democratic Republic

- Islamic Republic of Pakistan

- Republic of Mali

- Islamic Republic of Afghanistan

- Republic of Albania

- Republic of Angola

- Republic of Botswana

- Republic of Chad

- Central African Republic

- State of Eritrea

- Republic of Guinea

- Russian Federation

- Federal Republic of Somalia

- Democratic Republic of the Congo

- Republic of the Congo

- Republic of Malawi

- Republic of Mozambique

- Republic of Kyrgyzstan

- Bosnia and Herzegovina

- Republic of Uzbekistan

- Turkmenistan

- Republic of Burundi

- Republic of Sudan

- Republic of South Sudan

- Republic of Nicaragua

- Republic of Vanuatu

- Republic of Macedonia

- Lebanese Republic

- Commonwealth of the Bahamas

- Republic of Kosovo

- Islamic Republic of Iran

- Republic of Iraq

- Republic of Liberia

- State of Libya

- Syrian Arab Republic

- Republic of Tajikistan

- Republic of Yemen

- Republic of Belarus

- Plurinational State of Bolivia

- Bolivarian Republic of Venezuela

- Regions of Crimea, Donetsk, and Luhansk

- United States of America

- Canada

Expected Season 2 airdrop fixes:

Based on how things were for Season 1, experts believe the following enhancements will surface across the upcoming airdrop seasons:

- Increased token airdrop clarity and transparency

- Adjustment in the token allocation strategy

- Improved inclusion of stakeholders

- Modification in the token transfer rules

Can EigenLayer tokens be traded? If so, where?

Season 1 of EigenLayer airdrops clearly mentions that the tokens are non-transferable. This means even after claiming EigenLayer tokens, you cannot simply move them to DEXs and CEXs to offload. Even though this initial restriction was criticized by many, it makes sense when it comes to avoiding rapid sell-offs.

Based on how other airdrops in the past have materialized, gradual token releases are expected once Phase 1 and Phase 2 airdrop claims are handled for Season 1. Also, we expect EIGEN tokens to be available on the leading crypto exchanges in time.

How can you navigate airdrops safely?

With the EigenLayer airdrop or any other similar event, navigating the space requires you to be aware of the terms and conditions beforehand. From verifying eligibility to identity, you must cover every required element before proceeding.

Furthermore, it is crucial to check and verify EigenLayer airdrop claims using only the official EigenLayer website page. Airdrops present opportunities for scammers, with unscrupulous parties often waiting to prey on unsuspecting users and compromise wallet security. The idea is to remain safe, aware, and prepared, all while having complete control over your custody options.

Frequently asked questions

What is an EigenLayer airdrop?

How can I participate in airdrop?

Does EigenLayer have a token?

What are the benefits of participating in an EigenLayer airdrop?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.