The holidays can mean increased volatility for the unprepared crypto trader. In this guide, we provide essential crypto tips tailored for the holiday season, offering five straightforward strategies to secure and manage your investments. Discover how to confidently navigate the season’s market shifts and make informed decisions that align with your crypto investment goals.

How should crypto fans prepare for the holidays?

Preparing for the holidays is crucial for crypto enthusiasts, particularly when considering the dynamic nature of DeFi, the blockchain ecosystem, and the broader crypto community. Here are a few key examples that can help arm you for the festivities ahead.

Assess your portfolio

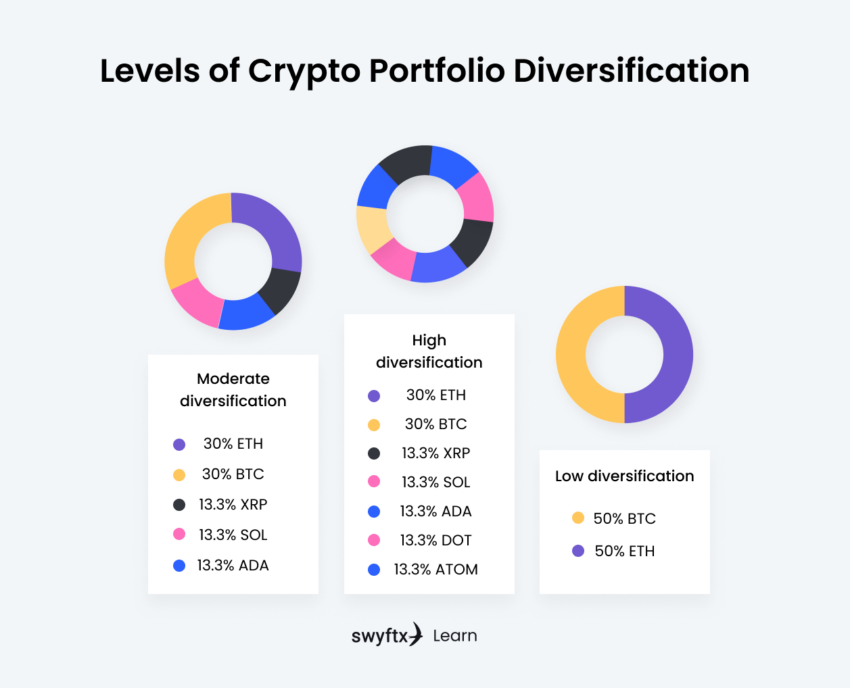

As the year winds down and the holidays loom, markets often waver under the weight of unpredictability. Diversification isn’t just a strategy; it’s a necessity. A well-rounded portfolio can act as your anchor against the tides of holiday volatility. Incorporating a range of assets, including various cryptocurrencies and blockchain-based investments, can provide the balance and resilience needed to weather the unpredictable shifts typical of holiday market trends.

Diversification in crypto is about spreading risk across various assets. It’s akin to not putting all your eggs in one basket. A diverse portfolio can absorb shocks from market swings, providing a buffer during the season’s trading storms.

Utilizing stablecoins

Stablecoins are the foundation of any diversified portfolio, maintaining their value without swaying with market sentiment. Especially during the holidays, when crypto markets can be as unpredictable as a flickering festive light, these assets provide a comforting sense of stability. This makes them a particularly appealing choice for investors seeking to navigate the seasonal volatility of the crypto world.

Building a diversified crypto portfolio

A portfolio exclusively made up of payment-focused coins like litecoin is likely to show a strong correlation with bitcoin’s performance. In contrast, diversifying your portfolio with a mix of payment coins, stablecoins, privacy coins, security and utility tokens, and DeFi tokens typically results in a much lower correlation. When crafting your diversified portfolio, consider integrating:

- Stablecoins: Digital currencies like USDT or USDC that are pegged to the dollar offer stability.

- Blue-chip cryptos: Established cryptocurrencies with a larger market cap can be less volatile than their junior counterparts.

- Tokenized commodities: Crypto assets tied to real-world commodities, like gold tokens, often retain value when digital markets dip.

Rebalance and assess your crypto portfolio

To begin, evaluate your portfolio’s current performance and adjust it to align with your long-term objectives. Additionally, utilize insights gained from the holiday market to enhance and fortify your investment strategy for the upcoming year. Furthermore, by diversifying your portfolio before the holidays, you proactively improve its resilience. These actions can help safeguard you against market fluctuations and ensure the robustness of your investments.

Explore automated trading tools for the holidays

While the holiday season may distract you from monitoring your investments, it’s important to remember that the crypto market operates continuously. Here are some trading tools and tips to ensure your digital assets continue to work for you even as you unplug:

Embracing automation in crypto trading

Automated trading tools are akin to having a diligent trading assistant who doesn’t take holidays. They can execute trades based on preset criteria, manage risks, and secure profits without your constant oversight.

Bots and stop-loss orders: Your silent guardians

- Trading bots: These programs can follow market trends and execute buy or sell orders following your established strategies. They’re the elves working in the background, ensuring your crypto portfolio is managed while you focus on the festivities.

- Stop-loss orders: Consider them your safety net, catching your investments before they fall too far. They automatically sell off assets at a predetermined price point, thus mitigating potential losses during sudden market downturns.

Choosing the right automated tools for crypto

Selecting the best automated tools requires understanding and aligning their features with your trading style. Here are a few to consider:

- Reliability: Opt for tools that have proven uptime. You don’t want a bot taking a holiday break!

- Customization: Look for platforms that allow detailed strategy implementation. Your bot should trade as if it’s an extension of you.

- User reviews: Research and read reviews from other traders. Community feedback can be invaluable.

- Security: Ensure that any tool you use has strong security measures in place. Even when automated, your assets should be under lock and key.

Test before you invest

Before you entrust your crypto trading to a bot, test it out. Many platforms offer simulation modes or backtesting with historical data. Ensure your tool of choice understands the difference between a gift and a lump of coal regarding trades. Setting up automated trading tools is like programming the holiday lights to shine even when you’re not home. It keeps your crypto journey brightly lit, ensuring peace of mind as you indulge in the holiday cheer.

Utilize mobile alerts and subscription services

Staying abreast of the volatile crypto market during the holiday hustle can be challenging. Let’s delve into how mobile alerts and news subscriptions can be your eyes and ears on the market, providing real-time updates no matter where your holiday adventures take you.

Harnessing mobile alerts for market movements

- Push notifications: Set up alerts on your mobile device to receive instant notifications about significant market movements, from price swings to volume spikes. It’s like having a market whisperer in your pocket.

- Custom alerts: Tailor alerts based on your portfolio and watchlist. This ensures you’re notified about the changes that matter most to you, filtering out the festive noise.

Subscribing to the right crypto news services

- Dedicated crypto news apps: Subscribe to apps that specialize in cryptocurrency news. They provide curated content that keeps you at the forefront of the latest trends and shifts.

- Financial news aggregators: Platforms that consolidate news from various sources can give you a panoramic view of the market. They’re the all-seeing eyes of the crypto world.

Top apps and services for real-time updates

- CoinMarketCap or CoinGecko: For price tracking and alerts, these are the go-to sources for many enthusiasts.

- CryptoPanic: An aggregator that helps you stay informed about the latest market news.

- Twitter & Reddit: Follow key influencers and subscribe to threads that offer timely insights and discussions.

The key is to use information proactively rather than reactively. In a market driven by speculation, knowing when to act and when to stay put is crucial. Real-time updates can guide these decisions, but remember not every alert is a call to action.

With the right set of mobile alerts and subscriptions, you can enjoy your eggnog without fretting over your crypto investments. After all, being well-informed is one of the greatest gifts a crypto enthusiast can receive during the holiday season.

Secure your investments: Fortifying your digital fortunes

As the festive cheer spreads, it’s vital for crypto enthusiasts to reinforce the security of their digital treasures. Here’s a guide to bulletproofing your crypto investments against the unseen Grinches of the digital world.

Prioritizing wallet security

- Hardware wallets: Consider these the vaults of the crypto world. They keep your assets offline and immune to online hacking attempts. Trezor and Ledger are popular choices that blend security with peace of mind.

- Multi-factor authentication: This is your digital drawbridge. Enabling two-factor or multi-factor authentication on all your crypto accounts isn’t just recommended; it’s a must.

Strengthening your exchange account security

- Regular password updates: Change passwords periodically and use a password manager to generate and store complex passwords. This isn’t just holiday housekeeping; it’s an essential security ritual.

- Phishing scam vigilance: Be on high alert for phishing attempts. Remember, no reputable service will ask for your private keys or password.

Embracing a security-first mindset

A proactive approach to security can be the difference between a prosperous new year and a cautionary tale. Implement these tips not just for the holidays but as permanent fixtures in your crypto journey. Remember, in the crypto realm, the best gift you can give yourself is the assurance that your investments are as secure as they can be.

Plan for crypto tax implications: Navigating the fiscal wonderland

As the year winds down and holiday festivities take center stage, it’s crucial for crypto traders to look ahead at the tax implications of their annual trading activities. Here’s a concise guide to help you glide through the fiscal snow without any surprises.

Understanding the tax landscape

“Investors really ought to be paying attention to tax-free opportunities to harvest crypto gains.”

Tom Wheelwright, CEO of WealthAbility: CNBC

Know your liabilities; different jurisdictions have varying crypto tax laws. It’s essential to understand how your holiday trading could affect your tax bill. Whether it’s capital gains tax or income tax, awareness is your first line of defense. Additionally, consulting a tax professional can provide clarity and ensure compliance with these complex and varying regulations.

Strategic record-keeping

- Meticulous documentation: Keep a detailed log of all your transactions, including dates, amounts, and asset types. Tools like CoinTracking or TokenTax can automate much of this process.

- Year-end moves: Consider making strategic trades or sales at the year’s end to offset gains with losses, a practice known as tax-loss harvesting. It can help reduce your overall tax burden.

Planning for the inevitable

- Consult a tax professional: Tax laws surrounding crypto can be as complex as the blockchain. Don’t hesitate to consult with a tax professional who understands the nuances of crypto taxation.

- Prepare for payments: If you anticipate a tax liability from your crypto activities, set aside funds to cover it. It’s better to plan ahead than to be caught off-guard when taxes are due.

A little foresight goes a long way in managing your tax responsibilities effectively. By staying informed and prepared, you can ensure that tax season doesn’t dampen the holiday cheer. Remember, in the world of crypto, staying fiscally fit is just as important as portfolio performance.

Finding your zen during the holiday season

Diversification, using automated tools, robust security measures, and strategic tax planning are essential for success in the crypto market during the festive period. These tips, especially relevant during the holidays, can help you maintain a balanced and secure trading approach. Embrace these strategies, and you can enjoy the holiday merriment with peace of mind, confident that your crypto investments are well-prepared for the new year. Cheers to a healthy trading future!

Frequently asked questions

How can I protect my crypto investments during the holiday market volatility?

What should I do to keep up with crypto market changes if I’m traveling?

Are there extra security precautions I should take when trading during the holidays?

How important is it to consider the tax implications of trading over the holidays?

Can automated trading tools really handle unexpected market turns during holidays?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.