The US featured prominently in crypto this week as the US Federal Reserve (Fed) said it would keep rates fixed amid soaring national debt levels. On Monday, a New York Post writer accused the chair of the Securities and Exchange Commission (SEC) of focusing on crypto enforcement at the expense of other crimes.

The Fed’s decision to keep rates high saw a rise in the yields of long-term US treasuries, an instrument becoming increasingly associated with TRON founder Justin Sun. On Saturday, Sun minted $865 million stUSDT at Huobi exchange, which offers a 5% yield on all stUSDT deposits, allegedly made possible by government bonds.

Upcoming Debt Bubble Bust

On Wednesday, Fed chair Jerome Powell confirmed the central bank needs to keep rates higher for longer. The move came a day after the Kobeissi Letter affirmed that the US debt had reached an unprecedented $33 trillion.

The US government has accrued $1 trillion per month since the recent debt level crisis and could end up paying $1 trillion annually in interest expenses. While Treasury Secretary Janet Yellen appears unperturbed, others, such as hedge fund mogul Mark Spitznagel, warn that the credit bubble will soon pop:

“But we know that credit bubbles have to pop. We don’t know when, but we know they have to.”

Justin Sun Mints $865 Million TUSD for stUSDT

But one corner of the market is enjoying the recent rate hikes. Last week, Tron founder Justin Sun minted $865 million TUSD, a stablecoin that was relatively unheard of until recently.

He used the new TUSD to mint a USDT derivative stUSDT on the Huobi exchange, which offers customers annual returns of about 5%. When questioned about the source of the interest payments, Tron said that all minted stUSDT was backed by government bonds.

Learn where to find the best stablecoin returns here.

With the likelihood of increased corporate refinancing ahead of looming bond maturity dates, as well as the US and other governments seeking to raise funds in a high interest rate environment, Sun may be sitting on a goldmine. But market watchers previously warned that a significant chunk of Huobi’s assets may be illiquid.

Solana Founder Calls for Lawmakers to Experiment With Crypto

On Tuesday, Solana co-founder Anatoly Yakovenko urged US regulators to move forward with crypto regulation. He argues that politicians should be allowed to experiment instead to better understand the technology.

“Ethics rules prohibit most government officials who regulate digital assets from using them,” he said. “This makes it tough to craft good policy: Imagine trying to regulate social media without having ever opened Facebook!”

Yakovenko’s SOL token is now trading at $19.91, more than 90% below its 2021 peak of $259.

Read about notable projects being built on Solana here.

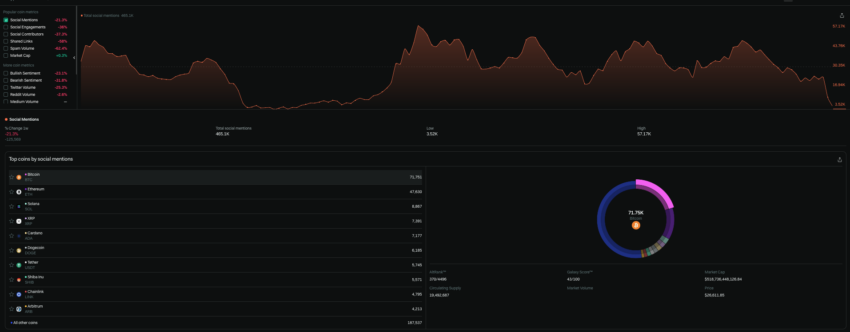

Crypto – Socially Speaking

SEC Called a Banana Republic by New York Post

In keeping with US regulations, New York Post columnist Charles Gasparino recently criticized the SEC’s regulation by enforcement as an indicator that SEC chair Gary Gensler is running the organization like a banana republic.

Read about one of the SEC’s industry-shaping court cases against Ripple here.

In a scathing post on Monday, Gasparino said Gensler’s targeting of the crypto industry has seen many misbehaviors go unpunished. He commented:

“The SEC chief is supposed to be Wall Street’s top cop, but Gensler has chosen to ignore real malfeasance such as the obvious pumping and dumping we’ve seen in some “meme stocks,” costing generational wealth for small investors who believed the pumpers.”

He argued that in addition to targeting crypto, Gensler appeared to be cherry-picking his targets. Gasparino contends that SEC enforcement measures also appear wildly out of sync with Gensler’s drive to “fix” markets.

Chainlink Founder on Tokenization Challenges Banks Face

But while Gensler’s tirade continues, industry noise around the potential of tokenization is getting louder.

On Wednesday, Sergey Nazarov, the CEO of decentralized oracle network Chainlink, highlighted the struggle banks face in adopting new technologies like blockchain. He said banks invest heavily in security and train staff to use existing transfer systems like the Society for Worldwide Interbank Financial Telecommunications (SWIFT) system.

Recently, Chainlink helped Australia’s ANZ bank conduct a successful asset transfer using the new Cross-Chain Interoperability Protocol (CCIP). The CCIP used SWIFT’s messaging structure to allow ANZ to buy an asset from an outside network.

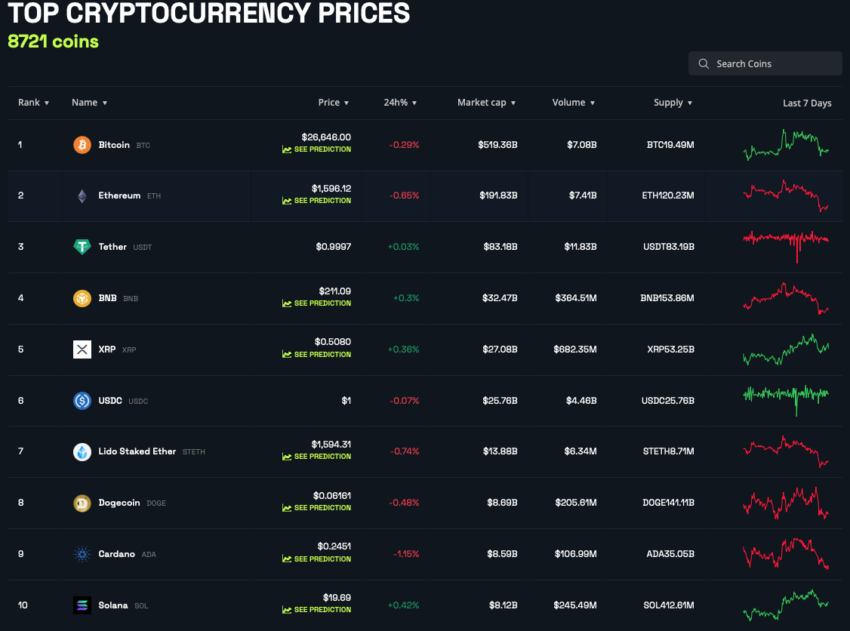

The Week’s Crypto Top 10

Got something to say about the biggest stories in crypto this week, like the Fed decision to keep rates high, the US debt ceiling, or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.