The broader crypto market continues to show signs of caution, with total market capitalization dipping by a modest 0.34% over the past 24 hours.

While major assets remain relatively flat, a handful of altcoins have attracted traders’ attention. Some of them include NOT, AURA, and SUI.

Notcoin (NOT)

NOT is up 0.22% over the past day, and currently trades at $0.0019. Readings from the token’s daily chart show that it has trended within a descending parallel channel since May 14, its price plummeting by 41%.

A descending parallel channel is formed when an asset’s price moves between two downward-sloping, parallel trend lines, connecting lower highs and lower lows over time. It signals an extended bearish trend as buy-side pressure declines.

If selloffs continue among NOT holders, its price could attempt to break below the descending parallel channel to trade at $0.0015.

On the other hand, if demand climbs, the token’s price could rally toward $0.0023.

aura (AURA)

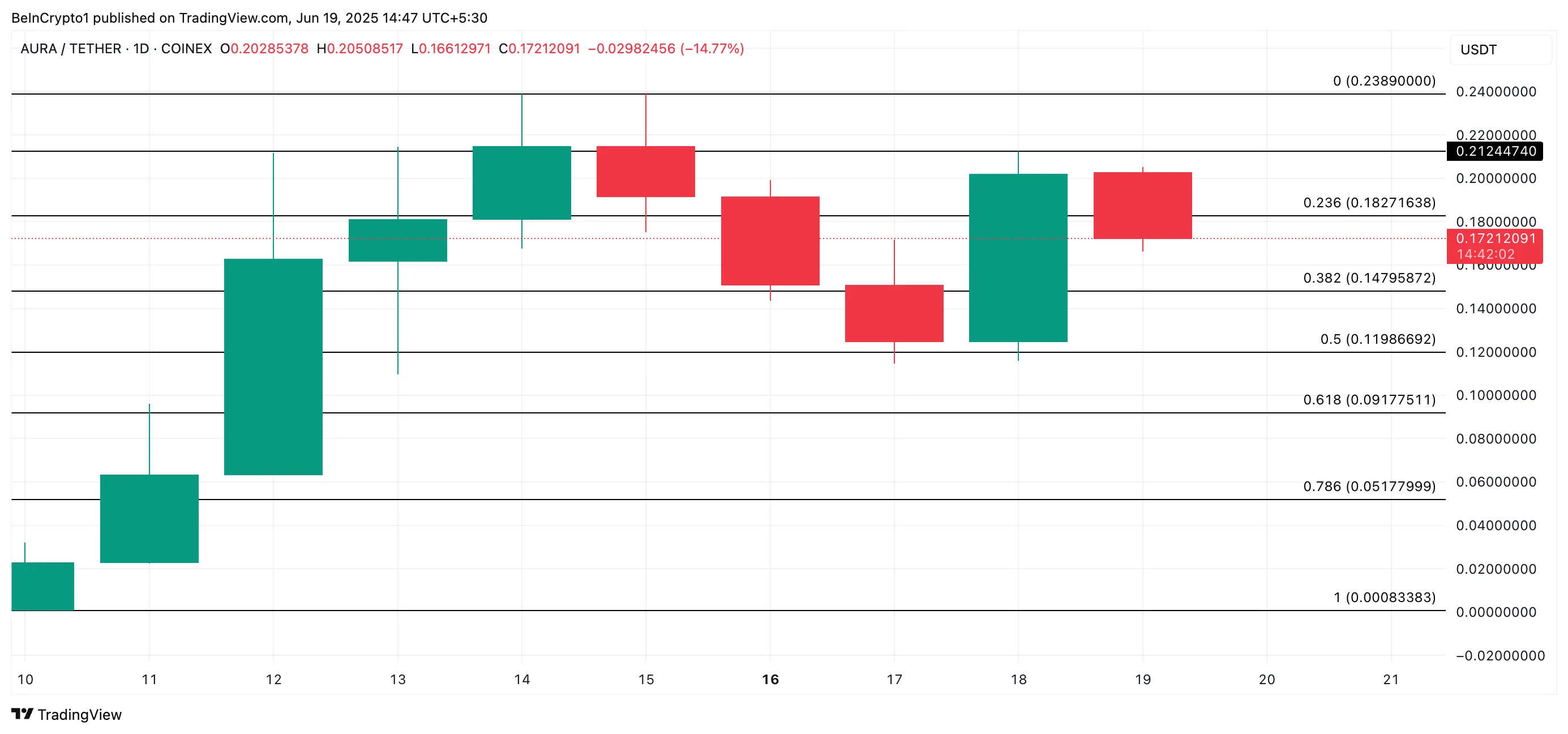

AURA, a culture token built on the Solana blockchain, is another altcoin trending today. At press time, the token trades at $0.17. It is up over 20%, defying the broader market’s lackluster performance over the past 24 hours.

During that period, the token’s trading volume has climbed by 11% to reach $21 million. This means that significant demand backs AURA’s price jump.

If this trend continues, the token’s price could break above the resistance at $0.18. A succesful breach of this level could propel AURA’s price to $0.21.

AURA Price Analysis. Source: TradingView

However, if profit-taking commences, the altcoin’s value could fall to $0.14.

Sui (SUI)

Layer-1 asset SUI is another altcoin that is trending today. It currently trades at $2.81, up by a modest 0.25% over the past day. However, bearish pressures persist.

On the daily chart, the altcoin remains below its 20-day Exponential Moving Average (EMA), indicating a steady surge in the demand for sell orders.

The 20-day EMA measures an asset’s average price over the past 20 trading days, giving weight to recent prices. When price trades below the 20-day EMA, it signals bullish momentum and suggests sellers dominate the market.

If this continues, SUI could extend its price decline to $2.70.

However, if selloffs reduce, the coin could climb toward $2.91.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.