In December 2020, the SEC sued Ripple Labs, claiming the company illegally sold XRP as unlicensed securities. This lawsuit has become pivotal for the crypto industry, with billions at stake and significant implications for digital asset regulation. This guide will keep you updated on the key developments and the broader impact of the Ripple vs. SEC battle.

KEY TAKEAWAYS

➤ The Ripple vs. SEC lawsuit has clarified how digital assets like XRP are treated under U.S. securities law, particularly distinguishing between institutional and retail sales.

➤ While Ripple’s partial victory boosted XRP’s price, the coin’s real progress came following the re-election of Trump and the removal of Gary Gensler as SEC Chair.

➤ In 2025, the case is ongoing, following a last minute appeal filing by the SEC under Gensler.

Ripple vs. SEC lawsuit: A detailed timeline of events

XRP is designed as a cross-border payment system for businesses and financial institutions. Ripple Labs, the company behind the blockchain and native crypto, announced its first partnership with a traditional finance institution back in 2015.

While many early investors considered Ripple to be one of the few enterprises offering a legitimate real-world use case for crypto, it wasn’t long before the endeavor caught the eye of U.S regulators. Here’s a timeline of all the key events in the seminal, ongoing Ripple vs. SEC lawsuit.

Dec. 21, 2020

The SEC initiated the lawsuit against Ripple Labs, CEO Brad Garlinghouse, and co-founder Chris Larsen.

Ripple Labs was accused of selling unregistered securities instead of a commodity in a centralized environment. The SEC accused the two Ripple Labs executives of selling over 14.6 billion XRP tokens to fund the company and get rich.

Ripple Labs CEO Brad Garlinghouse announced that the company would defend itself in court.

Dec. 28, 2020

Coinbase, the largest cryptocurrency exchange, announced the delisting of the XRP token. Full suspension was planned for Jan. 19, 2021, at 10 a.m. Pacific Standard Time.

March 3, 2021

Ripple Labs execs Garlinghouse and Larsen sent letters to the U.S. District Court Southern District of New York Magistrate in pursuit of getting Judge Sarah Netburn to dismiss the lawsuit Ripple vs SEC. They argue the lack of “fair notice and due process.”

March 8, 2021

The SEC responds by sending a letter to the judge requesting that the “fair notice” defense be struck and that a hearing be immediately requested.

March 22, 2021

Judge Netburn told the SEC that her understanding of XRP is that “… not only does it have a currency value but it has a utility, and that utility distinguishes it from Bitcoin and Ether.”

April 13, 2021

SEC Commissioner Hester M. Peirce published the Token Safe Harbor Proposal 2.0. The updated proposal seeks to provide a three-year grace period for developers to find a way to simplify participation in a decentralized network, in which they would be exempted from the securities law.

June 14, 2021

The court granted the SEC’s motion to delay the disclosure of SEC’s internal communications about Bitcoin, Ethereum, and XRP until August 31.

Internal documents on other cryptos may shed some light on the general view of the SEC on crypto. The court had yet to rule on whether they wanted the SEC to disclose their internal trading policies around crypto at the time.

Aug. 31, 2021

The deadline for disclosing the SEC’s internal documents. The fact discovery must take place by this date.

Oct. 15, 2021

The expert discovery deadline is for the collection of what experts in the crypto space and securities have to say on the matter.

July 13, 2023

The United States District Court for the Southern District of New York (S.D.N.Y.) issued its long-awaited opinion ruling on summary judgment motions in SEC v. Ripple Labs et al. on July 13, 2023. Judge Analisa Torres ruled in partial favor of both the SEC and Ripple Labs, granting certain aspects of each party’s motions.

According to Judge Torres,

XRP, as a digital token, is not in and of itself a ‘contract, transaction, or scheme that embodies the Howey requirements of an investment contract.

Rejecting the notion that all tokens are securities, the court specified that the circumstances of each transaction type must be considered. For Ripple Labs, this amounted to four transaction types, of which three Judge Torres determined did not constitute securities transactions.

The transaction types classified as securities are Ripple’s sales of XRP to institutional investors through written contracts.

The transaction types that do not constitute the unlawful offer and sales of securities are Ripple’s sales of XRP to programmatic buyers (i.e., to the general public through digital asset exchanges or trading algorithms), distribution of XRP as compensation (e.g., to employees), and sales by the defendants (Larsen and Garlinghouse) of XRP to programmatic buyers.

Lastly, Judge Torres explicitly chose not to extend her opinion to cover secondary market sales of XRP or other tokens, stating that:

Whether a secondary market sale constitutes an offer or sale of an investment contract would depend on the totality of circumstances and the economic reality of that specific contract, transaction, or scheme.

Aug. 7, 2024

The Southern District of New York issued its final ruling, confirming that Ripple’s institutional sales were unregistered securities but that digital exchange sales did not constitute securities transactions. Ripple was fined $125 million, and the ruling is expected to be appealed.

As a result, the price of XRP ripped higher, marking a recovery of over 1,000% from its lawsuit-induced low of $0.1748. This would eventually lead to XRP flipping the market cap of Tether and Solana.

Nov. 5, 2024

Donald Trump is re-elected as President of the United States. With Trump known for his pro-crypto policies, the crypto market exploded, with XRP being on of the main beneficiaries, rallying more than 500% since Trump’s win.

Nov. 21, 2024

Gary Gensler announces his resignation from the SEC; a bullish sign for XRP.

Jan. 15, 2025

The SEC files an appeal against the outcome of the lawsuit, days before Gary Gensler was due to relinquish his position as Chair.

Feb. 11, 2025

In a novel move, Binance and the SEC jointly filed a motion to pause their ongoing legal proceedings for 60 days. The filing followed the SEC’s establishment of a new crypto taskforce, which is thought will influence the case’s outcome. While these proceedings are separate from Ripple’s battle with the regulator, the move may be a sign that a similar hold could be placed on the XRP case on Feb. 13, 2025.

Feb. 13, 2025

The upcoming SEC closed meeting on Feb. 13, 2025 will be crucial and may determine the future of XRP.

The Sunshine Notice Act states that the agenda will include:

- Institution and settlement of injunctive actions

- Institution and settlement of administrative proceedings

- Resolution of litigation claims

- Other matters relating to examinations and enforcement proceedings

Many in the crypto community expect the SEC might choose to drop it’s appeal in the ongoing case, which could potentially lead to XRP making new all-time highs. However, if the SEC proceeds with the appeal, XRP’s price may slide considerably. A third outcome — of a pause, similar to the agreed with Binance — may now be the most likely.

What is a financial security?

A “security” does not have a utility and is a tradable financial asset representing some form of ownership in a corporation or similar entity. For instance, publicly traded companies often represent shares as “securities “ to raise capital.

There are three types of securities: equity, debt, and hybrid. Together with public sales, securities are regulated by the SEC.

Companies, partnerships, or trusts that issue equity securities give their owners an ownership interest in the entity’s assets. A debt security is a financial instrument representing money borrowed. The terms specify the loan amount, annual percentage rate, maturity period (when it must be repaid), and other conditions.

How does the SEC define a security?

A “security” for the SEC is somewhat unclear, given the fact that in 2019, the agency publicly stated that Bitcoin is not a security, arguing that the SEC, in determining whether a token is legally a security, the SEC uses the Howey Test.

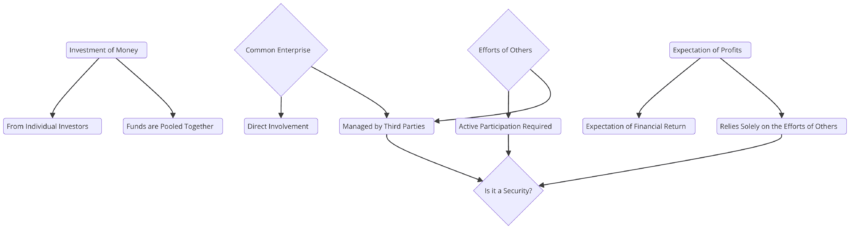

What is the Howey test?

The U.S. SEC vs W.J. Howey was a Supreme Court case in 1946 that has a pivotal role in securities-related cases. It helps determine if a transaction is an investment contract, as stated in the Securities Act of 1933.

What was the Howey case about?

In 1946, two individuals from Florida received parts of their citrus grove land from a sale. They offered the option to lease the land back to the sellers. They would serve the land, harvest, and market the products, and share part of the profit with the landowners.

However, the U.S. Securities and Exchange Commission (SEC) sued them for not filing a securities registration statement.

The Supreme Court ruled that the contract was an investment contract, and it set the following guidelines to be used for future cases:

- There is an investment of money

- The investment needs to be in a company or project (A common enterprise where the investors pool in their money and assets to invest in a project.)

- Profit is expected

The profits come from the promoter’s or third party’s efforts. Although the Howey test uses the term “money,” it is also used for other kinds of investments and assets.

A key point in declaring an investment contract a “security” is the control of the investor over the profit. If the investors have no control over that asset, it is usually a security. For a crypto to be classified as a security, it needs to meet all the criteria mentioned in the Howey test.

How does the Howey Test apply to Ripple?

The Howey Test admittedly has vague guidelines. The SEC concluded that XRP complies with the requirements of the Howey test:

- Ripple Labs, the company, sold $1.38 billion worth of XRP tokens.

- Investors bought XRP because they believed they were investing in a common enterprise.

- Ripple’s marketing promotion and supply manipulation made investors believe that the company’s efforts would raise XRP’s price.

The recent court ruling clarified that while Ripple’s institutional sales of XRP were deemed unregistered securities under the Howey Test, the sales on digital asset exchanges were not considered securities transactions. This distinction is crucial as it limits the scope of the SEC’s application of the Howey Test to XRP sales.

What does the lawsuit mean for the crypto community?

The entire cryptocurrency industry has watched the Ripple vs. SEC lawsuit play out. The lawsuit’s findings should help clarify the regulatory arena for future ICOs.

While the initial ruling offered some clarity, it also raised new questions, particularly regarding secondary market sales and the broader application of the Howey test to digital assets.

The case’s outcome leaves some ambiguity about how other cryptocurrencies might be classified, leading to potential legal uncertainty for projects operating in the U.S. market.

Ripple vs. SEC: Where does the crypto community stand?

The Ripple vs. SEC lawsuit has been a pivotal moment for the entire crypto community, not just Ripple supporters. The case has highlighted the broader potential of blockchain technology to disrupt traditional financial systems. Throughout the case, the crypto community largely remained optimistic, with many believing the odds favored Ripple Labs.

When the court announced Ripple’s partial victory, XRP’s price surged, although it corrected later as investors booked profits. The outcome of this case continues to send a strong message to the entire crypto industry, influencing perceptions and future regulatory actions.

Frequently asked questions

What is the Ripple vs. SEC lawsuit?

Why is the lawsuit against Ripple important?

What is a security?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.