The Waves price increased sharply on July 10, reaching its June high value of $2.92. But, the upward movement could not be sustained, and the price fell by 25% afterward.

The weekly and daily time frame analysis both give inconclusive results, which means that the trend’s direction is not confirmed yet. The reaction to the current resistance area could be crucial in predicting the future trend.

Has WAVES Begun a Bullish Trend Reversal?

The weekly chart shows that the WAVES price has fallen under a descending resistance line since May 2022. Thus, the line has been in place for 413 days so far.

Until now, WAVES made several failed breakout attempts (red icons). It is currently in the process of making another one. While it increased considerably above it, it has yet to reach a close above this line. That would be required to confirm the bullish trend reversal.

Moreover, the weekly RSI also gives an undetermined reading.

When evaluating market conditions, traders use the RSI as a momentum indicator to determine if a market is overbought or oversold and to decide whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true. The indicator is increasing but is below 50, a sign of a still undetermined trend.

Read More: 9 Best Crypto Demo Accounts For Trading

WAVES Price Surges but Fails to Clear Resistance

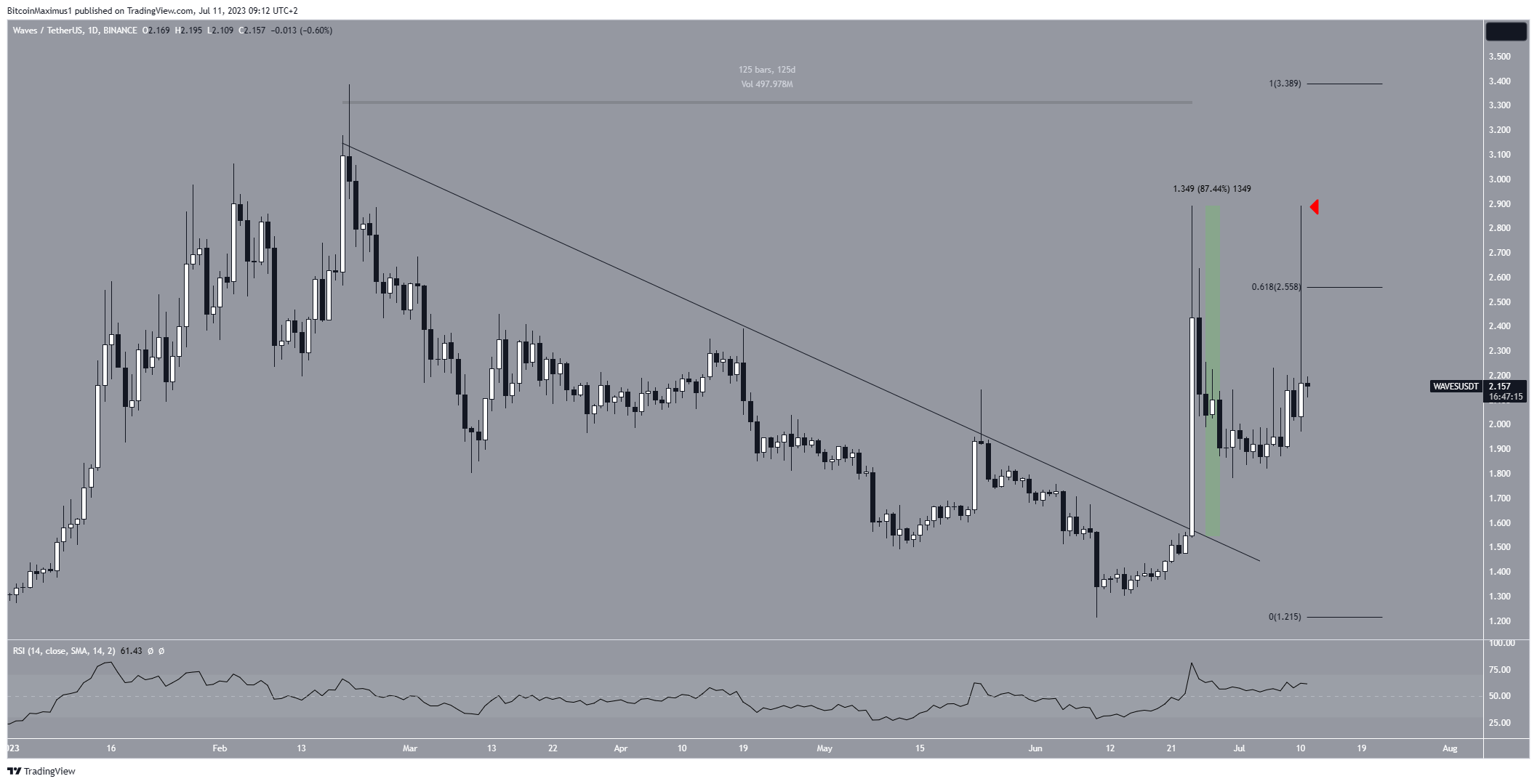

The daily time frame analysis shows that the WAVES price has increased since falling to a yearly low of $1.21 on June 10. The upward movement accelerated on June 24, causing a breakout from a descending resistance line. At the time of the breakout, the line had been in place for 125 days.

The price increased sharply after the breakout. The high point of the day was 87% above the daily low. However, WAVES has fallen since. It made another attempt at moving upwards on July 10, but that only led to the creation of a very long upper wick (red icon), considered a sign of selling pressure.

Read More: Best Crypto Sign-Up Bonuses in 2023

Moreover, the price created a double top considered a bearish trend reversal pattern.

WAVES trades below the 0.618 Fib retracement resistance level at $2.55. According to the Fibonacci retracement levels theory, following a significant price change in one direction, the price is expected to partially return to a previous price level before continuing in the same direction.

The 0.618 level is crucial in determining whether the increase is corrective. The fact that the wick highs were made above this level and the price fell below it afterward supports the possibility that the trend is bearish.

Despite the seemingly bearish price action, the daily RSI is still bullish. The RSI is increasing and is above 50, both signs of a bullish trend.

Therefore, the WAVES price prediction will likely be determined by whether the price closes above $2.66 or continues trading below it. If it closes above, an increase to the yearly high of $3.30 will be expected.

However, if it fails to do so, WAVES could fall to $1.60.

For BeInCrypto’s latest crypto market analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.