In late 2017, the Central Bank of Uruguay surprised the world with a decision to explore the viability of a Central Bank Digital Currency (CBDC).

At the time, no other country was ready to deploy a consumer-oriented token. And certainly not in Latin America. For context, its closest rival, the Venezuelan Petro digital currency, did not formally launch until February 2018.

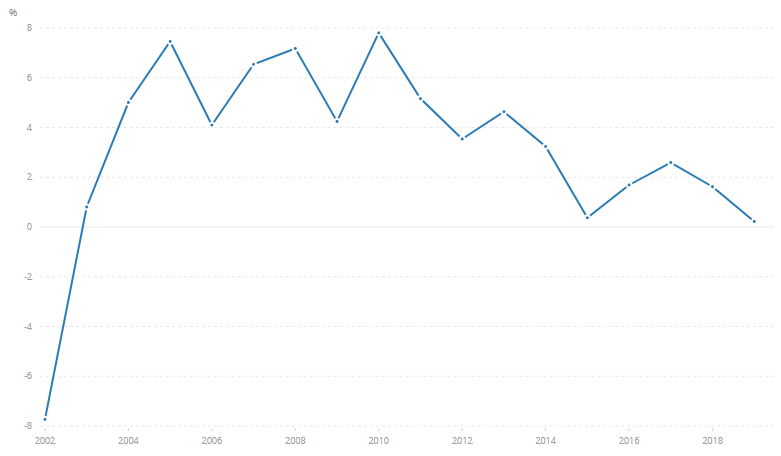

Uruguay is surrounded by Argentina to the West and Brazil to the North, two of the most prominent economies in Latin America. Politically, however, the country is widely regarded as far more stable than its immediate neighbors. It’s sometimes even referred to as ‘the Switzerland of South America’.

The Birth of the e-Peso

In 2017, the Uruguayan central bank began exploring the viability of a token that would serve as a digital version of its fiat counterpart. The decision was reportedly a proactive one with the government wanting to stay ahead of other countries in this emerging space. Government officials cite the increasing prominence of cashless societies in the modern world and the decline of physical currency. The Uruguayan CBDC initiative was meant to address both these problems, while also boosting the country’s image as a financial leader and innovator. The Central Bank of Uruguay announced the initiative under the title ‘e-Peso’. They proclaimed it ‘legal tender’ that could be used nationwide at participating merchants. There are, however, some interesting differences between traditional cryptocurrencies such as Bitcoin and the e-Peso.Why the e-Peso Differed From Traditional Cryptocurrencies Like Bitcoin

The e-Peso’s biggest departure from the traditional cryptocurrency model was a complete absence of blockchain or distributed ledger technology (DLT). Instead, tokens would reside directly on user’s mobile phones allowing transactions to take place in a peer-to-peer manner. This approach drew a lot of criticism from the cryptocurrency community. Blockchain transparency is regarded as the pinnacle of digital currency innovation. However, the central bank’s approach also had positive repercussions. They claim the token could be exchanged between users even in the absence of telecommunication networks and centralized hubs.

The Central Bank Approach

Traditional cryptocurrencies, on the other hand, do not require tokens to carry a serial number. This allows them to be fungible. In other words, tokens have identical characteristics and can be substituted with each other. While advanced analytics and forensics tools have challenged the validity of Bitcoin’s fungibility, plenty of other cryptocurrencies are still championing privacy. The e-Peso throws out fungibility. It’s a less anonymous payment method and more of a mobile-only bank account. The central bank confirmed that transactions on the network would be traced if needed. This breaks down the argument about the need for a digital version of the Peso. Uruguay’s approach to the e-Peso is not far off from other countries, including China and the European Union. Central banks will always need to maintain some level of traceability within their crypto networks. CBDCs need to be compliant with anti-money laundering and anti-terrorism legislation.How Uruguay Differentiated Itself From Other CBDC Implementations

Regardless of the privacy pitfalls, eliminating the internet connectivity requirement allows the Uruguayan CBDC to stand out from the crowd. In cryptocurrency circles, a lack of access to sophisticated hardware such as smartphones, laptops, and computing devices has long been one of its biggest criticisms. Uruguay solves this problem by offering users without smartphone access the ability to use Unstructured Supplementary Service Data (USSD) to register and manage their wallets. Even a tiny fraction of the population with basic handsets can access digital funds by dialing a special number (*228#). No need to ever download an application. The e-Peso does not require its users to maintain an active cellular connection. While internet reach has definitely improved in recent years, there are still parts of society that don’t have access to crypto.A Deep Dive Into the e-Peso Pilot Program

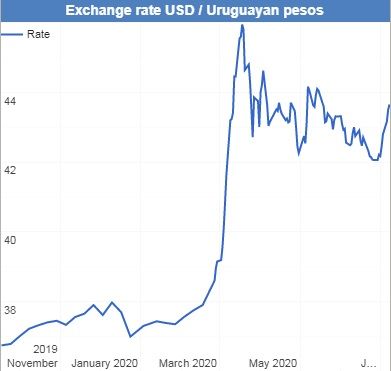

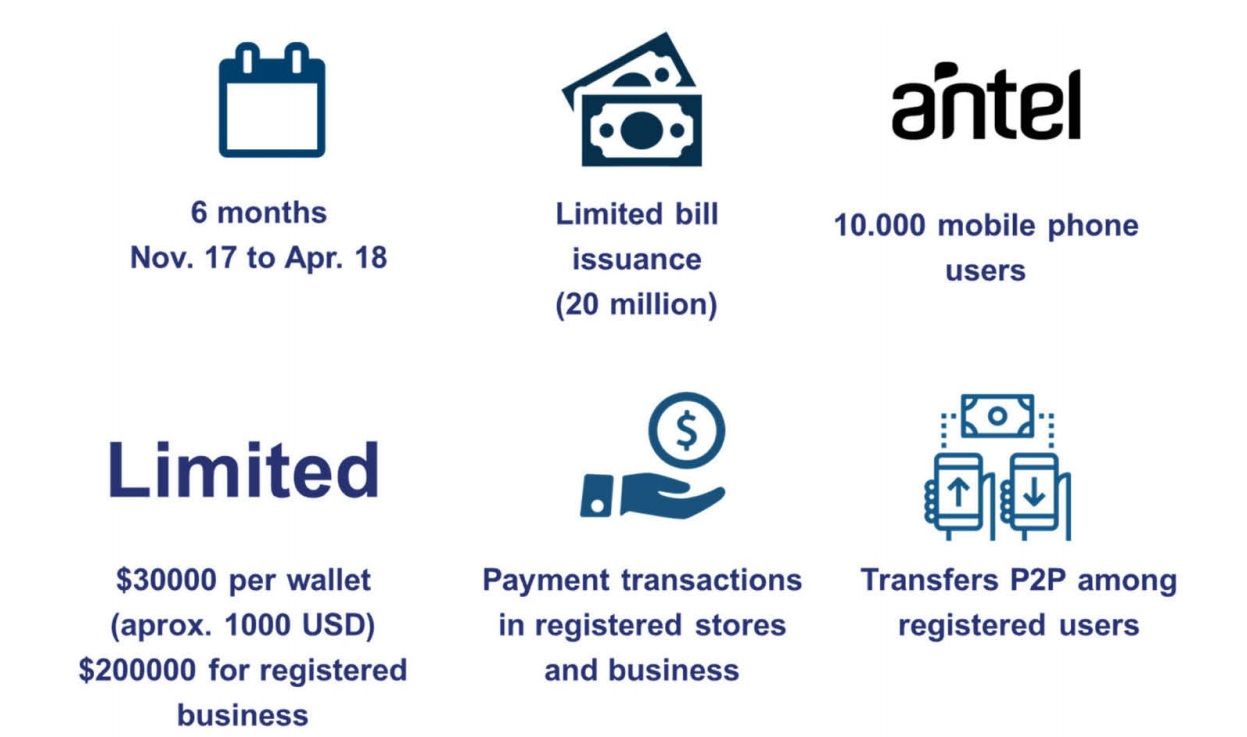

The e-Peso digital currency project was first launched in November 2017 as part of a six-month trial. At the time, the government said that it would evaluate the results and consider a gradual nationwide implementation thereafter. To be eligible for the e-Peso digital currency pilot, users would need to be active subscribers of the state-owned network Antel. Authorities approved a total of 10,000 users to create wallets on a first come first serve basis. Third-party payments firm, RedPagos, would then load tokens on these wallets. For the duration of the pilot, consumer e-Peso wallets could hold a maximum of 30,000 Uruguayan pesos (~$1000). Businesses and commercial users, meanwhile, had a much higher limit, set at 200,000 pesos or (~$6,000). In total, the central bank said that it expected to issue 20 million pesos (~$500,000) worth of digital currency during the trial.

The Results are In

All in all, the project seemed like a well thought out CBDC implementation. And indeed, at the end of the six-month trial, the token had gained significant traction among users, businesses, and even private banks. The payment network also did not fall victim to any security breaches or technical errors. The central bank emphatically declared the e-Peso a success. Many, however, questioned the point of a digital currency that does not offer the benefits of decentralization. While the answer was not immediately obvious, a conference held by European Money and the Finance Forum later revealed that the Uruguayan Central Bank was hoping to use CBDCs to eliminate the country’s reliance on physical cash altogether.Praise Be to the e-Peso

Jorge Ponce, an economist in charge of the central bank’s Economic Research Department, reasoned that the cost of using cash in Uruguay accounted for approximately 0.58% of the nation’s GDP. The vast majority of this cost is borne by the private sector, or more specifically, retailers. They argued that using a CBDC would lift this burden, even partially, and substantially reduce transaction costs across the country. Ponce concluded:“Central banks should be part of the new digital paradigm. They should be prepared to fulfill their mandates in this digital era and ready to exploit new technologies in their favor. Central banks need to be proactive in order not to arrive too late to this digital revolution, to be able to fulfill their mandates, and to contribute to a healthy development of financial systems. The pilot plan of E-Peso in Uruguay is a step in this direction.”The e-Peso project went on to be praised in international finance circles. In 2019, the International Monetary Fund (IMF) acknowledged the token’s success in its annual report. It called Uruguay:

“one of the pioneers in [the] world in taking a proactive approach in evaluating the case for the CBDC”.However, the IMF did note that further research was needed to analyze the impact of a CBDC on monetary policy transmission, financial institutions, and dollarization. Uruguay’s banks were largely left out of the pilot. The report suggested that the e-Peso could lead to an increase in bank funding costs if the token went on to replace bank deposits entirely. Such a scenario would naturally cause interest rates to spike.

Future Scope

In spite of the successful pilot that concluded in mid-2018, the Uruguayan Central Bank has remained relatively quiet on the subject. It remains unclear whether the country’s CBDC plans have been indefinitely postponed or if token development continues. One thing is clear though: Uruguay will forever be remembered for its contributions to the CBDC ecosystem. With its long-standing reputation of stability, it’s likely that Uruguay is patiently waiting on other countries to first launch their own CBDC solutions. China should do exactly that sometime between now and 2021. Private solutions like Libra are expected to follow. What does the country decide to do next with the e-Peso? Well, that’s anybody’s guess.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored