After double-digit gains in the second half of June, Uniswap (UNI) price has dropped to $5.3 this week following unsuccessful attempts at reclaiming the $6 territory. On-chain data suggests the UNI price rally is cooling off as the SEC FUD surrounding centralized exchanges fades.

UNI price rallied 30% in June as investors turned to Uniswap and other prominent DEXs after the Securities and Exchange Commission (SEC) lawsuit against Binance and Coinbase.

However, Coinbase shares are up 50% one month down the line. Binance’s BNB coin has rebounded 10% to reclaim $250, while regulated CEXs like Kraken and Bitstamp have also seen significant trading volume growth.

How could the resurgence of these centralized exchanges impact UNI prices in the coming weeks?

Uniswap Trading Volume Downtrend Raises Concerns

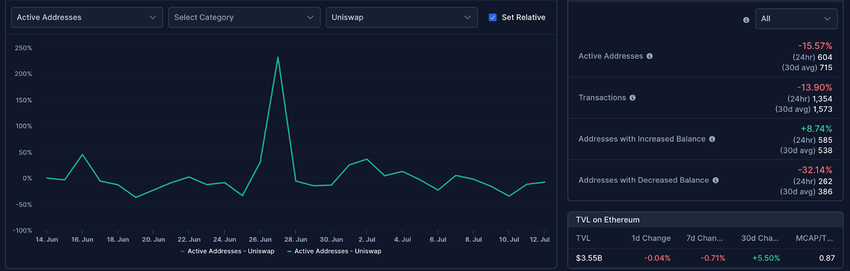

On-chain data shows that the resurgence of the centralized exchanges has gradually cannibalized some of Uniswap’s traction. According to data from the blockchain analytics platform The Tie, Uniswap user activity and transaction volume declined significantly in July.

The chart below shows that UNI attracted 935 active users on July 1. But that figure has now dropped to 632 active addresses by the close of July 11.

Uniswap transaction volume on July 11 dropped 14% below the 30-day average.

Active Addresses evaluates user activity by counting the daily number of wallet addresses carrying out transactions. When it drops, as seen above, it highlights a drop in number of users utilizing the core services offered by the network.

It’s no surprise that transactions involving UNI have also now dropped below the 30-day average. If this bearish trend of decreased market participation persists, UNI holders can anticipate more downside.

Read More: 9 Best Crypto Demo Accounts For Trading

Investors Unstaking UNI Could Pile on More Bearish Pressure

One of Uniswap’s most significant utility and price stability mechanisms is the passive income offered to investors that stake UNI in liquidity smart contracts. However, on-chain data compiled by Glassnode shows that investors have been unstaking their UNI tokens over the past two weeks.

The chart below shows how Uniswap investors unstaked 116,000 UNI tokens (0.02% of total circulation supply) between June 28 and July 12.

The Supply in Smart Contract metric tracks the real-time changes in the percentage of a token’s circulating supply currently deposited across various staking protocols.

When it drops it instantly increases the number of tokens available to be traded on the markets.

If the newly unstaked 116,000 tokens hit the market amid the ongoing demand downtrend, UNI price could drop further in the coming days.

Read More: Best Upcoming Airdrops in 2023

UNI Price Prediction: The Bears are Eyeing the $4.50 Territory

The factors mentioned above indicate that the Uniswap bears could be eyeing a reversal toward the $4.50 territory.

But first, they would have to surmount the $5.20 resistance. At that zone, 11,000 investors that bought 27 million UNI tokens at an average price of $5.24 could prevent the drop.

But if the bears gain a foothold as predicted, UNI’s price could drop to $4.50.

Still, the bulls could invalidate the bearish prediction if UNI prices break above $6. However, the $5.80 resistance could pose a challenge once again.

As seen above, 12,000 investors had bought 18 million UNI tokens at an average price of $5.77. If they chose to book profits, Uniswap could retrace once it nears that price range.

Nevertheless, if the resistance level does not hold, then UNI could reach the $6 target.

More From BeInCrypto: 9 Best AI Crypto Trading Bots to Maximize Your Profits