Uniswap(UNI) price quickly gained 12% last week, as concerned investors flocked to the leading DEX as leading CEXs battled lawsuits. A week later, the UNI price is down 3% after failing to break the critical $5 resistance level. Will the ongoing loss of traction exacerbate the losses even further?

Uniswap remains the largest Decentralized Exchange globally. However, rivals like PancakeSwap and Balancer have been encroaching on a significant portion of the market share in recent weeks.

Amid rising community concerns, will the Uniswap team be able to attract new investors and spur confidence in the coming weeks?

Uniswap is Struggling to Attract New Users

According to the data presented by Glassnode, UNI has been struggling to attract new demand since this week. The chart below illustrates that New Addresses created on the Uniswap network have declined since the recent high on June 10.

Particularly, between June 10 and June 19, it dropped 66% from 733 to 440 new wallet addresses.

Network Growth evaluates the rate at which a blockchain network attracts new users by summing up the new wallet addresses created daily. As observed above, it often impacts price negatively when it drops persistently.

Unless this trend reverses, it could further exacerbate the ongoing UNI price drop.

More From BeInCrypto: Crypto signals: What Are They and How to Use Them

Rival DEXs Are Encroaching Uniswap’s Market Share

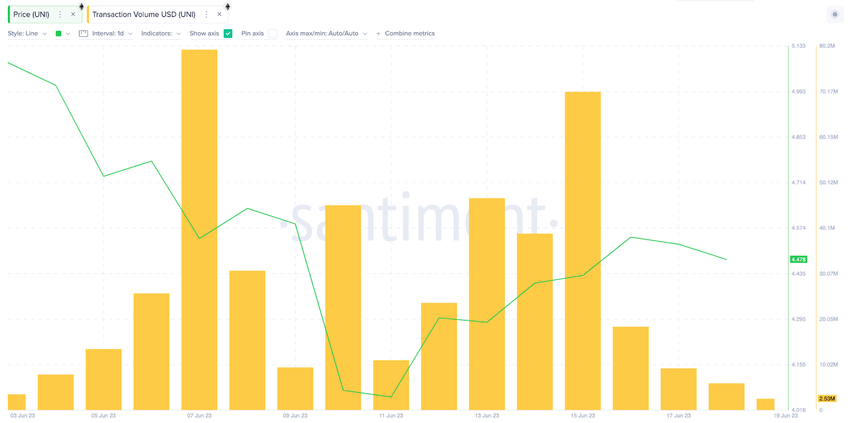

In confirmation of the bearish stance, Uniswap appears to be losing market share to its competition’s Decentralized Exchanges protocols. Between June 5, the SEC first announced its lawsuit against Binance and Coinbase, and June 7, UNI Transaction Volume quickly spiked 900%.

But the chart below shows that it has since dropped 1,200% from $79.4 million to a lowly $5.93 million at the close of June 18.

The Transaction Volume (USD) metric evaluates the dollar value of daily confirmed transactions involving a specific crypto asset. It usually has a direct correlation to price.

Unless the Uniswap team is able to reverse this trend, UNI could head toward another price downtrend in the coming days.

Read More: Top 11 Crypto Communities To Join in 2023

UNI Price Prediction: The Bears Could Target $3.75

According to IntoTheBlock’s IOMAP distribution data, UNI price will likely enter a bearish downswing toward $3.75.

Currently, the 1,360 investors that bought 9.66 million UNI tokens are expected to offer considerable support when the price approaches its average purchase price of $4.34

If that support folds, as expected, the Uniswap price will likely decline to $3.75.

Still, the Uniswap bulls can negate this bearish narrative if the UNI price rises above $4.70. But as seen above, some of the 2,300 addresses holding 5.2 million tokens at the maximum price of $4.70 could pose significant resistance.

Nevertheless, if that resistance level does not hold, the UNI price could finally reclaim the $5 milestone.

More From BeInCrypto: 9 Best AI Crypto Trading Bots to Maximize Your Profits