Bitcoin’s (BTC) price rose toward the $26,800 territory on Friday, as markets reacted positively to the Consumer Price Index (CPI) data published on Sept 13. On-chain analysis examines if the bulls can sustain the price rally and push for $30,000.

Investors often shift capital from the markets when an asset’s price declines. However, a contrarian trend has emerged over the past two weeks in the Bitcoin derivatives markets.

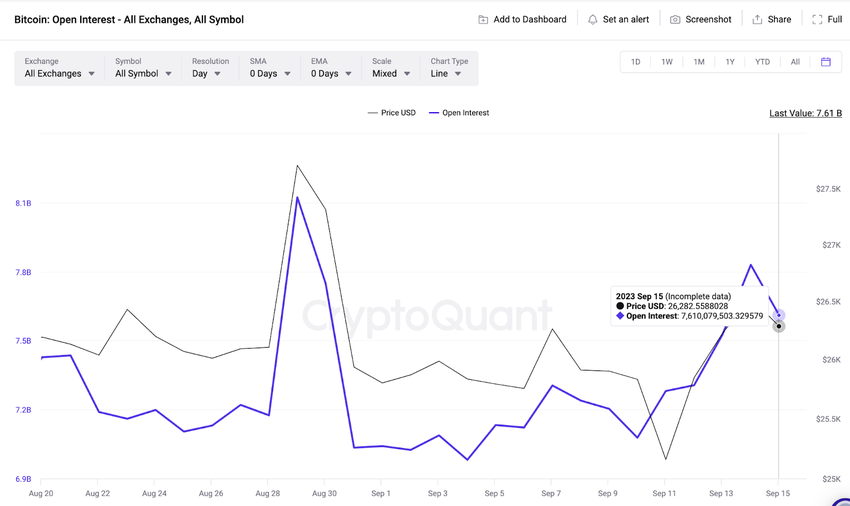

Speculative Traders Have Pumped in $650 Million into the Bitcoin Derivatives Markets

Between September 1 and September 15, BTC’s Open Interest price has increased by $640 million. Meanwhile, the chart below depicts that before the CPI data published on September 13, the BTC price had declined by up to 8% since losing $27,100 support on August 31.

Open Interest sums up the total value of active derivatives contracts for an asset. An uptrend in Open Interest is a bullish signal, indicating that traders are increasing their capital inflows.

Hence, this growing demand and investor participation in the Bitcoin market could potentially propel BTC into a prolonged price rally.

Bitcoin Investors Are Not Looking to Book Early Profits

Following the CPI data announcement, BTC price has rallied 7% to hit $26,800 on Friday, but early on-chain signals show that bulls are still gunning for more gains.

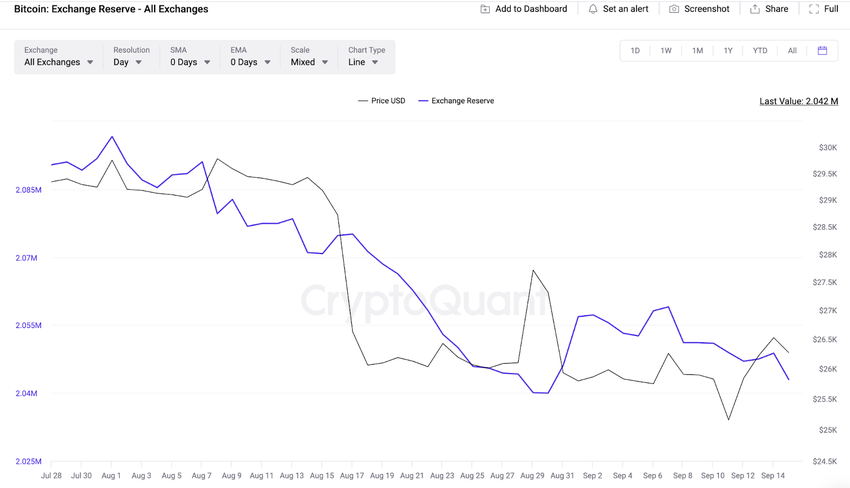

According to CryptoQuant’s Exchange Reserves data, Bitcoin investors have now moved 13,000 BTC out of crypto exchanges this month.

Notably, the chart below depicts that about 6,000 of those BTC outflows were made after the CPI data was published on September 13.

The Exchange Reserves metric tracks real-time changes in balances that investors currently hold in crypto exchange-hosted wallets. A rapid drop in exchange balances implies many holders opt for self-custody and could refrain from selling in the short term.

If this decline persists in the coming days, Bitcoin price could score even more gains.

BTC Price Prediction: $28,700 is the Target In Focus

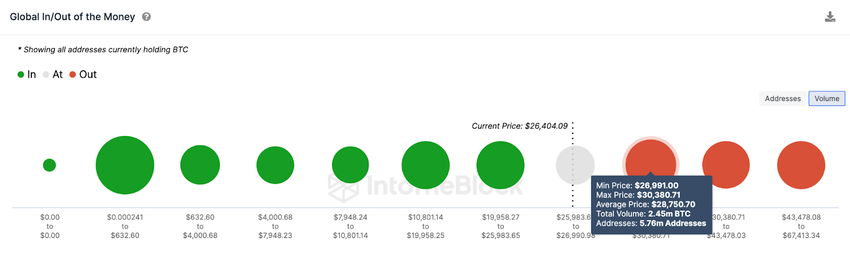

From an on-chain perspective, Bitcoin price looks set to score more gains if the momentum in the broader crypto markets flips bullish. However, the $28,750 range sell-wall could form a major stumbling block.

The Global In/Out of the Money Around Price (GIOM), which depicts the entry price distribution of current Bitcoin holders, also affirms this narrative.

It clearly illustrates that 5.76 million addresses had bought 2.45 million BTC at the average price of $28,750. If they book profits early, they could trigger a Bitcoin price correction.

But if the resistance level gives way, the bulls could push the Bitcoin price rally toward $30,000

Still, the bears could force an instant downswing if the BTC price falls below the $25,000. In that case, the 5.5 million addresses that had bought 2.13 million BTC at the maximum price of $25,980 could offer initial support.

If that support level fails to hold, Bitcoin’s price could slide below $25,000.