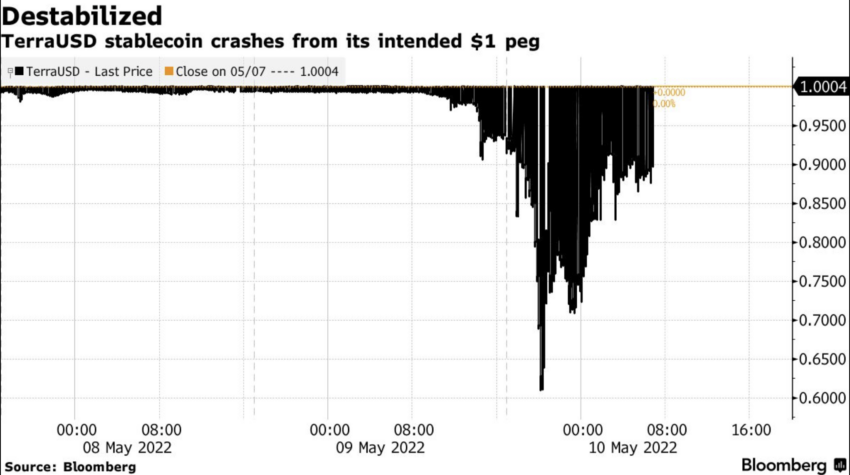

Jump Trading will join crypto firm Terraform Labs (Terraform) and the US Securities and Exchange Commission (SEC) in a civil trial next year. A judge ruled that Terraform engaged in sales of unregistered securities, but he may need fresh insight on how Jump Trading acted as a market maker for the company.

The judge ruled that Terraform Labs did not engage in unregistered securities swaps. His request for Jump Trading to be involved came after an internal whistleblower claimed knowledge of Jump’s intent to prop up TerraUSD in May 2021.

Judge Needs Clarity on Jump Involvement

If true, then claims inventor Do Kwon made about how his algorithm could keep TerraUSD at $1 would be questioned. The judge said that, at the moment, the SEC’s evidence on this matter was “compelling but circumstantial.”

The court also needs to determine the credibility of the whistleblower.

Terraform Labs has denied it sold unregistered securities. The judge set January 29, 2023, as a new trial date.

In February, the SEC sued Kwon and Terraform for offering unregistered securities in a fraud erasing $40 billion from the crypto market. Kwon is serving time for passport fraud in Montenegro.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

What 2024 Holds for the SEC and Crypto

The Terraform ruling caps off a year of high-profile enforcements against crypto products, companies, and personalities. There were 501 stand-alone enforcement actions in 2023, including several crypto cases.

The SEC sued PulseChain founder Richard Heart, former FTX CEO Sam Bankman-Fried, and FTX executives. Following his criminal conviction in November, Bankman-Fried will face the SEC’s wrath in March.

The SEC’s case against Heart will also spill over into the new year, as the agency has been unable to notify Heart of the enforcement action directly.

Coinbase is also in a heated battle with the SEC to clarify US crypto rules. The SEC may also need to defend an appeal from Ripple Labs and make decisions on whether to approve several spot Bitcoin exchange-traded funds.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Do you have something to say about the alleged involvement of Jump in the Terraform saga or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.