Coinbase, a prominent US cryptocurrency exchange, is escalating its fight with the US Securities and Exchange Commission (SEC) for regulatory clarity for the crypto industry. The exchange has launched an appeal against the SEC’s refusal to classify cryptocurrencies as securities.

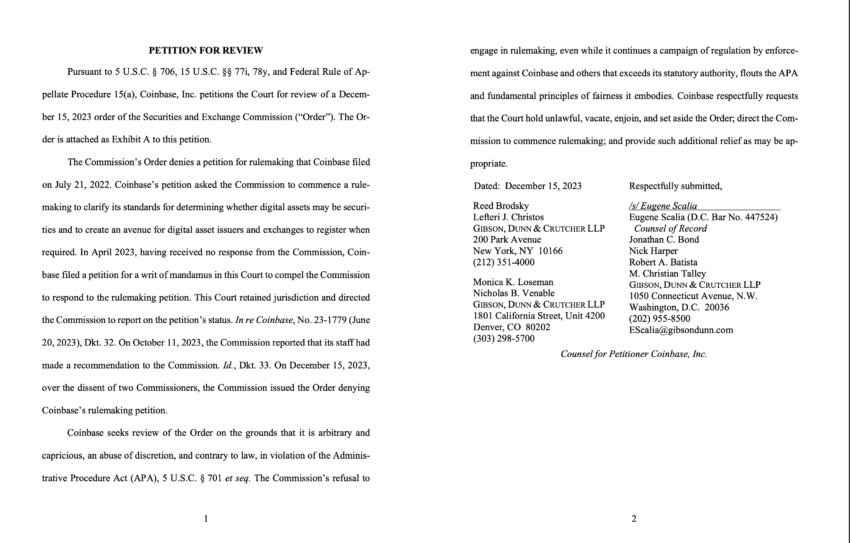

On December 15, the SEC rejected Coinbase’s petition for rulemaking on cryptocurrency. Unfazed, Coinbase swiftly filed an appeal, underscoring its commitment to establishing clear regulatory guidelines.

Coinbase Puts Crypto Regulation Ball Back in SEC Court

Paul Grewal, Coinbase’s Chief Legal Officer, expressed immediate concern over the SEC’s decision, catalyzing the exchange’s swift legal response. Then, on December 18, the US Third District Court of Appeals instructed the SEC to make a decision by January 24, 2024.

In its appeal, Coinbase criticized the SEC’s stance as,

“Arbitrary and capricious, an abuse of discretion, and contrary to law.”

This strong language reflects Coinbase’s position that the SEC’s actions violate the Administrative Procedure Act and fundamental fairness principles.

The SEC’s denial was further scrutinized for lacking “text or the substance of any proposed rule,” challenging the claim that existing regulations are “unworkable.”

Read more: Coinbase Review 2023: The Best Crypto Exchange for Beginners?

Vying for Control

The crypto community echoed this criticism, voicing concerns over the SEC’s discretionary power in regulating the industry.

Gary Gensler, SEC Chair, defended the Commission’s decision, highlighting three key reasons:

- Applicability of existing laws to crypto securities markets

- The SEC’s ongoing rulemaking efforts in this domain

- Importance of maintaining the Commission’s discretion in setting regulatory priorities.

This statement also reflects the SEC’s stance on maintaining regulatory control over crypto securities.

Coinbase’s appeal marks a critical juncture in the ongoing debate over cryptocurrency regulation. The exchange’s push for clarity in a sector marred by legal uncertainties has been a long-standing effort.

Read more: Coinbase Vs Robinhood: Which Is The Best Crypto Platform?

Despite filing a rulemaking petition in July 2022, Coinbase has faced continued stonewalling from the SEC. This has also exemplified the regulator’s slow response and procrastination.

All in all, as digital asset exchanges like Coinbase and Kraken face legal challenges for failing to register as securities brokers, the industry looks towards this appeal as a potential turning point.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.