The defense for Terraform Labs and Do Kwon have submitted new evidence about Jump Trading’s (Jump) role in the collapse of the TerraUSD (UST) stablecoin. The letter, submitted to the Supreme Court of Singapore, offers insight into UST trading on KuCoin during its May 2021 and May 2022 depeg.

The Singapore Supreme Court requested the information after the US Securities and Exchange Commission (SEC) alleged that Terraform Labs misrepresented the ability of its algorithm to restore UST’s peg 2021. The SEC argues the coin’s 2021 depeg was fixed by Jump Trading, a US market maker, which was absent when the coin collapsed in 2022.

Exchange Data Reveals Role of Jump Trading

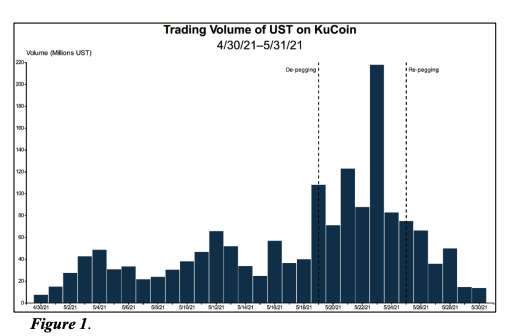

The defense lawyers said that May 2021’s depeg was caused by traders withdrawing USDT from KuCoin into decentralized (DEX) and centralized exchanges (CEX). Commercially available data from KuCoin, the first exchange to list UST, revealed increased selling activity on the day of the depeg.

According to SEC expert Dr. Bruce Mizrach, Jump allegedly made most purchases that helped push UST’s price back up to $1. Lawyers confirmed that Jump Crypto did trade on the day and provided wallet addresses for Jump and its affiliates to understand their trading strategy.

Read more: 10 Best P2P Crypto Exchanges You Need To Know About in 2023

Like the 2021 depeg, UST withdrawals on KuCoin spiked just before UST fell below $1 in May 2022. Traders pulled UST from KuCoin and sent them to other centralized exchanges and DEXes.

Like 2021, KuCoin data again reveals that Jump did trade on the day, though it is not clear the extent to which they traded. Addresses linked with Jump will shed more light on whether its trading played a role in UST’s re-peg in 2021.

If Jump played a diminished role in purchasing UST in 2022, then the SEC could prove that Terraform’s algorithm to keep UST at $1 was flawed.

Regulators Crack Down on Crypto Business Models

The role of Jump Crypto in the health of the Do Kwon’s Terra ecosystem revealed how crypto companies had stretched the bounds of existing regulations to boost their businesses at the height of the bull market. A mixed business model consisting of brokerage, market-making, and settlement was all the rage in 2021 when Bitcoin reached $66,000.

But these conflicting business units united behind a single storefront concerned regulators. A crypto exchange could use its multiple roles to enrich itself at the expense of investors.

Last year’s collapse of crypto exchange group FTX Trading stemmed from the FTX exchange’s deep entanglement with its sister market-maker, Alameda Research. Alameda’s balance sheet comprised FTX’s FTT tokens that Alameda used as collateral to borrow money.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

The collapse of both companies rippled across the entire crypto industry and sapped vital liquidity from global crypto markets.

These shocks hurt investors, prompting the US Securities and Exchange Commission to intensify crackdowns. Coinbase, the largest US crypto exchange, has been accused of operating as an unregistered broker-dealer that violated decades-long securities laws.

Two-tier exchanges that consist of a separate exchange and settlement model found favor for complying with existing exchange rules. But the SEC has warned that non-compliant firms will face charges before it reviews its definitions of an exchange.

Do you have something to say about the SEC probe into Jump Trading’s relationship with TerraUSD, crypto market-makers, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.