The Solana (SOL) price has fallen since the $27 horizontal resistance area rejected it in July.

The readings from the daily timeframe suggest that the decrease is expected to continue in the near future.

Solana Price Trades Below Long-Term Resistance

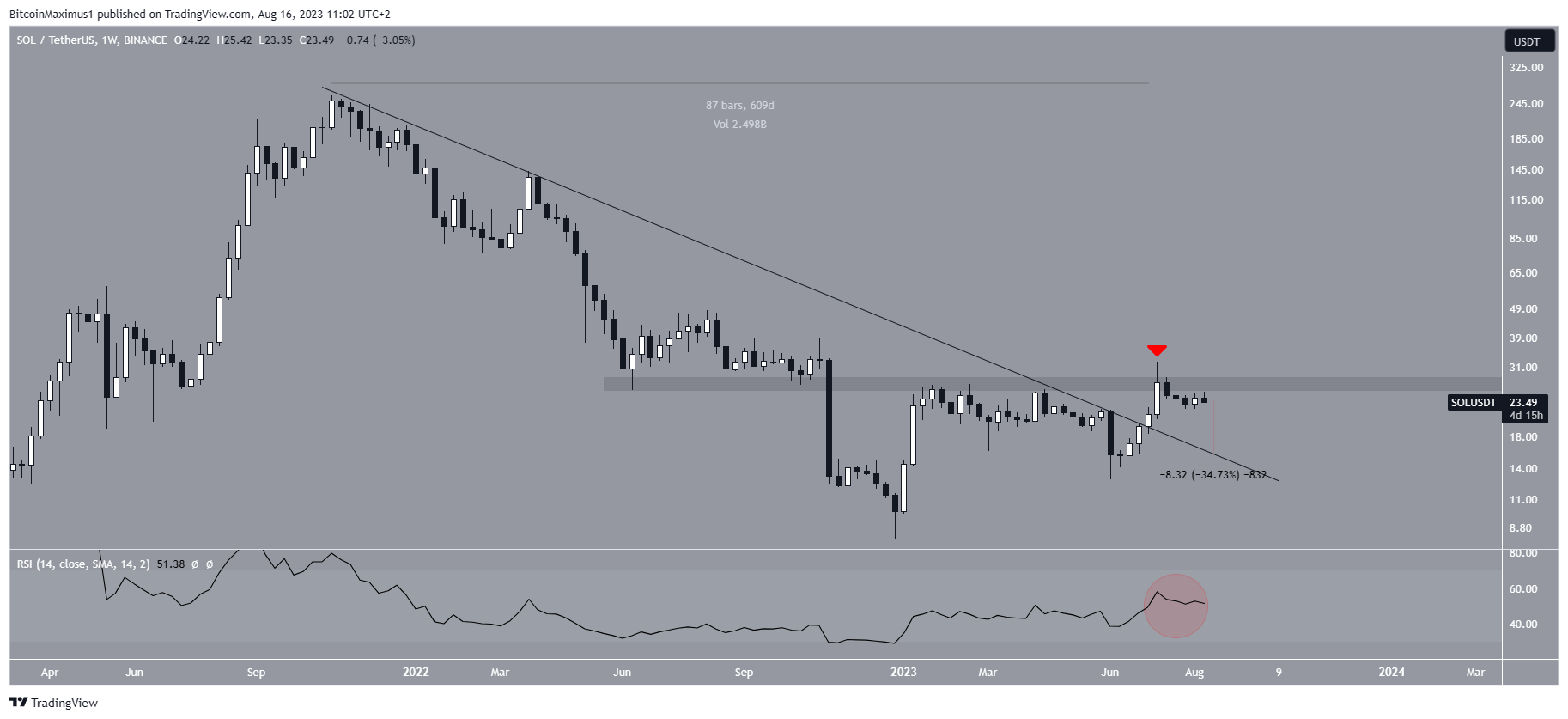

The analysis of SOL’s weekly time frame reveals that the price broke through a descending resistance line in July. The line had been present for 609 days before the breakout.

Despite this breakout, the SOL price could not surpass the $27 horizontal level, creating a long upper wick (red icon). This upper wick confirmed the $27 area as a resistance zone. Therefore, the confirmation of the breakout hinges on the SOL price closing above this particular level.

Looking at the weekly Relative Strength Index (RSI), there is a slight inclination toward a bullish stance. Traders commonly use the RSI as a momentum indicator to gauge whether a market is potentially overbought or oversold, aiding in decisions to accumulate or sell an asset.

An RSI reading above 50 and an upward trend signifies a favorable position for the bulls. Conversely, a reading below 50 implies the opposite.

Although the RSI is presently above 50 (red circle), it has yet to surpass this threshold conclusively. Consequently, there remains a possibility that it might soon dip below this level.

To validate the bullish trend, it is essential for both a definitive rebound in the RSI and a price closure above $27 to occur. On the other hand, the continuing decrease could lead to a 35% drop to the resistance line at $16.

Turning to developments within the Solana Network, there is a mixture of news. Saga Mobile, a part of Solana, has significantly reduced the prices of its web3 smartphone by 40%, aiming to boost adoption.

However, Solana’s Cypher protocol suffered a security breach resulting in a $1 million exploit on Monday. Solana also launched a new application that rewards Artificial Intelligence (AI) data providers with crypto.

SOL Price Prediction: Initial Retracement Expected

Unlike the weekly timeframe technical analysis, which is neutral, the daily trend is bearish. The main reason for this is the deviation above the $27 resistance area, the creation of a long upper wick (white circle), and the subsequent decline below it.

Moreover, the price created a lower high below the resistance line on August 14 (red icon). Both the lower high and the fact that the price did not reach the $27 area are considered signs of weakness.

Finally, the daily RSI has fallen below 50 and is decreasing (red circle). On the weekly timeframe is neutral, and the daily trend is leaning bearish.

If the decrease continues, the SOL price can fall by another 33% and reach an ascending support line at $15.40.

Despite this bearish SOL price prediction, closing above the $27 area will mean that the trend is still bullish. In that case, a 96% increase to the next resistance at $46 will likely be the future price scenario.

Check Out the Top 11 Crypto Communities To Join in 2023

For BeInCrypto’s latest crypto market analysis, click here