Solana’s Cypher Protocol froze its smart contract after losing a suspected $1,035,203 to an exploit on Monday.

The project’s team said it is open to discussing a way forward with the hacker via email or session chat.

Suspected Cypher Hacker Stole $1 Million in SOL and USDC

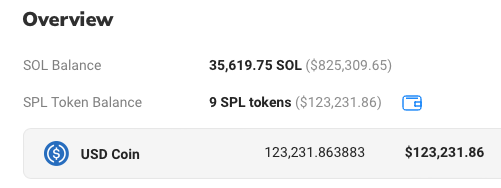

According to Solscan, the suspected attacker stole 38,530 Solana (SOL) and $123,184 in USDC from the decentralized exchange. Later, they sent 30,000 USDC to a wallet on Binance in what could have been an attempt to cash out their money.

Cypher froze its smart contract following the attack and reached out to the alleged hacker on social media. The offending wallet received several NFT messages requesting a return of the funds.

So far, the suspected hacker has not responded. At press time, their wallet contained roughly 35,600 SOL and 123,231 USDC.

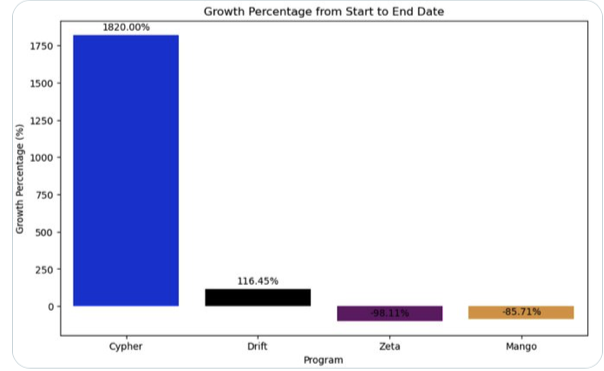

Cypher is the largest decentralized futures exchange on Solana, with an 1,820% growth in users reported on Aug. 1. The market share of its closest competitor grew by roughly 116.45% between early February and August.

Since the exploit, the total value locked on Cypher has fallen over 50% from $1.2 million to under $510,000.

Decentralized Exchanges Play a Vital Role in DeFi Ecosystems

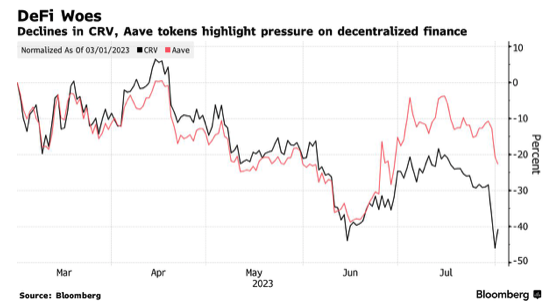

Decentralized exchanges contribute liquidity essential for participating in on-chain lending and borrowing. Last week, DeFi participants suffered a liquidity shortfall after a hacker stole $50 million from three asset pools on Curve Finance. Curve is the second-largest decentralized exchange on Ethereum after Uniswap.

Interested in learning more about decentralized finance on Ethereum and Solana? Read more here.

The hack tanked Curve’s native CRV token by 40% and shook confidence in decentralized finance. Later, the exchange paused loan issuances to protect liquidity.

Research firm Kaiko said large investors mainly used Curve since the sizes of individual traders have not fallen below $200,000 since 2021. Following the attack, billionaire entrepreneur Justin Sun confirmed he purchased five million CRV tokens.

Got something to say about the $1 million exploit of Solana DEX Cypher or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.