After reaching its yearly high of $32.13 on July 14, the price of Solana (SOL) has declined. This decline confirmed the $27 horizontal area as a resistance level.

The conflicting outlooks from the weekly and daily time frames have made it challenging to determine the trend’s direction. As it stands, the weekly trend is bullish while the short-term one is bearish.

SponsoredSolana Price Trades Below Long-Term Resistance

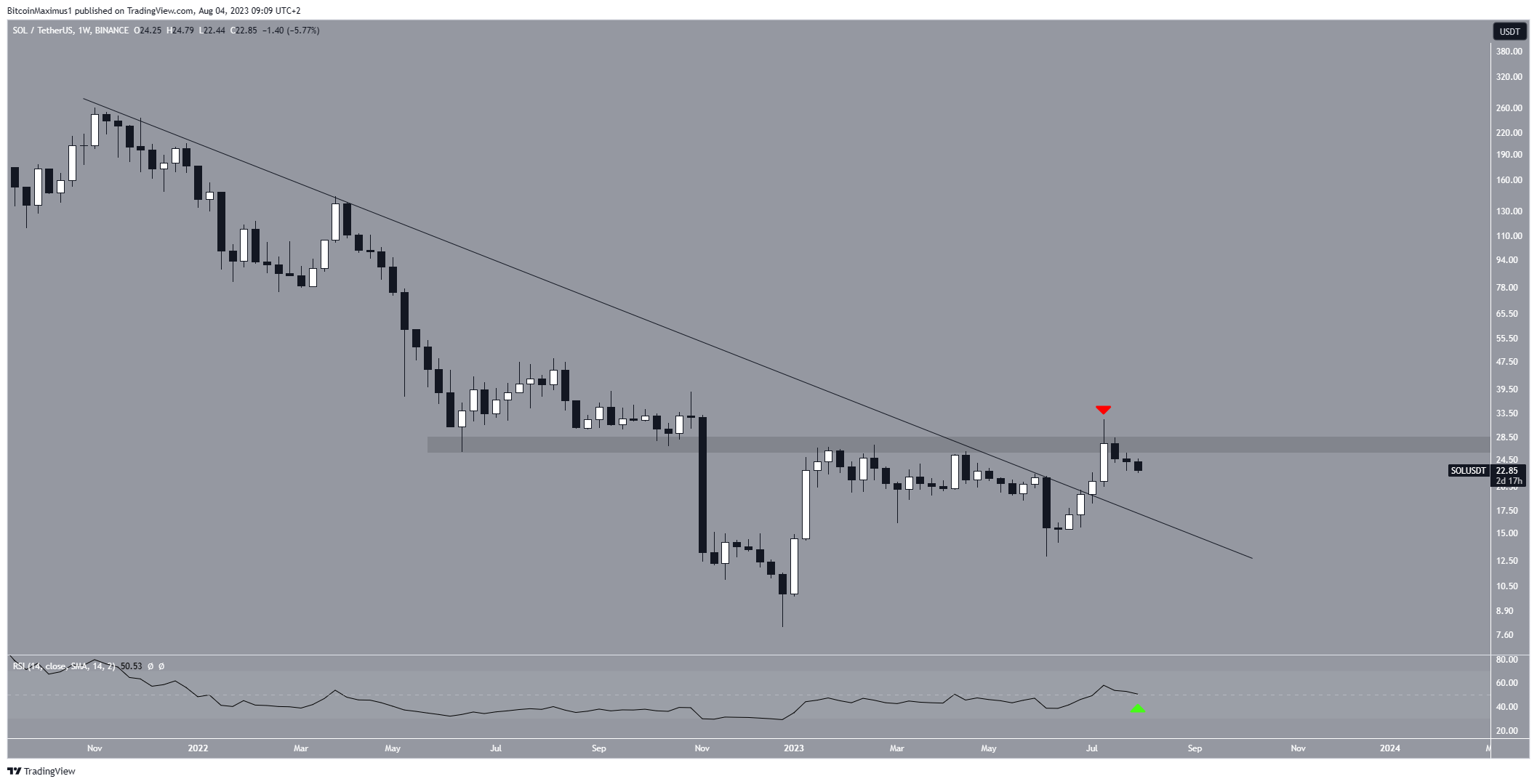

The analysis of SOL’s weekly time frame price movement reveals a significant breakout from a resistance line that had been active for over 600 days. Such breakouts often signal the end of the previous trend and the beginning of a new bullish trend.

This suggests that SOL’s price may have initiated a bullish trend reversal, and there is a likelihood of it gradually rising towards its previous highs.

Crypto investing, simplified. Get price predictions here:

However, SOL encountered strong resistance at the $27 level, leading to the formation of a long upper wick, indicating selling pressure. Consequently, the price has now declined for consecutive weeks and is trading below the $27 area.

To validate the breakout’s legitimacy, traders often refer to the Relative Strength Index (RSI) on the weekly timeframe. The RSI is a tool used to assess market momentum and identify potential overbought or oversold conditions.

Currently, the RSI has shown a higher low and is positioned above 50. Last week’s close above 50 marks the first occurrence of this since the end of 2021.

However, for a confirmed bullish trend reversal, it is crucial for SOL’s price to convincingly break out from the $27 horizontal area. Also, the RSI has to hold above the 50 line for the breakout to remain legitimate.

SponsoredSOL Price Prediction: Is Deviation Start of the Decrease?

While the weekly timeframe technical analysis is bullish, the daily trend shows bearish signs, creating indecision between the different timeframes.

The main reason for the bearishness is the deviation and decrease below the $27 resistance area (red circle). This is considered a bearish sign and usually leads to a significant decrease.

After the deviation, SOL fell to a low of $22.48 and is current trading near this level.

The daily RSI is also turning bearish, since it has fallen over the past two weeks and just moved below 50 (red icon). Movements below this line are considered signs of a bearish trend.

SponsoredIf the decrease continues, there is support at an ascending support line which is currently at $17. Measuring from the current price, this would be a decrease of 27%.

However, if the SOL price manages to bounce, it can reach the $27 area again and possibly validate it as resistance.

Read More: Top 11 Crypto Communities To Join in 2023

For BeInCrypto’s latest crypto market analysis, click here