The Solana (SOL) price has been on a tear since June 10. This led to a new yearly high of $32.13 and caused a breakout from a long-term descending resistance line.

However, the short-term price action casts some doubt on the possibility of a long-term bullish trend reversal. This is due to a deviation above a horizontal resistance level.

Solana Price Breaks out but Cannot Sustain Increase

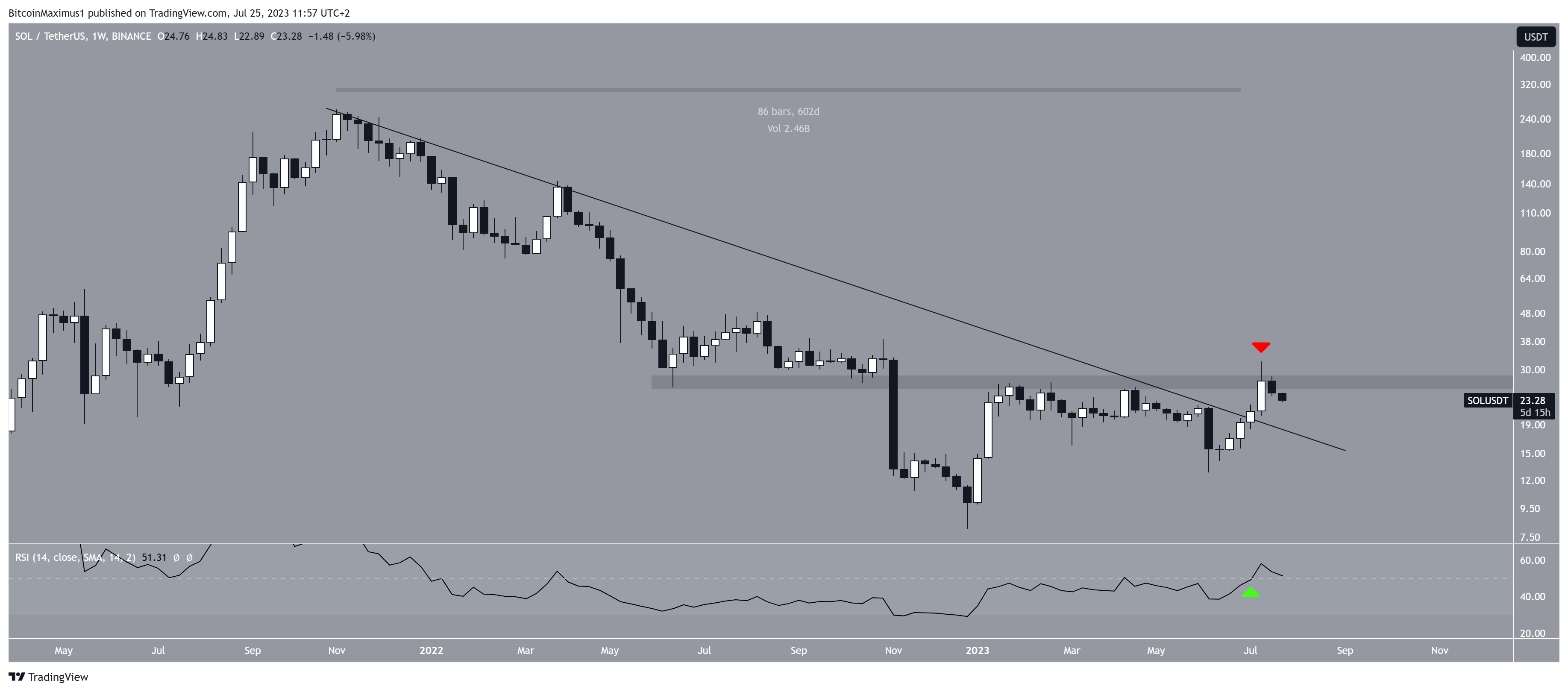

An analysis of SOL’s weekly time frame reveals a significant event that took place three weeks ago. During this occurrence, SOL surpassed a downward resistance line that had been active since November 2021, spanning over 600 days.

Such breakouts often signal the end of the previous trend and mark the start of a new trend in the opposite direction. Consequently, it appears likely that SOL’s price has now initiated a bullish trend reversal.

Read More: Solana (SOL) Price Prediction for 2022

This idea gains further support from the presence of four bullish candlesticks observed since the lows in June.

However, it’s worth noting that the SOL price couldn’t close above the $27 horizontal area, resulting in a long upper wick (red icon), which indicates selling pressure.

The breakout’s legitimacy is backed by the weekly Relative Strength Index (RSI), a tool frequently used by traders to assess market momentum and identify whether an asset is overbought or oversold, which affects their buying or selling decisions.

Significantly, the RSI has shown a higher low and is presently positioned above 50. Last week’s close above 50 marked the first instance of this occurrence since the end of 2021.

Nevertheless, a breakout from the $27 horizontal area will be crucial in order to confirm the possibility of a bullish trend reversal.

SOL Price Prediction: Is Deviation a Worrisome Sign?

Nevertheless, while the weekly technical analysis is leaning bullish, the daily one is still undetermined. The main reason for this is the deviation above the $27 resistance area and subsequent fall below it (red circle). Such deviations are considered bearish and often lead to a significant movement in the other direction.

Additionally, the daily RSI is at risk of falling below 50. When combined with the deviation, this would confirm that the trend is bearish if it were to occur.

In that case, the SOL price would likely fall to $18, reaching an ascending support line that has been in place since December 2022.

Therefore, while the long-term Solana price prediction is bullish, the short-term one is bearish as long as the price trades below the $27 horizontal area.

Reclaiming the latter can lead to an increase towards $35, while failure to do so will likely result in a drop to the ascending support line at $18.

For BeInCrypto’s latest crypto market analysis, click here