Solana is experiencing robust growth amid the ongoing bull market run that has spread through the crypto industry.

Indeed, Solana’s SOL token has emerged as one of the best performers, rising by around 30% during the past month to around $190.

Solana’s DeFi Soars to All-Time High

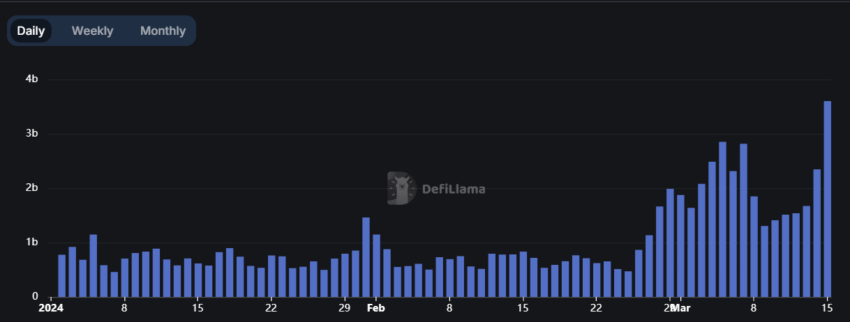

Solana’s decentralized finance (DeFi) ecosystem has flourished with the broader crypto market rally since the year’s outset. Data from DeFiLlama illustrates this trend, revealing an extraordinary surge in Solana-based decentralized exchange (DEX) activity.

Over the past 24 hours alone, daily transaction volume has surpassed an impressive $3.6 billion, establishing a new all-time high.

This remarkable upswing in Solana DEX transactions can be primarily attributed to two key factors. One is the network’s commendably low transaction fees, and the second is the rising popularity of meme coins. Noteworthy meme coins like Wen, Dogwifhat, Bonk, and Book of Meme (BOME) have recently witnessed substantial trading volumes and interest.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

Interestingly, the collective impact of these factors has propelled Solana’s DEX trading volume beyond that of Ethereum on numerous occasions in recent months.

“Solana is insanely congested right now and still broke a record in all-time DEX volume stoked to see what we can achieve once the network is functioning better,” Mert Mumtaz, the CEO of Helius Labs chimed.

Of particular interest are the top three frontrunners among Solana’s DEX platforms. Orca leads with $1.64 billion in trading volume over the past 24-hour period, followed by Raydium at $867 million and Lifinity at $679 million.

Meanwhile, the total value of assets locked on the Solana network is also at a two-year high of almost $4 billion. DeFi analyst Patrick Scott pointed out an interesting fact. Solana DeFi TVL, including liquid staking, flipped the Binance Smart Chain (BSC) for the first time during the past day.

“In 2023, Solana DeFi was declared dead. Since then, its TVL is up 18x. And yesterday, Solana just flipped Ethereum in daily stablecoin transfer volume. That’s quite a turnaround,” prominent crypto influencer Lark Davis stated.

In addition, the network has seen a notable increase in the creation of new Solana Public Library (SPL) tokens. Over the past week, an average of over 7,800 SPL tokens were minted daily on the Solana network. On March 11, this figure peaked at 9,690 tokens, setting a new single-day record, according to Solscan data.

Read more: 6 Best Platforms To Buy Solana (SOL) in 2024

All these milestones reflect Solana’s ascending trajectory within the DeFi ecosystem. This positions it as a formidable contender against Ethereum’s enduring sector dominance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.