Although Ripple (XRP) price may not have been among the best-performing cryptocurrencies this quarter, it is still in an uptrend.

This uptrend, however, may halt for a while as the shaking conviction among XRP holders could cause a price dip.

Are Ripple Investors Skeptical?

XRP price, like any other token in the crypto market, tends to be heavily impacted by the actions of its long-term holders (LTH). Their accumulation tends to drive the price up, whereas selling causes deep drawdowns.

In the case of the Ripple native token, these long-term investors have a pattern of moving their assets monthly, which has been priced at this point. However, recently, the age consumed metric, which multiplies the total volume moved with the time since it was last moved, has shown spikes in the last few days.

These spikes, being out of the pattern, suggest that XRP LTHs are moving their holdings around during uncertain market conditions. This could be their attempt to sell their holdings to secure profits or offset losses.

Regardless, the altcoin could face a bearish impact on this development.

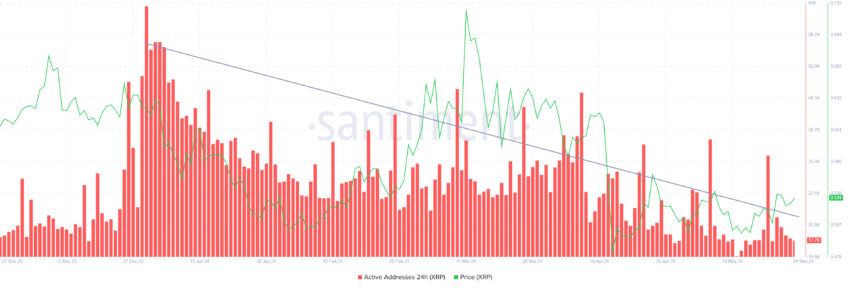

Furthermore, XRP holders’ total participation has also come down considerably. The total number of investors conducting a transaction on the network started declining in December 2023.

This decline has continued to date, which is a negative sign for the cryptocurrency.

Read More: How To Buy XRP and Everything You Need To Know

The decline in active addresses shows that participation is down, which is a bearish development for the XRP price.

XRP Price Prediction: Fall Back to Key Support

XRP price trading at $0.53, managed to secure the 23.6% Fibonacci Retracement level as support. This level is also known as the bear market support floor and staying above it during bearish market conditions prevents excessive drawdowns.

This level marked at $0.51 is the likely target for the altcoin. The aforementioned factors, should they initiate a decline, could bring XRP price down to this price point. Losing it would also mean losing the support of the uptrend line sending the altcoin to $0.50 or lower.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

However, if the broader market cues remain in favor of gradual uptrend, XRP price could prevent a drawdown and continue rising. As a result the bearish thesis would be invalidated and the altcoin could rise to $0.56.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.