Coinbase has announced that New York users can trade XRP again, a significant development for the cryptocurrency community.

This move follows a long suspension since January 2021 due to regulatory issues.

Resumption of XRP Trading on Coinbase in New York

On January 19, 2021, Coinbase stopped the token trading because the US SEC filed a lawsuit against Ripple Labs. The SEC claimed Ripple sold unregistered securities worth $1.38 billion through the token sales. This caused widespread token suspensions and delistings in the US, including on Coinbase.

The initial suspension significantly impacted its market presence. Users couldn’t trade or convert their XRP to fiat currency but could still deposit, store, and transfer the token. Coinbase took this step to mitigate legal risks from the SEC’s lawsuit against Ripple.

Paul Grewal, Coinbase’s Chief Legal Officer, shared the news on social media.

“XRP trading on @coinbase is available again in NY. We heard you and put in the work in strong partnership with the State. And now the word can be put out— we are back up,” he said.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

Customers can now log in to their Coinbase accounts to buy, sell, convert, send, receive, or store the token via the Coinbase website and its iOS and Android applications.

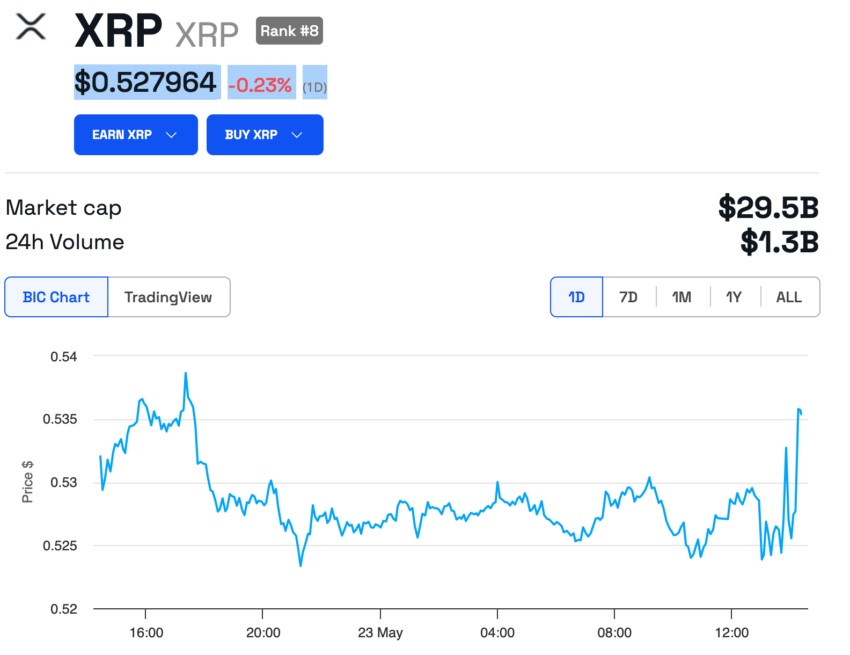

Following the news of Coinbase reinstating XRP trading for New York users, the price of the token has remained relatively stable. As of now, XRP is priced at $0.527964, showing a minor decrease of 0.23% in the past 24 hours.

Despite the positive news, XRP’s future fate is in doubt. The legal battles have created uncertainty around the project, so Ripple now faces the challenge of restoring its image to shine again.

“Even though Ripple has scored some notable wins in their legal battle against the SEC, the battle itself has marred the project in insecurity and cost XRP precious time and market share. There’s a pretty good chance we’ll have total regulatory clarity pretty soon, but by now they have a lot of ground to cover and a tarnished image that will need to be rigorously polished if they’re to compete in today’s institutionally focused crypto landscape,” Mati Greenspan, founder & CEO of Quantum Economics, told BeInCrypto.

Read more: Everything You Need To Know About Ripple vs SEC

The recent passage of the FIT21 bill also poses a serious threat to Ripple: the document defines decentralization as no single entity controlling the blockchain and no related parties holding more than 20% of the cryptocurrency or voting power.

Ripple, meanwhile, holds 46.5% of the 100 billion the token supply, with 5,258,162,324 XRP currently in their possession. Additionally, 41.3 billion XRP, currently locked, will be subject to escrow. In this way, the story of the confrontation between the company and US regulators may take a new unexpected turn.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.