The XRP Ledger (XRPL), a decentralized public blockchain supporting the XRP cryptocurrency, has achieved a significant milestone, surpassing 88 million ledgers.

This achievement highlights the platform’s continuous growth and success in the cryptocurrency market.

XRP Ledger Achieves 88 Million Ledgers Milestone

In the XRP Ledger ecosystem, the term “ledger” has a unique meaning. Unlike a personal financial ledger, the XRP Ledger is a decentralized, digital record of all XRP transactions. When a user sends XRP to someone, the validators confirm and validate the transaction. This agreement occurs every few seconds in what are known as “ledgers.”

XRP Ledger Services shows a ledger count of 88,165,021, with 5,199,695 accounts. These accounts, excluding a few in 2022 with zero balances, hold 60,278,958,763 XRP.

Ripple’s Q1 2024 XRP Markets Report reveals significant developments. Blockchain recorded 251.39 million on-chain transactions, a 108% increase from Q4 2023. Additionally, the average transaction cost dropped by 45% to $0.000856.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

However, all these achievements had almost no effect on XRP price. Unlike many altcoins that have achieved new all-time highs in 2024, the token’s dynamics remain modest.

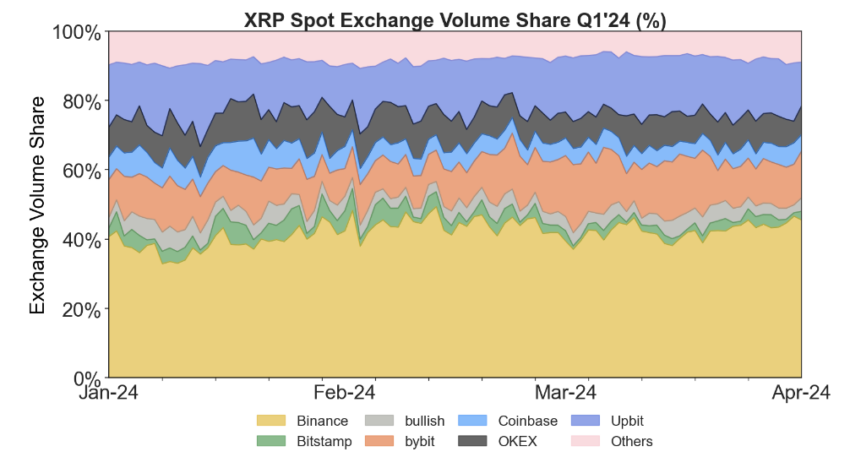

Trading volume remained steady across major cryptocurrency exchanges, with Binance, Bybit, and Upbit handling over 70% of the total volume. The volume traded via fiat pairs dropped from 15% in Q4 to 11% in Q1. Most XRP trading now occurs against USDT.

The continuing legal dispute between Ripple and the United States Securities and Exchange Commission (SEC) remains a critical challenge for both the company and XRP holders. On March 22, the SEC filed a request in court seeking roughly $2 billion in remedies against Ripple for institutional XRP sales. Ripple responded on April 22, arguing that a penalty of no more than $10 million was justified in this case.

The company argues that the law doesn’t permit the SEC to require disgorgement or interest without proving harm, showcasing resilience and determination in the legal battle.

“Ripple remains confident that the Judge will approach the remedies phase fairly,” Ripple noted.

Read more: Everything You Need To Know About Ripple vs SEC

Yesterday, the FIT21 bill passed, raising questions about XRP’s future. Ripple holds 46.5% of the 100 billion XRP supply, with 5,258,162,324 XRP currently in their possession. Additionally, 41.3 billion XRP, currently locked, will be subject to escrow. The bill defines decentralization as no single entity controlling the blockchain and no related parties holding more than 20% of the cryptocurrency or voting power. The law clarifies that crypto is regulated by both the Commodity Futures Trading Commission (CFTC) and the SEC, which might impact the ongoing lawsuits.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.