Ripple Labs has firmly opposed the U.S. Securities and Exchange Commission’s (SEC) hefty penalty proposal, with a filing that could set a precedent for the cryptocurrency industry.

The blockchain giant has contended the near $2 billion fine over its sales of the XRP Ledger’s native token, arguing for a significantly lower sum and highlighting the broader implications for the sector.

Ripple Responds to SEC: Argues $1.95 Billion Fine Is Excessive

In a recent legal filing, Ripple pushes back against the SEC’s call for a $1.95 billion combination of disgorgement and civil penalties. This comes after a pivotal court ruling found that Ripple had violated federal securities laws through institutional sales of XRP. However, it sided with Ripple by dropping exchange and algorithmic sales allegations.

Ripple’s stance is resolute: the SEC’s ask is not only disproportionate but also reflects an overreach, given the absence of any allegations or findings of reckless conduct or fraud in the case. Ripple’s lawyers argue that the remedies sought by the SEC disregard the actual outcomes and precedents set by the Supreme Court and Circuit courts.

“We remain confident that the Judge will approach this final remedies phase fairly.” Chief Legal Officer of Ripple, Stuart Alderoty concluded.

With a proposed penalty cap of $10 million, Ripple contrasts the SEC’s unprecedented penalty demand, which is more than 20 times higher than any similar case. Ripple’s filing brings to light its financial activities, including institutional sales revenue, tax contributions, and losses, countering the notion that the company profited unjustifiably.

Read More: Everything You Need To Know About Ripple vs SEC

The case’s outcome remains balanced, with Ripple expressing confidence in a fair judicial resolution. Furthermore, the company’s statement underscores a commitment to due process and a fair consideration of the facts as the industry closely watches for ripple effects that may redefine digital asset regulations in the United States.

XRP Price Consolidates – Could See More Upside Next

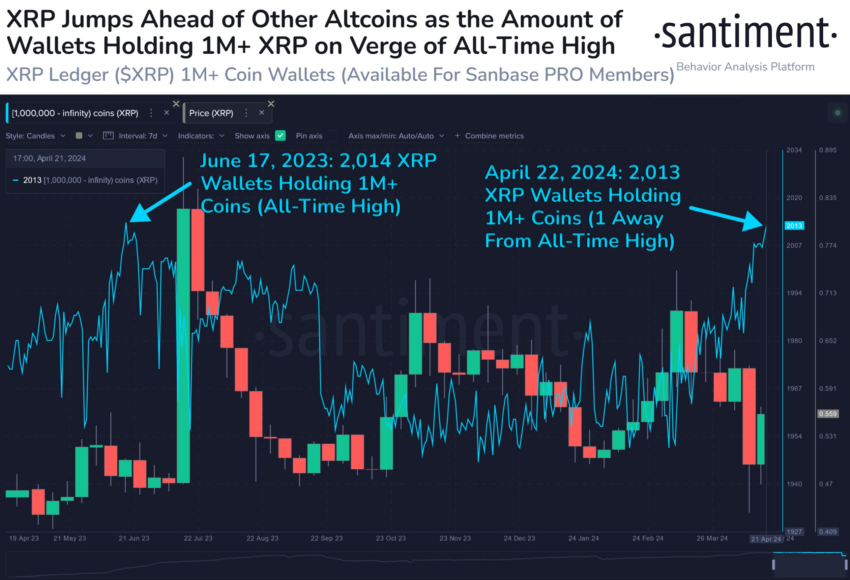

In a dynamic shift, XRP’s price has seen steady growth this week, outpacing the altcoin market with a notable 6% leap, reaching a peak of $0.56. The uptrend coincides with a surge in the number of wallets holding a minimum of 1 million XRP, which has increased by 3.1% over the last six weeks. This growth positions the wallet count just one shy of the all-time high.

Investor confidence in XRP appears to be strengthening as the digital asset reclaims crucial resistance points. Hence, this positive market movement reflects an active and growing user base, hinting at an optimistic outlook for the cryptocurrency’s future performance.

Additionally, on the weekly chart, XRP is consolidating at key support. According to trader Anbessa, the chart is looking bullish.

“This small range is still 8 months potential consolidation, although I think it will happen much sooner.” Anbessa states.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

However, the trader notes that XRP will have its time to shine, and there is likely still time to enter before the price shifts upwards.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.