Ripple’s (XRP) price is likely exhausting the pessimistic sentiment noted in the past few days.

In the future, XRP holders will mostly opt to hold on to their assets or attempt to initiate a buying spree to prevent a bearish outcome.

Ripple Investors Exhibit Patience

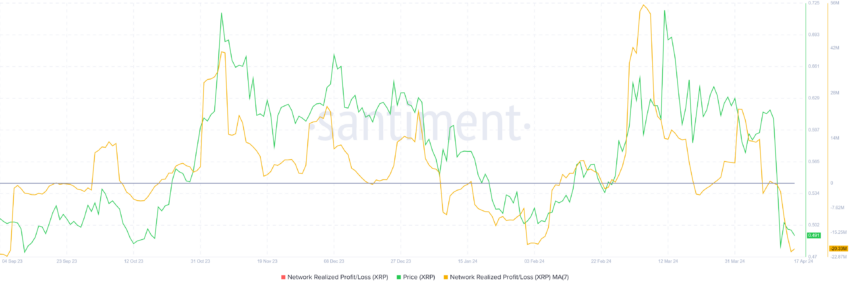

XRP price taking a turn for the worse was expected, given it was following a bearish pattern. However, investors have shown resilience by opting not to sell their holdings. The network realized profit/loss indicator shows that the investors are largely witnessing losses following the price decline.

Such instances are usually followed by accumulation or HOLDing. This is because the extent of losses is such that investors prefer to refrain from participating in the network over increasing their losses.

Read More: Everything You Need To Know About Ripple vs SEC

This resilience is further substantiated by the Mean Coin Age (MCA) indicator. This indicator represents the average age of all coins in a cryptocurrency network. It provides insight into the network’s activity level and potential for market movements.

The incline in this indicator is a sign of investors HOLDing their assets, while the decline hints at XRP moving among addresses, i.e., potential selling. This resilience will drive investors to act bullishly, pushing the price back up.

XRP Price Prediction: Defeating the Bears

XRP price drawdown was part of the descending triangle pattern’s bearish outcome. A 25% correction was likely per the pattern, which would have sent the Ripple token to $0.42. However, the altcoin halted its decline at $0.47.

Trading at $0.48 at the time of writing, the altcoin now stands 13% above the anticipated bearish target. On the other hand, the XRP price is only 13% away from reclaiming the crucial support of $0.60.

Considering the above factors, the likely outcome is bullish, with XRP price rising by 13%, which would help it reclaim $0.60, potentially pushing it further.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

However, if the support of $0.47 is lost, the 13% decline would be registered, invalidating the bullish thesis and validating the descending triangle.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.