The Perpetual Protocol (PERP) price is halfway on its increase toward its range high, which began after a breakout from a diagonal resistance line.

The weekly and daily timeframe readings support the continuing of the increase, suggesting that the price will eventually reach the range high.

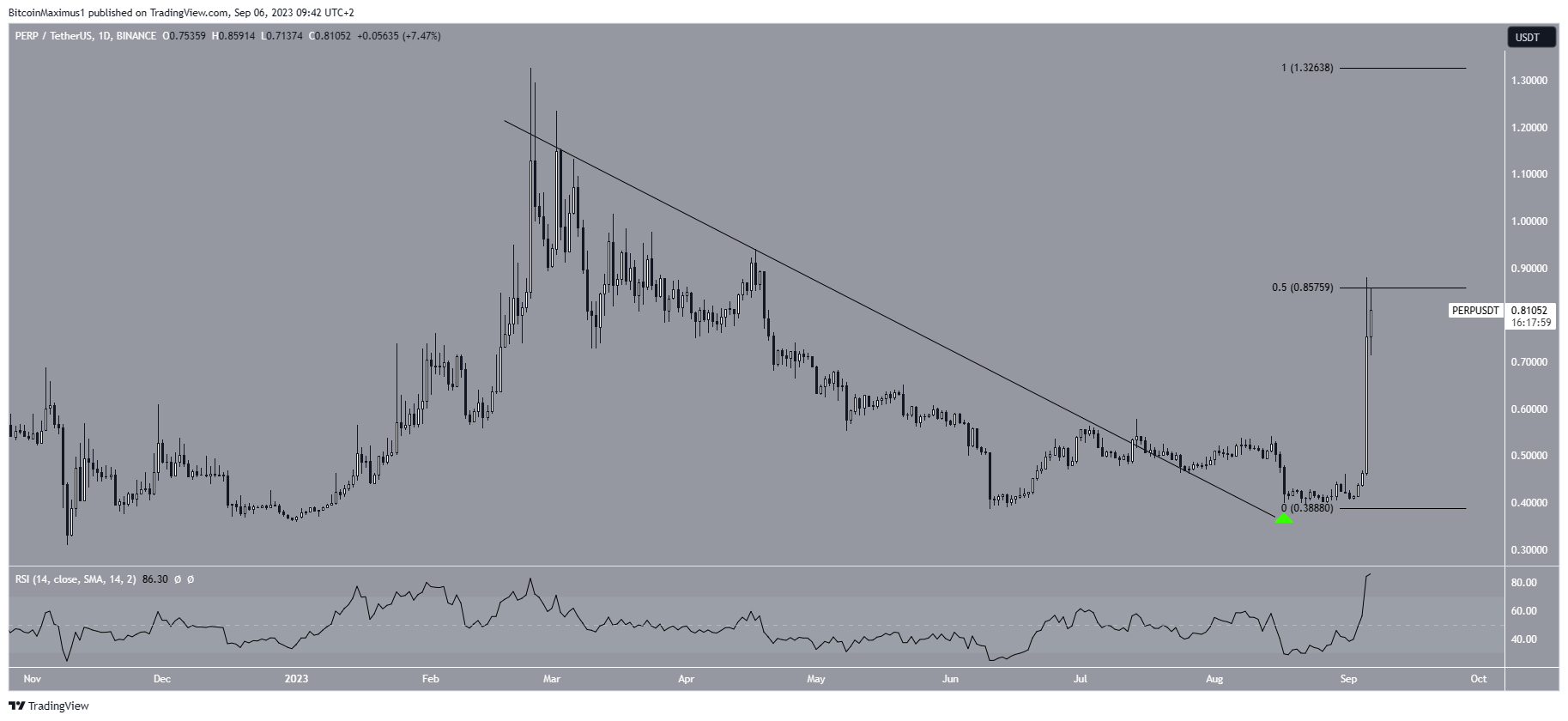

Perpetual Protocol Price Bounces at Range Low

The PERP price has traded in a range between $0.40 and $1.15 since May 2022. During this time, the range’s top and bottom have been validated numerous times.

Since November 2022, PERP has also followed an ascending support line. The line has been validated four times, creating a higher low each time. After the final bounce, PERP increased significantly. So far this week, the price has moved upwards by 80%.

The weekly RSI supports the continuation of the increase. Traders utilize the RSI as a momentum indicator to assess whether a market is overbought or oversold and to determine whether to accumulate or sell an asset. Bulls still have an advantage if the RSI reading is above 50 and the trend is upward.

The opposite is true if the reading is below 50. The indicator is above 50 and increasing (green circle), both signs of a bullish trend.

If the increase continues, the range high of $1.15 will be 45% above the current price. On the other hand, a decrease to the ascending support line at $0.42 will amount to a drop of 48%.

Read More: 9 Best Crypto Demo Accounts For Trading

PERP Breaks out but Struggles at Resistance

The daily timeframe technical analysis shows that the PERP price broke out from a descending resistance line in the beginning of March. After breaking out, the price validated the line as support (green icon) and accelerated its increase.

The increase is also supported by the daily RSI, which moved above 50 while the price accelerated its increase. This is a sign associated with bullish trends.

The PERP price is currently attempting to move above the 0.5 Fib retracement resistance level at $0.86. According to the Fibonacci retracement levels theory, following a significant price change in one direction, the price is expected to partially return to a previous price level before continuing in the same direction. The 0.5 Fib level often acts as the top during corrective movements. Therefore, whether the price breaks out above this level or gets rejected will determine the future trend.

The weekly and daily timeframe readings support the possibility of a breakout. In that case, PERP can increase towards the range high of $1.15.

Despite this bullish PERP price prediction, failure to reclaim the 0.5 Fib retracement resistance level will likely stunt the rate of increase. In that case, the PERP price can fall back to the long-term ascending support line, a drop of 48% measured from the current price.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.