MoneyGram, a global payments platform, is set to launch a non-custodial wallet, enabling users to seamlessly swap between fiat currency and USDC, a stablecoin tied to the US dollar.

The wallet will be powered by the Stellar blockchain and signifies MoneyGram’s continued efforts to integrate crypto into its services. With greater adoption, these kinds of services could redefine how money moves between fiat currencies.

MoneyGram Rolling Out USDC Stablecoin Services

MoneyGram’s CEO, Alex Holmes, emphasized the potential of this wallet to address the challenges faced by cross-border payments. Slow processing times and high fees are two of the biggest roadblocks to contend with. Amid these challenges, the real-time settlement capabilities of crypto present a viable solution.

However, crypto adoption has been hindered by scalability issues, high transaction fees, and regulatory uncertainty.

Despite these hurdles, MoneyGram’s new wallet offers a solution. Users can deposit cash and hold it in USDC, thereby hedging against exchange rate fluctuations and inflation before deciding when to transfer it into a different currency.

Read more: What Is a Stablecoin? A Beginner’s Guide

This feature addresses the limitations of global banking, where users cannot hold funds between transfers.

Holmes acknowledges the supremacy of cash but sees value in utilizing blockchain technology to facilitate global fund transfers. He stated,

“We’re turning MoneyGram into a global ATM concept using blockchain.”

The wallet, while adhering to “know-your-customer” requirements, will only be compatible with other MoneyGram wallets, a move aimed at shielding the company from regulatory scrutiny.

Remittances a Strong Crypto Use Case

While the US dollar dominates the global stablecoin market, the rise of native stablecoins in Latin America offers new opportunities for cross-border remittances.

In countries like Argentina and Venezuela, where inflation rates are high, dollar-backed digital assets provide a means of hedging against inflation.

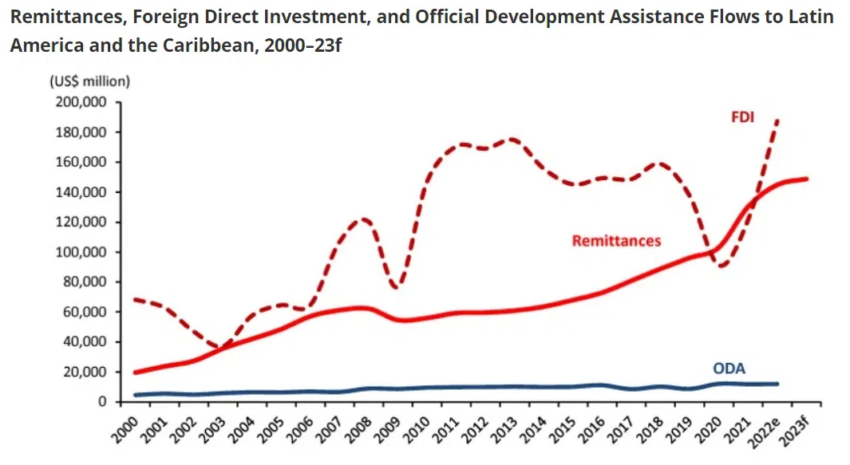

According to the World Bank, remittance flows into Latin America and the Caribbean reached $145 billion in 2022. This highlights the massive potential of these technologies for cross-border remittances.

However, the market for indigenous Latin American stablecoins is still emerging. Companies such as Num Finance and Anclap are developing stablecoins pegged to South American currencies. Their goal is to transform how people move money across borders.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.