Uphold is a long-standing trading platform supporting both crypto and traditional assets. But how does it stack up against its competitors? This comprehensive Uphold review examines the platform’s performance across a number of key parameters. Here’s what you need to know.

Uphold

- Uphold

- Uphold at a glance: Our overall review

- What is Uphold?

- What can I trade on Uphold?

- Where is Uphold available?

- How to sign up for Uphold in 2024

- Welcome offer/bonus

- Deposit and withdrawals

- How does Uphold compare to others?

- Features and tools from Uphold

- Staking on Uphold

- Security and payment processing

- Customer support

- How we have tested Uphold

- Regulatory compliance and safety

- Invest responsibly

- Conveniently rebalance your portfolio

Uphold at a glance: Our overall review

Our Uphold review finds the platform to be a highly transparent, easy-to-operate exchange. Here’s how the review does across a number of parameters:

| Criteria | Assets | Fees | Customer experience | Products | Security | BeInCrypto score |

|---|---|---|---|---|---|---|

| Score | 5/5 | 3/5 | 4/5 | 4/5 | 4/5 | 4 |

What is Uphold?

Uphold is a multi-asset digital trading platform for global users. In other words, you can trade multiple asset types, including crypto, fiat currencies, and precious metals.

Uphold operates in over 184 countries, facilitating seamless foreign exchange and cross-border remittance services for its global members. It supports a vast array of over 200 currencies, both fiat and cryptocurrencies, as well as precious metals.

Uphold has been in operation since 2015 and has facilitated transactions exceeding $4 billion in value. Halsey Minor, founder of CNET and an early supporter of salesforce.com, founded Bitreserve in 2013.

In 2015, the company rebranded to Uphold, with Anthony Watson, former Nike CIO, assuming the role of CEO.

What can I trade on Uphold?

As already touched upon, Uphold gives you access to an assortment of assets. This includes cryptocurrencies (stablecoins included), fiat currencies, and precious metals.

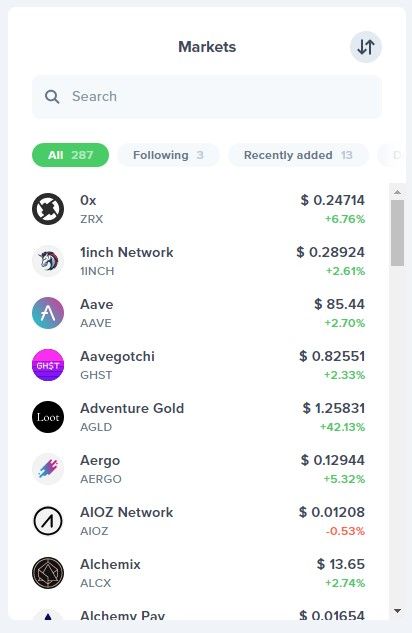

Crypto trading on Uphold

Uphold allows you to trade more than 250 cryptocurrencies on the platform. Some of these include bitcoin, ethereum, XRP, and several others.

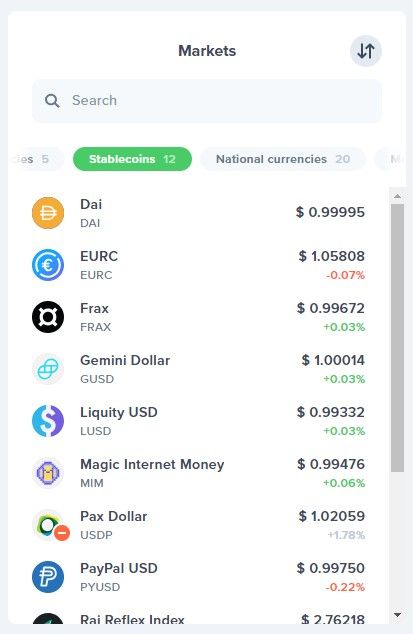

You also have the luxury of trading at least 12 stablecoins. Another notable aspect of Uphold’s selection of stablecoins is that some are not pegged to the dollar but to other currencies like the Euro.

Fiat currency trading on Uphold

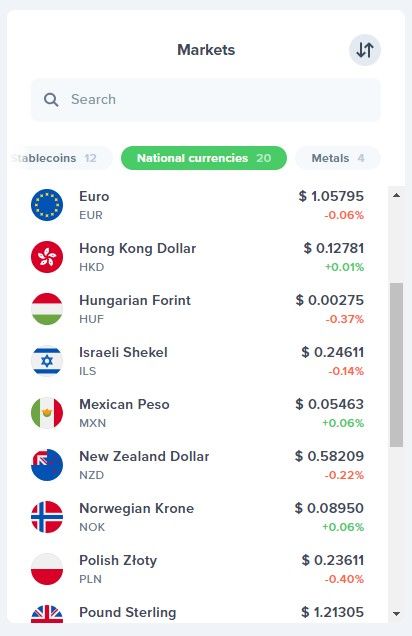

One of the standout offerings of the Uphold platform is its fiat currency selection. On the platform, you can choose between 20 different fiat currencies. Some of these include the Euro, British Pound, United States Dollar, Canadian Dollar, and more.

Fiat currencies are particularly useful for remittances and cross-border payments. For some background, it can be rather difficult for some people to gain access to other nation’s currencies. Uphold’s selection makes foreign currency swaps much easier.

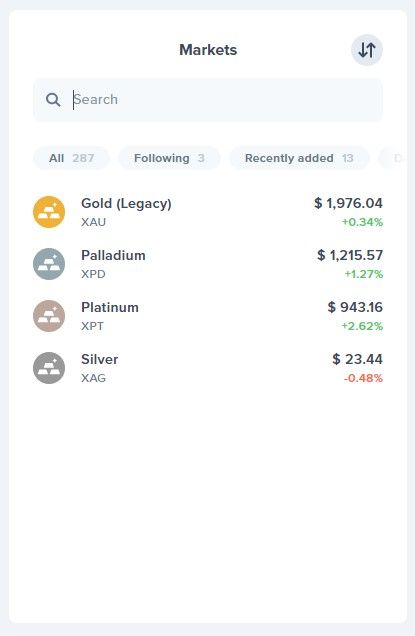

Precious metals trading on Uphold

Lastly, you can also trade precious metals on Uphold. Precious metals are naturally occurring elements that have high economic value. They are considered a store of value because they have a consistent demand, particularly for industrial or tech uses.

On Uphold, you have four options of precious metals: gold, silver, platinum, and palladium.

Where is Uphold available?

Uphold is available in the U.S. (except New York and the U.S. Virgin Islands) and most parts of Europe. You can also Uphold in other parts of the world; however, there are many restricted nations. Refer to the official website for an extensive list.

How to sign up for Uphold in 2024

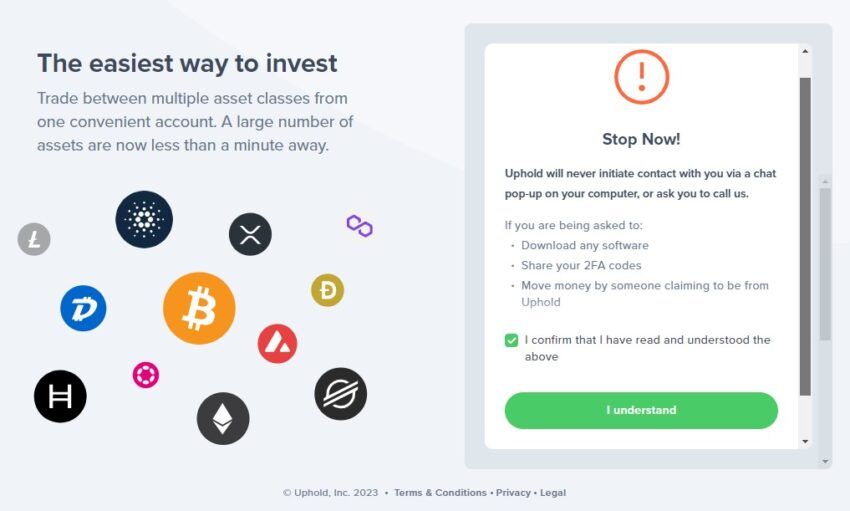

1. Firstly, go to Uphold‘s official website and select “Sign Up.” On the following page, confirm that you have read and understood the provided information.

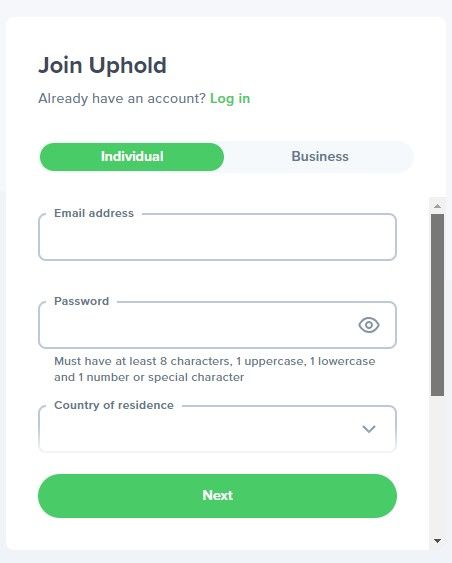

2. Secondly, select whether you want an Individual account or a Business account. For our Uphold review guide, we will sign up for an Individual account.

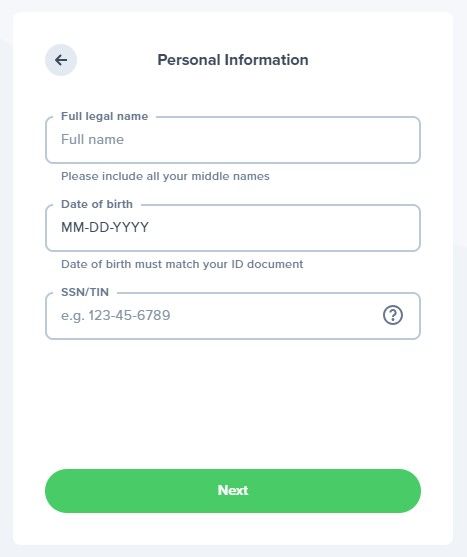

3. Next, you will have to fill out a form with some personal details. Please give your full legal name, date of birth, and social security number (for U.S. residents).

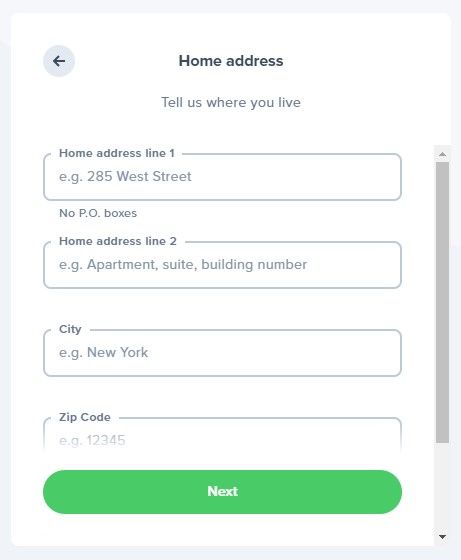

4. On the next page, you will have to enter your home address, city, and zip code.

5. After you have completed the previous steps, you will have to certify that the tax information that you have entered is correct. Review the information, certify, and e-sign to verify that the information is true.

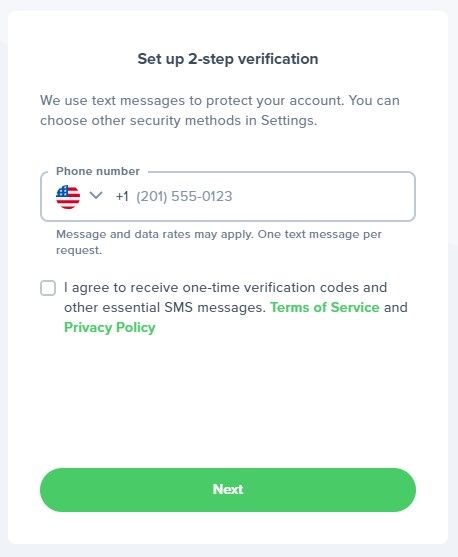

6. Enter your phone number to receive a verification code. Enter the verification code on the screen that pops up.

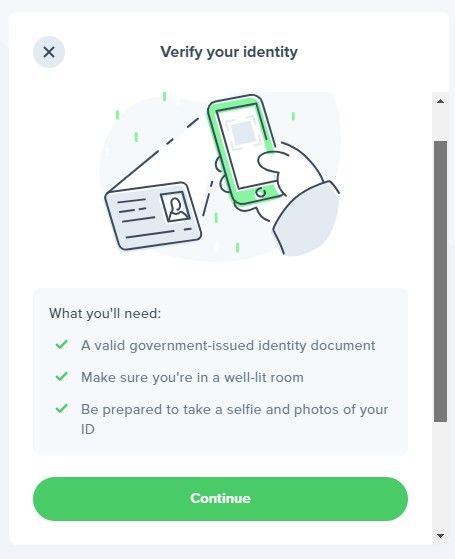

7. In the final steps, you must verify your identity. Simply take pictures of your government-issued ID and your face. The system will complete an out-of-view process in the background to verify your identity.

8. Congratulations, you are now the owner of an Uphold account.

Welcome offer/bonus

Uphold’s referral program offers rewards to both referrers and referees. Eligible participants can receive up to US$20 worth of bitcoin for each qualified “Wallet” referral.

However, Uphold limits the maximum payout to any individual eligible referrer to a total of 20 qualified referrals per calendar month.

To qualify for the referral rewards, the following conditions must be met within 30 calendar days of the eligible referral opening an account with Uphold:

- The Eligible Referrer must invite their friend(s) to join Uphold using a personal referral link provided by Uphold.

- The friend(s) must join Uphold by opening an account through the Eligible Referrer’s personal referral link rather than directly visiting the Uphold site or app.

- The referred friend(s) must complete Uphold’s standard Know Your Customer background check and become verified members.

- The referred friend(s) must fund their Uphold account with at least US$250.00 via bank transfer or Debit/Credit card during the Referral Program Period.

- The referred friend(s) must also transact at least US$250.00 into any crypto asset in their Uphold account during the Referral Promotion Period.

Rewards are paid out within 45 calendar days from the end of the month of the Qualified Referral, delivered via the participants’ Uphold wallet.

Deposit and withdrawals

When it comes to deposits, Uphold provides a variety of methods, including debit/credit card deposits, bank deposits, crypto network deposits, and the option to include a destination tag or memo for specific transactions.

/Related

More ArticlesFor withdrawals, users have multiple options, including bank withdrawals, inviting a friend to Uphold, debit card withdrawals, crypto network withdrawals, and peer-to-peer (P2P) transfers.

These options offer flexibility for users to manage their funds according to their preferences and needs. It is important to note that there are certain limitations and fees associated with each method, particularly by amounts and region.

Payment methods accepted by Uphold

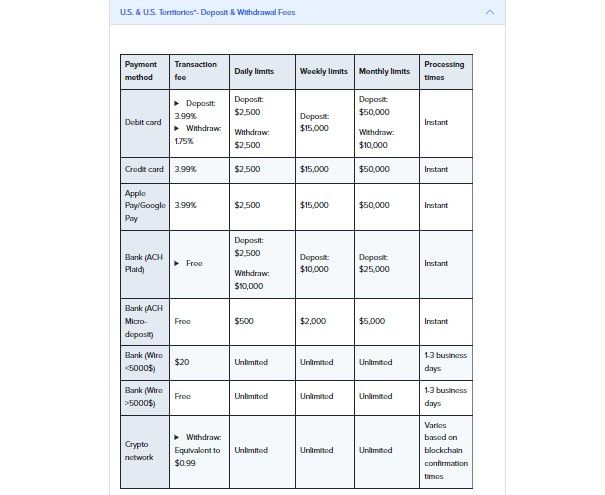

When depositing via a debit card, users incur a fee of 3.99%. On the other hand, withdrawals made through the same medium are charged at a rate of 1.75%.

The daily transaction limits for both deposits and withdrawals using a debit card are set at $2,500. Over a week, users can transact up to $15,000, while the monthly cap for deposits is $50,000, and for withdrawals, it’s $10,000.

Credit card users experience a transaction fee of 3.99%. Their daily transaction limit is $2,500, and they can engage in up to $15,000 worth of transactions weekly.

The monthly limit for credit card users stands at $50,000. Similarly, transactions made through Apple Pay or Google Pay also come with a 3.99% fee and share the same transaction limits as credit card users.

For those who prefer bank transfers, Uphold offers two options: Bank (ACH – Plaid) and Bank (ACH – Micro). The former, ACH via Plaid, offers free transactions.

Its daily deposit limit is $2,500, while users can withdraw up to $10,000. Weekly transactions are capped at $10,000, and the monthly limit is $25,000. In contrast, the ACH Micro option does not levy any fees and has lower transaction limits, with a daily cap of $500, a weekly cap of $2,000, and a monthly cap of $5,000.

For larger transactions, Uphold provides Bank Wire options. For wire transactions up to $5,000, there’s a $20 fee. Any wire transaction exceeding $5,000 is processed for free. These transactions have the advantage of being unlimited daily, weekly, and monthly.

Lastly, for users transacting in cryptocurrencies, withdrawals have a fee equivalent to $0.99. The transaction limits for deposits and withdrawals for crypto are unlimited.

How does Uphold compare to others?

| Platform | Assets | Payment methods | Users | Fees (spot) | Customer reviews |

|---|---|---|---|---|---|

| Uphold | 250+ assets (crypto, fiat, & precious metals) | Debit/credit, Google/Apple Pay, Bank, and crypto | Global (with restricted countries) | High | Average |

| Coinbase | 200+ cryptocurrencies | Bank, PayPal, Debit card, and gift card | U.S., Canada, and Europe | Mid | Low |

| Binance | 350+ cryptocurrencies | Crypto | Global | Low | Low |

| Kucoin | 700+ | Bank, crypto, and third-party (Wise, Paypal, Zelle, Skrill) | Global | Low | Low |

Uphold

A versatile platform with over 250 assets, including cryptocurrencies, fiat currencies, and precious metals. It supports various payment methods, such as debit/credit cards, Google/Apple Pay, traditional bank transfers, and crypto deposits.

Uphold caters to a global user base but may have restricted access in some countries. It is known for relatively higher fees in the spot market and receives an average rating from customers.

Coinbase

Offers access to more than 200 cryptocurrencies and accepts various payment methods, including bank transfers, PayPal, debit cards, and even gift cards. While it primarily serves users in the U.S., Canada, and Europe, it is among the most well-known and widely used exchanges.

Coinbase‘s fees fall in the mid-range category, making it a popular choice for beginners and experienced traders. It generally receives positive customer reviews and is recognized for its user-friendly interface.

Binance

A global cryptocurrency exchange with an extensive selection of over 350 cryptocurrencies, Binance primarily operates in the crypto-to-crypto space, making it suitable for traders seeking a wide range of assets.

Binance is known for its low spot market fees, attracting a large user base worldwide. It is considered a go-to platform for crypto enthusiasts and traders. Customer reviews also tend to be favorable, highlighting its broad offerings and competitive fees.

KuCoin

This platform boasts an impressive array of over 700 assets and supports various payment methods, including traditional bank transfers, cryptocurrencies, and third-party services like Wise, PayPal, Zelle, and Skrill.

KuCoin serves a global audience and, like Binance, is recognized for its low spot market fees, making it an attractive option for traders looking for a diverse range of assets without high costs. Customer reviews for Kucoin are generally positive, emphasizing its extensive asset selection and affordable fee structure.

Features and tools from Uphold

Debit card

Uphold offers a versatile debit card feature that allows you to spend cryptocurrencies directly from your wallet. This feature extends across different currencies and locations, offering the convenience of 0% foreign transaction fees and competitive foreign exchange rates.

Additionally, there are no setup or annual fees associated with this service. Uphold’s debit card can also be seamlessly integrated with mobile wallets like Apple Pay and Google Pay, providing a centralized platform for managing your payments.

Cryptocurrencies

Uphold boasts an extensive selection of over 250 digital currencies, including major cryptocurrencies, alternative coins, and emerging tokens.

This diverse range of assets empowers users to diversify their portfolios and explore various investment opportunities within the cryptocurrency space.

Reservechain and Reserveledger

Uphold has implemented an innovative system for real-time transparency. This system comprises two key elements.

The Reservechain is a real-time, anonymous public record of all transactions occurring across Uphold’s network. Meanwhile, the Reserveledger is a real-time public record of all changes in the assets held in reserve.

API access

For businesses and developers, Uphold provides an open API that facilitates the automation of payment flows and grants access to Uphold’s full functionality.

This API allows companies to streamline payments to vendors, employees, and more in multiple currencies, making it a valuable tool for businesses of all sizes.

Precious metals

Uphold goes beyond cryptocurrencies, allowing users to buy and trade precious metals seamlessly. This feature is supported by bank connectivity in 36 countries, as well as seamless debit/credit card payments and integration with blockchain networks.

Fiat currencies

Uphold provides users instant liquidity into 27 national fiat currencies, allowing for easy conversion between cryptocurrencies and traditional currencies as needed. This feature enhances flexibility for users who require quick access to fiat for various financial activities.

Staking on Uphold

Uphold offers a staking program that enables users to earn rewards on their crypto assets. With staking options available for more than 30 different cryptocurrencies, users can earn passive income. Some of these include:

- ATOM (Cosmos)

- KAVA (Kava)

- DOT (Polkadot)

- SGB (Songbird)

- KSM (Kusama)

- MINA (Mina)

- ZIL (Zilliqa)

Rewards are distributed weekly, and while the unstaking process varies depending on the token, Uphold aims to expedite the majority of unstaking requests for user convenience.

Security and payment processing

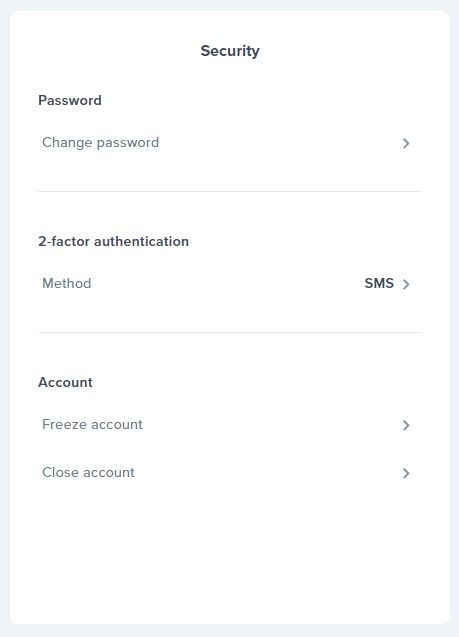

Uphold gives users a few security options to secure their accounts. Firstly, you have the option of two-factor authentication. This comes in two forms: SMS and an authenticator app.

Secondly, you can freeze your account. If you would like to limit the capabilities of your account while you are inactive, this is another good option for users.

Customer support

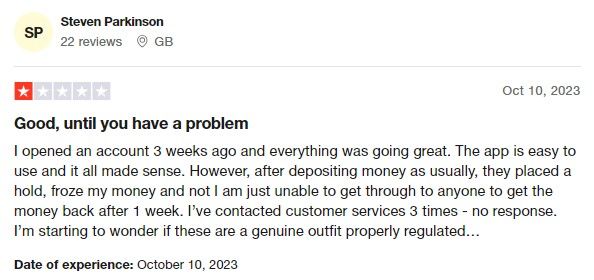

Uphold’s customer support gives you the standard options that come with online platforms. You can communicate a problem via support tickets, chatbot, or email. When our team raised customer service tickets, the platform responded to our query within 48 hours. However, such experiences do not always seem to be replicated. Based on the customer reviews on Trustpilot, Uphold’s customer support and user experience appear to have mixed feedback.

On the positive side, some users have praised Uphold’s customer service for being responsive and providing quick solutions to their inquiries. However, a number of negative reviews indicate that some users have faced challenges with Uphold’s customer support. Reviews express difficulty in reaching out to customer service and receiving a response.

How we have tested Uphold

We tested the Uphold platform using a rigorous process. Firstly, we underwent the platform’s KYC process to give customers an idea of how to sign up on the platform.

We also tested its customer support and used the app and services to learn what was in store for customers regarding usability and user experience. Lastly, we searched through Uphold’s policies, terms of service, fee structure, and any other relevant documentation to provide customers with a full scope of the platform.

Regulatory compliance and safety

Uphold operates as a regulated financial service provider with oversight and compliance measures in place across multiple jurisdictions:

- United States: Uphold is regulated in the U.S. by the Financial Crimes Enforcement Network (FinCEN) and state-level regulators, ensuring adherence to anti-money laundering (AML) controls and relevant financial laws.

- United Kingdom: In the UK, Uphold is regulated by the Financial Conduct Authority (FCA), ensuring compliance with British financial regulations.

- Canada: Uphold is registered with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), aligning with Canadian regulatory standards.

- Europe: Uphold is registered with the Financial Crimes Investigation Service under The Ministry of the Interior of the Republic of Lithuania, demonstrating its commitment to complying with European financial regulations.

What does this mean?

As a regulated financial service provider, Uphold is obligated to uphold stringent AML controls and follow local, state, federal, and international laws pertaining to consumer data protection.

This includes compliance with data protection requirements in the European Union, the Gramm-Leach-Bliley Act (GLBA) in the U.S., and the regulations in place in the People’s Republic of China to safeguard personal information.

To further enhance security, Uphold is required to adhere to the Payment Card Industry Data Security Standards (PCI-DSS), which helps reduce credit card fraud risk by implementing robust controls around cardholder data. An external Qualified Security Assessor (QSA) conducts an annual validation of compliance.

It’s important to note that Uphold HQ Inc. is not a broker-dealer and is not affiliated with regulatory bodies like the Financial Industry Regulatory Authority (FINRA) or the Securities Investor Protection Corporation (SIPC).

Investments in crypto assets on the platform are not protected by Federal Deposit Insurance Corporation (FDIC) or SIPC insurance.

However, deposits of U.S. dollars held on the platform may be eligible for pass-through FDIC insurance, covering up to $250,000 per depositor in case of a bank failure.

Invest responsibly

Investing in any financial asset, including crypto, carries inherent risks. It’s crucial to approach investing with caution and due diligence. Past performance is not indicative of future results, and the value of investments can fluctuate significantly.

Investing responsibly means understanding and accepting these risks, staying informed, and making informed choices that align with your financial goals and risk tolerance. Always invest with a plan and an exit strategy.

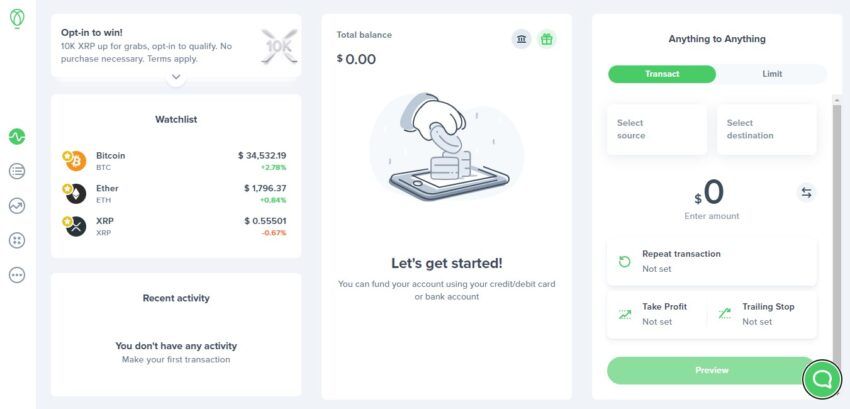

Conveniently rebalance your portfolio

Uphold’s motto is “anything to anything.” In this sense, it is extremely successful. The platform is particularly useful for individuals who are more accustomed to traditional markets. This allows investors to conveniently rebalance their portfolio as market conditions change. Moreover, this Uphold review found the platform to be highly transparent and trustworthy — essential qualities in a volatile crypto market.

Frequently asked questions

Uphold is useful for individuals that would like to purchase crypto, precious metals, or fiat currencies. However, you might not want to use Uphold due to its moderately high deposit and withdrawal fees.

Uphold has a Reservechain and Reserveledger to ensure users that their assets are safe. However, you may want to use a non-custodial crypto payment service if you are still skeptical of using Uphold.

Uphold is a good option for purchasing crypto, precious metals, and fiat currencies. Although, outside of this purpose, the features are limited. The platform also has relatively high deposit and withdrawal fees.

Withsrawing money from Uphold is simple. Go into the Uphold app and select “Transact,” then select “Destination.” Then choose the bank that you would like to withdraw into.

Yes, Uphold has deposit and withdrawal fees. The fees vary by amount, method, and location. It is known for relatively high fees in the spot market when compared with competitors.

Uphold is regulated and has a reserve system to prove to users that they are solvent. However, users should always exercise caution when depositing money into any platform.

Uphold uses a reserve system to prove to users that it is solvent. Additionally, the company is regulated. However, users should always exercise caution when dealing with any form of crypto platform. Prioritize security at all times, be aware of possible scams, and make sure not to follow phishing links.

Uphold is a U.S. based company, created by Halsey Minor. Although, the company has a global user base. Uphold operates in over 184 countries, facilitating seamless foreign exchange and cross-border remittance services for its global members. It supports a vast array of over 200 currencies, both fiat and cryptocurrencies, as well as precious metals.

The minimum deposit is $1, or equivalent in cryptocurrency. Although, there are certain fees associated with each deposit method.

Yes, Uphold has a mobile app. It is available on iOS and Android. The platform is also available on desktop.

Uphold does not have a demo account in the typical sense. The platform does have a “sandbox” for developers. The sandbox account is a test account which developers can use to test applications being built on the Uphold platform.

Uphold’s limits depend on the methods used. For example, monthly debit card limits are $50,000 in deposits, and $10,000 in withdrawals.

Yes, Uphold requires KYC. The process requires a phone number, email, government identification and a face scan. If you’re looking for a platform to buy crypto anonymously, you will need a dcentralized exchange.

Yes, Uphold is a legitimate site. It is regulated in the U.S., and other countries. Make sure you download the official app if you are accessing the platform on mobile.

There are many places that cannot use Uphold’s services. Some of these include New York, China, and Eritrea. See the official website for an extensive list.

Uphold’s referral program offers rewards to both referrers and referees. Eligible participants can receive up to US$20 worth of bitcoin for each qualified “Wallet” referral.

Uphold’s customer support receives mixed reviews. When comparing these reviews against competitors, Uphold’s customer support can be considered slightly above average. Or tests found Uphold to have a responsive and helpful custoemr service department.

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.