Cryptocurrencies are not just randomly named coins. Most have their own self-sustaining micro-economies with unique mechanisms. Tokenomics is comprised of numerous factors that work to shape the future of a project’s native crypto. This information can give us a window into a crypto’s viability, dynamics, and potential impact. This guide explores what tokenomics entails and its role in determining a cryptocurrency’s supply and demand.

KEY TAKEAWAYS

• Tokenomics is a mix of the words token and economics.

• It is the study and design of a cryptocurrencies economic model, which includes its distribution, utility, and governance.

• Key components of tokenomics includes mechanisms like minting, burning, and staking.

• An efficient token economics framework is essential for the sustainability and security of a crypto project.

What is tokenomics?

Tokenomics is a mix of the words token and economics. Most people have a different interpretation of what it means. Generally, tokenomics is the study and design of the economic model of a cryptocurrency. It entails the launch, distribution, utility, and governance mechanisms of the token.

It (a merging of “token” and “economics”) shapes the structure of a cryptocurrency’s economy. Critical factors like scarcity, market demand, token velocity, and inflation/deflation mechanisms collectively shape a token’s price and determine its overall market behavior. To fully understand the concept of tokenomics, let’s explore what a token is.

What’s a token?

In the traditional financial system, governments have the authority to issue fiat currency and determine monetary policy, essentially shaping the functioning of our economy through money as a medium of exchange.

In crypto, a token represents a digital currency or ownership stake that is transformed into a standardized format and recorded on an established blockchain network. You can understand a token as a form of currency issued on a blockchain.

Frequently, people use crypto tokens to secure funding for various projects. They typically go through an initial coin offering (ICO), where tokens are created, distributed, sold, and circulated through crowdfunding initiatives.

Tokens operate under predefined supply mechanisms, which often include fixed supplies or algorithmic issuance rules implemented through smart contracts.

Token economy

Tokenomics encompasses the entire process of coin creation and management. A project’s tokenomics provides insights for investors looking to determine a project’s legitimacy and long-term value potential. The following key points are crucial for a token economy:

- Incentivization: A well-crafted token economy incentivizes participants to actively contribute to the network, provide liquidity, and drive adoption. This collective effort can result in a gradual increase in the token’s value over time.

- Fair distribution: This helps ensure an equitable distribution of tokens, preventing the accumulation of power and wealth within a select few individuals or entities.

Dynamics that might impact a token economy include:

Token burning and buybacks: These practices employed in tokenonomics can significantly impact a token’s value. Token burning involves permanently removing tokens from circulation and reducing the token supply. This reduction in supply, when coupled with consistent demand, can increase the scarcity of the token, leading to a potential increase in its value.

Token staking and rewards: Serve as powerful incentives for token holders to participate actively in the network. Staking tokens involves locking them up for a specific period to contribute to network operations, such as transaction validation. In return, token holders receive rewards, which can be additional tokens or other benefits.

Token liquidity and exchange: Listings are vital for tokens to thrive in the market. Liquidity, achieved through easy token buying and selling, offers traders flexibility and accessibility. When reputable exchanges list a token, it gains visibility, attracts more traders, and enjoys increased liquidity. Improved liquidity and exchange listings contribute to the overall token demand, leading to potential value appreciation.

Role in blockchain projects

These mechanisms harmonize the actions of various stakeholders, including founders, developers, investors, and users. Let’s delve into the key components of a solid tokenomics framework.

Key components

The three main types of tokens include utility, payment, and security. Other prominent token types include stablecoins, DeFi tokens, and NFTs. Let’s explore the three main types in detail.

Security tokens

Security tokens are digital assets that leverage blockchain technology to represent ownership or stakes in real-world companies or assets. These crypto-security tokens function similarly to traditional security instruments issued by companies, trusts, governments, or legal bodies.

Several examples of security tokens include BCAP, which stands for Blockchain Capital’s tokenized venture fund, Sia Funds, and VEVU. These tokens allow investors to hold fractional ownership in ventures or assets through a secure and transparent blockchain infrastructure.

Utility tokens

Utility tokens are seamlessly integrated into blockchain protocols, granting users access to various services offered within these protocols. Unlike security tokens designed for investment purposes, utility tokens primarily serve as a means of payment within their respective ecosystems.

Decentraland (MANA) is a utility token exclusively created for the virtual Decentraland world. MANA is primarily utilized to purchase LAND and other virtual goods within the game. Another noteworthy project is ApeCoin (APE), which provides holders access to exclusive features like games, events, and services and also facilitates participation in a project’s governance votes.

Payment tokens

Payment tokens are specifically designed to facilitate crypto transactions, regardless of whether they are classified as security or utility tokens. They are classic cryptocurrencies such as Bitcoin, Litecoin, Bitcoin Cash, and Solana and can be used as a means of payment.

These cryptocurrencies enable purchasing and selling goods and services without intermediaries typically found in traditional financial and banking systems. However, unlike security tokens, they do not offer any additional utilities beyond their monetary value.

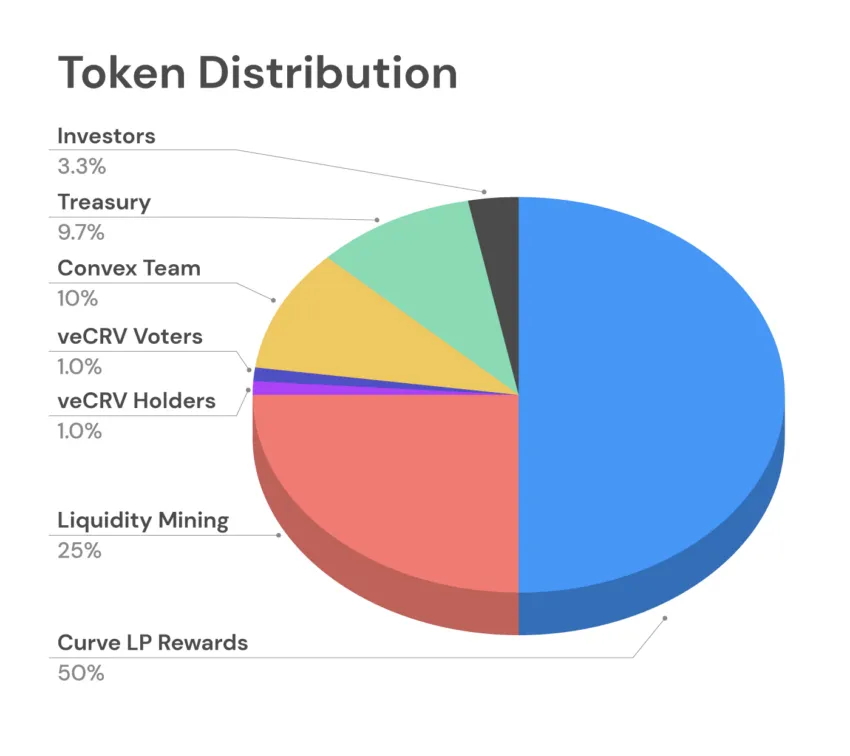

Token distribution

Token distribution refers to the process of allocating tokens within a blockchain ecosystem. This often includes the allocation of tokens among various participants, including founders, investors, contributors, and users.

This distribution process can be determined through predetermined allocations or influenced by factors like participation, proof-of-work, or proof-of-stake. There are various methods for distributing tokens, which depend on the underlying technology and project-specific needs. Here are some comprehensive distribution methods:

Token sales

A token sale is a method of fundraising for blockchain-based projects. It is one of the most common methods for token distribution, and it involves the issuance and distribution of tokens to investors in exchange for established cryptocurrencies or fiat currencies. This method allows projects to raise funds for development while distributing tokens to early adopters.

The first token sale (i.e., ICO) took place in July 2013 with the launch of Mastercoin. Afterward, in 2014, Ethereum’s groundbreaking offering of a blockchain platform that catered to decentralized applications (DApps) captured investors’ attention, raising $18 million.

Airdrops and rewards

A crypto airdrop involves the distribution of free tokens directly to the wallet addresses of eligible users. Numerous cryptocurrency projects employ this method to achieve a network effect, bolster platforms’ activity, and build a community. By setting aside a substantial quantity of tokens and rewarding project advisors and dedicated platform users, developers can facilitate the expansion of their platforms.

An airdrop is often crucial in fostering project awareness and cultivating a strong and supportive community that stands behind a platform or project.

Lockdrops

A lockdrop is a token distribution mechanism utilized by decentralized autonomous organizations (DAO) and crypto projects to distribute their new tokens. This mechanism differs from an airdrop in that tokens are exclusively provided to individuals who express their interest in the project by locking up their existing tokens.

Investors

Token distribution can incorporate strategic partnerships and investors who contribute valuable resources, expertise, or market access to the project. This approach secures valuable support and facilitates the formation of a network of stakeholders who can actively contribute to the project’s growth and adoption.

By fostering mutually beneficial relationships, this strategy enhances the project’s potential for success and long-term sustainability.

Token supply and value

Supply and value are essential considerations in crypto tokenomics. Effective supply management is crucial for crypto projects, as it directly impacts the token’s price in the following manners: an increase in token supply, combined with unchanged demand, results in a price decrease. Conversely, a decrease in token supply, with demand remaining constant, typically leads to an increase in price.

- Circulating supply: Circulating supply refers to the publicly available and actively traded amount of cryptocurrency coins or tokens in the market. The circulating supply of a crypto asset can vary over time. For instance, Bitcoin’s circulating supply gradually increases until it peaks at the maximum supply of 21 million coins. It’s important to note that the circulating supply represents the coins accessible to the public and should not be confused with the total supply or maximum supply.

- Maximum supply: Maximum supply refers to the ultimate number of the project’s tokens that will ever be minted. It can be limited or unlimited.

- Total supply: This is the cumulative sum of the circulating supply and the assets locked in reserve. You can understand the total supply as T=Δm, where T is the total supply, and Δm is the total change in the maximum supply. The expanded version is T = M – B, where T is the maximum supply minus any burned tokens (B), and B is a non-negative number (B≤0). To simplify this, the total supply is the maximum supply minus any burned tokens.

Price and market dynamics

Similar to how central banks regulate and stabilize traditional currencies, a similar approach can be advantageous in the realm of tokenomics.

For example, the announcement of a government-imposed ban on cryptocurrency trading can significantly impact the demand and value of a token. Conversely, when a big institution adopts a specific token as a form of payment, it can amplify the token’s desirability and value.

Moreover, increasing the token supply in a market experiencing excessive volatility can help temper price fluctuations and improve stability.

Utility and governance

Many projects also use tokens for governance purposes.

Governance is a model wherein token holders possess voting rights to shape decisions regarding protocol upgrades, consensus mechanisms, or other platform modifications. This utility model promotes decentralization and community engagement in decision-making processes. For example, Compound Finance (COMP) supports the most widely used governance model in the web3 space.

The Compound governance contracts and frameworks are the most widely used in crypto today. They’re copy, pasted repeatedly, Open Zeppeiln has standardized them and it’s basically a library that, you know, a huge number of projects are using for on-chain governance.

Robert Leshner, Compound founder

Incentives and rewards

Another crucial aspect of tokenomics revolves around how tokens incentivize participants, ultimately ensuring long-term sustainability. In platforms like Ethereum and various other proof-of-stake mechanisms, users can lock their tokens to validate transactions.

Locking more tokens increases the likelihood of a user being chosen as a validator and receiving rewards for transaction validation. These features effectively incentivize participants to act honestly and uphold the protocol’s security.

Numerous DeFi projects have embraced a variety of incentive mechanisms, including yield farming, to foster rapid growth. This phenomenon can be traced back to the distribution of the COMP governance token in June 2020, initiated by Compound.

By rewarding both lenders and borrowers within the application with their governance token, Compound set a DeFi trend that is still going strong in 2025.

Access to platform features or services

Tokens serve as admission fees to access blockchain infrastructure or specific products, akin to entry fees at a theme park. This approach incentivizes user engagement, including activities such as paying security deposits, running smart contracts, or covering usage fees.

Why should you care about tokenomics?

Tokenomics is of utmost importance when assessing a crypto project. Just as nails fortify a structure, a token must fulfill various roles to guarantee the underlying business model’s robustness, security, and longevity. Tokens serve various key functions within blockchain ecosystems, and a solid tokenomics model is the hallmark of any solid web3 project.

Frequently asked questions

What is tokenomics?

What is a tokenomics example?

What is the role of tokenomics?

What are the benefits of tokenomics?

What are the components of tokenomics?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.