The decentralized finance (DeFi) market continues to grow, with decentralized trading protocols like dYdX spearheading innovation. The leading perpetual exchange offers a wide variety of decentralized trading and lending products. This guide covers everything you need to know about the dYdX exchange and its ecosystem, including its origin, features, and the native dYdX token.

BeInCrypto Trading Community in Telegram: read reviews on the best crypto projects & platforms, read technical analysis on coins & get answers to all your questions from PRO traders & experts!

What is dYdX?

dYdX is a decentralized cryptocurrency exchange catering to advanced traders. The DEX offers a wide range of services, including borrowing, lending, margin, and leverage trading.

The platform allows users to trade listed assets without registering for accounts or submitting details as part of a know-your-customer (KYC) process generally demanded by centralized exchanges like Binance or Coinbase. Moreover, as of April 27, 2023, the protocol’s dYdX token had a market capitalization of $404.88m, making it one of the most liquid derivatives trading platforms on Ethereum.

Built as a professional trading protocol, the dYdX exchange provides options for traders who want to be in control of their assets while enjoying a similar trading experience to that of centralized exchanges. To make this possible, the platform currently utilizes an Ethereum layer-2 scaling solution developed by Starkware. However, to provide an even more seamless trading experience, dYdX announced a move to a new ecosystem, Cosmos.

Origin

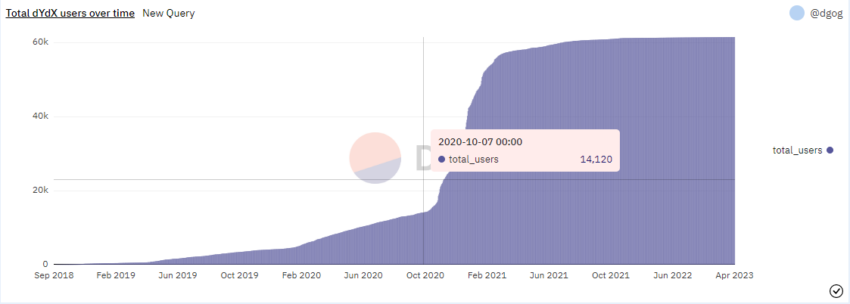

Antonio Juliano, a former software engineer at Coinbase and Uber, founded dYdX in mid-2017. Juliano’s goal was to create an open-source, community-governed derivatives exchange that would allow users to own their trades truly and, eventually, the exchange itself. The protocol was launched in July 2017 with the release of its layer-1 product. From the get-go, dYdX supported lending, borrowing, and margin trading on Ethereum.

Soon enough, though, dYdX encountered problems with Ethereum’s volatile gas fees that would increase with user traffic. So, to address this issue, dYdX started to migrate to StarkWare’s layer-2 network called StarkEx in August 2020. This provided the ability to boost the transaction count while profiting from lower transfer fees.

In April 2021, the layer-2 product was launched to the public. Since then, dYdX has launched 30 markets on the layer-2 network, generating over $100 billion in trading volume.

Three months later, in August 021, dYdX Trading Inc. announced the creation of the dYdX Foundation. The foundation is in charge of deploying governance smart contracts and issuing the dYdX governance token. Moreover, the foundation also supports community research to help activate community activities and projects. It further educates investors on the dYdX ecosystem and manages the dYdX community treasury.

Team

The story of dYdX started in 2017 with Antonio Juliano. Juliano studied Computer Science at Princeton and left the university with a desire to work on tech startups. While at Coinbase, he became interested in Ethereum and decided to create a decentralized exchange for trading crypto assets.

Council members, including Arthur Cheong, Rebecca Rettig, and Markus Spillman, govern the dYdX Foundation. They oversee the development of the dYdX layer-2 protocol and the issuance of its governance token dYdX.

The team and council members are all committed to extolling the virtues of DeFi. For Cheong, the decentralization of finance is a key opportunity for the growth of financial education.

The best investment one can make is to level up your personal finance knowledge. DeFi is a crash course on this if one is doing it correctly.

Arthur Cheong via Twitter

Funding

The dYdX protocol has received significant backing from well-known investors, including Andreessen Horowitz, Polychain Capital, Three Arrows Capital, Wintermute, and Paradigm. Notably, these investors have contributed large amounts of capital to the protocol and are actively involved in its development, enabling it to grow and develop new features.

The protocol has successfully raised funds in several rounds, with the latest being a Series C round in June 2021, led by Paradigm, which raised $65 million. Prior to this, the company raised $10 million in a Series B round in January 2021 and another $10 million in a Series A in October 2018. During its 2017 Seed round, dYdY raised $2 million with participation from Andreessen Horowitz and Polychain.

Roadmap

dYdX Exchange’s main goal is to build a fairer and more transparent financial system through decentralization. To achieve this goal, dYdX is working on its next version, V4. Surprising to many, this decision marked an expansion beyond Ethereum.

Whereas the exchange currently works on StarkEx, the Ethereum layer-2 scaling solution was considered not to be the best solution for further scalability going forward. Consequently, the decision was made to move to another standalone blockchain built through the Cosmos SDK. The community will control this new Cosmos-based blockchain. The release of V4, which is timed for the end of September 2023, is currently dYdX’s top priority,

Today, dYdX is a hybrid decentralized exchange, meaning that some components of the platform are still centralized. Crucially, with V4, dYdX plans to become fully decentralized, with no central points of control or failure. The primary aspect is to decentralize the order book and matching engine. Note that dYdX has split the development of the blockchain into several milestones, each containing a set of features to be built.

The expected schedule for each milestone is as follows:

- Milestone 1 – Developer testnet – Complete.

- Milestone 2 – Internal testnet – Complete.

- Milestone 3 – Private testnet – Complete

- Milestone 4 – Public testnet – End of July 2023

- Milestone 5 – Public mainnet – End of September 2023

How does dYdX work?

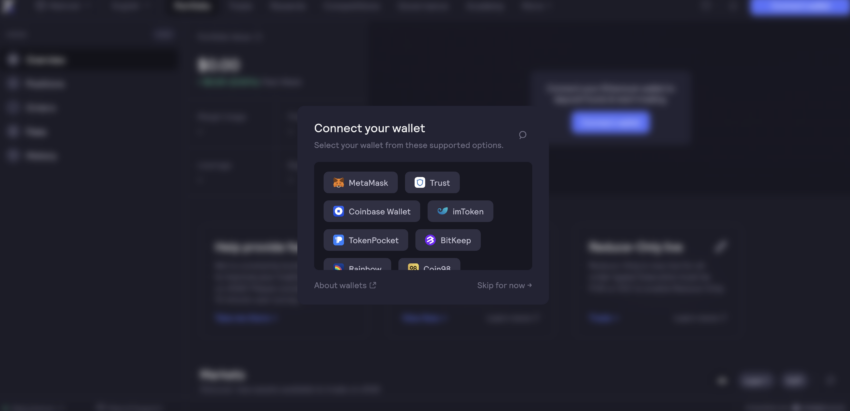

dYdX operates through smart contracts, allowing users to trade crypto assets without intermediaries. By using smart contracts, dYdX is structured as a non-custodial exchange, enabling users to have complete control over their funds while trading. To use dYdX, users only need a crypto wallet such as MetaMask, Ledger, or Trust Wallet.

In August 2020, dYdX migrated to StarkWare, a Layer-2 scalability solution that uses Zero-Knowledge (ZK) rollups to speed up transactions and reduce fees. Currently, dYdX still uses Ethereum to finalize transactions. However, its trading engine operates off-chain with an off-chain matching engine and order book.

Note:

Due to recommendations from its product and legal teams, dYdX temporarily suspended its layer-2 transfer feature to prevent potential exploits. The exchange plans to reactivate the feature with the launch of dYdX V4. Notably, this launch is set to transform the derivatives protocol into a standalone interoperable blockchain based on Cosmos SDK and Tendermint proof-of-stake consensus algorithm.

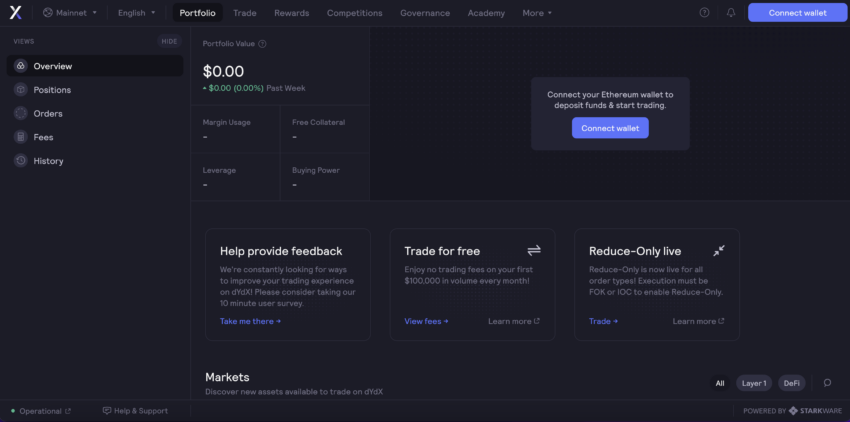

To use dYdX, follow these steps:

1. Visit the dYdX exchange app

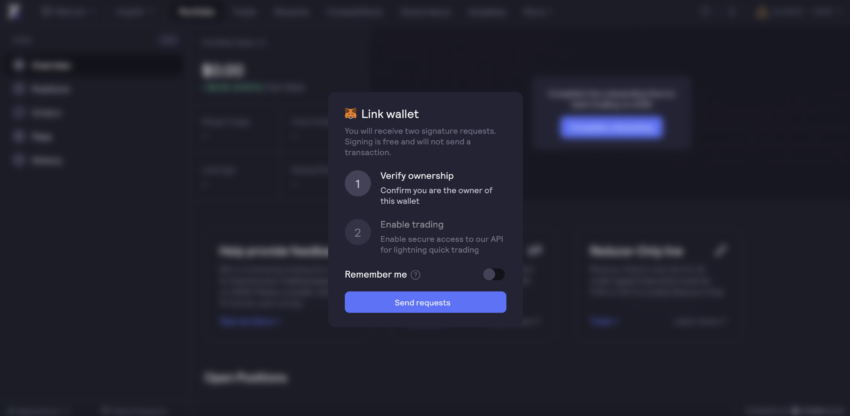

2. Connect your wallet (e.g., MetaMask, Ledger).

3. Onboard and verify ownership.

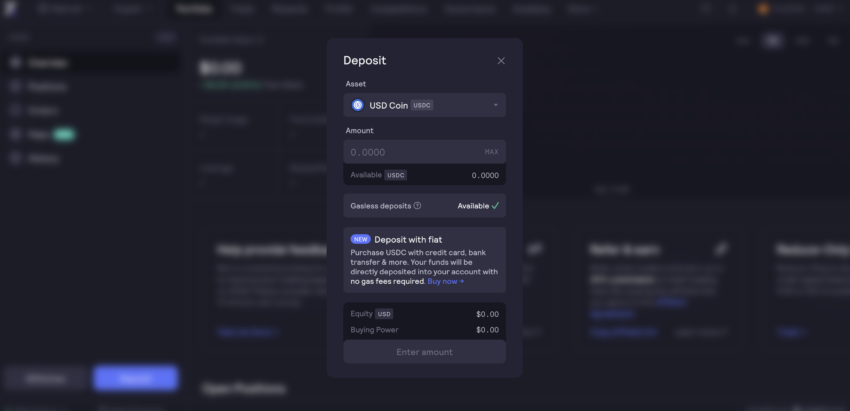

4. Deposit funds using Vault ID and Stark Key.

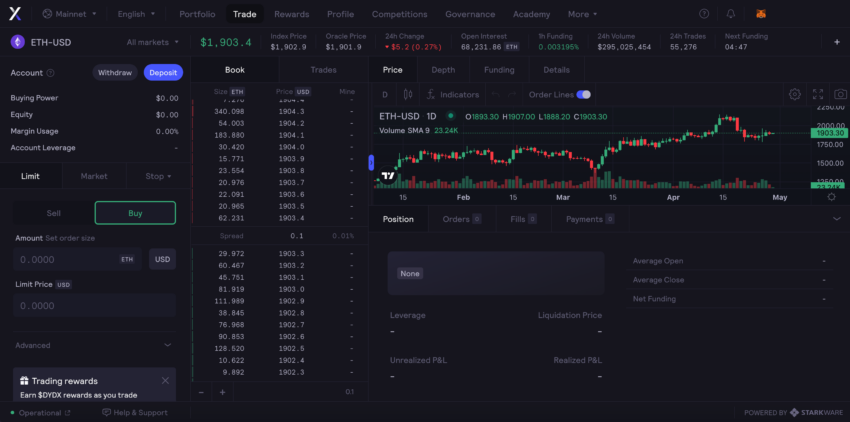

5. Go to trade.

6. Select order type (e.g., Limit, Market).

7. Choose leverage, take profit, and stop loss.

8. Open a long or short position.

9. Track PNL under portfolio.

dYdX V4 will feature taker and maker fees. As such, fees collected on the platform will accrue value and be distributed to validators and stakers. The team plans to release V4 by the end of 2023 and launch a $5.5 million growth fund program to increase user adoption and awareness.

Features of dYdX

The dYdX Exchange has many features that both seasoned and newbie traders appreciate. These include:

Decentralized exchange

dYdX is partly decentralized and operates on the Ethereum blockchain. Moreover, there is no central authority controlling the exchange, and users can trade directly with each other through its peer-to-peer structure.

Non-custodial

Compared to centralized exchanges, dYdX does not require users to deposit their funds to the platform, thereby providing a trust-minimized architecture. Instead, funds remain in the user’s wallet while trading. As a result, users have full control over their assets. This reduces the risk of hacks and fraud.

Perpetual swaps

dYdX allows users to trade perpetual swaps, which are a type of derivative instrument. They are similar to traditional futures contracts but without an expiration date. Crucially, perpetual swaps allow traders to stay in the market for longer and take advantage of possible opportunities.

Margin trading

dYdX also features a powerful margin trading protocol. Margin trading allows investors to leverage their holdings, allowing them to take bigger market positions, potentially increasing their profits. Nonetheless, it also increases the risk of greater loss.

Limit orders and stop losses

dYdX supports limit orders and stop losses, allowing users to automate their trades and reduce risk. For example, if a trader sets a stop-loss order at 5% below the coin’s price, the market position is automatically closed when the price hits this target. Hence, preventing further losses.

Order books and TradingView integration

dYdX exchange offers a web application that integrates TradingView‘s features and strategies into a dYdX trading account. TradingView is a popular tool traders use to map out and implement their trading strategies. For dYdX users, the ability to leverage TradingView’s features directly on dYdX makes trading easier and more efficient.

Flash loans

A flash loan is a financial instrument that allows users to borrow a certain amount of digital assets from a protocol without collateral or proof of income. This is possible because the borrowed amount is paid back within the same blockchain transaction. Through dYdX, users can take on flash loans which are normally executed within. Note that dYdX doesn’t charge any fees for this.

Lending and borrowing

dYdX also comes with a powerful lending and borrowing feature. As a result, users can earn interest on their assets by lending or take advantage of more opportunities in the market by borrowing.

dYdX controversies

In August 2022, dYdX blocked some users’ accounts linked to Tornado Cash, mistakenly also suspending some who never engaged with the mixer in the process. The derivatives platform had compliance parties scan for potentially illicit accounts, which resulted in many accounts being flagged, even those that were not directly involved with Tornado Cash. They later unbanned certain accounts.

In September 2022, dYdX ended its short-lived $25 deposit bonus promotion, citing overwhelming demand. However, most people believe it was due to the backlash dYdX faced over its “liveness check” feature for user verification, which prompted a privacy debate.

To participate in the promotion, users had to scan their faces with a webcam to establish that they had not opened more than one account. It brought into question how much dYdX values user privacy. However, dYdX maintained that the verification was to prevent fraudulent activity and that participation in the promotion was optional.

Benefits and drawbacks of dYdX

dYdx comes with various pros and cons that stand out. Let us take a look at some of them below.

Pros

Ease of use

The dYdX platform is easy to use. Notably, it comes with an interactive web interface, TradingView integration, and a mobile application for iOS devices.

No KYC requirements

Since there is no need for KYC, dYdX users can connect their wallets, trade, and leave the platform without ever revealing their identities.

Trust-minimization

Trust minimization is one of the biggest benefits of using a decentralized exchange such as dYdX. Moreover, in contrast to centralized exchanges, where users have to trust a third party with their funds, decentralized exchanges let users retain control over their assets. Furthermore, all smart contracts on dYdX are open-sourced and regularly audited.

Speed

dYdX uses zk-rollups – a layer-2 scaling solution, which reduces the time it takes to complete transactions. Furthermore, with the upcoming change to Cosmos, transaction speed, throughput, and costs should become even better.

Cons

No Fiat On-Ramp

dYdX allows only crypto-to-crypto deposits and withdrawals. Moreover, there is no option to deposit fiat currencies.

Steep Learning Curve

The dYdX platform may demand a steep learning curve, specifically for new users unfamiliar with how decentralized exchanges and blockchain technology work. As such, the exchange is generally associated with more experienced traders.

Varying Interest Rates

dYdX offers interest rates for lending assets such as ETH, DAI, and USDC. However, these rates are subject to change.

dYdX (DYDX) token

The dYdX token is the governance token of the dYdX protocol. It is built on the Ethereum blockchain as an ERC-20 token. The dYdX token was designed to incentivize users to contribute to the development of the dYdX protocol and provide users with a voice in dYdX’s governance. Furthermore, the dYdX token enables the protocol to fund its operations and development.

Besides allowing users to participate in the decision-making process of the protocol, users can stake dYdX tokens and thus claim a portion of the rewards generated by the platform.

Tokenomics

There is a maximum of 1 billion dYdX tokens, which dYdX is to release over a period of five years. Here is a summary of dYdX’s tokenomics as of April 27, 2023.

| Tokenomics | Amount |

| Maximum supply | 1 billion |

| Total supply | 1 billion |

| Circulating supply | 156,256,174 dYdX (15.6% of total supply) |

| Token price | $2.60 |

| Market cap | $406,599,410 |

| Fully diluted Value | $2,593,482,594 |

| 24-hour trading volume | $130,994,354 |

DYDX token uses

The dYdX token has a number of use cases that make it an attractive asset for users of the dYdX protocol. These include:

Governance

Holders of dYdX tokens have a say in the development of the platform. This allows them to impact the protocol’s future direction. Note that this is one of the primary use cases of the dYdX token.

Trading discounts

Users can receive discounts on trading fees using dYdX tokens.

Staking

The dYdX token can also be used to stake and earn rewards. Users can also earn rewards by trading on the dYdX layer-2 platform. These rewards are earned in the form of dYdX tokens, providing users with a financial incentive to contribute to the success of the platform.

dYdX distribution

An initial distribution of dYdX tokens was carried out through an airdrop process. Tokens were given to eligible users for free. By using this approach, dYdX’s token distribution aimed at making the tokens accessible to a wide range of users and avoiding its concentration in the hands of a few individuals.

In the overall distribution model, the tokens are allocated to different categories of users as follows:

- The dYdX community: Traders, stakeholders, liquidity providers, and users receive 50% of the total supply, depending on their completed milestones.

- Active users: Previously active users received 27.72% of dYdX tokens.

- Employees and consultants: 15.27% of tokens are issued to dYdX official members, founders, employees, and others.

- Future employees and consultants The final 7% of the tokens are reserved for future employees who join the platform.

dYdX wallet

Currently, dYdX does not have a native wallet. Nonetheless, since it is an ERC20 token operating on the Ethereum blockchain, it can be stored on a wide range of non-custodial wallets. These include software wallets such as MetaMask, Trust Wallet, Atomic Wallet, MyEtherWallet, and hardware wallets such as Ledger and Trezor.

Did you know that you can get $10 cashback for inviting friends to ZenGo wallet?

- Create a blockchain wallet ZenGo using THIS LINK

- Go to Settings in your ZenGo wallet app and copy your personal promo code

- Invite your friends using the promo code. Once your friend buys $500+ worth of crypto both of you will get $10 cashback.

ZenGo wallet can be connected to any NFT Marketplace or Web3 dapp via WalletConnect.

dYdX exchange offers a compelling alternative to CEXs

The dYdX decentralized exchange offers an alternative to both traditional crypto exchanges. It caters to more experienced traders whose needs go beyond the basic financial tools found in traditional exchanges. This is indicated by the fact that dYdX also offers derivative solutions.

With its focus on community governance and decentralization, dYdX is well-positioned to build a fairer and more transparent financial system. The upcoming dYdX V4 release, which will move the exchange to a blockchain on the Cosmos Network, is expected to be a major milestone for the platform, enabling it to become more decentralized.

Frequently asked questions

How does dYdX make money?

What is dYdX built on?

Who owns dYdX?

Is dYdX safe to use?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.