This Maker price prediction comprises fundamental analysis, tokenomics, on-chain metrics, and data-informed/updated technical analysis to help you analyze how far Maker (MKR) could go.

- Maker price prediction and the related fundamental analysis

- Is Maker a good investment: A look at the DeFi presence

- Maker tokenomics and the price potential

- Maker price prediction, on-chain metrics, and other insights

- MKR price prediction and technical analysis

- Maker (MKR) price prediction 2023

- Maker (MKR) price prediction 2024

- Maker (MKR) price prediction 2025

- Maker (MKR) price prediction 2030

- Maker (MKR’s) long-term prediction until the year 2035

- Is the Maker price prediction model reliable enough?

- Frequently asked questions

Maker price prediction and the related fundamental analysis

Maker — an ecosystem built on the Ethereum Blockchain — hosts a DAO, a protocol (software platform), and a stablecoin named DAI. MKR, the native token of this decentralized ecosystem, handles the governance and even offers price-specific stability to DAI.

Did you know? Despite having a decentralized focus, Maker is continuously diversifying its treasury with an exposure to the U.S. Treasury Bills worth $1.73 billion, as of December 2023.

For the unversed, DAI is a crypto-backed stablecoin with its value pegged to that of the US dollar. MKR reserves also offer collateral support to DAI. Hence, if the stablecoin drops or even partially de-pegs from its desired level, we might see the price of MKR turn volatile.

“The stablecoin mullet: USDC in the front, Dai Savings Rate in the back”

Rune Christensen, Co-Founder of MakerDAO: X

As for the Maker ecosystem, it is a quintessential lending platform focusing on offering overcollateralized loans via smart contracts. While that explains a lot about Maker, here are some additional insights to help you better ascertain the Maker price prediction theory fundamentally:

- Maker protocol surfaced way back in 2014 and is open-source.

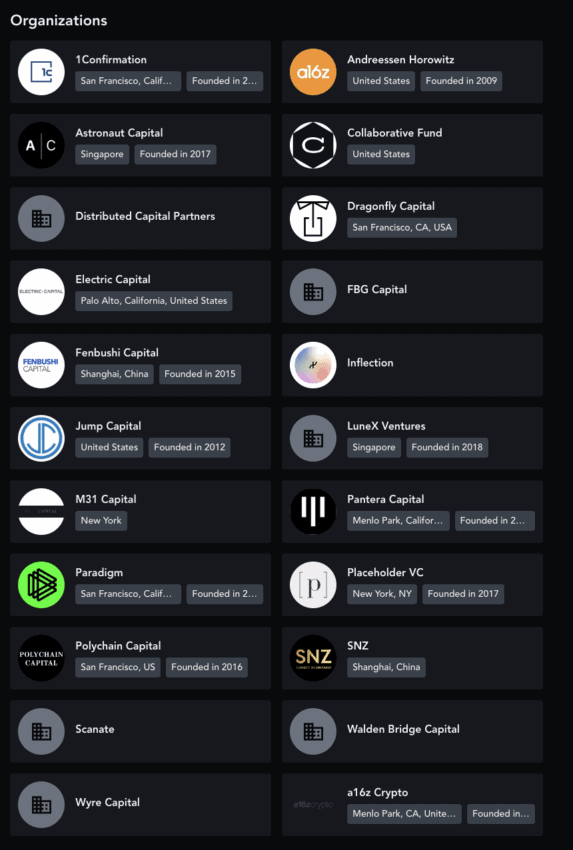

- Maker ecosystem has an illustrious lineup of organizational investors, including Andreessen Horowitz and Pantera Capital

And finally, Maker was one of the earliest DeFi projects on the crypto scene. With CeFi bodies suffering multiple knocks in 2022, DeFi projects like Maker have the opportunity to make it big in 2023 and beyond.

Is Maker a good investment: A look at the DeFi presence

MKR might come across as a governance token, but Maker as a protocol has a significant DeFi presence. Read on for our early 2023 DeFi analysis of Maker.

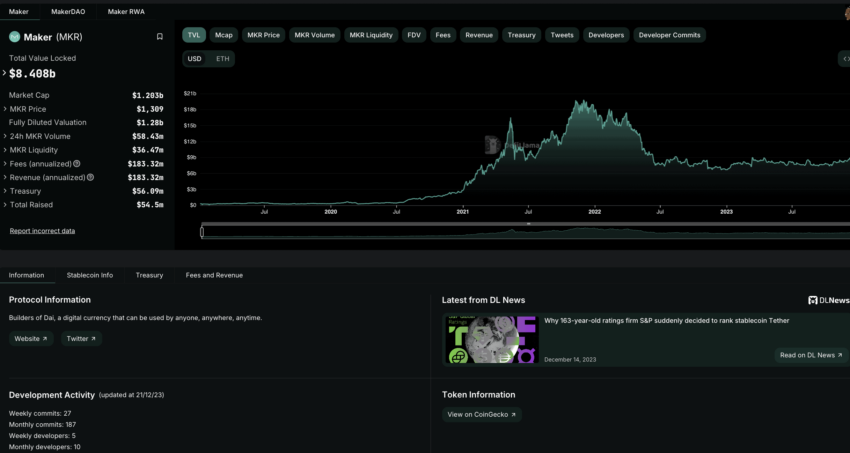

When it comes to the overall ranking, it comes second on the DeFi TVL list. As a CDP protocol (Collateralized Debt Position), as of Feb. 1, 2023, Maker holds $7.08 billion in total value locked. The entire DeFi space has started looking up in 2023, with even MakerDAO booming by 18.14% month-on-month.

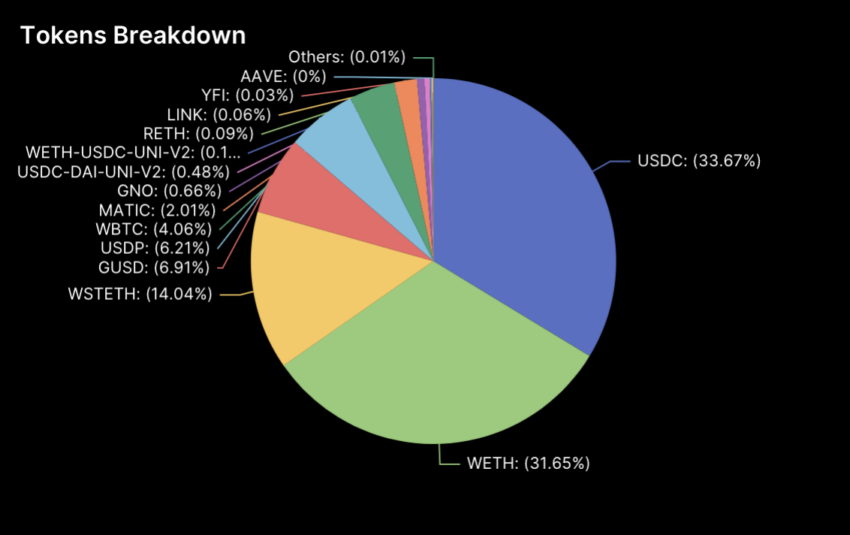

Moving to Maker’s DeFi exposure, as of early 2023, most was covered by WETH (Wrapped ETH) and USDC. Hence, if the broader market bleeds or popular stablecoins give out depegging scares, we can expect Maker’s TVL to take hits.

Despite big DeFi chains like Polygon and Arbitrum seeing a drop in DeFi TVL values, Maker ramped up over $1.4 billion by December 2023.

Maker tokenomics and the price potential

Maker has a current max supply of .92 million tokens. And as of December 2023, 91.38% of these tokens make the circulating supply. And even though the tokenomics model looks simple, the entire governance outlook follows DAI closely. As MKR is inherently a governance token, there is no hard cap. The total supply is meant to take care of the state of its stablecoin DAI, as mentioned.

For instance, if the DAI liquidation in case of a collateralized loan isn’t enough, it is possible to mint more MKR tokens. Burning MKR is also an option if the DAI amount exceeds the cause. And MKR tokens are getting burned as the circulating supply was as high as 97% in February 2023.

Therefore, the demand-supply curve follows an algorithmic connection making MKR’s token model both innovative and dynamic.

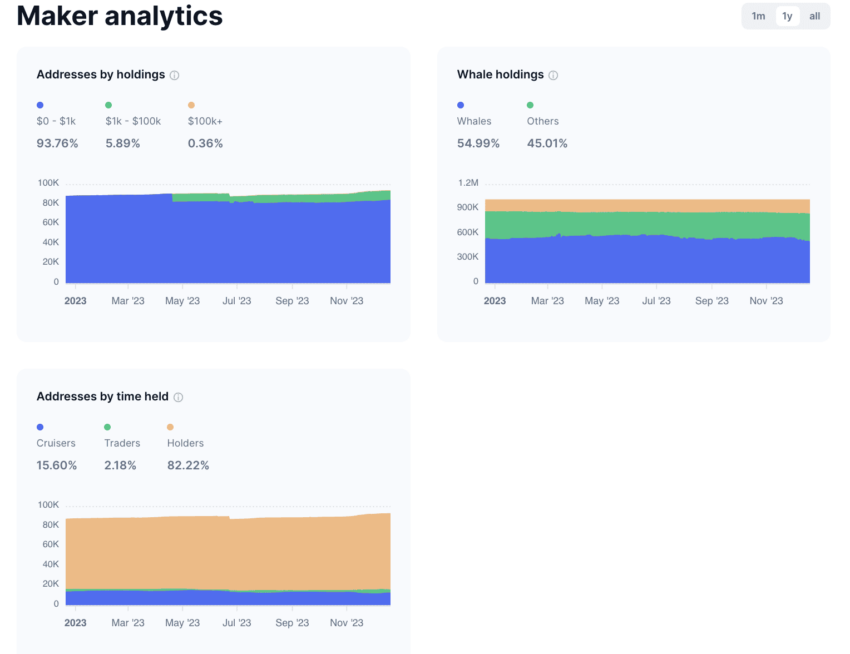

As Maker is based on the Ethereum blockchain, MKR is an ERC-20 token compatible with most crypto wallets. In February 2023, the top 100 MKR holders managed almost 84% of MKR’s circulating supply — making a market-wide sell-off a distant option. Yet, there hasn’t been any indication to suggest this might happen.

As of December 2023, Whales comprise almost 55% of the supply but almost 82% of the MKR users are holders. And the latter feels like a pro-price-surge indicator.

Maker price prediction, on-chain metrics, and other insights

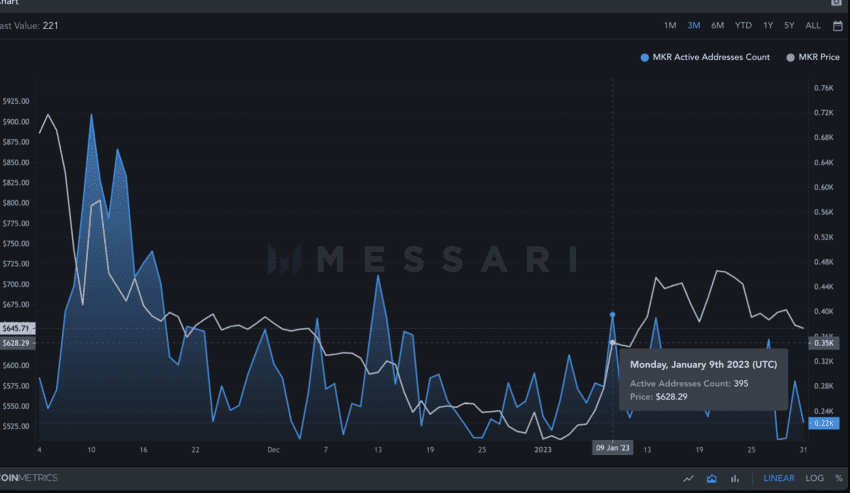

Here is the chart showing the active address count of Maker in February 2023. Notice that the numbers have dipped considerably since November 2022. However, the peak made on Jan. 9, 2023, saw prices increase. The broader crypto market rally helped, but post-January, the address count and coin price have started looking up.

Now, if we shift our focus to December 2023, the network activity did peak in the form of active address count and even took the prices up, along with it. If this kind of surge in network activity continues, we might even expect the prices to keep growing.

If you look at the price volatility, there might be some short-term optimism for MKR. The historical data surrounding volatility shows that prices usually drop when the volatility peaks. However, the recent lows with prices holding up pretty well hint at optimism.

Overall, the Maker Protocol needs active address buildup for the price of MKR to look up. However, till that happens, the dropping volatility can be a good ally.

MKR price prediction and technical analysis

Before we delve deeper into the patterns and broader market trends, let us analyze the short-term price action of MKR. This might help us understand the path for Maker (MKR) in 2024.

Short-term analysis

The daily MKR/UST chart shows an interesting pattern. After successive higher highs that took the price close to $1600, MKR experienced a lower high pattern, followed by a sharp drop to $1250. However, it is currently trading inside a descending channel, with a bullish breakout happening above the upper trendline.

If the volume pillars permit and MKR manages to break past $1442 and then $1511, we can expect the uptrend to resume.

We shall now look closely at the price chart of MKR to analyze the trends and patterns. While the price chart doesn’t represent the state of the Maker protocol, it can help predict MKR’s minimum and maximum price across years. But first, let us discuss the pattern we expect it to form.

Pattern identification

MKR starts the weekly chart with a couple of higher highs, eventually forming a peak. MKR forms lower highs after the peak, with S as the lowest point.

Now there are two conditions in play. If the next high post-S surfaces are lower than G, we can expect the lower-high pattern to hold. However, if the next high is higher than G, we can expect the pattern to end. This might even start a higher high formation, like the A-B-C path.

Price changes

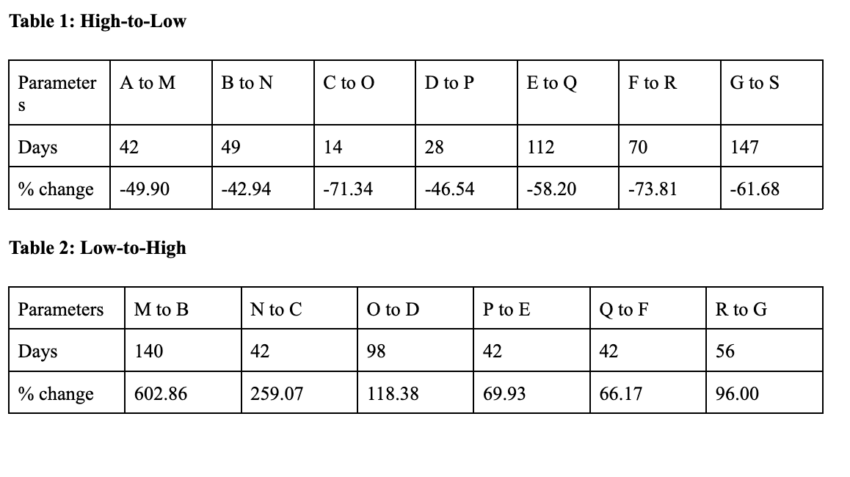

For identifying the next high and low, we will need to locate price percentage changes and the number of days for the low-to-high and high-to-low movements.

Utilizing the data from the tables provided, we’ve determined the average points for market movements. The average decline from high to low is noted at -57.77% over 66 days.

In contrast, the low-to-high average shows an increase of 202.06% occurring over approximately 70 days. With these averages derived from the datasets mentioned, we can plot the next set of points in this market trend analysis.

Maker (MKR) price prediction 2023

Our Maker (MKR) price prediction for 2023 exceeded expectations. We predicted a high of $1536, and on Binance, the price of MKR went as high as $1565. Here is how we successfully predicted the same:

Considering S as the last low on the chart, the low-to-high average of 202.06% might help us trace the next high. And while the average price-changing distance for low-to-high is 66 days, we can take the max time (140 days) to plot the next high.

And the growth of 202.06% seems possible, considering the growth of DeFi adoption.

The next point can therefore surface at $1536. While this can be the MKR price prediction for 2023, we can expect the low to follow the average dip of -57.77% and a max timeframe of 147 days. Therefore, the minimum price in 2023 can surface at $650.

But do note that in 2023 the price of MKR already made a low of $508, which we do not expect to get breached. Hence, $508 could be the lowest MKR price in 2023.

Maker (MKR) price prediction 2024

Outlook: Bullish

We can mark 2023 high at A1. Notice that this might show up higher than G. And this might start an uptrend at MKR’s counter. Hence, from the low of 2023 or $650, we can expect the next high at a growth of 202.60%. This level might surface at $1970 and close to March 2024.

The next low could take 147 days to surface (as per the maximum high-to-low distance). And there might be a drop of 57.77%, per the high-to-low average. Therefore, in 2024, the minimum price of MKR could be $829.

Projected ROI from the current level: 61%

Maker (MKR) price prediction 2025

Outlook: Bullish

The next high, in 2025, can surface at the peak of $2504. This is because the previous pattern gets repeated, and we finally get hold of the peak or C1. We can get the next low from C1 or the Maker price prediction level for 2025 at a drop of -57.77%. This assumption puts the 2025 low at $1080.

Notice that from this low in 2025, we can expect the next set of highs to make lower highs per the previous pattern. Therefore, D1 might just surface at the peak of 118.38% — the immediate price peak lower than the average of 202.60%. This assumption puts the next high at $2203, which might also develop in 2025.

Projected ROI from the current level: 92%

Maker (MKR) price prediction 2030

Outlook: Very bullish

The high after C1 might, therefore, be surface lower. The price drop could continue to be at -57.77% and, this time in 66 days, owing to the evident swing-high or a downtrend. This puts the 2026 low for the price of MKR at $973.

The next high could again be lower than the previous high of $2203 — provided the price of MKR continues to follow the historical data. Therefore, the Maker price prediction for 2026 might surface at a high of $2129.

However, with DeFi growing rapidly and the market conditions expected to improve by 2026, we don’t expect the next low in 2026 to drop 57.77%. Instead, the second average low in 2026 could show up in 66 days and take support at $1517 — a strong support level coinciding with Q from the previous pattern.

As this low would be a higher low compared to the previous level. The high in 2027 should go back to the average growth rate of 202.06%. Therefore, the maximum price of MKR in 2027 could show up at $4576.

Now with the 2027 high and the 2026 low in sight, we can use the Fib levels to draw the path till 2030. The projected growth rate can put the price of MKR at $27885 by the end of 2030. And while this sort of price prediction might look outrageous, much depends on the health of the DAI stablecoin, driven by the Maker protocol.

Projected ROI from the current level: 2045%

Maker (MKR’s) long-term prediction until the year 2035

Outlook: Bullish

By 2030, MKR does look like a good investment as post-2028, we expect it to make a new all-time high. Yet, if you plan on holding the token long-term, here is a table to help you gauge the price of MKR through 2035.

You can easily convert your MKR to USD here

| Year | | Maximum price of MKR | | Minimum price of MKR |

| 2023 | $1565 | $508 |

| 2024 | $1970 | $809 |

| 2025 | $2504 | $1080 |

| 2026 | $2129 | $973 |

| 2027 | $4576 | $2873.12 |

| 2028 | $9243.52 | $6339.02 |

| 2029 | $16176.16 | $10029.22 |

| 2030 | $27885 | $17289 |

| 2031 | $30673.50 | $23,925 |

| 2032 | $39875 | $31102.50 |

| 2033 | $47850.66 | $37323.52 |

| 2034 | $83738.65 | $51917.96 |

| 2035 | $92112.52 | $71847.76 |

The average price of MKR in any given year might differ from the highs and lows mentioned in the table. A lot will depend on the growth and development of the Maker protocol.

Is the Maker price prediction model reliable enough?

This Maker price prediction model is based on a data-backed technical analysis of the MKR token. Plus, it considers the fundamental aspect of the governance token whilst delving into the DeFi-specific attributes of the Maker protocol. While all of this paints a reliable picture, we need to continue tracking the price performance of Maker’s peers like Abracadabra and Acala Dollar. This will allow us to adjust the MKR price prediction levels as and when needed.

Frequently asked questions

What will Maker be worth in 2030?

Is Maker a good coin to invest in?

What is Maker coin used for?

Is Maker a stablecoin?

Is MKR a good long-term investment?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.