Loopring (LRC) is the token powering the Loopring protocol. This layer-2 Ethereum solution enables fast and scalable decentralized applications (DApps) on top of the most famous smart contract network. So, how does the Loopring cryptocurrency work, and what is the Loopring protocol?

KEY TAKEAWAYS

► Loopring (LRC) is a layer-2 scaling solution that uses zk technology to accomplish fast, secure, and low-cost transactions on decentralized exchanges.

► The Loopring protocol combines both AMM and order-book models for a hybrid DEX and supports both centralized and decentralized order settlement.

► The native token, LRC, plays a vital role in governance, staking, and incentivizing liquidity on the Loopring exchange.

► Loopring continues to innovate with features like its smart wallet and NFT support, although challenges remain, including dwindling total value locked (TVL) and security issues from the wallet.

What is Loopring (LRC)?

Loopring is an open protocol for building a decentralized exchange protocol (DEX) on the Ethereum blockchain. LRC is the native ERC20 token.

Among other things, Loopring aims to facilitate centralized order-matching exchanges with decentralized on-chain order settlement exchanges. The idea is to reduce the need for centralized exchanges and grant traders access to global crypto liquidity.

The main issues Loopring is trying to solve are transparency, speed, and security. The Loopring Foundation, a non-profit organization operating from Shanghai, is in charge of project development.

It seeks to offer rewards to all participants of the ecosystem to perpetuate decentralized and non-custodial exchanges. To offset the main issues with on-chain exchanges, such as throughput, speed, and high transaction fees, Loopring performs all computation off-chain and leverages zero-knowledge proofs to retain trustless trading.

Loopring (LRC) history

The project was founded in 2017 by Daniel Wang, a former Google software engineer.

The development team had plans to extend the Loopring functionalities on top of NEO and QTUM networks. However, the Loopring team announced that they are not focusing on NEO deployment, and QTUM deployment has stopped.

Loopring’s token, LRC, was first launched during an initial coin offering (ICO) in August 2017 and raised $45 million worth of Ethereum (ETH). However, a great part of the amount was returned to the investors due to China’s active regulations at the time. The rest of the funds were used for developing the Loopring protocol. December of 2019 saw the deployment of the mainnet.

The project has been updated five times in its history, and the latest version is Loopring 3.8. The protocol released its own decentralized exchange in February 2020, which uses both AMM and order-book models.

Loopring protocol up close

Loopring is a zero-knowledge Rollup (zk-Rollup) protocol. It combines Ethereum smart contracts and zero-knowledge (ZK) circuits to build secure and scalable DEXs and AMMs.

The zk-Rollup was the first protocol deployed on the Ethereum network, and it marked the beginning of the layer-2 scaling (L2) and zkEVMs (ZK-Ethereum virtual machines) eras.

The latest version of Loopring constitutes a performant and secure solution for decentralized protocols. The protocol uses the Loopring relayer to a zk-Rollup run.

The Loopring relayer manages the off-chain Merkle tree, creates roll-up blocks, generates zk-SNARK proofs of the validity of the rollup block, published proof, and data to the Ethereum network, and more.

Moreover, the Loopring protocol allows anyone to build and run their own zk-Rollups and products. The Loopring relayer is servicing the Loopring layer-2. That’s how developers and users can use the Loopring relayer API for high-speed transactions on Ethereum without paying gas fees.

What is a zk-Rollup?

A zk-Rollup is a blockchain that bundles (or rolls up) a batch of transactions off-chain, generates a zero-knowledge proof of the transactions’ correctness, and publishes the result on the layer-1 blockchain.

The SNARK is the validity proof and is posted on the network’s mainnet, which is the layer-1. The zk-Rollup has a smart contract on the mainnet that updates the state of all transactions on the layer-2, the off-chain component. The state can only be updated by providing a validity proof.

Zk-Rollups can be optimized to reduce transaction size. The main advantages of using the zk-rollup system for recording transactions are:

- Fast transactions: The state is verified instantly after the proofs are sent to the mainnet.

- Secure and decentralized: Data needed to restore the state is stored on layer 1.

How does Loopring work?

The protocol relies on the ring miners to fulfill the necessary tasks. Ring miners, together with order rings, help execute orders in exchange for rewards. Miners receive rewards paid as feed by traders or the margins for an order:

- Order fee: Traders can set the maximum LRC tokens that go to the miner

- Split-margins: Traders can determine the claimable margin for a specific order, leaving the miner to choose the fees and the margins

The Loopring exchange: making transactions cheap and fast

The Loopring Layer 2 app is a non-custodial exchange that supports both automated market maker (AMM) and order-book exchange models. It also has a payment platform built on the Loopring protocol.

This trading platform allows users to cross-exchange many digital assets. The Loopring DEX offers secure trading at high speed and with no transaction fees.

The Loopring protocol allows batching the orders received and communicating them off-chain to various exchanges. Both centralized and decentralized exchanges can use the Loopring platform, which is convenient for traders too, who can easily check the prices for their digital assets across the market.

This also creates liquidity across the many Ethereum exchanges. Often called an “agnostic” platform, Loopring can be easily integrated with any smart contract platform.

All trades are grouped in blocks that are stored off-chain in the Merkle tree. Any change in the state of the tree can be verified on-chain by generating a ZK proof using a circuit. The operator is responsible for creating and committing blocks to the Merkle tree. The Loopring exchange platform can perform the following tasks:

- Authorize protocol

- Create orders

- Mix and match orders (ring mining)

- Order verification and settlement

The Loopring L2 supports Ethereum wallets (MetaMask or any wallet supported on WalletConnect).

Loopring’s competitors

| Chain | Type | Token |

|---|---|---|

| Loopring | ZK | LRC |

| Polygon | ZK | POL |

| Arbitrum | Optimistic | ARB |

| Optimism | Optimistic | OP |

There are quite a few layer-2 solutions trying to fix the scalability and transaction speed, and high fees of the Ethereum network (layer-1). Loopring’s main competitors are:

- Polygon, formerly known as Matic, is a platform enabling developers to deploy Ethereum-based DApps, in a more optimized way. Polygon solutions are highly scalable.

- Arbitrum offers interoperability with the Ethereum network and enables Solidity developers to build cross-compatible DApps. It offers support for sidechain aggregation of transactions (rollup technology).

- Optimism is a scaling solution that offers improved transaction speed and lower fees. It allows off-chain UIs and wallets.

Loopring roadmap and development

Loopring released the first version of the protocol in December 2017. In 2018, there were three airdrops of LRN (for NEO network) and LRQ (for QTUM network) tokens for Loopring (LRC) holders who had a minimum of 100 coins.

The second version of the protocol was released exactly a year after the first version. The upgrade included a more efficient ring settlement, additional ways to create orders, and a new fee model.

In December 2019, Loopring 3.0 was released. This was the first zk-Rollup decentralized exchange protocol on the Ethereum mainnet. In December 2020, the team launched Loopring Exchange v2, based on the Loopring protocol 3.6. This period also saw the launch of the Loopring Wallet.

In November 2021, online forums started to talk about the rumored partnership with GameStop, which made the Loopring price surge to an all-time high of $3.83.

As of 2025, Loopring supports NFT minting, trading, and transfers directly for both ERC721 and ERC1155 token standards. The Loopring Smart Wallet was deployed on Ethereum and Arbitrum; it subsequently underwent an upgrade in 2024.

What is Loopring (LRC) token?

The Loopring protocol allows for the creation of a new LRx token derivative token for each integrated chain, where x represents the blockchain. The protocol is most known for the Ethereum LRC token.

The LRC burn rate increases the token’s scarcity by burning a portion of the fees that come from the wallets. It also burns a portion of ring miners’ fees. Traders that stake Loopring (LRC) crypto are entitled to lower transaction fees on the Loopring exchange. The token is available on Binance, Coinbase, KuCoin, Gate.io, and Huobi.

How to buy Loopring?

Loopring (LRC) can be bought using the most popular cryptocurrency exchanges, such as Binance or Coinbase. We’ll list the steps for buying Loopring (LRC) on Binance.

Step 1. Get a Binance account

Firstly, if you do not have a Binance account, you will need to sign up for an account.

Go to Binance > Register Now > Select your country > Enter the details required for the account (email or mobile).

After your Binance account has been confirmed, you will be able to sign in.

To enable credit and debit card purchases on Binance, you need to complete the Identity verification process. Go to User Account (top right) > Identification. Here you can see the current verification level for your account.

Step 2. Buy Loopring (LRC) token using credit or debit card

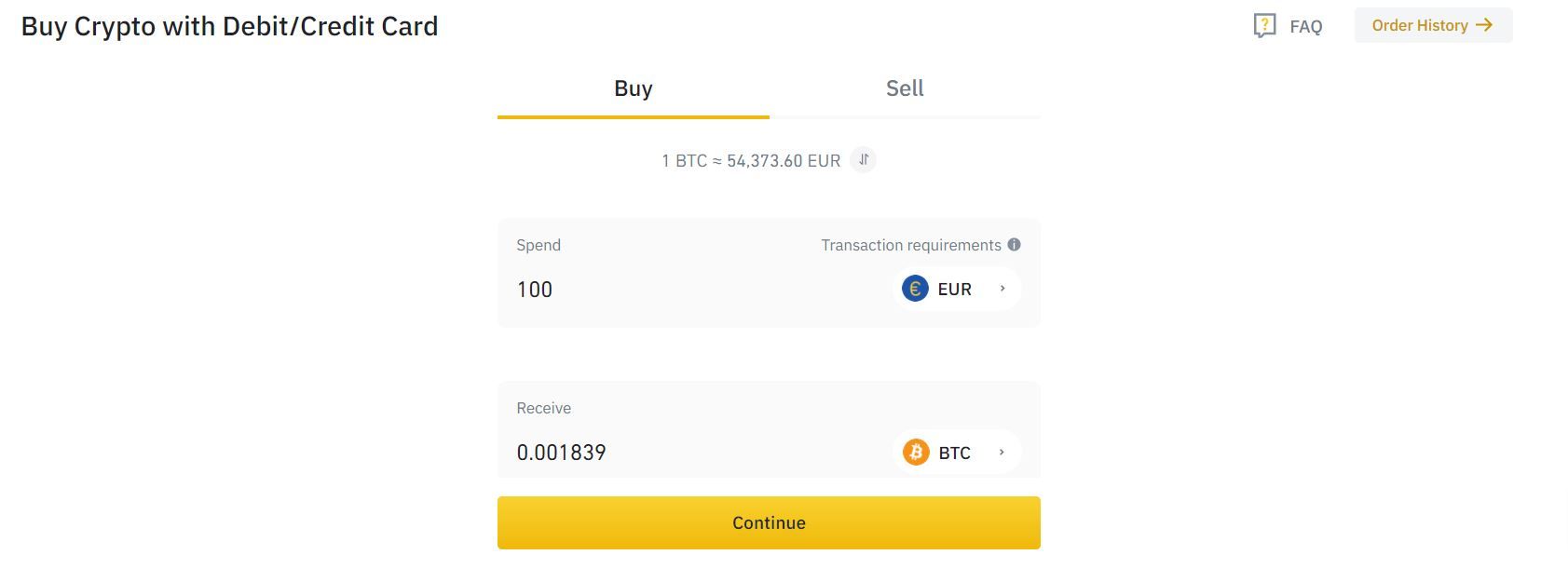

Secondly, after your Binance account is verified, you can buy LRC using your credit or debit card. To purchase cryptocurrency on Binance, go to Buy Crypto (top left) > Credit/Debit Card.

IF you are not able to purchase Looping (LRC) directly, you will need to buy one of the available cryptocurrencies. We will buy Bitcoin (BTC) and then trade it for Looping (LRC).

Search for BTC in the field box and then enter the desired amount. Click Continue, and then add your card as a payment method. Continue with the purchase.

Step 3. Exchange BTC with Loopring (LRC)

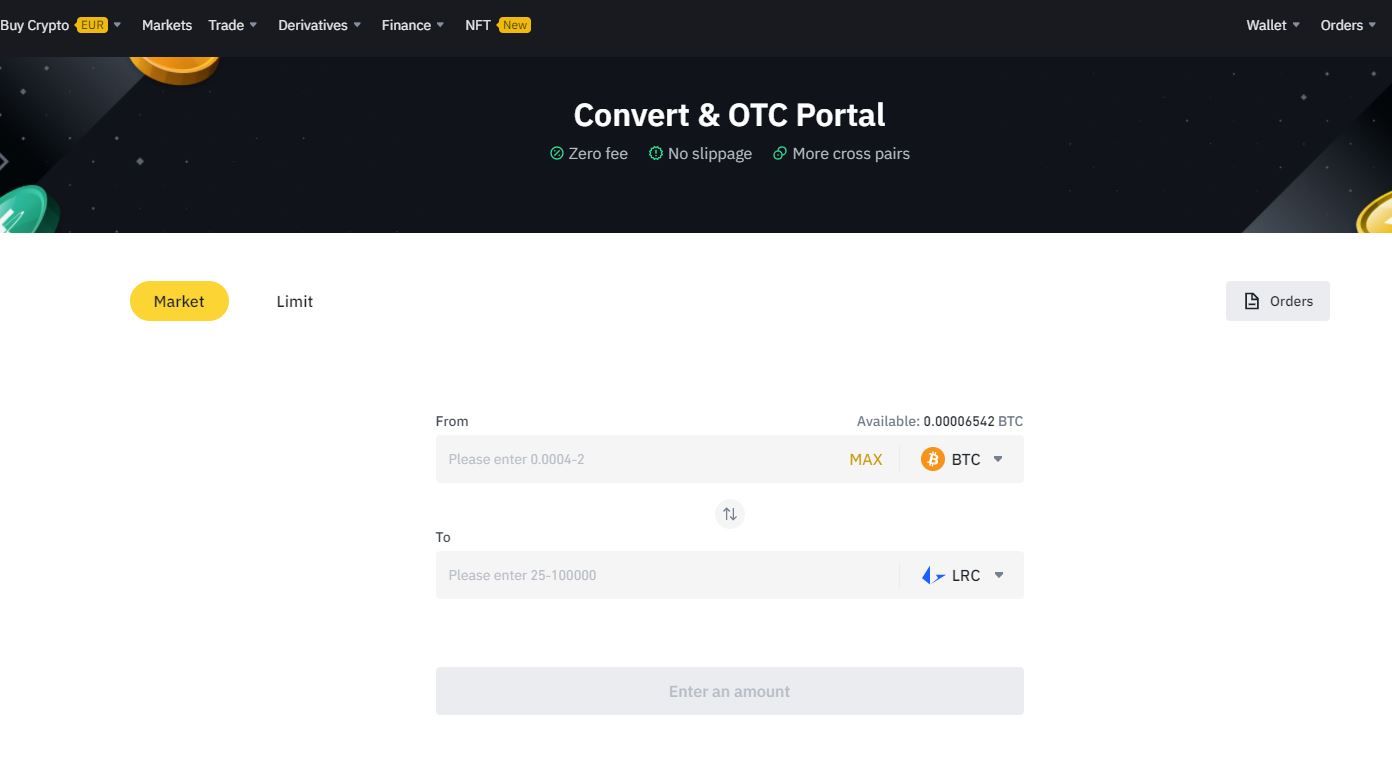

Thirdly, to complete the process and finally buy Loopring (LRC), you have two options. You can either convert the crypto you bought at step 2 into Loopring coin or trade it on the markets tab.

If you are a beginner and want to make no mistakes, we recommend converting. Go to Trade > Convert.

Here you will need to choose what crypto to convert and in what you want to convert it. Firstly, you will need to choose the crypto you bought at step 3 and then the amount you want to convert. In our case, we will choose BTC.

For the second field, click on the dropdown and search for LRC. After you are all set, click Preview Conversion to get the exact amount of LRC tokens you will get in exchange for the BTC. Click Convert when you are ready to convert and buy Loopring (LRC) tokens.

Due to the volatile nature of cryptocurrencies, the preview price will expire every six seconds, and you will need to refresh to view the new price.

Should you buy Loopring (LRC)?

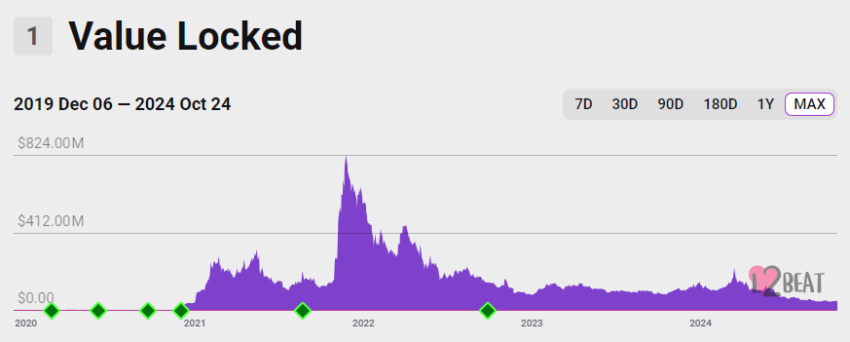

It’s always important to remember that cryptocurrency investments are risky and can lead to loss. However, the Loopring protocol has seen dwindling activity and total value locked (TVL).

Although the team works constantly on releasing new features on the Loopring ecosystem and focuses on new partnerships, you may want to wait until the protocol finds a renewed interest.

Is Loopring protocol the future of Ethereum DEXs?

Now that we have answered the questions about Loopring (LRC) and how it powers the entire Loopring protocol ecosystem, you should always check the project’s latest developments if you’re looking for a new investment opportunity.

The Loopring protocol has never stopped evolving and deploying new features. The network TVL may be contracting, but the community has shown no signs of slowing down.

Frequently asked questions

How do I get a Loopring (LRC)?

What is Loopring used for?

Is Loopring supported by Coinbase?

Is Loopring a currency?

What is Loopring v2?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.