Kraken, Binance, and Coinbase are among the most recognizable brand names in crypto. When the playing field is at such high level, any valuable comparison inevitably comes down to the finer details. It becomes a game of inches, where minor differences can tip the scales — particularly when it comes to fees. So, whether you are new to crypto or considering switching exchanges, a careful comparison of Kraken fees vs. Binance fees vs. Coinbase fees is crucial before you commit to any of these industry heavyweights.

KEY TAKEAWAYS

• Fees are an important factor to consider when comparing top crypto exchanges like Kraken, Binance, and Coinbase.

• Binance offers a tiered fee structure with BNB discounts, which makes it an attractive option for high-volume traders.

• Coinbase provides a straightforward fee structure, ideal for those who prefer simplicity.

• Kraken’s maker-taker fee model benefits active traders seeking to minimize costs.

Kraken fees vs. Binance fees vs. Coinbase fees: A detailed comparison

Let’s analyze the fees levied by all three exchanges one by one.

Kraken fees

Instant buy/sell fees

Kraken charges a displayed fee and a spread for using its Instant Buy/Sell services. The spread varies based on market conditions and order size. A 3% fee applies to balance conversions below the minimum order size.

NFT fees

Kraken charges a 2% fee on the sale price for each NFT transaction. Listing NFTs is free. However, for transferring NFTs, the fees are:

- Ethereum-based transactions: 0.01 ETH

- Solana-based transactions: 0.02 SOL

- Polygon-based transactions: 0.5 MATIC

Deposit and withdrawal fees

Deposits and withdrawals have varying fees depending on the method and currency. Some deposits may be free, while withdrawal fees vary by cryptocurrency and network conditions. For instance, the minimum withdrawal limit for Bitcoin is 0.0004 BTC, and the corresponding fee is 0.0002 BTC.

Kraken supports fiat withdrawals through bank transfers only, with specific minimum withdrawal limits and fees:

- USD: Minimum $1-$150, fees range from free to $35.

- EUR: Minimum €1-€150, fees range from free to €35.

- GBP: Minimum £1-£150, fees range from free to £35.

- CAD: Minimum $15-$1,000, fees range from free to $35 or 35%.

- CHF: Minimum ₣2-₣150, fees range from ₣1 to ₣35.

- AUD: Minimum $5-$150, fees range from free to $55.

- JPY: Minimum ¥15,000, fee is $35 equivalent in JPY.

Spot crypto fees

Kraken’s spot trading uses a maker-taker fee model. Maker fees start at 0.16%, and taker fees begin at 0.26%. Volume-based incentives apply, reducing fees for higher 30-day trading volumes:

- $0 – $50,000: 0.16% (maker), 0.26% (taker)

- $50,001 – $100,000: 0.14% (maker), 0.24% (taker)

- $100,001 – $250,000: 0.12% (maker), 0.22% (taker)

- $250,001 – $500,000: 0.10% (maker), 0.20% (taker)

- $500,001 – $1,000,000: 0.08% (maker), 0.18% (taker)

- $1,000,001 – $2,500,000: 0.06% (maker), 0.16% (taker)

- $2,500,001 – $5,000,000: 0.04% (maker), 0.14% (taker)

- $5,000,001 – $10,000,000: 0.02% (maker), 0.12% (taker)

- $10,000,001 +: 0.00% (maker), 0.10% (taker)

Stablecoin and FX pairs fees

Trading stablecoins and FX pairs follow the same maker-taker model as spot crypto trading, with similar volume-based fee reductions.

Margin trading fees

Kraken charges fees for margin trading based on the borrowed amount and duration. Margin positions have opening and rollover fees, varying by asset and leverage used. For instance, opening fees range from 0.01% to 0.02%, and rollover fees accrue every four hours.

Futures trading fees

Futures trading also employs a maker-taker model, with volume-based incentives reducing fees for higher trading volumes:

- $0 – $100,000: 0.02% (maker), 0.05% (taker)

- $100,001 – $1,000,000: 0.015% (maker), 0.04% (taker)

- $1,000,001 – $5,000,000: 0.01% (maker), 0.03% (taker)

- $5,000,001 – $10,000,000: 0.01% (maker), 0.025% (taker)

- $10,000,001 – $20,000,000: 0.01% (maker), 0.02% (taker)

- $20,000,001 +: 0.01% (maker), 0.015% (taker)

These volume-based incentives encourage higher trading activity by lowering costs for frequent traders.

If you are new to crypto, or don’t have much experience with Kraken, check out our detailed Kraken review for an up-close look at the platform and where it stands in comparison with other major exchanges.

Binance fees

If you choose to buy cryptocurrencies using a debit or credit card, Binance charges up to 3.75%. Due to these relatively high fees, it is often more cost-effective to use alternative payment methods. Wire transfers, for example, come with no transaction fee, though their availability depends on your location. If wire transfers are supported in your area, using them can help you avoid the higher fees associated with card payments.

Deposit and withdrawal fees

Binance offers free deposits across the board, making it easy to add funds to your account without additional costs. Withdrawal fees, however, depend on the cryptocurrency and blockchain network used, varying based on network congestion.

For instance, withdrawing Bitcoin via BEP2 incurs a 0.0000046 BTC fee, while using the BTC network costs 0.0005 BTC. These fees are adjusted regularly to reflect network conditions and ensure fairness in the fee structure.

Trading fees

Binance employs a maker-taker fee model that rewards liquidity provision. The base fee for makers and takers starts at 0.1%, which can be reduced through various means. Holding Binance Coin (BNB) in your account allows you to pay fees with BNB in return for a 25% discount. This reduces the trading fee to 0.075%.

Additionally, users can benefit from a 20% discount through the referral program. Binance’s tiered fee structure is designed to incentivize high-volume trading. It is based on 30-day trading volume and BNB balance.

Margin trading fees

Binance’s margin trading fees include interest on borrowed funds, which varies by VIP level and the specific cryptocurrency borrowed. VIP levels range from VIP 0 to VIP 9. Higher VIP levels, achieved through increased trading volume or BNB holdings, benefit from lower interest rates. This structure encourages active trading and greater BNB usage.

Futures trading fees

Binance offers USDⓈ-M (USD-Margined) and Coin-M (Coin-Margined) futures trading with leverage up to 125x. Standard fees for futures trading start at 0.02% for makers and 0.04% for takers. Users paying with BNB receive an additional 10% discount.

Cross-collateral interest rates

Binance supports cross-collateral loans, allowing cryptocurrencies like BTC, ETH, EUR, and BUSD to be used as collateral. Interest rates vary by VIP level and the cryptocurrency borrowed, with higher VIP levels enjoying lower rates.

This flexible borrowing system supports a wide range of trading strategies and financial needs.

Binance US fees

In the United States, Binance US mirrors the global platform’s fee structure with some regional adjustments. Deposits remain free, while withdrawal fees depend on the cryptocurrency and method. Verification levels affect withdrawal limits, with higher verification providing access to larger daily withdrawal amounts.

Trading fees follow a similar tiered model, with discounts for using BNB to pay fees, and users starting at VIP 0.

Coinbase fees

Your non-custodial Coinbase Wallet is free. Moving crypto between Coinbase accounts also won’t cost you a dime. But remember, when you transfer crypto off the platform, network transaction fees come into play.

Network transaction fees

Coinbase charges a network transaction fee every time you transfer crypto off the platform. These fees are estimated based on network congestion and can vary with time. Keep in mind that the final fee paid by Coinbase may differ from the estimated fee shown to users because of transaction batching.

Lightning Network processing fee

If you’re a Bitcoin enthusiast, Coinbase’s Lightning Network offers faster and cheaper transactions. However, do note that it comes with a 0.1% processing fee.

Fiat deposit and withdrawal

Fees for adding cash or cashing out depend on the payment method selected. For example, ACH transfers are free, but wire transfers cost $10 for deposits and $25 for withdrawals. SEPA deposits cost €0.15 and are free for withdrawals, while SWIFT deposits are free and withdrawals cost £1.

- ACH: Free deposits and withdrawals.

- Wire (USD): $10 deposit fee, $25 withdrawal fee.

- SEPA (EUR): €0.15 deposit fee, free withdrawals.

- Swift (GBP): Free deposits, £1 withdrawal fee.

Credit transactions

Coinbase lets you borrow USD against your Bitcoin holdings, but it comes with a 2% flat fee on the total transaction if your collateral is sold. Margin trading, where you leverage borrowed funds, also incurs fees based on the borrowed amount and may trigger liquidation fees if your position gets too risky.

Trading fees and spread

Coinbase uses a maker-taker model for trading fees, which decrease as your 30-day trading volume increases. High-volume traders enjoy significant discounts. The spread, essentially the difference between buying and selling prices, also factors into your trading costs.

For example, trading fees can range from 0.05% to 0.60% for takers and 0.00% to 0.40% for makers, based on your 30-day trading volume. Here are the specifics:

- $0K-$10K: 0.60% (taker), 0.40% (maker)

- $10K-$50K: 0.40% (taker), 0.25% (maker)

- $50K-$100K: 0.25% (taker), 0.15% (maker)

- $100K-$1M: 0.20% (taker), 0.10% (maker)

- $1M-$15M: 0.18% (taker), 0.08% (maker)

- $15M-$75M: 0.16% (taker), 0.06% (maker)

- $75M-$250M: 0.12% (taker), 0.03% (maker)

- $250M-$400M: 0.08% (taker), 0.00% (maker)

- $400M+: 0.05% (taker), 0.00% (maker)

Coinbase Advanced and Coinbase One

With Coinbase Advanced, users interact directly with the order book, so no spread is included in the fees. This feature provides more precise control over trade execution and pricing.

Meanwhile, Coinbase One, a subscription service, offers fee-free trading but retains the spread. It’s a good option for frequent traders seeking to minimize transaction costs.

Asset recovery charges

If unsupported cryptocurrencies are sent to your Coinbase account, recovery may be possible. A network fee applies for the recovery attempt, and for recoveries over $100, a 5% recovery fee is charged on the amount exceeding $100.

Stablepair fees

There is no maker fee on Coinbase if you are trading stablecoins. However, taker fees still apply based on your trading volume. If you’re converting large amounts of USDC to USD, expect additional fees to kick in after exceeding $60 million in 30 days.

- Tier 1: 0.001%

- Tier 2: 0.0015%

- Tier 3: 0.002%

- Tier 4: 0.003%

- All other users: 0.0045%

Additional considerations:

- Miner fees: These are estimated and charged for crypto transfers, and the final amount may differ due to network conditions.

- Coinbase Card: Spending with your Coinbase Card is fee-free, but remember, the spread is baked into the exchange rate.

- Staking services: Earn rewards by staking your crypto, but Coinbase takes a cut of those rewards as a commission.

If you are new to crypto, or don’t have much experience with Coinbase, check out our detailed Coinbase review for an up-close look at the platform and where it stands in comparison with other major exchanges.

Kraken fees vs. Binance fees vs. Coinbase fees compared

| Fee type | Kraken | Binance | Coinbase |

| Deposit fees | Free for crypto; fiat deposits may have fees based on method and currency. | Free for crypto; wire transfers free (availability varies by region). | Free for crypto; fiat deposit fees vary by method (ACH free, Wire $10, SEPA €0.15, SWIFT free). |

| Withdrawal fees | Varies by crypto; e.g., BTC 0.0005 BTC. Fiat withdrawals have minimums and fees based on currency. | Varies by crypto; e.g., BTC 0.0005 BTC, ETH 0.005 ETH. | Varies by crypto; fiat withdrawal fees vary by method (ACH free, Wire $25, SEPA free, SWIFT £1). |

| Trading fees | Maker 0.16% – 0.00%, Taker 0.26% – 0.10%, volume-based discounts. | Maker 0.10% – 0.02%, Taker 0.10% – 0.04%, with a 25% discount using BNB. | 0.50% for Instant Buy/Sell; 0.05% – 0.60% (taker), 0.00% – 0.40% (maker) on Coinbase Pro. |

| Instant buy/sell fees | Not specifically listed, integrated into the trading fee structure. | 0.50% for Instant Buy/Sell. | 0.50% per transaction. |

| Margin trading fees | Opening fees 0.01% – 0.02%, rollover fees accrue every 4 hours. | Interest varies by VIP level and crypto. | N/A. |

| Futures trading fees | Maker 0.02%, Taker 0.05%, with volume-based discounts. | Maker 0.02%, taker 0.04%, with a 10% discount using BNB. | N/A |

| Stablecoin/FX trading fees | Maker 0.16% – 0.00%, Taker 0.26% – 0.10%, similar to spot trading. | Similar to spot trading fees. | 0.50% per transaction. |

| Staking fees | Not specifically listed, dependent on the network. | N/A. | Up to 35% commission on rewards; 26.3% for Coinbase One members on select assets. |

| Credit transactions | N/A. | N/A. | 2% flat fee on USD loans when BTC collateral is sold. |

| NFT fees | 2% sale price fee, listing free; withdrawal 0.001 ETH, 0.02 SOL, 0.5 MATIC. | N/A. | N/A. |

| Lightning Network fees | N/A. | 0.1% processing fee for BTC transactions via Lightning Network. | N/A. |

Different types of fees charged by crypto exchanges

At the risk of stating the obvious, crypto exchanges are not charities — they’re businesses that need to make money. They do this via a variety of fees, which, while seemingly small and insignificant at first, can quickly make an impact. Fees can subtly add up and significantly hamper your overall trading profitability.

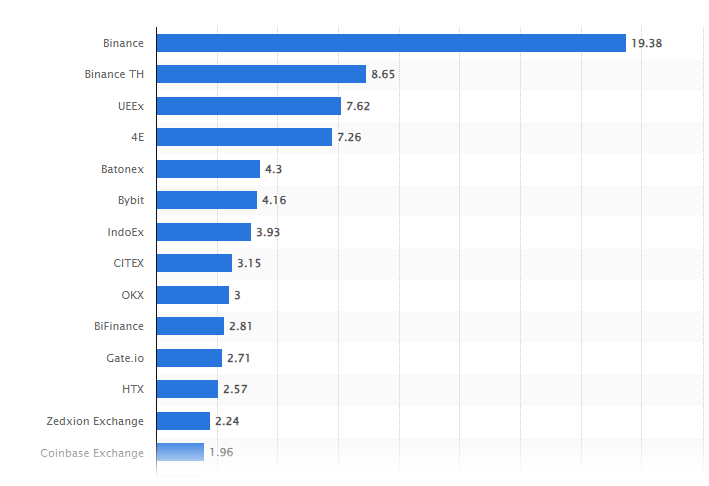

Top global crypto exchanges by 24h trade volume (June 3, 2024): Statista

So, what are these sneaky fees that can eat into your profits? Well, most exchanges charge a combination of the following.

Trading fees: The price of making moves

Whenever you buy or sell crypto, you’ll incur trading fees. These come in two main flavors:

- Maker fees: These are charged when you add liquidity to the market with a limit order. Essentially, you’re “making” the market by placing an order that isn’t executed immediately, waiting for someone to match it.

- Taker fees: Conversely, these are charged when you “take” liquidity by executing a market order or a limit order that’s filled immediately.

Naturally, taker fees tend to be higher than maker fees because you’re demanding instant action. Put simply, the maker-taker model aims to incentivize liquidity and ensure a smoother trading experience for everyone. Each exchange sets its own fee schedule, often with tiered structures based on your trading volume and/or account status.

Deposit & withdrawal fees: The cost of moving your crypto

While depositing crypto is often free, some exchanges might surprise you with fees for certain methods like bank transfers or credit cards. Be sure to check the fine print before you fund your account.

Withdrawing your digital assets will usually incur a fee, which can vary depending on the crypto, network congestion, and the exchange’s policies.

Network fees (gas fees)

These fees aren’t unique to exchanges. Rather, they’re the fuel that powers transactions on the blockchain. You could think of it as a toll for using the network’s computational power needed to process your transaction.

Gas fees can fluctuate wildly depending on network congestion. To ensure you avoid getting stuck in traffic, some exchanges offer features to optimize these fees, allowing you to schedule transactions for less congested periods.

Advanced trading fees

If you plan to dip your toes into more complex trading strategies like futures or leverage trading, be prepared for additional fees:

- Funding fees: These are specific to futures trading. Exchanges impose funding fees in futures trading to balance the price of perpetual futures contracts with the underlying asset. In other words, they incentivize equilibrium in the market. These fees can apply to either buyers or sellers depending on market conditions.

- Leverage trading fees: In leverage trading, traders borrow additional capital to open larger positions. Exchanges charge fees based on the borrowed amount, and these fees can vary with the demand for leverage. If a leveraged position gets forcibly closed due to insufficient margin, traders may also incur liquidation fees.

So, these are some of the most common fee types exchanges like Kraken, Binance, and Coinbase charge.

Kraken fees vs. Binance fees vs. Coinbase fees: The verdict

As demonstrated in this detailed Kraken fees vs. Binance fees vs. Coinbase fees comparison, there’s no one-size-fits-all answer. Each platform offers a unique fee structure with its own advantages and drawbacks. High-volume traders might find Binance’s tiered system and BNB discounts appealing, while those seeking a simple fee structure might prefer Coinbase. Meanwhile, Kraken’s maker-taker model caters to active traders seeking low fees.

Ultimately, the best choice depends on your individual trading habits, preferences, and the specific cryptocurrencies you trade. Remember, fees can significantly impact your profitability, so take the time to compare and contrast the fee schedules of all three carefully.

Frequently asked questions

How does trading volume affect fees on crypto exchanges?

Are Kraken fees cheaper than Coinbase?

Which platform is the most cost-effective for beginners?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.