Founded by Changpeng Zhao in 2017, Binance has grown massively over the years. Binance.US, on the other hand, launched in 2019, months after Binance mentioned that it would no longer provide direct services to retail and institutional investors in the U.S. — citing regulatory concerns.

While both offer a similar experience to their user base, certain important differences could be important to the average cryptocurrency investor. Furthermore, users in America can only use Binance.US, barring those residing in Texas, Vermont, and a few other states. Here’s what to know.

KEY TAKEAWAYS

► Binance offers a broader range of features compared to Binance.US, primarily because of regulatory scrutiny within the U.S.

► Trading fees are generally lower on Binance with 0.1% on trades, whereas Binance.US has a higher fee of 0.4% and 0.6% on trades and 4.5% on debit card transfers.

► Binance operates globally and supports more extensive customer service options, while Binance.US is limited to the U.S. and offers less comprehensive customer support.

► Binance.US is more heavily scrutinized by the SEC, while Binance faces scrutiny by more global organizations, opting to leave countries such as Singapore and Canada as a result.

Binance vs. Binance.US: A comparison

Binance, the original platform, stands out from its U.S. counterpart. The range of cryptocurrencies, features, and ease of use far outdoes Binance.US. Many hope that the number of faults with the U.S. wing will reduce going forward.

The variation of available services, even from state to state, increases friction on the platform and rules out a large swathe of potential users. While this may improve with the expansion of Binance.US, Binance is currently by far the better platform when it comes to choice.

Here is a quick table for your reference:

| Parameters | Binance (Global) | Binance.US |

|---|---|---|

| SEC impact | Audits wash trading allegations and a 13-count lawsuit. No impact on trading activities, and it is still offering full services. | Temporary pause on fiat-to-crypto trading. |

| Supported cryptocurrencies | 600+ | 130+ |

| Binance Chain and Binance Smart Chain support | Chain support has evolved to BNB | Primarily supports BSC and BEP-20 tokens |

| Trading fees | 0.1% on spot trades and 1% on debit transfers | 0.4% (maker)/0.6% (taker) on spot trades and 4.5% on debit card-based transfers |

| Liquidity | Ranked 1st in spot trading | Ranked 32nd in spot trading |

| Supported countries | 100+ | Only the U.S. (44 out of 50 states) |

| User experience and UI | Basic and Pro sections with several products | A streamlined interface that is way easier to use |

| Customer support | 24×7 access to emails, Tele-calling, and chats | Only offers 24×7 email access |

| Trust and reputation | Globally trusted but has seen massive outflows in the recent past | Trusted in the U.S. Latest SEC-led concerns have triggered outflows |

| Increasing regulation | Has been facing increased global regulatory scrutiny | Always on the radar of the SEC and has recently been sued and had to discontinue USD-based trades |

Binance’s regulatory challenges

Before we move to the more objective differences between the two, it is important to address the effects of the SEC-led fiasco on each cryptocurrency exchange. For starters, the SEC entered 13 counts against Binance. And the extent of these charges includes its affiliate, Binance.US.

The actions led by the SEC against both belong to the same lawsuit and hinge on a belief that Binance maintained complete control over the U.S. arm despite the latter being created as a separate entity, adhering to country-specific regulatory compliance.

Firstly, Binance, the parent firm, was accused of offering and selling unregistered securities and products, including cryptocurrencies and its exclusive programs like the “BNB Vault” and “Simple Earn.”

These charges even extended to Binance.US, with BAM Trading Servcies Inc. — the body running the U.S. branch of Binance — being charged with misleading investors. The U.S.-specific “Staking-as-a-Service” program was also questioned.

Impact on Binance.US

The SEC alleged that Changpeng Zhao and Binance continued to control the U.S. affiliate while allowing many high-profile U.S. customers to keep using Binance.Com despite broader restrictions. This move scared banking partners, cutting off U.S. dollar-based trades completely.

As of now, Binance.US is a crypto-to-crypto trading exchange with no support for on-ramping and off-ramping via USD. Users who missed the deadline to cash out the deposited dollars can now convert the same to stablecoins and continue trading-related activities.

Please note that the SEC initially wanted to freeze Binance.US’s assets, but the court rejected that request, allowing trading activities to continue as usual.

While the entire SEC-driven fiasco caused a market-wide meltdown, Binance.US assured users that their funds were safe as part of the 1:1 reserve. This regulatory scrutiny resulted in the broader community calling for a unified stance to thwart what looks like a coordinated attack on crypto.

“The SEC refuses to provide clarity, or a clear framework, to the crypto industry despite repeated prayers for such. Instead, it has chosen to weaponize its powers to witch hunt perceived enemies regardless of the impact of its actions on the investors it is supposed to protect.”

B (Da Viking), Core Contributor at Floki: Twitter

As a result of the lawsuits by the SEC, CZ was sentenced to 4 months in prison on April 30, 2024, and was released in late September.

Supported cryptocurrencies

One of the clearest distinctions between the main Binance platform and Binance.US is the number of cryptocurrencies (and fiat currencies) that you can trade. The number of cryptocurrencies supported by Binance.US is about 130+.

Do note that after the SEC crackdown, Binance.US decided to delist a handful of BTC, BUSD, and USD trading pairs. Some of the more popular ones include BCH/BTC, DOT/BTC, ONE/BUSD, and more.

Binance Global currently supports over 500 cryptocurrencies and over 12,000 trading pairs. Despite SEC-led concerns, Binance continues to offer fiat-to-crypto trading, on-ramping, and off-ramping services to its users. Additionally, Binance.US lacks a futures trading counter, which the parent company has.

If you are a user outside the U.S., there are greater opportunities to trade using Binance. For those in the U.S. wanting to do the same, Binance.US might still be a better option, courtesy of the additional regulatory compliance.

Binance Chain and Binance Smart Chain

Both Binance Chain (BNB chain) and Binance Smart Chain (BSC) played a major role in developing the entire Binance ecosystem.

Binance merged the BNB Chain and BSC Chain, bringing newer staking, voting, and smart contract development standards into the mix. Yet, both BEP-2 and BEP-20 tokens are supported. Eventually, the BNB chain was sunset, and now only the BSC chain remains, which is now called the BNB Smart Chain.

Binance.US is more accommodative towards the Binance Smart Chain and BEP-20 tokens. Yet, the U.S. arm still supported some BEP-2 tokens for a while.

Trading fees

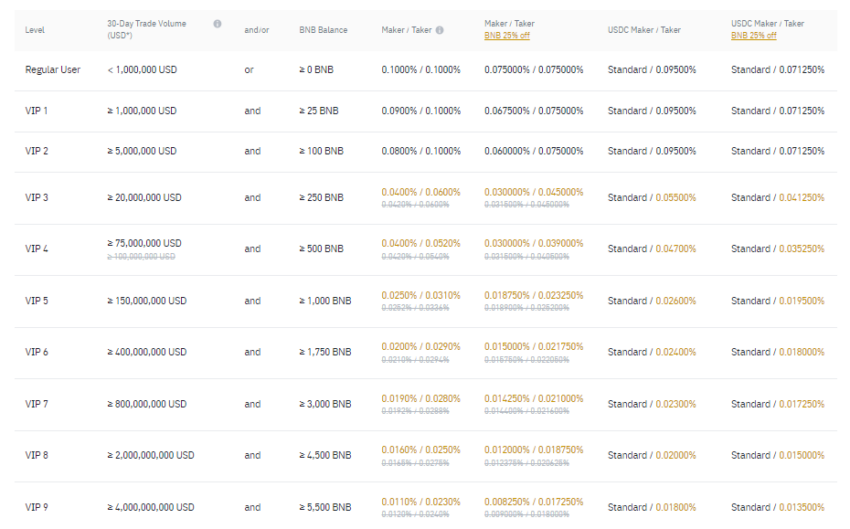

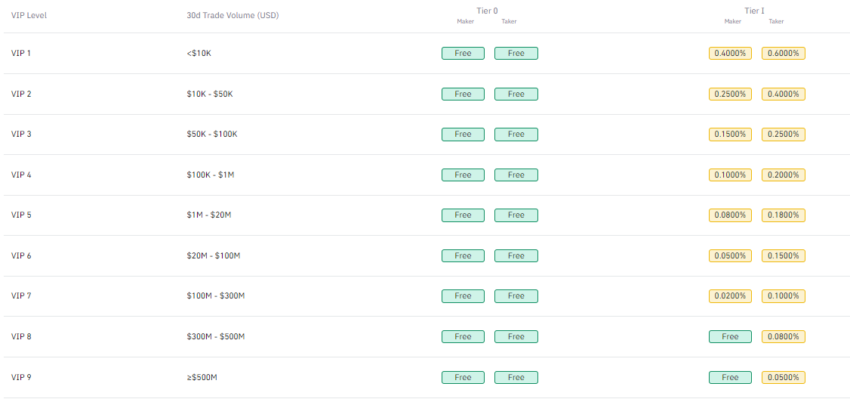

When it comes to the fee structure, both platforms have a tiered fee structure. The average user on Binance receives a 0.1% spot trading fee, while Binance.US users have a 0.4% maker and 0.6% taker fee. Another difference is that additional fees vary, depending on whether you are within the U.S. or not.

For example, fees for bank transfers to your Binance account are free outside the U.S. However, depending on your method of transfer, U.S. users may pay up to 4.5%. To simplify, these charges are valid on transfers made using debit cards.

Even though, courtesy of the lawsuit, purchases made using debit cards aren’t allowed on Binance.US. Only on-ramping was allowed for fiat-to-crypto trading. Presently, it’s just crypto-to-crypto trading.

Binance supports credit and debit card purchases and even transfers. Compared to the 4.5% in the U.S., Binance charges a mere 1%, making it the more affordable of the two. For credit card purchases, though, the overhead can go as high as 3.5% or a flat $10, whichever is higher.

This disparity in fee structure favors users outside the U.S., where the higher fees may be related to tighter regulation of crypto in the country. By comparison to other platforms, the fee structure of Binance.US and Binance looks more complicated. Users from outside the U.S. benefit from lower fees.

What makes the fee structure so complicated is Binance’s focus on different fees for different levels of users. While, theoretically, this is similar in both the main platform and Binance.US, the American platform has fewer of these levels.

For some, this may seem simple and clear, but it could also mean that using Binance.US is costlier than its main counterpart, tilting the Binance vs. Binance.US scales in favor of the former.

Liquidity

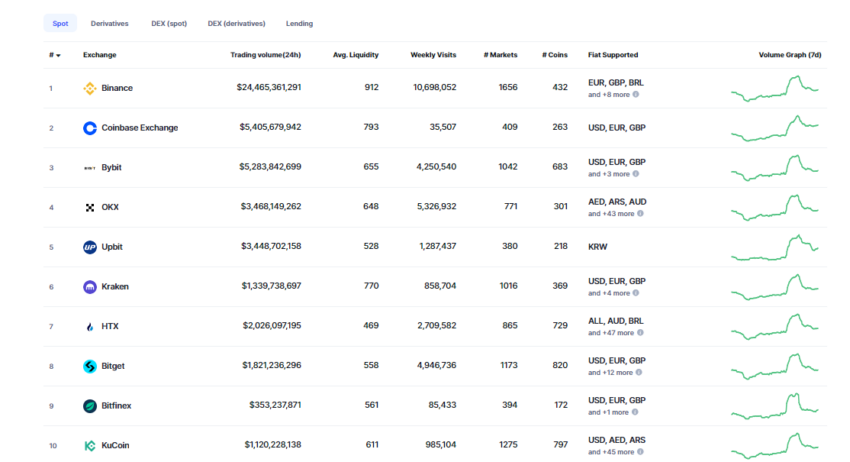

The SEC’s enforcement action has impacted liquidity and market depth associated with Binance.US. As of July 2025, the US-based exchange is ranked 23rd in terms of spot trading liquidity, according to CoinMarketCap.

Liquidity is the ability of an exchange to sustain large orders without impacting the price of the concerned assets. Binance supports more liquidity, enabling faster transactions and trades, which is important for the world’s biggest cryptocurrency exchange. It holds the first rank in terms of spot exchange liquidity.

Still, the U.S. platform is still to catch up when it comes to providing users with the same amount of liquidity and ease when trading. This is rather unfortunate for users in the U.S., making it a slower experience overall.

Supported countries

Unfortunately, while most users in the U.S. can use the Binance.US platform, it is not available in all states. Currently, the platform is only available in 44 of the 50 U.S. states.

While Binance.US is restricted to the mainland due to geographical restrictions, Binance has a more widespread reach. However, the global spread does come with its share of regulatory and geographical restrictions as well.

Binance’s services are unavailable in many countries. One such country, while perhaps surprising, is the U.K. As of mid-2021, the FCA (Financial Conduct Authority) ruled that the company’s U.K. arm is unable to conduct regulated activity.

Meanwhile, theoretically, U.K. users are still able to use the platform. However, a number of U.K. banks, including Barclays and HSBC, have banned their customers from depositing into Binance.

Users must face such restrictions when using Binance. Among countries to crack down on the company are Hong Kong, Malaysia, and Lithuania. However, many countries do have full use of Binance, and these countries present opportunities for growth in these areas for the future.

User experience and interface

A good interface can amplify user experience, allowing users to trade without lags or worries.

Binance, the parent firm, offers a more comprehensive app-specific user interface with the same segregated as “Basic” and “Advanced or Binance Pro.” The Binance Wallet integration supports most crypto and can be viewed via the Advanced or Pro UI.

Plus, you also get access to a wide range of trading tools, spot trading resources, charting tools with trading volume and market depth analysis, and more.

Binance.US focuses on keeping things simple and streamlined. While most of the UI is similar to Binance, the complexity quotient is low. Like Binance, the U.S. arm also offers an app and support for the Binance Wallet.

Customer support

Reviews of Binance.US are, on average, worse than those of Binance, a small consolation for those who live outside the U.S. Despite this, many of the issues raised regarding support for American customers relate to issues stemming from the company’s rushed setup of the newer website.

Support for users of both platforms definitely needs some improvement. Currently, the support provided by Binance beats that of Binance.US. With the restriction limiting U.S. users to this platform, many choose to shift their accounts to other crypto exchanges completely.

If we look at the broader picture, customer support is 24×7. Both exchanges offer round-the-clock email support. However, features like Tele-calling and online chats are Binance-specific. In this regard, the U.S. arm needs to improve a lot. All of that tilts the Binance vs. Binance.US comparison in favor of the former.

Trust and reputation

While much of the trust and reputation of both Binance and Binance.US depends on the support and functionality of the two platforms, customer support is not the only factor that may affect their reputation.

One such factor is the number of outages that the platforms have had, something far more common in the rest of the world than in the U.S. and a particular issue in mainland Europe. On this basis, Binance.US (despite being the newer platform) has experienced far fewer problems, boosting its reputation in territories that can access it.

Despite this, any lack of trust in Binance has a knock-on effect on how users perceive its U.S. platform due to the close association of the two. On reliability, the U.S. platform comes out on top. This does not mean that either has a good reputation. Binance has work to do, and lots of it.

Increasing regulation

Several factors explain why Binance.US was launched as a separate platform. Changes in regulations and Binance’s own rules and reaction to external changes stand out as large drivers.

Did you know? Catherine Coley — a former executive at Ripple (XRP) — was the first appointed CEO of Binance.US.

Also, when it comes to Binance, the regulatory radar is highly country-specific. In the past, the company stopped those in Singapore from making trades on their platform, reacting to a tightening in local regulations. Similarly, Binance had to face resistance in Canada, which led to it shutting shop on the mainland.

Binance.US, on the other hand, was created to adhere to U.S. regulatory compliance. Overseen by the Financial Crimes Enforcement Network (FinCEN), Binance.US adheres to the more stringent version of Know Your Customer (KYC) and Anti-Money Laundering (AML).

While Binance remains the most preferable of the two platforms currently, it is important to remember that changes corresponding to the global regulatory landscape might affect users’ experiences. That is one of the reasons why people have several Binance alternatives in their sight.

Binance vs. Binance.US: The final verdict

There has been a shift to using other cryptocurrency exchanges outside of Binance, but out of the two reviewed above, there is one clear leader. Binance currently caters to both novice and veteran cryptocurrency traders, while American users struggle to make full use of the platform.

Binance is undoubtedly the better and more developed platform and the best choice for users. However, the Binance vs. Binance.US discussion is ongoing due to regulatory concerns in the U.S. and across the globe.

Frequently asked questions

What is Binance?

How do I create an account on Binance?

Is Binance secure?

What is the difference between Binance International and Binance.US?

Why is Binance different in the U.S.?

Can I use regular Binance in the U.S?

Which country is best for Binance?

Why is Binance restricted in the U.S.?

Which has lower fees: Binance or Binance US?

Is Binance US safe to use?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.