Yearn Finance — a leading decentralized yield aggregator and optimizer — paved the way for DeFi users to earn crypto through farming protocols. And a number of other projects have tried to match Yearn’s accomplishments. But as yield farming has become more prevalent, the need for increasingly complex operations has grown, with investors looking to obtain higher APYs. The result, in part, has been higher gas fees for users. Enter Harvest Finance, the DeFi protocol positioned as a solution to this problem.

This guide assesses the features Harvest Finance contributes to the DeFi space and covers the role of the protocol’s native FARM token. Here’s what you need to know.

BeInCrypto Trading Community in Telegram: read reviews on the best DeFi projects, read technical analysis on coins & get answers to all your questions from PRO traders & experts!

What is Harvest Finance?

Harvest Finance is a decentralized yield farming protocol and asset management platform. It aims to provide users with the best yield rates via strategized vaults. This type of yield aggregator is ideal for those looking for returns on their crypto without managing their own holdings.

If you are looking for a yield aggregator that allows you to manage multiple DeFi activities all from one account, try Bake (ex. Cake DeFi). In addition to boosted rewards options, payouts are every 12 hours. Join now

A well-developed farming protocol requires specialized strategies and auditing, plus the constant moving of funds. This leads to high gas fees being passed on to users. Harvest Finance takes these responsibilities and pain points from the user, doing the work for you via its strategized vault system. All users have to do is deposit tokens and wait to receive some yield.

History

An anonymous team developed and launched Harvets Finance in 2020. After the platform and token launch, the project quickly became a leading yield aggregator protocol with over $1 billion of TVL. In December 2020, the team launched a cross-chain version of Harvest Finance on Polkadot.

Did you know? In October 2020, Harvest Finance experienced a devastating flash loan exploit in its vaults that resulted in a $24 million loss. The Harvest team then offered a $1 million bounty reward to anyone who had information regarding the attacker.

How does Harvest Finance work?

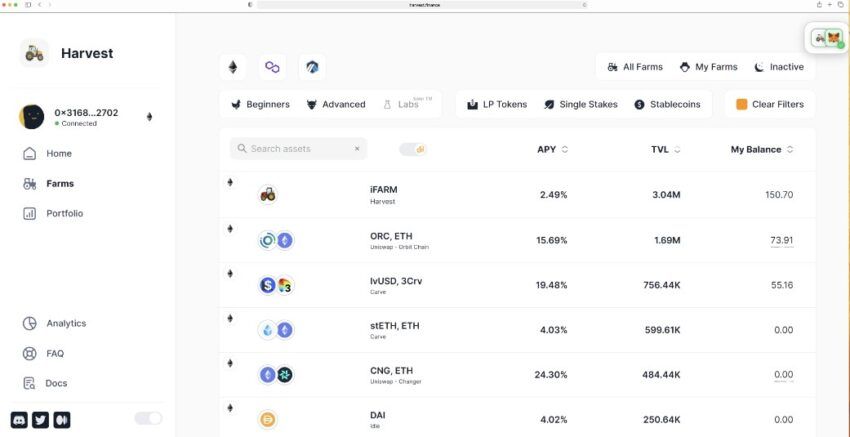

The basic premise of the protocol is that users first deposit their ERC-20 tokens into one of Harvest’s smart-contract-operated vaults. Once the tokens are in, investors receive an fToken compatible with the token deposited.

So, if you deposit into a USDC vault, the protocol will give you fUSDC. This will represent your share of the associated vault. Users can withdraw deposits at any time. For every withdrawal, there is a corresponding amount of fToken tokens burned.

The three main features that govern the system are as follows:

- Vaults: The vaults are smart contracts that hold the deposited funds. These smart contracts execute various yield-generating strategies that best serve the investor. Vaults automatically buy low and sell high on behalf of users.

- Strategies: The Harvest Finance team utilizes the latest and most profitable techniques and strategies in their vaults to maximize user returns. New projects are thoroughly evaluated and tested in order to qualify as one of the platform’s yield-generating strategies.

- Pools: The protocol provides two different lending pools: an interest-bearing pool and a savings pool. Users earn interest on their deposited crypto funds in the interest-bearing pool. For the savings pool, they earn rewards for providing liquidity to the platform. Furthermore, flash loans are also available, allowing investors to take out loans against their deposits.

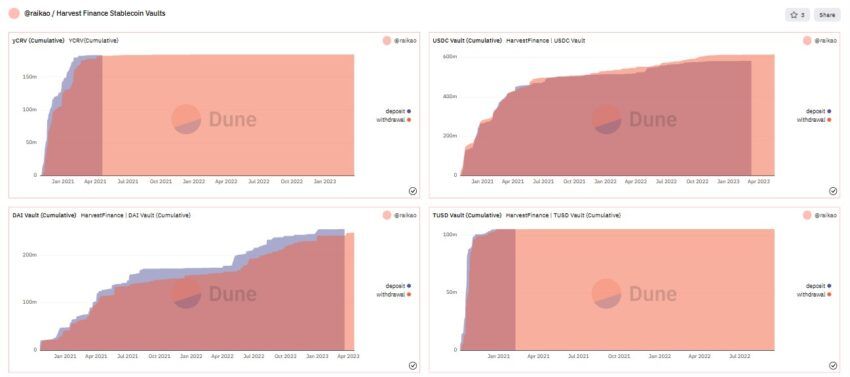

In the graph below, we can see the vaults live in action for some of the protocol’s tokens.

Enter the world of DeFi with PancakeSwap, where you can trade, engage in yield farming, provide liquidity, and seamlessly swap tokens on a cutting-edge platform. Join now

Pros and cons of Harvest Finance

Although the project successfully accomplishes its goals for DeFi users, it still poses risks. Before investing your money, always consider the platform’s advantages and disadvantages.

Pros

- Low fees: The protocol charges low fees for its services; transaction fees are only 0.03%.

- Earning interest: You can start earning interest immediately after depositing crypto funds, and the rates are set based on supply and demand.

- High liquidity: Users can access liquidity through the protocol’s decentralized exchange.

- Community-driven: Harvest Finance is open-source and very community-driven, so anyone can contribute to its development and can engage with each other on social media.

Cons

- Risks of hacks: As with any other DeFi platform, the project may be vulnerable to system hacks since it operates on the Ethereum blockchain.

- Lack of customer support: The project has no customer support team, so if you have issues, you will need to rely on the community.

- Unstable interest rates: The interest rates can fluctuate greatly, meaning you can earn a high yield one day and lose it the next.

FARM Token

FARM is Harvest Finance’s native ERC-20 token and is used for governance, staking, voting on proposals, and incentivizing the platform’s users. Key incentives include rewards for staking in the profit-sharing pool and FARM earnings for vault depositors. As per its governance use, FARM holders can vote on major issues regarding the project and the platform. The more FARM an investor stakes, the more influence they have when it comes to decisions.

The FARM tokens can be purchased on a few major exchanges, including Binance, Coinbase, Kraken, and DEXs, including PancakeSwap v2 (BSC) and Uniswap v2. The multi-platform Atomic Wallet and Trust Wallet are great wallets for storing your tokens.

Tokenomics

The FARM token has a live price of $28.12 with a total market capitalization of $19,153,881 (as of early June 2023). It has a circulating supply of 681,174.81 with a total supply of 700,442.5 and a max supply of 690,420 FARM.

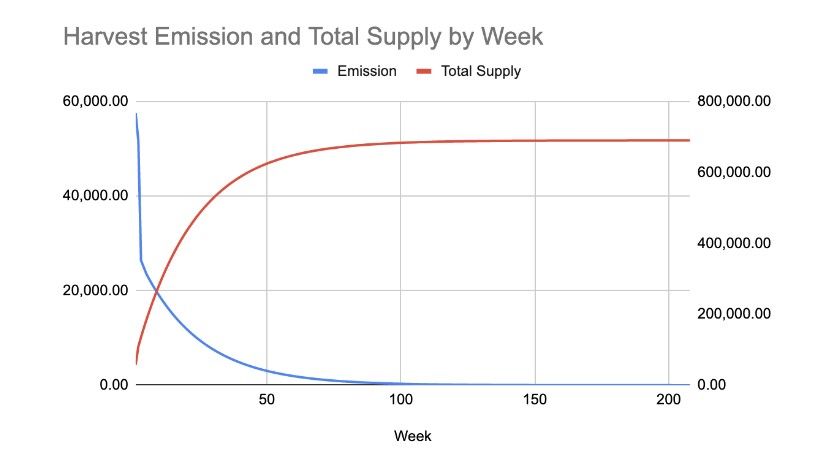

Currently, FARM has no VCs or investors. The token was bootstrapped without any presale, pre-mining, and 0 circulating supply at launch. A total of 5 million FARM are set to be distributed over four years. Newly minted tokens are released weekly and distributed:

- Liquidity providers from incentive pools (70%)

- Rewards to the operational treasury (10%)

- Rewards to the team for building Harvest (20%)

- FARM holders receive the 5% fee from Harvest operations

Since holders voted to reduce the emissions of tokens by 4.45% every week until week 208, the token emissions are currently set to follow this curve below.

The future of Harvest Finance

The Harvest Finance project provides a seamless system by which yield farming investors can receive maximum rewards for their deposits. By essentially doing all the heavy lifting work, the protocol’s vaults act as an intermediary between its users and the pooled funds.

We have only seen the beginning, however. The team plans to launch more future features, including staking pools, non-custodial wallets, and insurance products. We are currently at the very beginning of the DeFi revolution: of which yield aggregators specifically will be at the forefront.

Frequently asked questions

What is Harvest Finance?

How do I start yield farming with Harvest Finance?

What are the risks associated with Harvest Finance?

How does Harvest Finance work?

Who is the founder of Harvest Finance?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.