The Flare Network (FLR) is an innovative layer-1 blockchain. It makes cryptocurrencies like Litecoin, Ripple, and Dogecoin more functional by enabling DApps on their respective networks. This comprehensive Flare price prediction delves deeper into the operational aspect of the project but first maps out the price potential of its native crypto — FLR. Here’s what you need to know.

- Flare (FLR) long-term price prediction until 2035

- Flare (FLR) price prediction and technical analysis

- Flare (FLR) price prediction 2024

- Flare (FLR) price prediction 2025

- Flare (FLR) price prediction 2026

- Flare (FLR) price prediction 2027

- Flare (FLR) price prediction 2028

- Flare (FLR) price prediction 2029

- Flare (FLR) price prediction 2030

- Is FLR a good investment? Flare fundamentals

- Flare price prediction and the associated on-chain metrics

- Does Flare have a future?

- Frequently asked questions

Flare (FLR) long-term price prediction until 2035

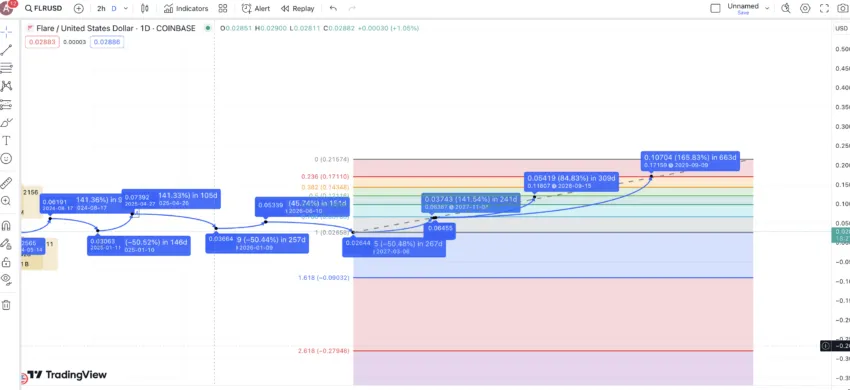

The FLR price prediction levels until the year 2030 are taken care of in the subsequent sections, supported by charts and relevant data. Still, if you want to hold FLR for many years into the future, here is a table that covers the expected price of FLR up until 2035.

| Year | Maximum price of FLR | Minimum price of FLR |

| 2024 | $0.0619 | $0.02411 |

| 2025 | $0.07392 | $0.03000 |

| 2026 | $0.05300 | $0.03600 |

| 2027 | $0.06387 | $0.02644 |

| 2028 | $0.12000 | $0.03162 |

| 2029 | $0.17000 | $0.05940 |

| 2030 | $0.22000 | $0.08415 |

| 2031 | $0.26270 | $0.10890 |

| 2032 | $0.31369 | $0.13004 |

| 2033 | $0.37457 | $0.15528 |

| 2034 | $0.44727 | $0.18541 |

| 2035 | $0.53408 | $0.22140 |

Flare (FLR) price prediction and technical analysis

This Flare price prediction takes the short-term, mid-term, and long-term price action into consideration. With Coinbase listing the crypto in early 2023, there is sizable historical data to base the future price of Flare (FLR) on.

Short-term analysis of FLR

The short-term price action of FLR was bearish for a while, courtesy of the double top formation. But then, if you look at the recent candles (as of 22 May, 2024), the price erosion seems to have stopped near the $0.0280. If FLR manages to hold this price, a level synonymous with the 200-day exponential moving average (blue line), the price action might turn bullish.

Even the relative strength index or the RSI indicator has formed a higher high, something that shows the bullish momentum at FLR’s counter. However, the overall chart pattern, the descending triangle, is largely bearish. A clear uptrend will only be confirmed if FLR manages to cross above the red line or the 50-day moving average. That would mean crossing the $0.031 mark.

A rise above $0.031, with high volume, can propel FLR towards $0.039 and $0.045, depending on market conditions.

Charting the long-term potential of FLR

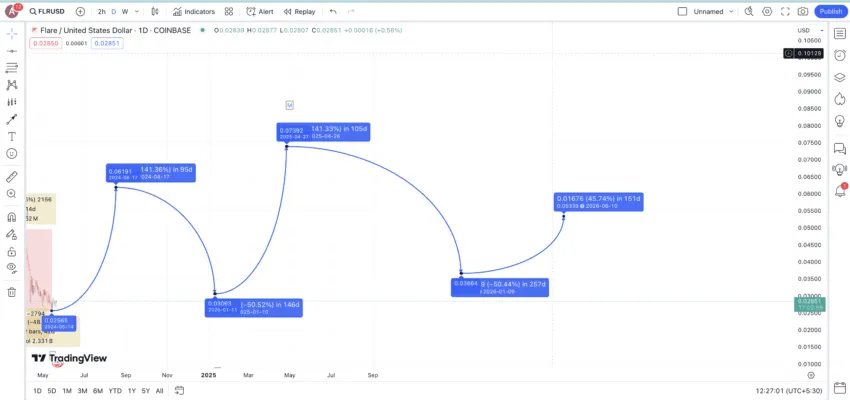

Let’s zoom out and look at the broader patterns associated with the price of FLR. One clear pattern is noticeable in the chart below. FLR started off with a high, before making a series of lower highs and then finding a bottom. From there starts a series of higher highs, all the way up to $0.056, which is the chart-specific all-time high for FLR, following its Coinbase listing.

This pattern is exhibited by the set of points from A to G. Do note that other highs and lows exist but only the most impactful ones have been picked for the sake of calculation.

Starting at G, FLR seems to be forming another lower-low pattern, like the first part of the original pattern — A to G. The next set of points can be marked as H, I, and J. The next task is to find K or the next high. Where that high is placed will determine whether the lower-low pattern continues or the higher-high part has started.

Finding the points to calculate using historical data

The next part is all about locating the time and price change between every point starting at A and ending at J.

| A to B | -63.28% in 61 days |

| B to C | 45.86% in 8 days |

| C to D | -58.86% in 118 days |

| D to E | 180.43% in 51 days |

| E to F | -31.85% in 4 days |

| F to G | 261.89% in 75 days |

| G to H | -49.95% in 22 days |

| H to I | 76.75% in 14 days |

| I to J | -48.56% in 42 days |

Now that now we have all the price hikes and price drops in sight, it is possible to calculate the average price correction and average price hike for Flare (FLR). The levels come out as -50.5% in 50 days (approx) and 141.23% in 37 days (approx).

We will use these data points to chart the price prediction levels for Flare (FLR).

Flare (FLR) price prediction 2024

Outlook: Bullish

If we consider J as the latest bottom formed by the price of FLR, we can expect the next leg of the pattern to go up by 141.23%, using the average price hike percentage we determined earlier. This puts the 2024 high at $0.0619. The timeline can vary as 37 days might not be enough for the price of FLR to scale this high.

That way, FLR would chart one of its newest all-time highs. As for the low, we can assume that FLR might not drop any lower than $0.02411 in 2024, considering the current state of the crypto market.

Projected ROI from the current level: 121%

Flare (FLR) price prediction 2025

Outlook: Bullish

Now that the 2024 high or K is expected to form higher than G, it is practical to consider K as one of the highs associated with the series of higher high formations. But first, you can expect the next low or L to form anywhere near the $0.03 mark, which is a 50.5% dip from K, per our previous calculations.

This could be the lowerst price of Flare in 2025. From the minimum price level, another 141.23% hike is expected, considering the higher-high scenario. This puts the maximum price of FLR in 2025 at $0.7392.

Projected ROI from the current level: 164%

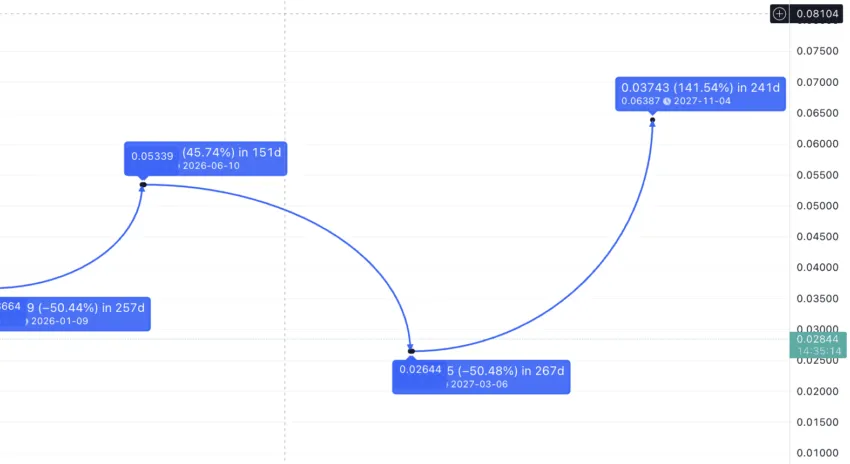

Flare (FLR) price prediction 2026

Outlook: Neutral

By 2026, you can expect the bears to take effect, which should start a series of corrections at FLR’s counter. Keeping the average price drop of 50.5% in mind, you can see the minimum price of FLR in 2026 to hit $0.036.

By now, the bears should take control of the market, and the price surge from this 2026 low might not be as aggressive as 141.23%. On revisiting the table above, we can expect the maximum price of FLR in 2026 to form after 45.86% from the last low of $0.036.

Note: 45.86% is the lowest price hike experienced by the price of Flare, per our price point table.

This puts the Flare price prediction high for 2026 at $0.053.

Projected ROI from the current level: 89.29%

Flare (FLR) price prediction 2027

Outlook: Bullish

In 2027, you can expect the price of FLR to follow the lower-low formation, with the minimum price expected to surface at $0.02644, down 50.5%. The next high could again surge by 141.23% as, historically, the price of Flare moves up aggressively after a couple of lower highs. This puts the 2027 price prediction level at $0.06387.

Projected ROI from the current level: 128.11%

Flare (FLR) price prediction 2028

Outlook: Very bullish

Now that we have the lows and highs for 2027, we can extrapolate these to locate the price levels until the year 2030. This kind of extrapolation takes several aspects into consideration, including price volatility, unprecedented market moves, and more.

Using the extrapolated view, you can expect the 2028 high for FLR to surface at $0.12. Do note that the actual prices might vary.

Projected ROI from the current level: 328.57%

Flare (FLR) price prediction 2029

Outlook: Very bullish

The maximum price of FLR for 2029 can be $0.17, based on the extrapolated approach. This takes into consideration the sentimental changes associated with the crypto market.

Projected ROI from the current level: 507.14%

Flare (FLR) price prediction 2030

Outlook: Very bullish

Based on the extrapolated levels using the Fibonacci retracement tool, we expect the price of FLR to reach $0.22 by the end of 2030.

Projected ROI from the current level: 685.17%

Is FLR a good investment? Flare fundamentals

Here are some of the key fundamental elements that make Flare stand out as a project:

Interoperability across blockchains

Flare’s primary value proposition lies in its ability to provide interoperability across various blockchain networks. By enabling smart contracts for blockchains that lack this capability, such as XRP and Litecoin, Flare opens up a myriad of possibilities for decentralized applications (DApps) and decentralized finance (DeFi) projects. This increased utility and cross-chain functionality can significantly drive the price of FLR.

Low transaction fees

Flare’s network design focuses on minimizing transaction fees, making it an attractive platform for developers and users alike. Specifically, Flare’s gas fees are as low as 25 nFLR (nanoflare), which is less than $0.01 per transaction. These low fees enhance user adoption and network activity, contributing to a higher market cap and pushing the coin price upward.

Robust ecosystem growth

The growth and expansion of Flare’s ecosystem are crucial. With more DApps, DeFi projects, and partnerships being developed on Flare, the network’s utility and demand for FLR will increase. This ecosystem growth can lead to higher average price levels and push the price of FLR towards new time highs.

Here is what Hugo Philion, co-founder of the Flare Network, had to say about the future prospects and path for this intuitive blockchain:

“We’ve done a lot of research in this area and that’s kind of where we’re interested in going forward… For us, we’re thinking about how do we prove things genuinely onto a chain and actually get usage.

And then, others are thinking about scaling and I think hopefully those two things come together, whereby you’ve got super scalable blockchains and really, really good data, and then people can actually start building products that can hit a billion people.”

Hugo Philion, co-founder and CEO of Flare Network: YouTube

Strong market cap potential

Flare has shown the potential to capture a significant share of the crypto market due to its unique features. As more investors and projects recognize its value, the market cap of FLR is likely to grow, which can positively impact the coin price and support bullish FLR price prediction scenarios.

Favorable technical analysis

From a technical analysis perspective, FLR has demonstrated substantial price movements in the past. Periods of significant growth and corrections indicate a responsive market, suggesting potential for future price hikes. Consistent analysis and market performance can help predict future minimum price levels and identify opportunities for investment.

Community and developer support

A strong and active community, along with developer support, is vital for the success of any blockchain project. Flare’s community engagement and developer activities can drive innovation and adoption, leading to sustained increases in the price of Flare.

Unique tokenomics

Flare Network’s tokenomics are designed to ensure broad and fair distribution while incentivizing network participation and development. Here is a detailed breakdown of the FLR distribution:

- Community allocation (58%)

- Team, advisors, and backers (19%)

- Foundation and ecosystem growth (22.5%)

Did you know? The largest portion of the coins, 58 billion FLR, was allocated for distribution to XRP holders via airdrops. The initial airdrop represented 15% of this allocation, with the remaining tokens to be distributed over time based on community governance votes.

Flare’s tokenomics includes mechanisms that can reduce the total supply of FLR over time, such as transaction fees and potential token burns. These deflationary aspects can positively impact the price of FLR by creating scarcity.

All these factors might complement the positive technical analysis associated with this EVM-specific layer-1 blockchain.

Flare price prediction and the associated on-chain metrics

It is now time to shift attention to the on-chain metrics associated with Flare, precisely to establish the connection between the activities within the blockchain and technical analysis.

The price of FLR has historically surged everytime the volatility metric has crossed under the green line (price line). This explains the short-term bullishness as the volatility is as low as it was in November 2023, which should push the prices higher.

Another metric is the development activity within the Flare network. Whenever the dev activity peaks, the prices surge with it. However, the surge experienced on April 24, 2024, hasn’t yet been followed by price hikes, something that makes us bullish in the short term (as of May 22, 2024).

Does Flare have a future?

Flare Network presents a compelling case for its future within the crypto market. With its innovative approach to interoperability, low transaction fees, and robust ecosystem growth, Flare has positioned itself as a significant player in the blockchain space. Fundamentals aside, the optimistic technical analysis elements make this Flare price prediction a key resource for mid-term and long-term holders.

Frequently asked questions

How much will a Flare coin be worth in 2030?

Can Flare reach $1?

What is the price prediction for FLR in 2024?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.